Light Commercial Vehicle Market Size, Share, Trends, Growth 2032

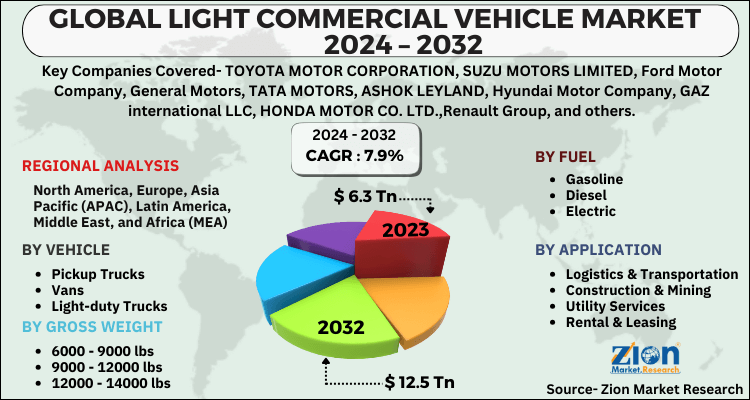

Light Commercial Vehicle Market By Vehicle (Pickup Trucks, Vans, and Light-duty Trucks), By Gross Weight (6000 - 9000 lbs, 9000 - 12000 lbs, and 12000 - 14000 lbs), By Fuel (Gasoline, Diesel and Electric), By Application (Logistics & Transportation, Construction & Mining, Utility Services, and Rental & Leasing), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.3 Trillion | USD 12.5 Trillion | 7.9% | 2023 |

Light Commercial Vehicle Industry Prospective:

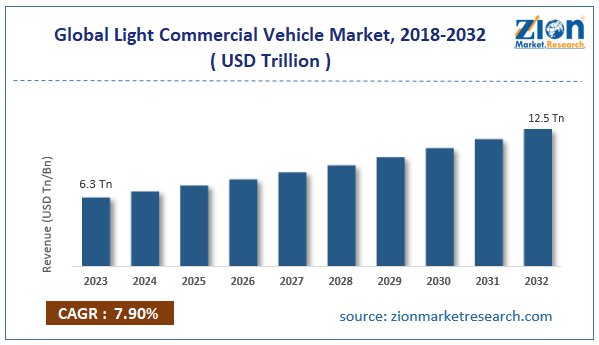

The global light commercial vehicle market size was worth around USD 6.3 trillion in 2023 and is predicted to grow to around USD 12.5 trillion by 2032 with a compound annual growth rate (CAGR) of roughly 7.9% between 2024 and 2032.

Light Commercial Vehicle Market: Overview

A motor vehicle used for transporting goods with four wheels or more is referred to as a light commercial vehicle (LCV). LCVs are used to distinguish between light commercial vehicles and heavy trucks based on their specific mass, which is expressed in tons (metric tons). This limit, which ranges from 3.5 to 7 tons, is determined by professional and national definitions.

Since light commercial vehicles (LCVs) are used in more industries, there is an increasing demand for light commercial vehicles that are powerful and efficient. Several companies launched their product across regions of the world, which has aided in the expansion of the worldwide light commercial vehicle industry.

Key Insights

- As per the analysis shared by our research analyst, the global light commercial vehicle market is estimated to grow annually at a CAGR of around 7.9% over the forecast period (2024-2032).

- In terms of revenue, the global light commercial vehicle market size was valued at around USD 6.3 trillion in 2023 and is projected to reach USD 12.5 trillion by 2032.

- The increasing adoption of EVs is expected to drive the Light Commercial Vehicle market over the forecast period.

- Based on vehicle, the pickup trucks segment is expected to dominate the light commercial vehicle market over the forecast period.

- Based on gross weight, the 6000 - 9000 lbs segment is expected to hold the largest market share over the forecast period.

- Based on fuel, the diesel segment is expected to hold the largest market share over the forecast period.

- Based on application, the logistics & transportation segment is expected to dominate the market during the forecast period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Light Commercial Vehicle Market: Growth Drivers

Expansion of e-commerce drives market growth

The buying and selling of items using the internet is known as e-commerce. The shipment of goods from retailers to customers is consequently handled by freight transporters. Furthermore, e-commerce businesses may concentrate on marketing and other company activities by using third-party logistics services to manage and supervise their supply chains. To transport the product to the nearest product delivery station, third-party logistics providers, like FedEx, XPO Logistics, and DHL, use several light commercial trucks. These companies have a larger fleet of LCVs for commuting within a city, as smaller LCVs use less fuel than heavy commercial vehicles.

In addition, the market for light commercial cars is expanding due to the many advantages that various automakers offer freight carriers, which is boosting the e-commerce sector's adoption of effective light commercial vehicles at a rapid pace.

Light Commercial Vehicle Market: Restraints

Stringent regulation hinders market growth

Stricter environmental laws are being implemented regarding the recycling and disposal of automobiles at the end of their useful lives. To protect the environment, automakers must make sure their cars are recyclable and adhere to trash disposal laws. For electric LCVs, this is especially difficult because battery recycling and disposal are still emerging issues. It is anticipated that battery recycling laws will become more stringent as electric LCVs proliferate.

Government regulations requiring manufacturers to properly handle and recycle batteries are likely to be enforced, adding to the logistical and financial strain on automakers. Therefore, the enforcement of this regulation across the globe is expected to hamper the light commercial vehicle market during the projected period.

Light Commercial Vehicle Market: Opportunities

Growing collaboration offers a lucrative opportunity for market growth

Over the predicted period, the light commercial vehicle market is expected to develop under the rising cooperation among the key industry participants. For instance, in June 2024, by distributing more than 100 Tata Ace EVs, including more than 60 Ace EV 1000 and more than 40 of the most recently announced Ace EV 1000, Magenta Mobility, a provider of integrated electric mobility solutions, has strengthened its relationship with Tata Motors, the largest commercial vehicle manufacturer in India. The two companies signed a contract in October 2023 outlining the 500 ground-breaking Tata Ace EV units to be deployed.

Light Commercial Vehicle Market: Challenges

The lack of availability of skilled technicians poses a major challenge to market expansion

More LCVs using cutting-edge technologies like electric drivetrains, autonomous features, and telematics are driving the demand for qualified technicians and service centers to handle maintenance and repairs. The shortage of qualified technicians educated in these technologies could slow down the acceptance of increasingly advanced LCVs. Therefore, the growth of the light commercial vehicle industry throughout the study period will be significantly hampered by the dearth of qualified technicians.

Request Free Sample

Request Free Sample

Light Commercial Vehicle Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Light Commercial Vehicle Market |

| Market Size in 2023 | USD 6.3 Trillion |

| Market Forecast in 2032 | USD 12.5 Trillion |

| Growth Rate | CAGR of 7.9% |

| Number of Pages | 222 |

| Key Companies Covered | TOYOTA MOTOR CORPORATION, SUZU MOTORS LIMITED, Ford Motor Company, General Motors, TATA MOTORS, ASHOK LEYLAND, Hyundai Motor Company, GAZ international LLC, HONDA MOTOR CO. LTD.,Renault Group, and others. |

| Segments Covered | By Vehicle, By Gross Weight, By Fuel, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Light Commercial Vehicle Market: Segmentation

The global light commercial vehicle industry is segmented based on vehicle, gross weight, fuel, application, and region.

Based on vehicle, the global light commercial vehicle market is segmented into pickup trucks, vans, and light-duty trucks. The pickup trucks segment is expected to dominate the light commercial vehicle market over the forecast period. Pickup trucks are highly prized for their capacity to serve both private and business purposes. Small enterprises, contractors, delivery services, and even the agricultural industry favor them since they combine the comfort of their passengers with the capacity to transport large goods. In both urban and rural settings, where off-road capability and cargo transportation are frequently crucial, their versatility fuels ongoing demand.

Based on the gross weight, the global light commercial vehicle industry is bifurcated into 6000 - 9000 lbs, 9000 - 12000 lbs, and 12000 - 14000 lbs. The 6000 - 9000 lbs segment is expected to hold the largest market share over the forecast period. The surge in e-commerce has raised the need for last-mile delivery services. Medium-duty LCVs weighing between 6,000 and 9,000 lbs are frequently used by enterprises to deliver goods in urban and suburban regions. One of the main factors driving demand for this vehicle sector is the expansion of last-mile delivery services, as companies need more durable trucks that can carry heavier loads while being nimble enough to maneuver through urban areas.

Based on the fuel, the global light commercial vehicle market is bifurcated into gasoline, diesel, and electric. The diesel segment is expected to hold the largest market share over the forecast period. Diesel engines are well-suited for the demands of commercial vehicle owners due to their strong torque and exceptional fuel efficiency. Businesses engaged in logistics, delivery, and transportation can save money using diesel-powered LCVs, which can travel great distances with fewer refueling stops. Because of this, diesel is favored in the LCV industry for heavy-duty and long-distance applications.

Based on the application, the global light commercial vehicle industry is bifurcated into logistics & transportation, construction & mining, utility services, and rental & leasing. The logistics & transportation segment is expected to dominate the market during the forecast period. The logistics and transportation business is facing driver shortages, particularly in industrialized countries such as the United States and Europe. Finding experienced drivers becomes more challenging as the demand for LCVs in last-mile and regional delivery applications rises. Furthermore, increasing wages and personnel shortages can drive up operational expenses for logistics organizations. Autonomous driving technology, while still in its early stages, may provide a long-term answer to this problem, though widespread use in LCVs is years away.

Light Commercial Vehicle Market: Regional Analysis

Asia Pacific dominates the market over the projected period

The Asia Pacific is expected to dominate the global light commercial vehicle market. LCV manufacturers such as Tata Motors, Ashok Leyland, Hyundai Motor Company, Isuzu Motors, and Toyota Motors have made breakthroughs, accelerating the market's growth across the area. Furthermore, China is home to enterprises that produce LCVs, such as Anhui Jianghuai Automobile, Beiqi Foton Motor Co., Ltd., FAW Group Corporation, and Dongfeng Motor Corporation, which are projected to increase the Chinese market.

Furthermore, as green mobility becomes more popular, these automakers are attempting to produce electric LCVs to help support the electric vehicle infrastructure. By the end of the current fiscal year, Ashok Leyland planned to launch its first electric light commercial vehicles. A new development designed to spearhead the company's EV strategy in India. The vehicle will be displayed by Switch Mobility Automotive.

Light Commercial Vehicle Market: Competitive Analysis

The global light commercial vehicle market is dominated by players like:

- TOYOTA MOTOR CORPORATION

- SUZU MOTORS LIMITED

- Ford Motor Company

- General Motors

- TATA MOTORS

- ASHOK LEYLAND

- Hyundai Motor Company

- GAZ international LLC

- HONDA MOTOR CO. LTD.,Renault Group

The global light commercial vehicle market is segmented as follows:

By Vehicle

- Pickup Trucks

- Vans

- Light-duty Trucks

By Gross Weight

- 6000 - 9000 lbs

- 9000 - 12000 lbs

- 12000 - 14000 lbs

By Fuel

- Gasoline

- Diesel

- Electric

By Application

- Logistics & Transportation

- Construction & Mining

- Utility Services

- Rental & Leasing

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A motor vehicle used for the transportation of goods that has four wheels or more is referred to as a light commercial vehicle (LCV). LCVs are used to distinguish between light commercial vehicles and heavy trucks based on their specific mass, which is expressed in tons (metric tons).

The light commercial vehicle market is driven by several factors such as the increasing automotive industry, rising collaboration, expansion of e-commerce, and others.

According to the report, the global light commercial vehicle market size was worth around USD 6.3 trillion in 2023 and is predicted to grow to around USD 12.5 trillion by 2032.

The global light commercial vehicle market is expected to grow at a CAGR of 7.9% during the forecast period.

The global light commercial vehicle market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market due to the increasing adoption of EVs and technological advancements.

The global light commercial vehicle market is dominated by players like TOYOTA MOTOR CORPORATION, SUZU MOTORS LIMITED, Ford Motor Company, General Motors, TATA MOTORS, ASHOK LEYLAND, Hyundai Motor Company, GAZ international LLC, HONDA MOTOR CO., LTD. and Renault Group among others.

The light commercial vehicle market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed