Lithium Fluoride Market Size, Share, Growth, Trends, and Forecast 2030

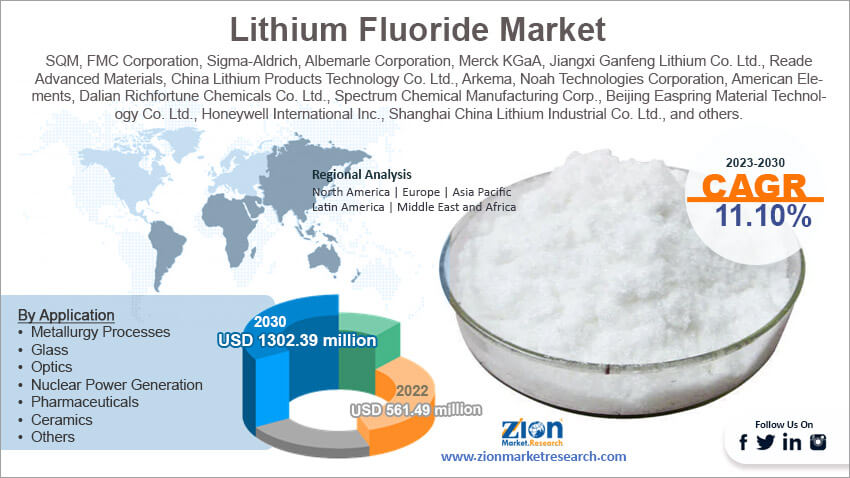

Lithium Fluoride Market By Application (Metallurgy Processes, Glass, Optics, Nuclear Power Generation, Pharmaceuticals, Ceramics, and Others), By Grade (Battery and Technical), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

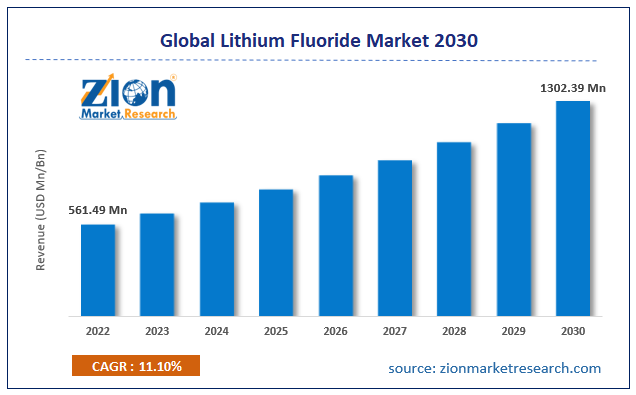

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 561.49 million | USD 1302.39 million | 11.10% | 2022 |

Lithium Fluoride Industry Prospective:

The global lithium fluoride market size was worth around USD 561.49 million in 2022 and is predicted to grow to around USD 1302.39 million by 2030 with a compound annual growth rate (CAGR) of roughly 11.10% between 2023 and 2030.

Lithium Fluoride Market: Overview

Lithium fluoride is an essential part of the global chemicals and materials sector. This inorganic compound is known by its widely recognized chemical formula LiF and like other inorganic compounds that play significant roles as coatings, pigments, catalysts, surfactants, fuels, and medicine, LiF is also extremely versatile with several end-user applications. In its original form, LiF is a colorless solid and transitions to white while decreasing crystal size. It does not exhibit any odor but has a bitter-saline taste. LiF, in its structural form, is similar to sodium chloride but has less water solubility. In terms of applications, it is primarily used as a component of molten salts. Studies indicate that lithium fluoride releases the highest energies per mass of reactants or specific energy, following beryllium oxide (BeO) owing to two main reasons. The primary is the presence of light elements that are lithium (Li) and fluoride (F) and the secondary is the high reactivity of F2. The preparation of lithium fluoride requires the use of hydrogen fluoride and lithium carbonate or lithium hydroxide.

Key Insights:

- As per the analysis shared by our research analyst, the global lithium fluoride market is estimated to grow annually at a CAGR of around 11.10% over the forecast period (2023-2030)

- In terms of revenue, the global lithium fluoride market size was valued at around USD 561.49 million in 2022 and is projected to reach USD 1302.39 million, by 2030.

- The lithium fluoride market is projected to grow at a significant rate due to the rising nuclear energy investments

- Based on grade segmentation, the battery segment was predicted to show maximum market share in the year 2022

- Based on application segmentation, nuclear power generation was the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Lithium Fluoride Market: Growth Drivers

Rising nuclear energy investments to drive market growth

The global lithium fluoride market is anticipated to grow due to the growing investments in nuclear energy and research in which LiF is one of the primary components, especially in liquid-fluoride nuclear reactors. LiF forms the basic component in the preferred mixture of fluoride salt used in liquid-fluoride nuclear reactors. It is a type of molten salt reactor also known as LFTR that uses fluoride-based molten fuel or salt and thorium fuel cycle. LFTR falls in the range of molten salt-fueled reactors (MSRs) which are a class of nuclear fission reactors responsible for supplying nuclear fuel mixed into molten salt. LFTRs are constructed using sophisticated technology and offer several advantages over traditionally used water-cooled or solid-fuel nuclear reactors. The main advantage of liquid-fluoride nuclear reactors is that they are safer to use due to the design structure and inherent nature. Moreover, they produce negligible nuclear waste as compared to other reactors. Research proves that radioactive fission products from nuclear waste produced by LFTRs do not survive longer in the environment. As world leaders and research giants continue to explore nuclear energy to meet the energy demands of the growing commercial world, the need for LiF and its consumption is expected to reach new heights.

This trend is evident in the recent large-scale investments in the construction of new and improved nuclear reactors. In August 2022, Thorizon, a company of nuclear professionals based in the Netherlands, announced that it had raised over EUR12.5 million in funds for the development of a new MSR. The company intends to use long-lived waste for generating carbon-dioxide-free energy and short-lived waste.

Lithium Fluoride Market: Restraints

Health risks associated with the compound may restrict market growth

The global lithium fluoride market growth is projected to be impacted by the increasing awareness of the health impacts of irresponsible or negligent handling of LiF. When the chemical is used in a controlled environment and safety protocols are followed, it does not pose any harm. However, as per official data, if LiF comes in contact with acid, it can lead to the release of toxic gasses. Furthermore, in case of accidental ingestion, lithium fluoride can be life-threatening due to its toxic content. Other side effects related to close exposure to the chemicals are skin irritation, respiratory conditions, and eye irritation. On the other hand, long-term exposure may lead to the onset of breathing issues and the development of related systemic problems.

Lithium Fluoride Market: Opportunities

Growing research in fluoride-ion batteries is an opportunity worth exploring

The lithium fluoride industry players must explore the ongoing research on fluoride-ion batteries in the expanding electric vehicle sector as the world is seeking measures to reduce dependency on non-renewable and environmentally polluting fuels such as diesel and petrol. The EV market is growing at a rapid rate across the public & private sectors and while current electric vehicles are powered by Lithium-ion (Li-ion) batteries, there is a significantly growing segment of researchers trying to leverage the advantages of fluoride-ion batteries as they try to get ahead in the EV technology game. A recent report discussed in detail the efforts undertaken by Japanese automakers to develop next-generation batteries that can travel around 1000 kilometers after a single charge as per predictions, fluoride-ion batteries have the potential to become a viable option as early as 2030. These batteries offer 6 to 7 times higher energy density than lithium-ion batteries and require fewer materials reducing production costs. The market continues to remain limited but with time, more investments are expected in this segment where compounds such as LiF may gain more exposure.

Existing use in the production of Li-ion batteries to continue pushing market growth

The industry for lithium fluoride is thriving due to the growing EV industry since LiF is an important component used in the production of Li-ion batteries that also has other significant buyers such as electronic product manufacturers. Li-ion batteries are essential components for electric products since these batteries are highly energy-efficient. The growing sale of EVs will continue to impact the consumption rate for lithium-fluoride along with other applications of Li-ion batteries.

Lithium Fluoride Market: Challenges

Limited applications and changing global industry dynamics may challenge market growth

The global lithium fluoride market growth is projected to be challenged by the limited application of lithium fluoride. Although it is an essential compound, it is used only in specific industries, unlike other chemicals and materials that have large-scale uses. This results in a limited number of suppliers and producers which in turn leads to high price volatility. In addition to this, the changing market dynamics due to unstable global order can lead to sudden disruptions in the supply chain impacting further application of the compound.

Lithium Fluoride Market: Segmentation

The global lithium fluoride market is segmented based on application, grade, and others.

Based on application, the global market segments are metallurgy processes, glass, optics, nuclear power generation, pharmaceuticals, ceramics, and others. In 2022, the highest growth trend was related to nuclear power generation and the same pattern can be expected during the projection period. The compound is used extensively in LFTRs across the globe as a prominent neutron absorber and helps in regulating fission reactions. The growing investments in nuclear power including generation and research are expected to trigger segmental growth. In 2020, around 20.28% of Russia’s total electricity generation was powered using nuclear energy.

Based on grade, the lithium fluoride industry divisions are battery and technical. In 2022, the former segment was a leading revenue generator fueled by growing demand for energy-efficient Li-ion batteries and the use of LiF for producing these power-storing devices. Battery-grade LiF tends to showcase higher purity levels while technical-grade may be less pure and hence not applicable for use in the production of lithium-ion batteries. In 2022, the Li-ion battery market was valued at over USD 47 billion as the consumption rate in the EV industry grew.

Lithium Fluoride Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Lithium Fluoride Market |

| Market Size in 2022 | USD 561.49 Million |

| Market Forecast in 2030 | USD 1302.39 Million |

| Growth Rate | CAGR of 11.10% |

| Number of Pages | 210 |

| Key Companies Covered | SQM, FMC Corporation, Sigma-Aldrich, Albemarle Corporation, Merck KGaA, Jiangxi Ganfeng Lithium Co. Ltd., Reade Advanced Materials, China Lithium Products Technology Co. Ltd., Arkema, Noah Technologies Corporation, American Elements, Dalian Richfortune Chemicals Co. Ltd., Spectrum Chemical Manufacturing Corp., Beijing Easpring Material Technology Co. Ltd., Honeywell International Inc., Shanghai China Lithium Industrial Co. Ltd., and others. |

| Segments Covered | By Application, By Grade, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Lithium Fluoride Market: Regional Analysis

Asia-Pacific to witness the highest growth rate during the forecast period

The global lithium fluoride market is projected to register the highest growth rate in Asia-Pacific with countries such as India, China, and South Korea as these nations are considered among the top suppliers and producers of chemical products. Asian nations are home to some of the largest chemicals and materials manufacturing facilities. In addition to this, Asia-Pacific is one of the leading regions for EV markets as China, in 2022, remained the top producer and exporter of electric vehicles across the price range. These vehicles, powered by Li-ion batteries, created a huge demand for lithium fluoride, an essential component for lithium-ion batteries. Furthermore, increased sales of portable smart devices such as laptops and smartphones led to higher investments in the regional Li-ion battery market.

Europe is expected to deliver significant results as the region continues to upgrade investments in nuclear energy. As per the latest findings, around 28% of Europe’s electricity is produced using nuclear power. The latest nuclear power plant in Finland Olkiluoto 3 has a nameplate capacity of 1600 MW.

Lithium Fluoride Market: Competitive Analysis

The global lithium fluoride market is led by players like:

- SQM

- FMC Corporation

- Sigma-Aldrich

- Albemarle Corporation

- Merck KGaA

- Jiangxi Ganfeng Lithium Co. Ltd.

- Reade Advanced Materials

- China Lithium Products Technology Co. Ltd.

- Arkema

- Noah Technologies Corporation

- American Elements

- Dalian Richfortune Chemicals Co. Ltd.

- Spectrum Chemical Manufacturing Corp.

- Beijing Easpring Material Technology Co. Ltd.

- Honeywell International Inc.

- Shanghai China Lithium Industrial Co. Ltd.

The global lithium fluoride market is segmented as follows:

By Application

- Metallurgy Processes

- Glass

- Optics

- Nuclear Power Generation

- Pharmaceuticals

- Ceramics

- Others

By Grade

- Battery

- Technical

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Lithium fluoride is an essential part of the global chemicals and materials sector. This inorganic compound is known by its widely recognized chemical formula LiF.

The global lithium fluoride market is anticipated to grow due to the growing investments in nuclear energy and research in which LiF is one of the primary components, especially in liquid-fluoride nuclear reactors.

According to study, the global lithium fluoride market size was worth around USD 561.49 million in 2022 and is predicted to grow to around USD 1302.39 million by 2030.

The CAGR value of the lithium fluoride market is expected to be around 11.10% during 2023-2030.

The global lithium fluoride market is projected to register the highest growth rate in Asia-Pacific.

The global lithium fluoride market is led by players like SQM, FMC Corporation, Sigma-Aldrich, Albemarle Corporation, Merck KGaA, Jiangxi Ganfeng Lithium Co., Ltd., Reade Advanced Materials, China Lithium Products Technology Co., Ltd., Arkema, Noah Technologies Corporation, American Elements, Dalian Richfortune Chemicals Co., Ltd., Spectrum Chemical Manufacturing Corp., Beijing Easpring Material Technology Co., Ltd., Honeywell International Inc., Shanghai China Lithium Industrial Co., Ltd., and others.

The report explores crucial aspects of the lithium fluoride market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed