Insurance Business Process Outsourcing (BPO) Market Size, Share, Analysis, Forecasts, 2034

Insurance Business Process Outsourcing (BPO) Market By Type (Asset Management, Finance and Accounting Services, Customer Care Services, Marketing, Policy Administration, and Others), By Enterprise Size (Large Enterprises and Small and Medium-sized Enterprises), By Application (Life Insurance and Non-Life Insurance), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

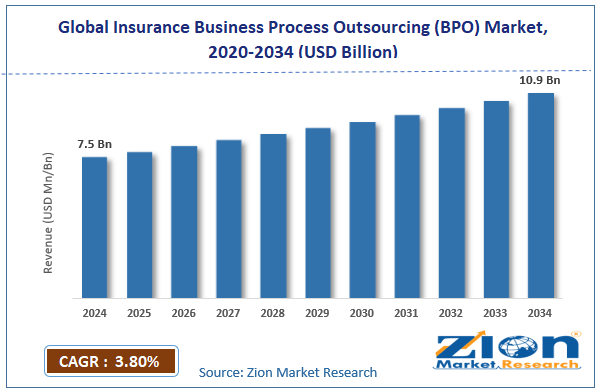

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.5 Billion | USD 10.9 Billion | 3.8% | 2024 |

Insurance Business Process Outsourcing (BPO) Industry Prospective:

The global insurance business process outsourcing (BPO) market size was worth around USD 7.5 billion in 2024 and is predicted to grow to around USD 10.9 billion by 2034, with a compound annual growth rate (CAGR) of roughly 3.8% between 2025 and 2034.

Insurance Business Process Outsourcing (BPO) Market: Overview

Insurance business process outsourcing (BPO) is the process of outsourcing particular business processes of an insurance firm to a third-party supplier with experience in doing so. Underwriting, policy management, customer service, claims processing, and other back-office tasks might all fit in here.

Through outsourcing some operations, insurance companies can focus on their core competencies, save costs, and boost output. Particularly in a market where demand may change significantly, insurance companies must be able to rapidly scale up or down their operations.

By outsourcing to BPO service providers, insurance companies can gain from the provider's ability to quickly scale their operations up or down in response to demand. Insurance companies also engage with BPO service providers to manage non-core tasks, including administrative work, customer service, and back-office operations.

After that, they may concentrate on underwriting, risk management, and product development—their main business operations. Still, data security presents one of the main challenges confronting the insurance BPO industry.

Key Insights

- As per the analysis shared by our research analyst, the global Insurance Business Process Outsourcing (BPO) market is estimated to grow annually at a CAGR of around 3.8% over the forecast period (2025-2034).

- In terms of revenue, the global Insurance Business Process Outsourcing (BPO) market size was valued at around USD 7.5 billion in 2024 and is projected to reach USD 10.9 billion by 2034.

- The rise of on-demand services & digital platforms is expected to drive the Insurance Business Process Outsourcing (BPO) market over the forecast period.

- Based on the type, the finance and accounting services segment is expected to hold the largest market share over the forecast period.

- Based on the enterprise size, the large enterprise segment is expected to dominate the market expansion over the projected period.

- Based on the application, the life insurance segment captures the largest market share over the analysis period.

- Based on region, North America is expected to dominate the market during the forecast period.

Insurance Business Process Outsourcing (BPO) Market: Growth Drivers

Growing number of cyberattacks in the financial sector drives market growth

As per a 2024 article on the International Monetary Fund's (IMF) website, the financial sector has suffered over 20,000 cyberattacks, leading to $12 billion in damage over the period. Insurance companies benefit from the cybersecurity knowledge of BPO providers since it may help safeguard private information and systems. Considering the prevalence of cybersecurity fraud worldwide, BPO firms place major trust in cutting-edge cybersecurity solutions.

Furthermore, several nations' regulatory bodies enforce strict laws about data security and protection. BPO companies reduce the possibility of penalties and damage to their reputation while assisting insurance companies in complying with these rules. In the event of a cyberattack, business process outsourcing (BPO) firms can provide quick and effective incident response services, minimizing operational harm and bolstering the expansion of the insurance BPO industry.

Insurance Business Process Outsourcing (BPO) Market: Restraints

Concerns about data security and privacy in insurance BPO services hinder market growth

The insurance business process outsourcing market expands dramatically when companies contract non-core business operations to outside providers. Tasks, including policy administration, customer service, underwriting, back-office operations, claims processing, and policy servicing, are often outsourced. By outsourcing, insurance firms can boost output, adapt to demand fluctuations, and focus on their core competencies.

Still, one major barrier is ongoing concerns about data security. BPO providers have to follow rigorous data security rules like GDPR and HIPAA if they want to safeguard private client data. Insurance BPO manages a lot of financial, medical, and personal data, increasing the likelihood of privacy invasions and data leaks. Thus, the data security and privacy concerns hamper the industry expansion.

Insurance Business Process Outsourcing (BPO) Market: Opportunities

Adoption of advanced technology such as AI, IoT, and robotics offers a lucrative opportunity for market growth

Since the incorporation of cutting-edge technologies like artificial intelligence (AI), machine learning, and data analytics, the insurance business process outsourcing industry is expanding significantly. By increasing productivity, facilitating scalability, and mitigating demand volatility, these innovations are transforming the insurance sector. It is very noteworthy because AI automates regular jobs, data processing, and decision-making.

Cognizant Technology Solutions Corp. and other insurance BPO service providers are incorporating AI algorithms into customer contact, claims processing, and underwriting support to produce faster, more accurate outcomes.

By outsourcing non-essential functions to outside companies, this technological advancement enables insurers to concentrate on their key strengths. The advantages of business process outsourcing (BPO), such as cost savings, customized services, and risk management, continue to draw in enterprise clients despite economic downturns and possible data security issues. Emerging technologies, a customer-centric strategy, and an emphasis on customized services will all influence the Insurance BPO market's future.

Insurance Business Process Outsourcing (BPO) Market: Challenges

Dependence on third-party providers poses a major challenge to market expansion

The insurance industry's strong reliance on outside service providers is one of the major obstacles faced by the business process outsourcing (BPO) market. Although outsourcing offers scalability, cost savings, and operational efficiency, an excessive reliance on outside contractors has significant hazards.

Customer satisfaction may suffer from service interruptions brought on by any operational breakdown or disturbance at the BPO provider's end. Reliance on a single supplier may be dangerous if the seller has financial difficulties or violates regulations.

Additionally, BPO providers might employ conventional solutions, which would limit flexibility to meet the demands of particular insurers. Contractual restrictions and varying company priorities may cause innovation to proceed more slowly. Thus hampering the industry expansion.

Insurance Business Process Outsourcing (BPO) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Insurance Business Process Outsourcing (BPO) Market |

| Market Size in 2024 | USD 7.5 Billion |

| Market Forecast in 2034 | USD 10.9 Billion |

| Growth Rate | CAGR of 3.8% |

| Number of Pages | 221 |

| Key Companies Covered | Invensis Technologies Pvt Ltd, Patra, Flatworld Solutions Pvt. Ltd., Solartis, Infosys Limited, Canon Business Process Services., Accenture, WNS (Holdings) Ltd., Acquire BPO Pty Ltd, Cogneesol, and others. |

| Segments Covered | By Type, By Enterprise Size, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Insurance Business Process Outsourcing (BPO) Market: Segmentation

The global Insurance Business Process Outsourcing (BPO) industry is segmented based on type, enterprise size, application, and region.

Based on the type, the global Insurance Business Process Outsourcing (BPO) market is bifurcated into asset management, finance and accounting services, customer care services, marketing, policy administration, and others. The finance and accounting services segment is expected to hold the largest market share over the forecast period. This expansion is driven by insurers seeking to optimize operations, reduce costs, and enhance financial accuracy.

Based on the enterprise size, the global Insurance Business Process Outsourcing (BPO) industry is bifurcated into large enterprises and small and medium-sized enterprises. The large enterprises segment is expected to dominate the market expansion over the projected period. This segment is driven by their extensive operational requirements and the need for efficient process management.

Based on the application, the global Insurance Business Process Outsourcing (BPO) market is bifurcated into life insurance and non-life insurance. The life insurance segment captures the largest market share over the analysis period. The life insurance business process outsourcing (BPO) market is changing dramatically as a result of both regulatory demands and technology breakthroughs.

To stay competitive, increase operational effectiveness, and adjust to shifting market conditions, insurers are using BPO services more and more.

Insurance Business Process Outsourcing (BPO) Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global insurance business process outsourcing market. It is renowned for having a large and well-established insurance industry, high operating costs, and a focus on digital advancements. To save expenses and increase efficiency, insurance companies in the US and Canada assign tasks such as policy management, customer service, and claims processing.

Insurers depend on BPO companies to handle compliance, fraud detection, and data administration because of high personnel costs and strict regulations.

For insurers looking to improve their operations, outsourcing is a recommended choice because this sector excels at implementing AI, automation, and cloud technologies.

Insurance Business Process Outsourcing (BPO) Market: Competitive Analysis

The global Insurance Business Process Outsourcing (BPO) market is dominated by players like:

- Invensis Technologies Pvt Ltd

- Patra

- Flatworld Solutions Pvt. Ltd.

- Solartis

- Infosys Limited

- Canon Business Process Services.

- Accenture

- WNS (Holdings) Ltd.

- Acquire BPO Pty Ltd

- Cogneesol

The global Insurance Business Process Outsourcing (BPO) market is segmented as follows:

By Type

- Asset Management

- Finance and Accounting Services

- Customer Care Services

- Marketing

- Policy Administration

- Others

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Life Insurance

- Non-Life Insurance

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Insurance business process outsourcing (BPO) is the process of outsourcing particular business processes of an insurance firm to a third-party supplier with experience in doing so. Underwriting, policy management, customer service, claims processing, and other back-office tasks might all fit in here.

The Insurance Business Process Outsourcing (BPO) market is driven by several factors, such as the rise of on-demand services & digital platforms, growing urbanization & busy lifestyles, rising disposable income & willingness to spend on home maintenance, aging population & demand for home healthcare services and others.

According to the report, the global insurance business process outsourcing market size was worth around USD 7.5 billion in 2024 and is predicted to grow to around USD 10.9 billion by 2034.

The global Insurance Business Process Outsourcing (BPO) market is expected to grow at a CAGR of 3.8% during the forecast period.

The global insurance business process outsourcing market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the technological advancements and the presence of major players.

The global Insurance Business Process Outsourcing (BPO) market is dominated by players like Invensis Technologies Pvt Ltd, Patra, Flatworld Solutions Pvt. Ltd., Solartis, Infosys Limited, Canon Business Process Services., Accenture, WNS (Holdings) Ltd., Acquire BPO Pty Ltd and Cogneesol among others.

The insurance business process outsourcing market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed