LED Lighting Drivers Market Size, Share, Growth, Trends, and Forecast 2030

LED Lighting Drivers Market By Application (Electronic Devices, General Lighting, Outdoor Display Lighting, and Automotive Lighting), By End-User (Industrial, Commercial, and Residential), By Product (Constant Current and Constant Voltage), By Control Feature (Wireless and Wired), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

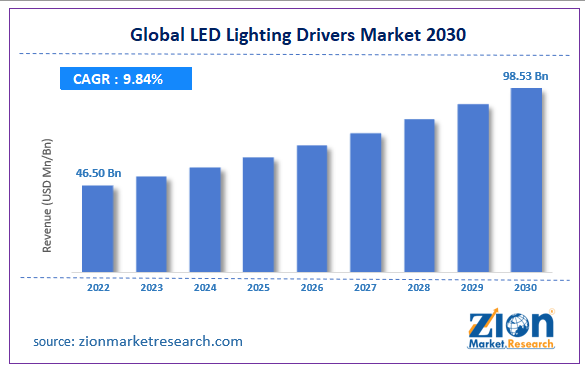

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 46.50 Billion | USD 98.53 Billion | 9.84% | 2022 |

LED Lighting Drivers Industry Prospective:

The global LED lighting drivers market size was worth around USD 46.50 billion in 2022 and is predicted to grow to around USD 98.53 billion by 2030 with a compound annual growth rate (CAGR) of roughly 9.84% between 2023 and 2030.

LED Lighting Drivers Market: Overview

Light-emitting diode (LED) is a semiconductor that emits light after being connected to a power source. An LED lighting driver is a self-contained power supply that manages and regulates the power needed by an LED or a set of LEDs for lighting. They require special power supplies since LEDs, inherently, are low energy-consuming semiconductors with longer lifespans as compared to other sources of light. An LED lighting driver can be compared to autopilot or cruise control in a vehicle. As the temperature of an LED light changes, the required power level is regulated by the LED driver. This way it helps prevent the LED from getting too hot and vulnerable to performance failure. To ensure that LED devices function as expected, the drivers are installed that ensure constant power supply to the device. There are two main types of LED drivers that are either installed externally or internally during the LED assembly process. The former type of LED is used in external settings such as roadway lighting while the latter is used in lighting devices used within a closed unit. They are easier to replace. The industry for LED lighting drives is projected to grow rapidly during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global LED lighting drivers market is estimated to grow annually at a CAGR of around 9.84% over the forecast period (2023-2030)

- In terms of revenue, the global LED lighting drivers market size was valued at around USD 46.50 billion in 2022 and is projected to reach USD 98.53 billion, by 2030.

- The LED lighting drivers market is projected to grow at a significant rate due to the increasing investments in smart homes and city development projects

- Based on application segmentation, electronic devices was predicted to show maximum market share in the year 2022

- Based on product segmentation, the constant current was the leading type in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

LED Lighting Drivers Market: Growth Drivers

Increasing investments in smart homes and city development projects to drive market growth

The global LED lighting drivers market is projected to grow owing to the rising investments in the development of smart cities and homes across the globe. As the urbanization rate continues to expand, there is a greater need to develop cities and modern living spaces that are energy efficient as poor planning can result in monumental pressure on non-renewable sources of energy and power wastage. Several companies providing lighting solutions are offering LED lights that suit the requirements of a smart home.

For instance, these lights have a longer lifespan than conventional lights since LED lights are known to last around 25,000 to 50,000 hours while the latter lifespan does not reach beyond 2000 hours. In addition to this, smart LEDs are considered eco-friendly since it is possible to dim the lights when not in use, eventually saving more than a few tonnes of energy. They can be controlled by voice which is apt for the modern population. A recent survey showcasing statistics on smart homes in the US showed that more than 50 million American households have reached the ‘smart home’ status. Between 2018 and 2023, the number of smart homes grew by almost 10% every year.

Reports claim that investments in smart city technologies in the Middle East reach around USD 2.35 billion in 2021. Similarly, there have been several developments in smart city projects around the globe. For instance, Volocopter, a German-based urban air mobility company received an investment of USD 1.7 billion from Hong Kong-based GLy Capital Investment and NEOM. Several other investments are an indicator of the trust that global leaders have in smart city projects.

LED Lighting Drivers Market: Restraints

High cost of LED lights to restrict the market growth

The global LED lighting drivers market growth may be limited due to the high cost associated with LED lights as compared to traditional lighting systems. This is because the technology used in the production of LED lighting systems is more advanced and sophisticated. In addition to this, the assembly line is longer as more parts are required to build a fully functional LED light or bulb. The cost of LED lights is further increased due to the expensive nature of LED drivers. In the current volatile social-political environment worldwide, the demand and consumption of expensive products such as LEDs may take a hit.

LED Lighting Drivers Market: Opportunities

Expansion in emerging economies and launch of new LED lighting solutions to create excellent expansion possibilities

The LED lighting drivers industry may come across extensive growth opportunities during the forecast period owing to the rising population in emerging economies that can pose potential clients in the future. These countries such as South Africa, India, and China have a growing middle-income group driven by rising job opportunities and migrating toward urban areas. Moreover, the players providing LED lighting solutions are investing in innovation. Increased research and development are expected to allow companies to tap into a broader group of audience in the coming years. In September 2023, Delta, a leading provider of thermal and power management solutions, announced the launch of EUCO-2.1kW LED drivers. The new range is an extension of its existing EUCO Arena Sport Series. With a certification of D4i standard, EUCO-2.1kW LED drivers are compatible with modern-age demand for Internet of Things (IoT) integration and connectivity.

In July 2023, ROHM announced the development of new LED driver integrated circuits (ICS) called the BD94130xxx-M series (BD94130MUF-ME2, BD94130EFV-ME2) with applications for automotive LCD backlights. Such development-oriented trends hold the key to the industry’s future.

LED Lighting Drivers Market: Challenges

Absence of common production standards or protocols to create obstacles against growth

The global LED lighting drivers market players are expected to face obstacles against growth owing to the lack or absence of common standards or protocols governing the production of LED lighting drivers. Since production rules and regulatory procedures concerning sales of LED drivers are dynamic and may change between countries, it created challenges for the companies that are trying to enter new markets as more resources are invested in meeting regional legal and performance expectations.

LED Lighting Drivers Market: Segmentation

The global LED lighting drivers market is segmented based on application, end-user, product, control feature, and region.

Based on application, the global market is segmented into electronic devices, general lighting, outdoor display lighting, and automotive lighting. In 2022, the highest growth was observed in the electronic devices segment as it contributed to over 40.1% of the segmental revenue share. The extensive growth trend was driven by increased sales of consumer electronics such as television sets, laptops, wearables, and smartphones. The modern consumer has higher expectations from companies and brands. They want energy-efficient products that meet higher quality standards leading to greater adoption of LED lighting drivers in display panels of products such as refrigerators and air-conditioners. The automotive lighting segment is expected to grow at a significant rate as the global automotive industry reaches USD 6 trillion by 2030.

Based on end-user, the LED lighting drivers industry is divided into industrial, commercial, and residential.

Based on product, the LED lighting drivers industry segments into constant current and constant voltage. In 2022, the highest revenue was generated by the constant current segment, and as per projections, the same growth trajectory will be observed during the forecast period. This is mainly due to the attribute of constant current LED drivers to the main specific current flow rate without any scope to exceed the maximum current rating marked on the LED device. This keeps the product safe from any form of current-based malfunction. The most common currents passing through the drivers are 2 mA, 10 mA, and 20 mA. Sub-products in the segment include Attractive Lamps, Reflectors, and Integrated LED Module, Type A-Lamps out of which the highest demand was recorded for Type A-Lamps.

Based on control feature, the global market divisions are wireless and wired.

LED Lighting Drivers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | LED Lighting Drivers Market |

| Market Size in 2022 | USD 46.50 Billion |

| Market Forecast in 2030 | USD 98.53 Billion |

| Growth Rate | CAGR of 9.84% |

| Number of Pages | 207 |

| Key Companies Covered | Mean Well, Philips Lighting (Signify), Tridonic, Osram GmbH, Thomas Research Products, EldoLED, ERP Power, Inventron Electronics, Inventronics, Advance Transformer Co., Delta Electronics, MOSO Power Supply Technology, MEAN WELL USA, ON Semiconductor, LIFUD., and others. |

| Segments Covered | By Application, By End-User, By Product, By Control Feature, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

LED Lighting Drivers Market: Regional Analysis

Asia-Pacific dominated close to half of the global revenue share in 2022

The global LED lighting drivers market is projected to be led by Asia-Pacific. In 2022, the region held control over 46.25% of the global revenue. The dominance was a result of control over the semiconductor industry by Asian countries such as China, South Korea, and Taiwan. These nations have higher domestic demand for LED products while they also continue to enjoy the status of market leaders in terms of semiconductor exports. One of the primary regional growth propellers is the extensive support by the governments that have helped in creating robust innovation and production ecosystems for semiconductors including advanced LEDs.

Additionally, regional market players have joined hands with other market leaders to create better solutions which has further opened new avenues for expansion. In January 2023, Nichia Corporation from Japan and Germany’s Infineon Technologies announced the launch of a high-definition (HD) light engine equipped with 16,000 micro-LEDs that is expected to showcase headlight applications. The project was a joint effort and has managed to assist the modern automotive industry in taking one step forward toward a brighter future.

LED Lighting Drivers Market: Competitive Analysis

The global LED lighting drivers market is led by players like:

- Mean Well

- Philips Lighting (Signify)

- Tridonic

- Osram GmbH

- Thomas Research Products

- EldoLED

- ERP Power

- Inventron Electronics

- Inventronics

- Advance Transformer Co.

- Delta Electronics

- MOSO Power Supply Technology

- MEAN WELL USA

- ON Semiconductor

- LIFUD.

The global LED lighting drivers market is segmented as follows:

By Application

- Electronic Devices

- General Lighting

- Outdoor Display Lighting

- Automotive Lighting

By End-User

- Industrial

- Commercial

- Residential

By Product

- Constant Current

- Constant Voltage

By Control Feature

- Wireless

- Wired

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Light-emitting diode (LED) is a semiconductor that emits light after being connected to a power source.

The global LED lighting drivers market is projected to grow owing to the rising investments in the development of smart cities and homes across the globe.

According to study, the global LED lighting drivers market size was worth around USD 46.50 billion in 2022 and is predicted to grow to around USD 98.53 billion by 2030.

The CAGR value of the LED lighting drivers market is expected to be around 9.84% during 2023-2030.

The global LED lighting drivers market is projected to be led by Asia-Pacific. In 2022, the region held control over 46.25% of the global revenue.

The global LED lighting drivers market is led by players like Mean Well, Philips Lighting (Signify), Tridonic, Osram GmbH, Thomas Research Products, EldoLED, ERP Power, Inventron Electronics, Inventronics, Advance Transformer Co., Delta Electronics, MOSO Power Supply Technology, MEAN WELL USA, ON Semiconductor, and LIFUD.

The report explores crucial aspects of the LED lighting drivers market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed