Liquid Biofuel Market Size, Share, Analysis, Trends, Growth, 2032

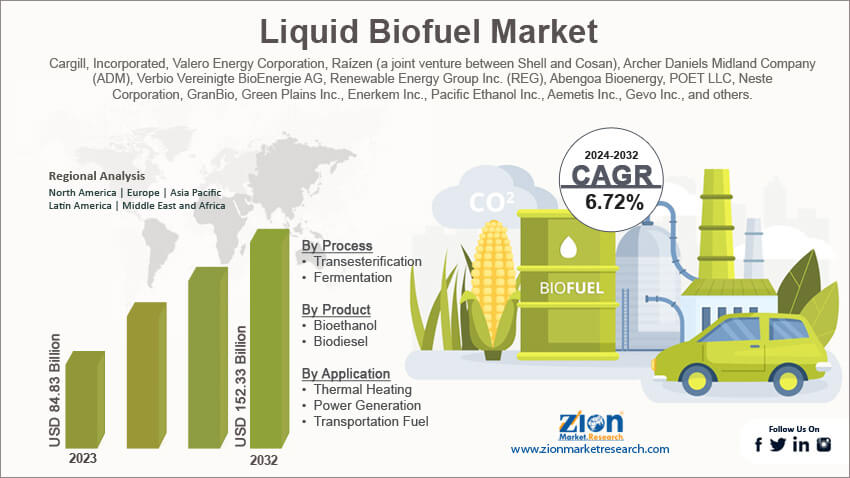

Liquid Biofuel Market By Process (Transesterification, Fermentation, and Others), By Product (Bioethanol, Biodiesel, and Others), By Application (Thermal Heating, Power Generation, Transportation Fuel), By Feedstock (Animal Fats, Vegetable Fats, Starch Crops, Sugar Crops, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

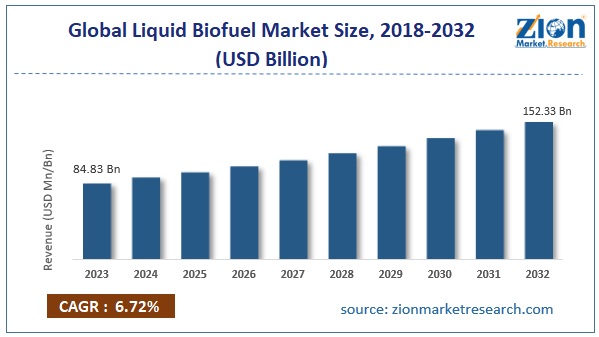

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 84.83 Billion | USD 152.33 Billion | 6.72% | 2023 |

Liquid Biofuel Industry Prospective:

The global liquid biofuel market size was worth around USD 84.83 billion in 2023 and is predicted to grow to around USD 152.33 billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.72% between 2024 and 2032.

Liquid Biofuel Market: Overview

Liquid biofuel is a power source produced using biomass. Liquid biofuels have applications across industries. Liquid biofuels are significantly different from traditional fuels produced using non-renewable energy reserves. Production of liquid biofuel is a short process since it does not take longer time which is mainly observed in the natural process of fossil fuel generation. As per claims by several research institutes, liquid biofuel is a more efficient alternative to oil-based fuel since it also avoids several disadvantages associated with traditional fuel. Liquid biofuel can be produced locally and does not require reliance on natural reserves. Governments can meet national energy demands using liquid biofuel as energy consumption is at a rapid rise. Some of the key advantages offered by liquid biofuel include the generation of mass employment and improvement in farmer income. Furthermore, the novel renewable energy source can also prevent the emission of harmful greenhouse gas (GHG), thus helping to prevent further damage to the climate conditions. Liquid biofuel is produced from a large range of options including sugar, cereal, and oil crops. Waste or residue can also be used as a primary feedstock for liquid biofuel production.

Key Insights:

- As per the analysis shared by our research analyst, the global liquid biofuel market is estimated to grow annually at a CAGR of around 6.72% over the forecast period (2024-2032)

- In terms of revenue, the global liquid biofuel market size was valued at around USD 84.83 billion in 2023 and is projected to reach USD 152.33 billion, by 2032.

- The liquid biofuel market is projected to grow at a significant rate due to the rising applications of liquid biofuel in the merchant shipping industry

- Based on the process, the fermentation segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the application, the transportation fuel segment is anticipated to command the largest market share

- Based on region, the US to lead growth in North America is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Liquid Biofuel Market: Growth Drivers

Rising applications of liquid biofuel in the merchant shipping industry will drive the market demand rate

The global liquid biofuel market is expected to witness high growth due to the growing applications of liquid biofuel in the merchant shipping industry. Around 80% of the world’s overall commercial trade is carried out through water channels. The maritime industry is one of the largest consumers of fuel. It is also a leading segment contributing to the growing GHG emissions. However, the merchant shipping sector is actively working toward switching to less harmful fuel and other solutions that can curb GHG emissions. In 2018, the International Maritime Organization (IMO) announced that it aims to reduce greenhouse gas emissions by 50% by 2050. In addition to this, large areas such as the Caribbean, the Baltic Sea, and the US West Coast are governed by regulations that control sulfur emissions. These areas do not promote high particulate marine fuel or high sulfur. This means that more than 70% of the fuel used in these areas must be replaced with more environmentally friendly alternatives. The marine shipping industry has been growing at a steady rate. For instance, in July 2023, the Indian government claimed that it had identified investment opportunities worth INR 10 trillion in the regional maritime industry. As world trade continues to grow, liquid biofuel producers can expect extensive revenue if they can supply the demand quantity.

Seriousness of environmental damage caused due to GHG emissions may encourage greater adoption of liquid biofuel

Greenhouse gas emissions have a significant impact on the environmental conditions. Gasses such as methane, carbon dioxide, sulfur hexafluoride, water vapor, ozone, and nitrous oxide among others are highly toxic to the environment. They lead to air, water, and soil pollution while also playing a major role in the rising temperature of the planet. Climate changes in the form of global warming have become more evident in the last decade. Consumers and businesses are steadily realizing the seriousness of the environmental damage caused by burning and excessive use of traditional fuel. These factors have caused several governments to take proactive measures to reduce consumption of fossil fuel and replacement with safe alternatives thus generating more demand in the global liquid biofuel market.

Liquid Biofuel Market: Restraints

Limited production capacity of liquid biofuel will limit the market’s adoption rate

One of the major drawbacks of the current state of the global liquid biofuel industry is the lack of infrastructure and resources to produce liquid biofuel in abundant quantities. The global fuel demand is currently at its peak and continues to rise. Such abundant demand for fuel can only be met by traditional sources of energy. Liquid biofuel production, although growing, has not reached its true potential and is hence unable to keep up with the global consumption rate. More active investments are required to rapidly escalate liquid biofuel generation for the industry to grow during the forecast period.

Liquid Biofuel Market: Opportunities

Thriving aviation sector to generate massive growth opportunities for the market players

The global liquid biofuel market is projected to encounter several new growth opportunities led by the significant demand for clean fuel in the aviation sector. Around 2% of the overall GHG emissions are associated with the aviation sector. The industry is seeking sustainable solutions to keep the industry running by investing in technologies such as solar-powered aircraft. However, the more economically and technically feasible solution is the use of bio-based jet fuels. The International Civil Aviation Organization has signed a deal with a 2050 vision for Sustainable Aviation Fuels. Under the new regulation, a significant share of the traditional fuel must be replaced with more environmentally friendly solutions. As per European industry officials and the government, biofuel-based sustainable aviation fuel (SAF) can reduce aviation emissions by over 80% and the region has called for more investments in the development of synthetic green power sources. In May 2024, Heathrow announced the launch of a one-of-a-kind breakfast under the name ‘The Fly Up’. The breakfast is cooked using recycled oil that has been converted into renewable biofuel. On the ground level, Heathrow has already switched to hydrotreated vegetable oil (HVO).

Rising partnerships between market players to develop new production facilities may create expansion possibilities

Against the backdrop of increasing demand for liquid biofuel, market players have shown significant partnerships and collaborations to improve the overall production output of the future-oriented resource. For instance, in September 2023, the Indian government announced the launch of the Global Biofuel Alliance during the G20 Summit. The regional government also encouraged other countries to join the cause to further promote growth in the global liquid biofuel market.

Liquid Biofuel Market: Challenges

Growing debates over fuel versus food may challenge the market expansion trend

The global industry for liquid biofuel is expected to be challenged by the rising debates over fuel versus food. The industry faces criticism since biofuels are known to compete with food supply which can result in food shortages. In addition to this, irresponsible expansion of liquid biofuel production may also impact usable land area further impacting the market growth trends.

Liquid Biofuel Market: Segmentation

The global liquid biofuel market is segmented based on process, product, application, feedstock, and region.

Based on the process, the global market divisions are transesterification, fermentation, and others. In 2023, the highest growth was observed in the fermentation process. This method is used for the production of bioethanol which is one of the most abundantly produced biofuel across the globe. In 2019, more than 109 billion liters of bioethanol was produced. The common feedstock used for ethanol production are crops with high starch and sugar content. It can also be produced using lignocellulosic materials.

Based on product, the global liquid biofuel industry is divided into bioethanol, biodiesel, and others.

Based on the application, the global market segments are thermal heating, power generation, and transportation fuel. In 2023, the highest demand was observed in the transportation fuel segment. The global logistics industry is the largest fuel consumer. The transportation sector accounts for 1/4th of the global energy-related carbon dioxide emissions. Hence, it is under tremendous pressure to seek alternate and clean fuel that has less impact on the environment.

Based on feedstock, the liquid biofuel industry segments are animal fats, vegetable fats, starch crops, sugar crops, and others.

Liquid Biofuel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Liquid Biofuel Market |

| Market Size in 2023 | USD 84.83 Billion |

| Market Forecast in 2032 | USD 152.33 Billion |

| Growth Rate | CAGR of 6.72% |

| Number of Pages | 225 |

| Key Companies Covered | Cargill, Incorporated, Valero Energy Corporation, Raízen (a joint venture between Shell and Cosan), Archer Daniels Midland Company (ADM), Verbio Vereinigte BioEnergie AG, Renewable Energy Group Inc. (REG), Abengoa Bioenergy, POET LLC, Neste Corporation, GranBio, Green Plains Inc., Enerkem Inc., Pacific Ethanol Inc., Aemetis Inc., Gevo Inc., and others. |

| Segments Covered | By Process, By Product, By Application, By Feedstock, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Liquid Biofuel Market: Regional Analysis

The US to lead growth in North America during the projection period

The global liquid biofuel market will be led by North America over the forecast period with the US dominating the largest part of the regional market share. It is the world’s largest producer of biofuels. It produced more than 1,557 petajoules of biofuel in recent times. The US produces excessive quantities of biodiesel. In February 2024, the U.S. Environmental Protection Agency (EPA) and the U.S. Department of Energy (DOE) informed of a new Funding Opportunity Announcement (FOA) called the Inflation Reduction Act Funding for Advanced Biofuels. The total worth of the project is around USD 9.4 million and will be directed toward the development of highly advanced biofuels. In addition to this, in November 2022, the country became a pioneer when United Airlines Ventures announced an investment in the development of NEXT Renewable Fuels (NEXT), a flagship refinery for biofuel production in the US. In September 2023, Arkema strengthened its hold in the US market with the addition of new investments directed toward the production of new dimethyl disulfide (DMDS), a key additive used for producing biofuels.

Liquid Biofuel Market: Competitive Analysis

The global liquid biofuel market is led by players like:

- Cargill

- Incorporated

- Valero Energy Corporation

- Raízen (a joint venture between Shell and Cosan)

- Archer Daniels Midland Company (ADM)

- Verbio Vereinigte BioEnergie AG

- Renewable Energy Group Inc. (REG)

- Abengoa Bioenergy

- POET LLC

- Neste Corporation

- GranBio

- Green Plains Inc.

- Enerkem Inc.

- Pacific Ethanol Inc.

- Aemetis Inc.

- Gevo Inc.

The global liquid biofuel market is segmented as follows:

By Process

- Transesterification

- Fermentation

By Product

- Bioethanol

- Biodiesel

By Application

- Thermal Heating

- Power Generation

- Transportation Fuel

By Feedstock

- Animal Fats

- Vegetable Fats

- Starch Crops

- Sugar Crops

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Liquid biofuel is a power source produced using biomass. Liquid biofuels have applications across industries.

The global liquid biofuel market is expected to witness high growth due to the growing applications of liquid biofuel in the merchant shipping industry.

According to study, the global liquid biofuel market size was worth around USD 84.83 billion in 2023 and is predicted to grow to around USD 152.33 billion by 2032.

The CAGR value of the liquid biofuel market is expected to be around 6.72% during 2024-2032.

The global liquid biofuel market will be led by North America over the forecast period with the US dominating the largest part of the regional market share.

The global liquid biofuel market is led by players like Cargill, Incorporated, Valero Energy Corporation, Raízen (a joint venture between Shell and Cosan), Archer Daniels Midland Company (ADM), Verbio Vereinigte BioEnergie AG, Renewable Energy Group, Inc. (REG), Abengoa Bioenergy, POET LLC, Neste Corporation, GranBio, Green Plains Inc., Enerkem Inc., Pacific Ethanol, Inc., Aemetis, Inc. and Gevo, Inc.

The report explores crucial aspects of the liquid biofuel market including a detailed discussion of existing growth factors and restraints while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed