Life Science Products Market Size, Share, Trends, Growth 2034

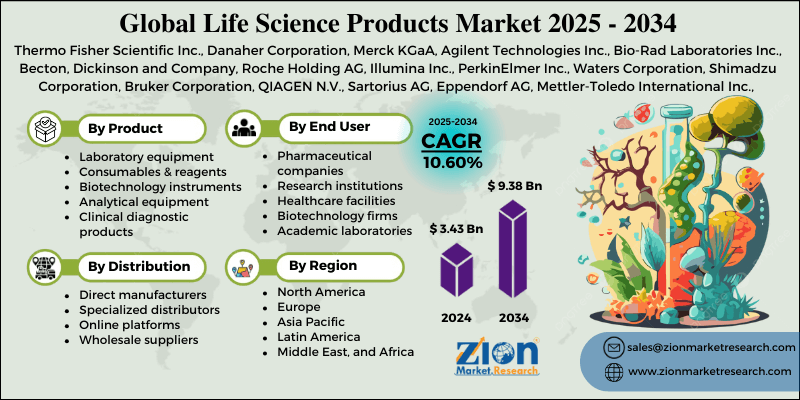

Life Science Products Market By Product Type (Laboratory Equipment, Consumables and Reagents, Biotechnology Instruments, Analytical Equipment, and Clinical Diagnostic Products), By End-User (Pharmaceutical Companies, Research Institutions, Healthcare Facilities, Biotechnology Firms, and Academic Laboratories), By Distribution Channel (Direct Manufacturers, Specialized Distributors, Online Platforms, and Wholesale Suppliers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

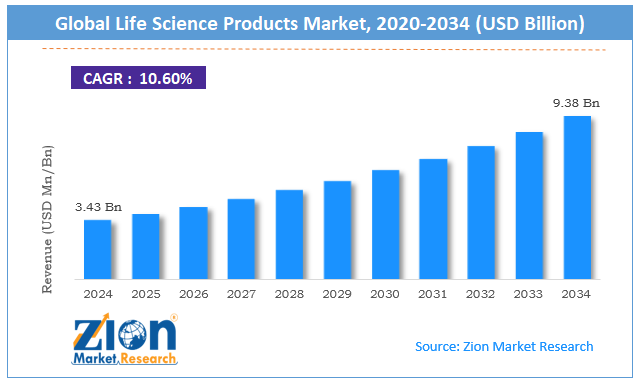

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.43 Billion | USD 9.38 Billion | 10.60% | 2024 |

Life Science Products Industry Prospective:

The global life science products market was valued at approximately USD 3.43 billion in 2024 and is expected to reach around USD 9.38 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 10.60% between 2025 and 2034.

Life Science Products Market: Overview

Life science products are tools, instruments, reagents, and consumables that support research, diagnostics, and drug development across pharmaceutical, biotech, healthcare, and academic sectors. This includes instrumentation, precision lab equipment, analytical tools, and specialized consumables to advance scientific discovery and clinical applications.

Life science products cover all research and clinical needs across various biomedical disciplines. Increasing research activities, technological innovations, and the growing prevalence of chronic diseases drive the life science products market.

Investment in healthcare infrastructure, digitalization of life science tools, and expansion of biopharmaceutical manufacturing capacity will drive growth in the life science products market over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global life science products market is estimated to grow annually at a CAGR of around 10.60% over the forecast period (2025-2034)

- In terms of revenue, the global life science products market size was valued at around USD 3.43 billion in 2024 and is projected to reach USD 9.38 billion by 2034.

- The life science products market is projected to grow significantly due to increasing research and development activities, rising demand for personalized medicine, and expanding biotechnology applications across diverse healthcare segments.

- Based on product type, consumables and reagents lead the segment and will continue to lead the global market during the forecast period.

- Based on end users, pharmaceutical companies are anticipated to command the largest market share.

- Based on the distribution channel, specialized distributors are expected to lead the market during the forecast period.

- Based on region, North America is projected to dominate the global market during the forecast period.

Life Science Products Market: Growth Drivers

Expanding biopharmaceutical research and precision medicine initiatives

Research and innovation are driving the growth of the life science products industry. Pharmaceutical and biotechnology companies are investing in new drug discovery platforms and diagnostic technologies.

Global research and development expenditure in life science products has increased, with particular emphasis on genomic medicine and targeted therapies. This investment increased with the emergence of new infectious diseases and continued as organizations developed advanced therapies and diagnostic solutions.

Precision medicine and biomarker discovery are driving demand, with a preference for high-end instruments and high-sensitivity detection systems.

Technological integration and automation in laboratory workflows

Technology is transforming life science research methodologies and is enhancing efficiency and reproducibility. Advanced robotics, artificial intelligence, and integrated workflow solutions are revolutionizing modern laboratories. Research indicates that automated life science product sales have increased, outpacing traditional manual alternatives.

Connected laboratory technologies, cloud-based data management systems, and digital pathology platforms are experiencing increased adoption across academic and commercial research facilities, further driving the growth of the life science products industry. This trend toward digital transformation is also enabling real-time data sharing, remote experiment monitoring, and improved collaboration across the market.

Life Science Products Market: Restraints

Stringent regulatory requirements and complex approval processes

Regulation around life science technologies is a major market barrier and operational challenge throughout the product development lifecycle. Compliance with regulatory frameworks requires extensive validation, documentation, and quality assurance processes.

Industry reports indicate that regulatory approval timelines for life science technologies have been extended, and manufacturers operate under documentation requirements that increase development costs. Harmonization challenges between different regulatory jurisdictions further complicate market dynamics, with different standards capable of delaying global commercialization strategies.

Life Science Products Market: Opportunities

Advanced analytical technologies and personalized healthcare solutions

Researchers emphasize personalized treatment approaches, which present growth opportunities for the global life science product market. Developing next-generation sequencing, single-cell analysis, and high-resolution imaging technologies creates new segments with substantial growth potential.

For example, companies introducing advanced proteomics platforms, microfluidic systems, and AI-enhanced diagnostic tools are experiencing growth rates exceeding traditional instrumentation.

Regenerative medicine applications, including cell therapy manufacturing solutions and tissue engineering platforms, are also gaining traction, further expanding the market. This shift toward precision medicine is reshaping research priorities and driving demand for specialized tools that support biomarker discovery, targeted drug development, and patient-specific diagnostics.

Life Science Products Market: Challenges

Economic pressures and research funding constraints

Manufacturers in the life science products industry identify budget limitations as their most significant challenge, particularly affecting academic institutions and early-stage biotechnology companies.

Sophisticated instrumentation often requires substantial capital investment, creating adoption barriers for resource-constrained organizations—the gap between equipment needs and available funding forces prioritization decisions that delay technology implementation. Cost-containment pressures within healthcare systems also affect clinical laboratory investment capabilities.

As competition intensifies, manufacturers struggle to balance innovation with affordability; premium life science brands are developing modular systems to offer entry-level configurations while maintaining upgrade pathways.

Budget cycles in public research institutions also create purchasing volatility, with 52% of procurement managers reporting funding uncertainty as their primary constraint in acquiring advanced life science technologies.

Life Science Products Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Life Science Products Market |

| Market Size in 2024 | USD 3.43 Billion |

| Market Forecast in 2034 | USD 9.38 Billion |

| Growth Rate | CAGR of 10.60% |

| Number of Pages | 213 |

| Key Companies Covered | Thermo Fisher Scientific Inc., Danaher Corporation, Merck KGaA, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Becton, Dickinson and Company, Roche Holding AG, Illumina Inc., PerkinElmer Inc., Waters Corporation, Shimadzu Corporation, Bruker Corporation, QIAGEN N.V., Sartorius AG, Eppendorf AG, Mettler-Toledo International Inc., GE Healthcare (now Cytiva), Lonza Group Ltd., Abbott Laboratories, Siemens Healthineers AG, and others. |

| Segments Covered | By Product Type, By End User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Life Science Products Market: Segmentation

The global life science products market is segmented into product type, end-user, distribution channel, and region.

Based on product type, the market is segregated into laboratory equipment, consumables and reagents, biotechnology instruments, analytical equipment, and clinical diagnostic products. Consumables and reagents lead the market because they are essential for daily lab operations, require continuous replenishment, and are used across a wide range of experiments and diagnostic procedures, ensuring consistent and recurring demand.

Based on end-users, the life science products industry is divided into pharmaceutical companies, research institutions, healthcare facilities, biotechnology firms, and academic laboratories. Pharmaceutical companies are expected to lead the market during the forecast period because their continuous investment in drug discovery, clinical trials, and advanced therapeutic development drives high demand for specialized equipment, reagents, and consumables across various research and production stages.

Based on distribution channels, the market is categorized into direct manufacturers, specialized distributors, online platforms, and wholesale suppliers. Specialized distributors are expected to lead the market since they offer technical expertise, logistics capabilities, and value-added services for life science product consumers.

Life Science Products Market: Regional Analysis

North America to lead the market

North America leads the life science products market due to strong research infrastructure, high healthcare investment, and a robust pharmaceutical innovation ecosystem. The U.S. accounts for 42% of global life science product consumption, as research funding is a national priority for both public and private.

The region has extensive networks of academic institutions, biotech clusters, and pharma research facilities, driving technology adoption across analytical platforms. North American researchers show high adoption rates for premium and integrated laboratory solutions, and advanced analytical system implementations outperform global averages.

The region's diverse research focus creates broad-based demand patterns; clinical diagnostics balance the fluctuations in basic research funding cycles. Increasing focus on translational research and personalized medicine makes the region key in life science products.

Moreover, favorable reimbursement policies, growing biopharmaceutical manufacturing capacity, and expanding CROs contribute to growth. Technological innovations like AI-enabled instruments and high-throughput screening platforms drive research demand.

Asia Pacific is set to grow significantly.

Asia Pacific is growing fast in the life science products industry, driven by biotech initiatives, healthcare infrastructure, and pharma manufacturing capacity. Countries like China, Japan, and South Korea are leading the adoption of advanced research platforms and innovative cell analysis technologies.

The region's focus on domestic biopharma development drives investment in research infrastructure; several countries have established national initiatives to strengthen the biomedical innovation ecosystem.

Cost-effective manufacturing capabilities create opportunities for local instrument makers while expanded life science education programs build specialized technical workforces. Rising chronic disease prevalence and government initiatives for preventive healthcare are driving demand for innovative diagnostic and research equipment in the Asia Pacific.

Recent Market Developments:

- In January 2025, Thermo Fisher Scientific expanded its analytical instrumentation portfolio by launching an advanced mass spectrometry platform featuring integrated artificial intelligence for automated sample analysis and enhanced sensitivity for low-abundance biomarker detection.

- In February 2025, Danaher Corporation introduced a comprehensive laboratory automation solution integrated with cloud-based workflow management, providing researchers with streamlined experimental protocols, real-time monitoring capabilities, and enhanced reproducibility features.

- In March 2025, Agilent Technologies launched an innovative liquid handling system featuring adaptive robotics, contamination-prevention technologies, and specialized protocols optimized for genomic and proteomic sample preparation workflows.

Life Science Products Market: Competitive Analysis

The global life science products market is led by players like:

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Merck KGaA

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Becton

- Dickinson and Company

- Roche Holding AG

- Illumina Inc.

- PerkinElmer Inc.

- Waters Corporation

- Shimadzu Corporation

- Bruker Corporation

- QIAGEN N.V.

- Sartorius AG

- Eppendorf AG

- Mettler-Toledo International Inc.

- GE Healthcare (now Cytiva)

- Lonza Group Ltd.

- Abbott Laboratories

- Siemens Healthineers AG

The global life science products market is segmented as follows:

By Product Type

- Laboratory equipment

- Consumables and reagents

- Biotechnology instruments

- Analytical equipment

- Clinical diagnostic products

By End User

- Pharmaceutical companies

- Research institutions

- Healthcare facilities

- Biotechnology firms

- Academic laboratories

By Distribution Channel

- Direct manufacturers

- Specialized distributors

- Online platforms

- Wholesale suppliers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Life science products are tools, instruments, reagents, and consumables that support research, diagnostics, and drug development across pharmaceutical, biotech, healthcare, and academic sectors.

The life science products market is expected to be driven by increasing research and development investments, growing demand for precision medicine applications, technological advancements in laboratory automation and analytics, expansion of biopharmaceutical manufacturing, and rising incidence of chronic and infectious diseases requiring advanced diagnostic solutions.

According to our study, the global life science products market was worth around USD 3.43 billion in 2024 and is predicted to grow to around USD 9.38 billion by 2034.

The CAGR value of the life science products market is expected to be around 10.60% during 2025-2034.

The global life science products market will register the highest growth in North America during the forecast period.

Key players in the life science products market include Thermo Fisher Scientific Inc., Danaher Corporation, Merck KGaA, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Becton, Dickinson and Company, Roche Holding AG, Illumina, Inc., PerkinElmer Inc., Waters Corporation, Shimadzu Corporation, Bruker Corporation, QIAGEN N.V., Sartorius AG, Eppendorf AG, Mettler-Toledo International Inc., GE Healthcare (now Cytiva), Lonza Group Ltd., Abbott Laboratories, and Siemens Healthineers AG.

The report comprehensively analyzes the life science products market, including an in-depth discussion of market drivers, restraints, emerging technological trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, innovation pathways, and the evolving research priorities shaping the life science products ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed