LNG Engine Market Size, Share, Trends, Growth and Forecast 2032

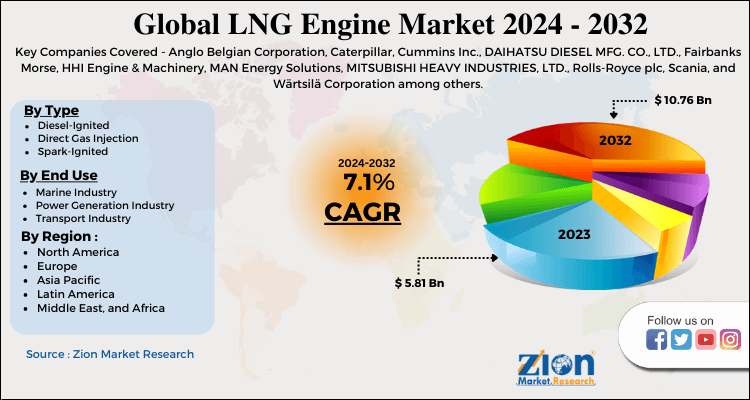

LNG Engine Market by Type (Diesel-ignited, Direct Gas Injection, Spark-ignited) by End-User (Marine Industry, Power Generation Industry, Transport Industry): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 to 2032

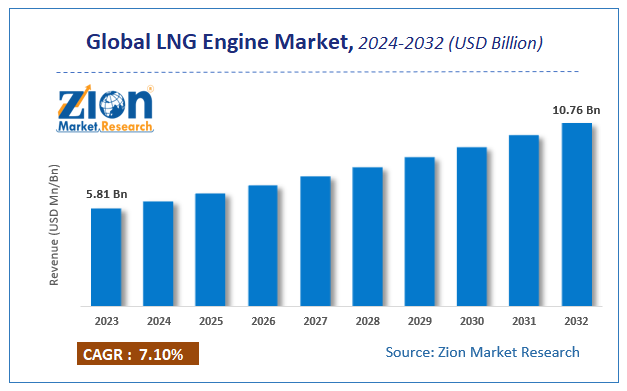

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.81 Billion | USD 10.76 Billion | 7.1% | 2023 |

LNG Engine Market Insights

According to Zion Market Research, the global LNG Engine Market was worth USD 5.81 Billion in 2023. The market is forecast to reach USD 10.76 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7.1% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the LNG Engine Market industry over the next decade.

Global LNG Engine Market: Overview

Liquid natural gas (LNG) has become a significant new source of renewable energy for the production of electricity. LNG volumes traded globally rose in 2018 by 28.2 million tonnes. In recent years, in order to meet LNG demands, many developing economies are growing their investment in LNG infrastructure projects.

The LNG supply system is in continuous development in many countries, which is not yet established. The optimal supply chain for LNG needs to be proven in order to handle the complex global supply chain network. Therefore, a standard production schedule that meets consumer demands must be established to allow for a cost-effective and safe LNG supply network. Difficulties occur in optimizing the LNG supply chains network, such as cost and demand volatility, multiple choices for the output of gas, variable modes of delivery, flexible navigation routes, fluctuating annual demands, and the simultaneous need to optimize the growth of infrastructure, and inventory routing. Due to the complexities of the LNG supply chain, there is some difficulty in optimizing the LNG supply system, thus addressing this issue will be challenging.

In light and heavy-duty trucks, diesel-LNG Internal Combustion Engines (ICEs) are becoming popular and are expected to advance during the forecast period at a healthy CAGR. Manufacturing companies are witnessing a transition towards clean energy and the hydrogen economy. This has contributed to the proliferation of diesel-LNG ICEs due to similarities between onboard fuel storage and injection technology.

Heavy-duty trucks are one category of profitable growth for companies in the LNG engine industry, as a reduction in emissions and fuel economy can be accomplished with the aid of LNG engines. LNG is a more realistic choice for heavy-duty trucks as far as cryogenic temperatures are concerned, as they are continuously in motion when compared to passenger vehicles that are often parked.

The decarbonization trend in maritime transport is serving as a key driver of growth for firms in the market for LNG engines. With a transition from fossil fuels to low-carbon fuels and engine technology, the LNG engine industry is undergoing a major change.

To know more about this report, request a sample copy.

Global LNG Engine Market: Growth Factors

The primary factor expected to improve the global LNG engine demand during the forecast period is the introduction of stringent government regulations and policies to lower carbon emissions. LNG engines are commonly used in a wide variety of applications, such as marine, transportation, and power generation.

Trade activities related to LNG have increased considerably across the world. The amount of global trade in LNG rose from 334 billion cubic meters in 2014 to 485 billion cubic meters in 2019. Growth in LNG trade can be due to increasing demand for natural gas in end-use industries such as marine, steel, and power plants.

As thermal coal is increasingly competing against LNG and renewables on a cost basis during the COVID-19 crisis, companies in the market for LNG engines can take advantage of this opportunity to enable customers to move to low-carbon fuels. Advancements in dual-fuel engines are ongoing as a result of the demonstration of a reduction in GHG emissions. However, due to the problem of capacitated vehicle routing in the marine sector, the problem of LNG delivery is emerging as an obstacle for stakeholders. As a result, companies in the LNG engine industry should concentrate on the optimum allocation of small-scale delivery of LNG and make progress in developing the LNG transport infrastructure.

In addition to developments in new fuels such as bio-and synthetic methane, hydrogen, and ammonia, manufacturers are companies are focusing on LPG, LNG, and biodiesel. Wärtsilä Oyj Abp, a Finnish company that produces and supplies energy sources and other equipment, is developing products in bio-and synthetic LNG to implement cost-efficiency in maritime transport and heavy-duty trucks. LNG has been found to deliver a substantial reduction in GHG emissions relative to heavy fuel oil used in marine transport.

LNG Engine Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | LNG Engine Market |

| Market Size in 2023 | USD 5.81 Billion |

| Market Forecast in 2032 | USD 10.76 Billion |

| Growth Rate | CAGR of 7.1% |

| Number of Pages | 110 |

| Key Companies Covered | Anglo Belgian Corporation, Caterpillar, Cummins Inc., DAIHATSU DIESEL MFG. CO., LTD., Fairbanks Morse, HHI Engine & Machinery, MAN Energy Solutions, MITSUBISHI HEAVY INDUSTRIES, LTD., Rolls-Royce plc, Scania, and Wärtsilä Corporation among others |

| Segments Covered | By Type, By End-User And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global LNG Engine Market: Segmentation

Demand for LNG engines has increased in the power generation and marine sectors due to an increase in the introduction of strict government regulations to minimize carbon emissions. Marine vessels are operating on bunker fuel, which creates a high degree of emissions. In addition, greenhouse gases are a big problem around the globe. Per year, air contaminants such as carbon monoxide, sulfur oxide, nitrogen oxide, and particulate matter are released to the environment in significant quantities.

LNG is used as a fuel in LNG engines and is the cleanest fossil fuel. As a result, LNG vehicles produce lower levels of toxic emissions and air pollution. LNG engines can also play a key role in reducing pollution and carbon emissions in the power generation and marine industries.

Marine is expected to be a highly profitable segment of the global LNG engine market in the coming years. The IMO 2020 Regulation has developed guidelines for the reduction of pollution and the emission of sulfur dioxide from ships. The use of the LNG engine is expected to minimize sulfur oxide (SOx) emissions by 90%-95%. It is expected to raise demand for LNG engines in the marine market.

Global LNG Engine Market: Regional Analysis

On the basis of region, the market is segregated into North America, Asia Pacific, Europe, the Middle East and Africa, and Latin America.

As fuel costs increased in Asia and Europe during the COVID-19 pandemic, the exports of LNG in the United States have also seen a spike, businesses are capitalizing on this opportunity to boost their super-cooled fuel supply chains. While consumption lagged during the months of March to August, companies are seen to compensate for their losses by rising consumption as factories become fully functional and consumer spending is on the rise.

South Korea has been successful in handling the current pandemic and has experienced steady LNG imports, thus companies in the LNG engine industry are tapping into incremental opportunities in the country. They promote a change from coal to LNG in countries like Japan that are aware of renewable fossil fuels.

Asia Pacific is the leading LNG exporting region, owing to increased demand for natural gas due to high industrial growth and adoption of clean energy sources. The spike in LNG trade has boosted the region's demand for liquefied natural gas. It is estimated that the increase in global demand for LNG to align with the emission standards set by the governing bodies will drive demand for LNG engines in the near future.

Global LNG Engine Market: Competitive Players

Key players operating in the global LNG Engine market include

- Anglo Belgian Corporation

- Caterpillar

- Cummins Inc.

- DAIHATSU DIESEL MFG. CO.,LTD.

- Fairbanks Morse

- HHI Engine & Machinery

- MAN Energy Solutions

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Rolls-Royce plc

- Scania

- Wärtsilä Corporation among others.

This Report Segments the Global LNG Engine Market into:

By Type

- Diesel-Ignited

- Direct Gas Injection

- Spark-Ignited

By End-User

- Marine Industry

- Power Generation Industry

- Transport Industry

Global LNG Engine Market: Regional Segment Analysis

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The primary factor expected to improve the global LNG engine demand during the forecast period is the introduction of stringent government regulations and policies to lower carbon emissions. LNG engines are commonly used in a wide variety of applications, such as marine, transportation, and power generation.

Trade activities related to LNG have increased considerably across the world. The amount of global trade in LNG rose from 334 billion cubic meters in 2014 to 485 billion cubic meters in 2019. Growth in LNG trade can be due to increasing demand for natural gas in end-use industries such as marine, steel and power plants.

As thermal coal is increasingly competing against LNG and renewables on a cost basis during the COVID-19 crisis, companies in the market for LNG engines can take advantage of this opportunity to enable customers to move to low-carbon fuels. Advancements in dual-fuel engines are ongoing as a result of the demonstration of a reduction in GHG emissions. However, due to the problem of capacitated vehicle routing in the marine sector, the problem of LNG delivery is emerging as an obstacle for stakeholders. As a result, companies in the LNG engine industry should concentrate on the optimum allocation of small-scale delivery of LNG and make progress in developing the LNG transport infrastructure.

In addition to developments in new fuels such as bio-and synthetic methane, hydrogen and ammonia, manufacturers are companies are focusing on LPG, LNG, and biodiesel. Wärtsilä Oyj Abp, a Finnish company that produces and supplies energy sources and other equipment, is developing products in bio-and synthetic LNG to implement cost-efficiency in maritime transport and heavy-duty trucks. LNG has been found to deliver a substantial reduction in GHG emissions relative to heavy fuel oil used in marine transport.

the global LNG Engine Market was worth USD 5.81 Billion in 2023. The market is forecast to reach USD 10.76 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7.1% during the forecast period 2024-2032

On the basis of region, the market is segregated into North America, Asia Pacific, Europe, Middle East and Africa, and Latin America.

As fuel costs increased in Asia and Europe during the COVID-19 pandemic, the exports of LNG in United states have also seen a spike, businesses are capitalizing on this opportunity to boost their super-cooled fuel supply chains. While consumption lagged during the months of March to August, companies are seen to compensate for their losses by rising consumption as factories become fully functional and consumer spending is on the rise.

South Korea has been successful in handling the current pandemic and has experienced steady LNG imports, thus companies in the LNG engine industry are tapping into incremental opportunities in the country. They promote a change from coal to LNG in countries like Japan that are aware of renewable fossil fuels.

Asia Pacific is the leading LNG exporting region, owing to increased demand for natural gas due to high industrial growth and adoption of clean energy sources. The spike in LNG trade has boosted the region's demand for liquefied natural gas. It is estimated that the increase in global demand for LNG to align with the emission standards set by the governing bodies will drive demand for LNG engines in the near future.

Key players operating in the global LNG Engine market include Anglo Belgian Corporation, Caterpillar, Cummins Inc., DAIHATSU DIESEL MFG. CO., LTD., Fairbanks Morse, HHI Engine & Machinery, MAN Energy Solutions, MITSUBISHI HEAVY INDUSTRIES, LTD., Rolls-Royce plc, Scania, and Wärtsilä Corporation among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed