Life Reinsurance Market Size, Share, Trends, Growth and Forecast 2032

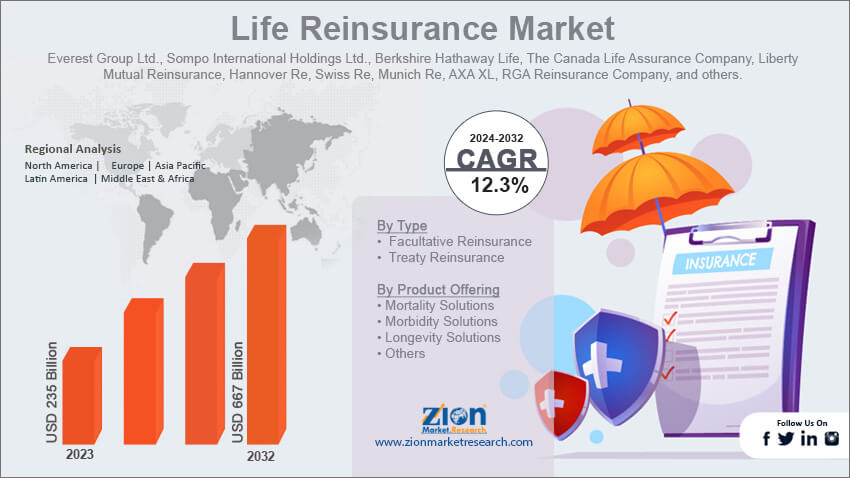

Life Reinsurance Market By Type (Facultative Reinsurance and Treaty Reinsurance), By Product Offering (Mortality Solutions, Morbidity Solutions, Longevity Solutions, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

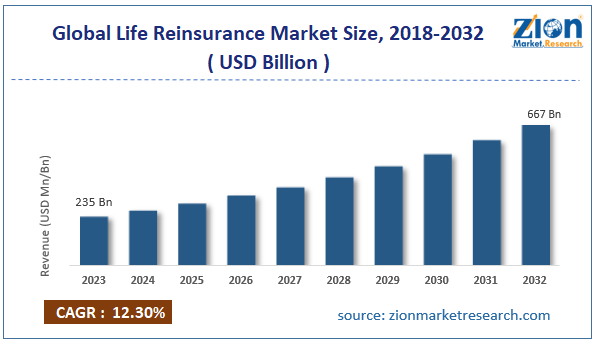

| USD 235 Billion | USD 667 Billion | 12.3% | 2023 |

Life Reinsurance Industry Perspective:

The global life reinsurance market size was worth around USD 235 billion in 2023 and is predicted to grow to around USD 667 billion by 2032 with a compound annual growth rate (CAGR) of roughly 12.3% between 2024 and 2032.

Life Reinsurance Market: Overview

For life insurance companies, reinsurance lets them transfer all or a part of their risk to another insurer. It helps life insurance firms to spread their risks, lower their liabilities, and boost their assets. Almost every product supplied by life insurers has some risk, which life reinsurers accept.

Furthermore, the concept of reinsurance enables insurance firms to stay in business even if losses are common in their area and allows clients to keep premiums reasonable.

Moreover, life reinsurance helps ceding insurers control their exposure to financial risks related to life insurance policies, such as mortality and longevity risk. It helps insurance companies maximize their resources, distribute their risk, and ensure that they meet their obligations to policyholders. In the insurance industry, life reinsurance is a fundamental risk-reducing strategy providing financial security.

Key Insights

- As per the analysis shared by our research analyst, the global life reinsurance market is estimated to grow annually at a CAGR of around 12.3% over the forecast period (2024-2032).

- In terms of revenue, the global life reinsurance market size was valued at around USD 235 billion in 2023 and is projected to reach USD 667 billion by 2032.

- The growing product launch is expected to drive the life reinsurance market over the forecast period.

- Based on type, the facultative reinsurance segment is expected to capture the largest market share over the forecast period.

- Based on product offering, the mortality solutions segment dominates the market.

- Based on region, North America is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Life Reinsurance Market: Growth Drivers

The rising number of claims drive market growth

Re-insurers have made a profit in the life reinsurance market as the category of claims in life insurance has grown faster. It lowers liability for a given risk, helps to stabilize losses, protects against disaster, and raises the capacity to attract fresh clients.

Moreover, a lot of life reinsurers have noted rising premium rates resulting from increased life insurance claims. Reversing the trend of low premiums, reinsurance companies manage risk and operate better.

Furthermore, driving the life reinsurance market are different market participants implementing distinct key tactics to provide extra services to their life insurance policies, enhancing their service efficiency and driving their revenue-generating possibilities. Moreover, the major objective of life reinsurance is to award beneficiaries a death benefit upon insured death. Unforeseeable events and an older population's resulting increase in mortality claims drive payouts to climb.

Also, given significant importance is the lifetime risk or chance that policyholders will live longer than expected. More reinsurance backing is needed when life expectancies rise since life reinsurers have to cope with the challenge of paying claims over longer times. Consequently, the demand for the life reinsurance market is driven by increased claims in the life insurance industry.

Life Reinsurance Market: Restraints

Intense competition and pricing pressure hinder market growth

Strong pricing pressure and intense competitiveness define the Life Reinsurance Market, both challenging market players. A small number of big reinsurers with significant capital reserves and worldwide influence rule the sector: Munich Re, Swiss Re, and Hannover Re.

Smaller and younger reinsurers find it challenging to establish a presence since these big firms can utilize their financial stability and reputation to grab a major share of the market. Smaller competing businesses may have to offer specialized reinsurance products or reduced premiums, influencing pricing. Thus, intense competition acts as a major restraint for the life reinsurance industry.

Life Reinsurance Market: Opportunities

Growing product launch offers a lucrative opportunity for market growth

The increasing product launch is expected to offer a lucrative opportunity for the life reinsurance market. For instance, in September 2024, Munich Re North America Life unveiled a new solution, longevity reinsurance, which allows clients to accumulate assets while transferring biometric risk.

Clients can transfer longevity risk by transforming uncertain future pension or annuity payments into a guaranteed cash flow stream, which locks in mortality assumptions and a charge at the outset.

With growing reserve and capital requirements for longevity risks, as well as upcoming reforms in the United States, insurers and asset reinsurers can benefit from Munich Re's solid balance sheet and extensive mortality experience.

Life Reinsurance Market: Challenges

High cost of life reinsurance poses a major challenge to market expansion

Purchasing reinsurance is expensive, which is the primary reason the life reinsurance market has experienced difficulties expanding. Purchasing reinsurance stabilizes loss experience, increases capacity, limits liability on particular risks, and/or protects against catastrophes, therefore reducing insurers' insolvency risk. Purchasing life reinsurance should thus help to lower capital expenses. Still, it is costly to expose risk to reinsurers.

For an insurer, the cost of reinsurance might be far more than the actual cost of the risk passed on. Consequently, although it greatly lowers the volatility of the loss ratio, buying reinsurance greatly raises the expenses of insurers. Purchasing life reinsurance allows insurers to lower their underwriting risk by accepting to pay more expenses for life insurance products. Thus, the high cost poses a major challenge for the life reinsurance industry.

Life Reinsurance Market: Segmentation

The global life reinsurance industry is segmented based on type, product offering, and region.

Based on the type, the global life reinsurance market is segmented into facultative reinsurance and treaty reinsurance. The facultative reinsurance segment is expected to capture the largest market share over the forecast period. When insurers come across unique or high-risk policies, such as high-value life insurance or specialty products (such as critical illness coverage), they frequently resort to facultative reinsurance. This demand for personalized solutions fuels revenue growth in facultative reinsurance, allowing primary insurers to shift risk that does not fit neatly into treaty agreements.

Furthermore, because each policy is customized and risk assessed, facultative reinsurance typically fetches greater rates than treaty reinsurance. This premium markup boosts revenue growth since reinsurers can charge more for taking on larger or more unexpected risks.

Based on product offering, the global life reinsurance industry is bifurcated into mortality solutions, morbidity solutions, longevity solutions, and others. The mortality solutions segment dominates the market. The growing aging population, particularly in developed nations, drives up demand for life insurance products, increasing the need for mortality solutions to control associated risks.

Furthermore, the introduction of new health risks, such as lifestyle-related diseases and pandemics, makes it difficult to anticipate mortality. To successfully handle these uncertainties, insurers demand robust mortality solutions.

Life Reinsurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Life Reinsurance Market |

| Market Size in 2023 | USD 235 Billion |

| Market Forecast in 2032 | USD 667 Billion |

| Growth Rate | CAGR of 12.3% |

| Number of Pages | 220 |

| Key Companies Covered | Everest Group Ltd., Sompo International Holdings Ltd., Berkshire Hathaway Life, The Canada Life Assurance Company, Liberty Mutual Reinsurance, Hannover Re, Swiss Re, Munich Re, AXA XL, RGA Reinsurance Company, and others. |

| Segments Covered | By Type, By Product Offering, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Life Reinsurance Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global life reinsurance market during the forecast period. Life insurance demand in North America is increasing due to aging demographics, more financial security awareness, and a growing middle class. This tendency drives the demand for life reinsurance solutions.

Furthermore, as a substantial section of the population ages, the need for life insurance products to cover longevity risk and provide financial security for dependents has increased, forcing insurers to seek reinsurance backing.

In addition, advances in data analytics, artificial intelligence, and predictive modeling enable reinsurers to assess risks and provide customized solutions for their clients more correctly. This technological advantage improves the value of life reinsurance solutions.

Life Reinsurance Market: Competitive Analysis

The global life reinsurance market is dominated by players like:

- Everest Group Ltd.

- Sompo International Holdings Ltd.

- Berkshire Hathaway Life

- The Canada Life Assurance Company

- Liberty Mutual Reinsurance

- Hannover Re

- Swiss Re

- Munich Re

- AXA XL

- RGA Reinsurance Company

The global life reinsurance market is segmented as follows:

By Type

- Facultative Reinsurance

- Treaty Reinsurance

By Product Offering

- Mortality Solutions

- Morbidity Solutions

- Longevity Solutions

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

For life insurance companies, reinsurance lets them transfer all or a part of their risk to another insurer. It helps life insurance firms to spread their risks, lower their liabilities, and boost their assets. Almost every product supplied by life insurers has some risk, which life reinsurers accept. Furthermore, the concept of reinsurance enables insurance firms to stay in business even if losses are common in their area and allows clients to keep premiums reasonable.

The life reinsurance market is driven by several factors, such as rising mortality rate, growth in the aging population, growing product launches, and others.

According to the report, the global life reinsurance market size was worth around USD 235 billion in 2023 and is predicted to grow to around USD 667 billion by 2032.

The global life reinsurance market is expected to grow at a CAGR of 12.3% during the forecast period.

The global life reinsurance market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the presence of major players.

The global life reinsurance market is dominated by players like Everest Group, Ltd., Sompo International Holdings Ltd., Berkshire Hathaway Life, The Canada Life Assurance Company, Liberty Mutual Reinsurance, Hannover Re, Swiss Re, Munich Re, AXA XL and RGA Reinsurance Company among others.

The life reinsurance market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed