Lithium-Sulfur Battery Market Size, Share, Trends, Growth 2032

Lithium-Sulfur Battery Market By Component (Separator, Electrolyte, Cathode, Anode, and Others), By Battery Capacity (High Capacity, Medium Capacity, and Low Capacity), By End-User Industry (Aerospace & Defense, Energy Storage Systems, Consumer Electronics, Automotive, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 109.3 Million | USD 853.14 Million | 29.40% | 2023 |

Lithium-Sulfur Battery Industry Prospective:

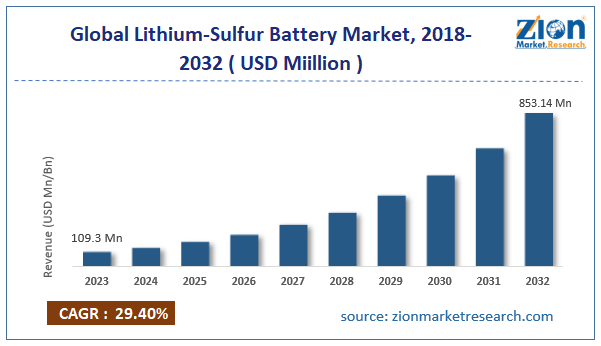

The global lithium-sulfur battery market size was worth around USD 109.3 million in 2023 and is predicted to grow to around USD 853.14 million by 2032, with a compound annual growth rate (CAGR) of roughly 29.40% between 2024 and 2032.

Lithium-Sulfur Battery Market: Overview

Lithium-sulfur battery is an emerging segment of the lithium-ion battery industry. It is a rechargeable system that uses sulfur as the cathode and lithium as the anode. The key advantage of lithium-sulfur batteries is exceptionally high energy density making them suitable for a wide range of several end-user applications.

However, lithium-sulfur batteries are currently in the early stages of development and have not reached large-scale production, according to market demands. Furthermore, high energy density is currently registered theoretically and more research is required to ensure practical applicability of the batteries in real-life scenarios. During the forecast period, investments in the lithium-sulfur battery industry are expected to reach new heights driven by increasing demand for rechargeable battery systems.

Moreover, the abundant availability of sulfur makes the industry more lucrative since sulfur can be obtained in large volumes at improved cost-efficiency. Furthermore, recent market trends suggest rising investments in research & development-oriented investments to increase the technology’s overall stability along with scalable production rate.

Key Insights:

- As per the analysis shared by our research analyst, the global lithium-sulfur battery market is estimated to grow annually at a CAGR of around 29.40% over the forecast period (2024-2032)

- In terms of revenue, the global lithium-sulfur battery market size was valued at around USD 109.3 million in 2023 and is projected to reach USD 853.14 million by 2032.

- The lithium-sulfur battery market is projected to grow at a significant rate due to the increasing demand for electric vehicles (EVs) worldwide.

- Based on the component, the cathode segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the industry, the automotive segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Lithium-Sulfur Battery Market: Growth Drivers

Increasing demand for electric vehicles (EVs) worldwide to drive market demand rate

The global lithium-sulfur battery market is expected to grow due to the rising demand for electric vehicles (EVs) worldwide. According to market research, lithium-sulfur batteries have shown remarkable energy density compared to lithium-ion counterparts. This property of lithium-sulfur batteries is influenced by the high energy density of sulfur along with the low atomic weight of lithium, making the technology highly popular for powering a vehicle. EVs have gained significant growth momentum in the last few years.

Factors such as changing consumer preference, increasing awareness about the environmental impact of internal combustion engine-powered vehicles, and private & supply volatility of fuel have created an urgent demand for more sustainable automobiles such as electric vehicles.

In addition, government support for establishing a more robust EV manufacturing industry has also been critical to the overall expansion rate of EV producers. In November 2024, the International Trade Association announced that Germany had set up an ambitious goal of putting around 15 million EVs on the road by 2030. The regional state authorities are also investing in developing a comprehensive charging infrastructure to support the large-scale deployment of electric vehicles.

In January 2025, the Federal Highway Administration of the US Department of Transportation announced a grant of USD 635 million for the construction of new EV charging stations along with alternative fueling infrastructure.

Growing pressure on lithium-ion battery production to meet rising global demand will drive higher industry revenue

The global modern electronic products are currently mainly powered by lithium-ion batteries. The end-user demand for electronic items as well as electric vehicles is growing at an unprecedented rate leading to burgeoning pressure on lithium-ion producers and suppliers.

However, the market players are facing operational and raw material-based difficulties in keeping up with the changing and rising demand rate. These events are likely to create more investments in the global lithium-sulfur battery market, as the latter is considered the next generation of rechargeable battery solutions by industry experts. The abundant availability of sulfur along with the high-performance index of the element are some of the lucrative factors for increasing interest in lithium-sulfur batteries.

Lithium-Sulfur Battery Market: Restraints

Lack of efficient scaling of the battery technology to limit the market expansion rate

The global industry for lithium-sulfur batteries is expected to be limited by the lack of efficient scaling of the technology. Currently, lithium-sulfur batteries are in the nascent stage of development with only limited players operating in the market. The technical barriers to producing lithium-sulfur batteries to meet the monumental end-industry demands have restricted the industry from reaching its true potential. During the forecast period, the industry players must focus on investing in developing lithium-sulfur batteries on larger scales to tap into new markets and final applications.

Lithium-Sulfur Battery Market: Opportunities

Growing rate of research & development (R&D) to generate growth opportunities in the coming years

The global lithium-sulfur battery market is expected to generate growth opportunities due to the rising rate of research & development. Innovation-backed growth will create new avenues for further investments and subsequent technological development.

For instance, a January 2025 study titled ‘All-solid-state Li-S batteries with fast solid-solid sulfur reaction’ published on the nature platform registered a breakthrough milestone achieved by researchers and scientists in the field of lithium-sulfur batteries. The researchers have developed a novel battery solution using lithium and sulfur that can retain around 80% of its charge capacity after achieving 25,000 charging cycles. The new design is established using a unique and specially formulated electrode thus representing a considerable improvement over the currently existing lithium-ion batteries. Researchers estimate that the new offering can open avenues for longer-lasting and compact batteries that are essential for addressing the global demand in EV and electronics sectors.

In November 2024, engineers at Monash University announced that they had developed an ultra-fast charging lithium-sulfur battery that can be used for powering long-haul drones and electric vehicles. The developers also claim that with consistent improvements, the technology can be used for powering electric aircraft in the coming years.

Lithium-Sulfur Battery Market: Challenges

High cost of initial investment and competition for raw materials to challenge market expansion

The global lithium-sulfur battery industry is projected to be challenged by the high cost of initial investment required for establishing a business offering the novel technology on a large scale. Additionally, research costs are equally high in the backdrop of the limited availability of skilled resources. The industry faces tough competition from other battery manufacturers in terms of accessing raw materials required for producing higher volumes of lithium-sulfur batteries.

Lithium-Sulfur Battery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Lithium-Sulfur Battery Market |

| Market Size in 2023 | USD 109.3 Million |

| Market Forecast in 2032 | USD 853.14 Million |

| Growth Rate | CAGR of 29.40% |

| Number of Pages | 222 |

| Key Companies Covered | Lyten, Oxis Energy, Southwest Research Institute (SwRI), Nanotek Instruments, Sion Power, KVI Technologies, Ionic Materials, Enovix, Excellatron, SolidEnergy Systems, Horizon Battery, Prieto Battery, BASF, StoreDot, 20C, and others. |

| Segments Covered | By Component, By Battery Capacity, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Lithium-Sulfur Battery Market: Segmentation

The global lithium-sulfur battery market is segmented based on component, battery capacity, end-user industry, and region.

Based on the components, the global market segments are separator, electrolyte, cathode, anode, and others. In 2023, the highest revenue was generated by the cathode segment and the same trend can be expected in the future. The growing demand for higher-density batteries in compact sizes will fuel the segmental expansion rate in the coming years.

Moreover, growing investment in high-performance electric vehicles that can last across longer ranges will also be critical to significant demand for the cathode. The theoretical energy density of sulfur in electric batteries is around 2,600 Wh/kg.

Based on battery capacity, the global lithium-sulfur battery industry is divided into high capacity, medium capacity, and low capacity.

Based on the end-user industry, the global market divisions are aerospace & defense, energy storage systems, consumer electronics, automotive, and others. In 2023, the highest demand was listed in the automotive sector mainly fueled by growing sales of electric vehicles across passenger and commercial variants.

One of the major inhibitors for higher adoption of EVs is the limited range offered by the vehicle, which the market players plan to overcome using longer-lasting batteries. At present, lithium-sulfur batteries can last up to 1,000 cycles, according to researchers at the University of Michigan.

Lithium-Sulfur Battery Market: Regional Analysis

Asia-Pacific to continue maintaining its dominance in recyclable batteries sector

The global lithium-sulfur battery market will be led by Asia-Pacific during the forecast period. The region currently dominates the recyclable battery designing and production industries, including lithium-sulfur-based solutions. Countries such as India, China, and South Korea are likely to induce higher growth rates in Asia-Pacific during the forecast period.

In October 2024, China-based General New Energy (GNE) announced the launch of the company’s lithium-sulfur (Li-S) battery technology. GNE launched its prototype solution offering an energy density of 700Wh/kg.

According to official reports, the new product exceeds the current offerings of lithium-ion batteries in terms of energy density but also provides higher safety and mileage.

In September 2024, another set of researchers at the University of Electronic Science and Technology of China revolved around the innovation of a new lithium-sulfur battery that can be cut off and folded, thus providing more practical applications. The group of researchers managed to overcome the stability issues associated with conversion-type transition-metal sulfides (MSx) to achieve this breakthrough. Rising end-user applications of longer-lasting batteries are further helping the region thrive.

Lithium-Sulfur Battery Market: Competitive Analysis

The global lithium-sulfur battery market is led by players like:

- Lyten

- Oxis Energy

- Southwest Research Institute (SwRI)

- Nanotek Instruments

- Sion Power

- KVI Technologies

- Ionic Materials

- Enovix

- Excellatron

- SolidEnergy Systems

- Horizon Battery

- Prieto Battery

- BASF

- StoreDot

- 20C

The global lithium-sulfur battery market is segmented as follows:

By Component

- Separator

- Electrolyte

- Cathode

- Anode

- Others

By Battery Capacity

- High Capacity

- Medium Capacity

- Low Capacity

By End-User Industry

- Aerospace & Defense

- Energy Storage Systems

- Consumer Electronics

- Automotive

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Lithium-sulfur battery is an emerging segment of the lithium-ion battery industry.

The global lithium-sulfur battery market is expected to grow due to the rising demand for electric vehicles (EVs) worldwide.

According to study, the global lithium-sulfur battery market size was worth around USD 109.3 million in 2023 and is predicted to grow to around USD 853.14 million by 2032.

The CAGR value of the lithium-sulfur battery market is expected to be around 29.40% during 2024-2032.

The global lithium-sulfur battery market will be led by Asia-Pacific during the forecast period.

The global lithium-sulfur battery market is led by players like Lyten, Oxis Energy, Southwest Research Institute (SwRI), Nanotek Instruments, Sion Power, KVI Technologies, Ionic Materials, Enovix, Excellatron, SolidEnergy Systems, Horizon Battery, Prieto Battery, BASF, StoreDot and 20C.

The report explores crucial aspects of the lithium-sulfur battery market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed