Global Laminated Labels Market Size, Share, Growth Analysis Report - Forecast 2034

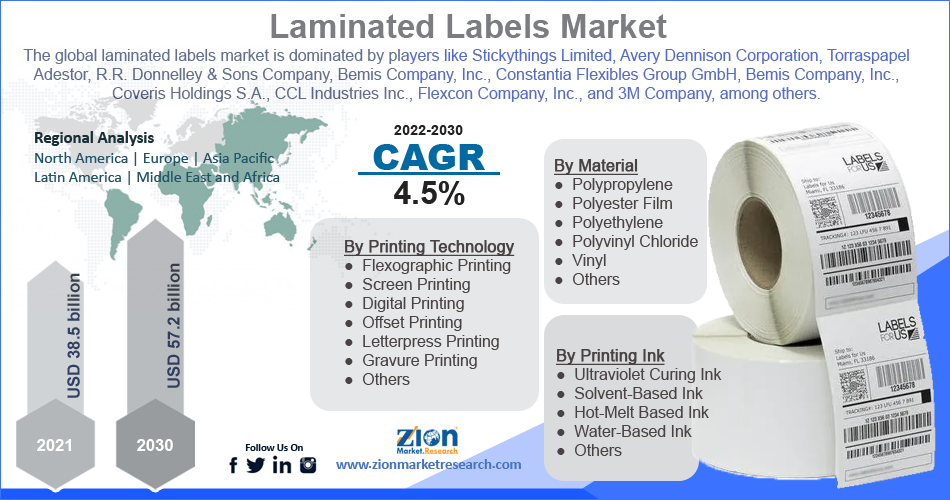

Laminated Labels Market By Technique (Hand-Applied, Brush-On, Spray-On, and Auto-Lamination), By Finish (Gloss, Semi-gloss, Matte, and Others), Material (Polypropylene, Polyester Film, Polyethylene, Polyvinyl Chloride, Vinyl, and Others), Printing Ink (Ultraviolet Curing Ink, Solvent-Based Ink, Hot-Melt Based Ink, Water-Based Ink, and Others), Printing Technology (Flexographic Printing, Screen Printing, Digital Printing, Offset Printing, Letterpress Printing, Gravure Printing, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

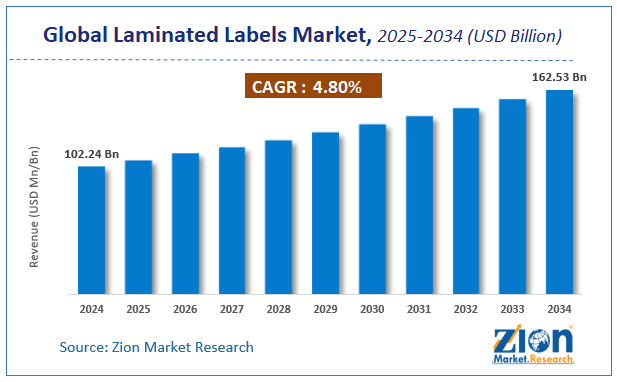

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 102.24 Billion | USD 162.53 Billion | 4.8% | 2024 |

Laminated Labels Market: Industry Perspective

The global laminated labels market size was worth around USD 102.24 Billion in 2024 and is predicted to grow to around USD 162.53 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.8% between 2025 and 2034.

The report analyzes the global laminated labels market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the laminated labels industry.

Laminated Labels Market: Overview

A printed or unprinted label is entirely encased during lamination to protect it from wear and tear from friction, scuffing, aggressive liquids, and harsh environmental conditions. In the production of laminated labels, polyester-release liners made of polyester film are frequently used. When compared to labels, laminated labels offer long-term imprint readability, which is why they are frequently used in several end-use sectors.

Key Insights

- As per the analysis shared by our research analyst, the global laminated labels market is estimated to grow annually at a CAGR of around 4.8% over the forecast period (2025-2034).

- Regarding revenue, the global laminated labels market size was valued at around USD 102.24 Billion in 2024 and is projected to reach USD 162.53 Billion by 2034.

- The laminated labels market is projected to grow at a significant rate due to rising demand for durable and water-resistant labeling solutions across industries like food & beverage and logistics.

- Based on Technique, the Hand-Applied segment is expected to lead the global market.

- On the basis of Finish, the Gloss segment is growing at a high rate and will continue to dominate the global market.

- Based on the Material, the Polypropylene segment is projected to swipe the largest market share.

- By Printing Ink, the Ultraviolet Curing Ink segment is expected to dominate the global market.

- In terms of Printing Technology, the Flexographic Printing segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

To know more about this report, request a sample copy.

Laminated Labels Market: Growth Drivers

Rapid Growth of the Healthcare and Medical Sector to drive the market growth

Laminated labels have the advantage of being more durable, and as medical and healthcare products have critical information on their labels, they need labels that should survive for a long time. Laminated labels are employed in medications and medical equipment due to this benefit. The growth of the global laminated labels market is being accelerated by the rising manufacturing of medicines.

For instance, the total pharmaceutical production in Europe was USD 328.23 billion in 2019, and it grew to USD 354.08 in 2020, a 5.7% rise, according to the European Federation of Pharmaceutical Industries and Association. Therefore, the rapid growth in the healthcare sector is expected to fuel market growth.

Laminated Labels Market: Restraints

Volatility in crude oil prices hampering the market growth

Polypropylene, Polyester Film, Polyethylene, Polyvinyl Chloride, Vinyl, and other upstream petroleum products are widely used as raw materials in the production of laminated labels. Consequently, the fluctuation in crude oil prices has an impact on the price of raw materials used to make laminated labels. According to BP's Statistical Review of World Energy, the price of crude oil has changed recently.

For instance, the cost of crude oil decreased from $98.95 a barrel in 2014 to $52.39 in 2015, increased from $43.73 in 2016 to $71.31 in 2018, and then decreased to $64.21 in 2019. Furthermore, the fluctuation in crude oil prices increases the cost of laminated labels. Thus, act as a major restraint for market growth.

Laminated Labels Market: Opportunities

The increasing automotive industry is expected to provide lucrative opportunities for market expansion

In the automotive and transportation sectors, every high-value part, piece, and surface is packaged and protected throughout import and export. Laminated labels are used in the identification of vehicle parts and components. For instance, China is the largest auto market in the world, according to the International Trade Administration (ITA), and the Chinese government expects that country to produce 35 million vehicles by 2025.

As a result of the rising per capita income of the population, which also contributed to the enormous demand for the production of laminated labels in the APAC region, the production of passenger cars in the new member region of the European Union increased from 4,131,358 in 2018 to 4,149,935 in 2019, an increase of 0.4%, according to OICA. Thus, increasing the automobile industry's fuel the global laminated labels market growth.

Laminated Labels Market: Challenges

Environmental protection laws and regulations

One major obstacle to the market expansion for laminated labels is the use of plastic in labels, such as polyester film, polypropylene, and other materials, as well as issues with disposal. As a result of mass production and lack of recycling, plastic landfills are expanding. According to the UN Environment, just 9% of plastic is recycled, with the remainder ending up in landfills, dumping sites, and the environment. Governments have established laws and standards governing label recycling.

For instance, the UK government and the Devolved Administrations, which are committed to environmental protection, have both expressed a strong desire to establish extended producer responsibility for the packaging, which would require producers to pay the full cost of disposing of the waste they produce.

Laminated Labels Market: Segmentation Analysis

The global laminated labels market is segmented based on Technique, Finish, Material, Printing Ink, Printing Technology, and region.

Based on Technique, the global laminated labels market is divided into Hand-Applied, Brush-On, Spray-On, and Auto-Lamination.

On the basis of Finish, the global laminated labels market is bifurcated into Gloss, Semi-gloss, Matte, and Others.

By Material, the global laminated labels market is split into Polypropylene, Polyester Film, Polyethylene, Polyvinyl Chloride, Vinyl, and Others.

In terms of Printing Ink, the global laminated labels market is categorized into Ultraviolet Curing Ink, Solvent-Based Ink, Hot-Melt Based Ink, Water-Based Ink, and Others.

By Printing Technology, the global Laminated Labels market is divided into Flexographic Printing, Screen Printing, Digital Printing, Offset Printing, Letterpress Printing, Gravure Printing, and Others.

Laminated Labels Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Laminated Labels Market |

| Market Size in 2024 | USD 102.24 Billion |

| Market Forecast in 2034 | USD 162.53 Billion |

| Growth Rate | CAGR of 4.8% |

| Number of Pages | 290 |

| Key Companies Covered | Stickythings Limited, Avery Dennison Corporation, Torraspapel Adestor, R.R. Donnelley & Sons Company, Bemis Company Inc., Constantia Flexibles Group GmbH, Bemis Company Inc., Coveris Holdings S.A., CCL Industries Inc., Flexcon Company Inc., and 3M Company, and others. |

| Segments Covered | By Technique, By Finish, By Material, By Printing Ink, By Printing Technology, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments:

- In February 2022, Fedrigoni, a global leader in high-value-added special papers for packaging, publishing, and graphics, as well as premium labels and self-adhesive materials, announced the acquisition of Divipa. A Derio-based corporation that develops, manufactures, and distributes self-adhesive materials. Fedrigoni is the main producer of wine labels and plays a leading role in high-tech self-adhesive labels and films for food, pharmaceutical, automotive, personal & home care sectors, and many more. Through this acquisition, the company continues its expansion in the increasingly promising sector of self-adhesive material.

- In November 2021, Based in San Giorgio Monferrato, Bobst Italia completed the acquisition of the assets of Officine Meccaniche Giovanni Cerutti and Cerutti Packaging Equipment, including the service company 24/7 Cerutti Service (Cerutti). The acquisition of Cerutti is consistent with Bobst's strategic objective to further solidify its technological and market dominance in the international gravure printing sector.

Laminated Labels Market: Regional Analysis

Asia Pacific region is expected to hold the largest market share during the forecast period

The Asia Pacific region is expected to hold the largest global laminated labels market share during the forecast period. Furthermore, the presence of growing economies like China and India is propelling the regional laminated labels market. The cosmetics, food, and pharmaceutical industries have a high need for laminated labels in China due to the region's large population. For instance, China's industrial production increased by 6.1% in 2018, according to the National Bureau of Statistics. The growth is projected to continue as a result of a 10.4% increase in retail sales of industrial products.

These variables are also significant drivers of automation in the country. Moreover, as per the same source, the manufacturing and production sector in India is one of the fastest growing, with a 7.9% year-on-year growth rate. The Make in India initiative aims to make India equally appealing to domestic and foreign players while also gaining worldwide recognition for the Indian economy. The Indian manufacturing sector is estimated to reach USD 1 trillion by the end of 2025.

Additionally, It is anticipated that market expansion in the Asia Pacific will be boosted by rising foreign direct investments and favorable government policies implemented in China and India. The region's laminated labels market is anticipated to increase as a result of the implementation of rules governing labeling and packaging requirements under the CLP Regulation on the classification, labeling, and packaging of chemicals and mixtures.

Besides, the second-largest market share for laminated labels is anticipated to come from Europe. Germany, the UK, France, Italy, and Spain are among the nations that dominate the European market. Due to the rising demand for premium and filmic laminated labels, Germany is expected to experience the fastest growth during the projection period. Moreover, the increasing product launches with more focus on sustainability are expected to drive market growth over the forecast period. For instance, In November 2021, German manufacturer Dimension-Polyant announced the launch of its new RX line of sustainable fabrics, which are certified cradle-to-gate climate neutral and carry the company’s cleenTEC seal.

Ready to tackle the outdoor elements, X-Pac RX 3-layer laminates are made with a 100 percent post-consumer polyester face fabric and X-PLY reinforcement. The recycled polyester fiber is made from discarded PET bottles sourced in the US. As with all X-Pac materials, the RX laminates are made in Dimension-Polyant’s Putnam, CT facility, which is 100 percent climate-neutral, Dimension-Polyant. Therefore, these facts influence the market growth in the region.

Laminated Labels Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the laminated labels market on a global and regional basis.

The global laminated labels market is dominated by players like:

- Stickythings Limited

- Avery Dennison Corporation

- Torraspapel Adestor

- R.R. Donnelley & Sons Company

- Bemis Company Inc.

- Constantia Flexibles Group GmbH

- Bemis Company Inc.

- Coveris Holdings S.A.

- CCL Industries Inc.

- Flexcon Company Inc.

- and 3M Company

The global laminated labels market is segmented as follows;

By Technique

- Hand-Applied

- Brush-On

- Spray-On

- and Auto-Lamination

By Finish

- Gloss

- Semi-gloss

- Matte

- and Others

By Material

- Polypropylene

- Polyester Film

- Polyethylene

- Polyvinyl Chloride

- Vinyl

- and Others

By Printing Ink

- Ultraviolet Curing Ink

- Solvent-Based Ink

- Hot-Melt Based Ink

- Water-Based Ink

- and Others

By Printing Technology

- Flexographic Printing

- Screen Printing

- Digital Printing

- Offset Printing

- Letterpress Printing

- Gravure Printing

- and Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Leading players in the global laminated labels market include Stickythings Limited, Avery Dennison Corporation, Torraspapel Adestor, R.R. Donnelley & Sons Company, Bemis Company Inc., Constantia Flexibles Group GmbH, Bemis Company Inc., Coveris Holdings S.A., CCL Industries Inc., Flexcon Company Inc., and 3M Company, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed