LTE IoT Market Size, Industry Analysis & Forecast 2032

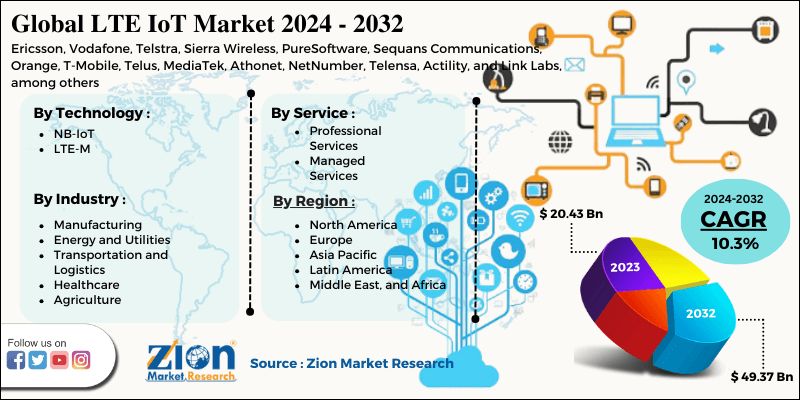

LTE IoT Market By Technology (NB-IoT and LTE-M), By Service (Professional Services and Managed Services), By Industry (Manufacturing, Energy and Utilities, Transportation and Logistics, Healthcare, and Agriculture), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

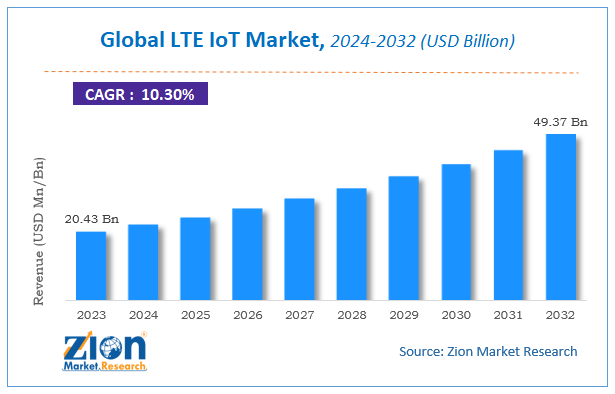

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 20.43 Billion | USD 49.37 Billion | 10.3% | 2023 |

LTE IoT Market Insights

According to a report from Zion Market Research, the global LTE IoT Market was valued at USD 20.43 Billion in 2023 and is projected to hit USD 49.37 Billion by 2032, with a compound annual growth rate (CAGR) of 10.3% during the forecast period 2024-2032.

This report explores market strengths, weaknesses, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and prospects that may emerge in the LTE IoT Market industry over the next decade.

LTE IoT Market: Overview

The Internet of Things (IoT) is rapidly evolving, resulting in a high demand for data transfer and storage applications. Several fields, including IoT-enabled manufacturing, professional services, telematics, navigation, and infotainment in transportation, are expected to contribute to the rapid growth. The emergence of connected devices is fueling the LTE IoT market to a large extent all over the world.

LTE IoT is made up of two main technologies: LTE-M and NB-IoT. LTE-M is a low-power wide-area network technology standard. It's unique to LTE CatM1, which was created specifically for IoT. By reducing complexity and expanding coverage, LTE-M aims to lower modem costs while also supporting data integrity and security. NB-IoT increases the spectrum's capacity and efficiency. The global LTE IoT market is expected to be driven by the high demand for key NB-IoT benefits such as improved range, better network reliability and security, easy deployment, and cost efficiency in the coming years.

COVID-19 Impact Analysis

Global supply chains and logistics are being impacted by the COVID-19 pandemic, as geographical lockdowns have been imposed, and the continuity of operations for a majority of industries has been severely impacted. Because of COVID-19, the majority of countries have halted all imports in order to prevent the virus from spreading further. As a result of the pandemic, the growth of the NB-IoT chipset market is expected to be slightly slower than previously forecasted due to a decrease in connectivity hardware supply.

The spread of COVID-19 has had an impact on the smart street lighting market, as highway and street infrastructure projects have been halted, as have smart city investments. As a result, the number of new smart street lighting installations has slowed. For the next two to three quarters, the shutdown is expected to hurt potential demand for infrastructure, including lighting. Due to the pandemic's disruptions, annual smart meter shipments will decrease in 2020.

LTE IoT Market: Growth Factors

Increased M2M communications are propelling the connected devices market forward, particularly in the industrial sector. Furthermore, industry trends such as the Internet of Things (IoT) have made connectivity possible in almost every industry, including healthcare, consumer electronics, and retail. Sensors are required for smart devices to generate real-time data. The lower cost of these sensors has resulted in a significant increase in IoT adoption across businesses.

Furthermore, smooth communications through better connectivity, low power requirements, and a growing preference for a smarter and greener planet are all driving the increased adoption of IoT. The deployment of M2M/IoT devices such as smart meters, smart streetlights, livestock monitoring devices, and smart parking solutions is expected to be driven by the rising demand for connected devices for long-range connectivity.

LTE IoT Market: Segmentation Analysis

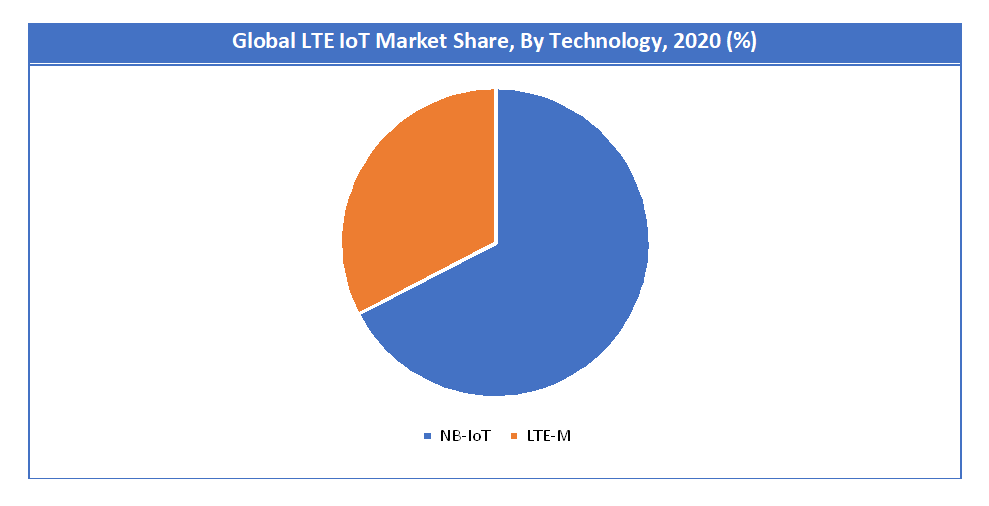

By Technology Segment Analysis

NB-IoT holds the major position in the technology segment. Wider applications of NB-IoT technology, increased industry participation in NB-IoT development, growing adoption of IoT, and increased use of connected devices are some of the factors driving the NB-IoT chipset market forward. LTE-M forms the other type of technology segment.

Request Free SampleBy Service Segment Analysis

Request Free SampleBy Service Segment Analysis

Professional services are needed before, during, and after the deployment of LTE IoT technologies like LTE-M and NB-IoT. Planning, design, and implementation, consulting, support and maintenance, and upgrades are all examples of these services. The professional services market is expanding, with large corporations turning to players for consulting and implementation services.

Professional services are very important in the LTE IoT market because customers need to understand the feasibility of LTE IoT solutions. As a result, companies that provide these services employ consultants, security experts, and dedicated project management teams who specialize in the design and delivery of critical decision support software, tools, services, and expertise. Managed services form the other type of service segment.

By Industry Segment Analysis

The manufacturing industry has changed dramatically as a result of technological advancements such as robotics and automated production lines. Because manufacturing operations are so delicate, manufacturers are turning to IoT solutions, sensors, and IoT wireless connectivity platforms to boost productivity and turn their operations into smart manufacturing. Many software and solution providers are offering smart manufacturing applications to industries that include proactive and automatic analytics capabilities, transforming industrial manufacturing into an intelligent and self-managing environment.

LTE technology is used to establish stable data transmission connectivity among various devices in a factory, allowing industries to address issues such as predictive maintenance and autonomous production. Energy and Utilities, Transportation and Logistics, Healthcare, and Agriculture form the other type of industry segment.

LTE IoT Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | LTE IoT Market |

| Market Size in 2023 | USD 20.43 Billion |

| Market Forecast in 2032 | USD 49.37 Billion |

| Growth Rate | CAGR of 10.3% |

| Number of Pages | 210 |

| Key Companies Covered | Ericsson (Sweden), Vodafone (UK), Telstra (Australia), Sierra Wireless (Canada), PureSoftware (India), Sequans Communications (France), Orange (France), T-Mobile (US), Telus (US), MediaTek (Sweden), Athonet (Italy), NetNumber (US), Telensa (UK), Actility (France), and Link Labs (US), among others. |

| Segments Covered | By Technology, By Service, By Industry, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

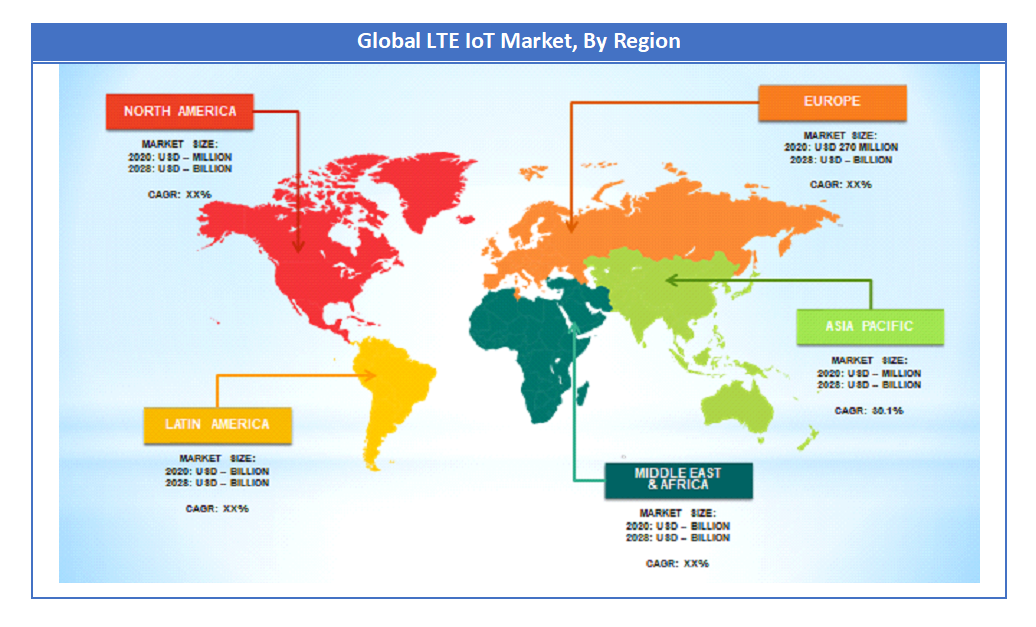

LTE IoT Market: Regional Analysis

The widespread adoption of LTE technology for enterprise IoT applications has propelled Europe to the forefront of the LTE IoT market. In terms of LTE IoT coverage, the region is on top. Europe claims credit for coining the term "Internet of Things" and for making a significant contribution to the global promotion of IoT telecom and related services. The European Commission and member states of the European Union are working on strategies to support experiments and the deployment of IoT telecom and related services.

Germany, the United Kingdom, and France are the top three contributors to Europe's LTE IoT market. The overall growth of LTE IoT would be driven by the rising adoption of telco cloud, growing data consumption, increasing adoption of smart devices at a peak rate, and reduced cost of IoT components with evolving wireless technology, such as 5G and NB-IoT.

Request Free SampleAPAC region is expected to have the highest growth in the forecast period. China leads the APAC market in IoT spending, accounting for more than half of all spending, followed by Japan and Australia. Government spending on smart cities accounts for nearly a third of all spending in the region, followed by transportation and logistics, and finally manufacturing. Around 40% of global Low Power Wide Area (LPWA) connections are in the APAC region, with NB-IoT accounting for 97 percent of those.

Request Free SampleAPAC region is expected to have the highest growth in the forecast period. China leads the APAC market in IoT spending, accounting for more than half of all spending, followed by Japan and Australia. Government spending on smart cities accounts for nearly a third of all spending in the region, followed by transportation and logistics, and finally manufacturing. Around 40% of global Low Power Wide Area (LPWA) connections are in the APAC region, with NB-IoT accounting for 97 percent of those.

On a macro level, the region's demand for digital IoT solutions such as eGovernment, public transportation, smart traffic management systems, and smart power grids is being fueled by the government's increased focus on smart cities and Industry 4.0 initiatives. Telcos are poised to become IoT one-stop shops, with portfolios ranging from business application solutions to data analytics and end-to-end platforms.

LTE IoT Market: Competitive Analysis

In terms of market share, some of the major players currently dominate the market. However, with the advancement in the industrial IoT application across multiple end-user industries, new players are increasing their market presence thereby expanding their business footprint across emerging economies. For instance, in a recent development in May 2019, Sequans Communications S.A. announced the certification and commercial availability of the SP150Q LTE Cat 1 module, which is designed to work with Sprint's Curiosity IoT dedicated core network and operating system, which is designed to generate real-time business intelligence from connected devices. PUI (Positioning Universal) is the first customer to use the module and has just launched the product.

Some of the leading players in the global market include

- Ericsson (Sweden)

- Vodafone (UK)

- Telstra (Australia)

- Sierra Wireless (Canada)

- PureSoftware (India)

- Sequans Communications (France)

- Orange (France)

- T-Mobile (US)

- Telus (US)

- MediaTek (Sweden)

- Athonet (Italy)

- NetNumber (US)

- Telensa (UK)

- Actility (France)

- Link Labs (US)

The global LTE IoT market is segmented as follows:

By Technology

- NB-IoT

- LTE-M

By Service

- Professional Services

- Managed Services

By Industry

- Manufacturing

- Energy and Utilities

- Transportation and Logistics

- Healthcare

- Agriculture

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global LTE IoT market size was worth around USD 20.43 billion in 2023 and is expected to reach USD 49.37 billion by 2032.

The global LTE IoT market is expected to grow at a CAGR of 10.3% during the forecast period.

Some of the key factors driving the global LTE IoT market growth are driven by the rising adoption of telco cloud, growing data consumption, increasing adoption of smart devices at a peak rate, and reduced cost of IoT components with evolving wireless technology, such as 5G and NB-IoT.

Europe region is expected to dominate the LTE IoT market over the forecast period.

Some of the major companies operating in the LTE IoT market are Ericsson (Sweden), Vodafone (UK), Telstra (Australia), Sierra Wireless (Canada), PureSoftware (India), Sequans Communications (France), Orange (France), T-Mobile (US), Telus (US), MediaTek (Sweden), Athonet (Italy), NetNumber (US), Telensa (UK), Actility (France), and Link Labs (US).

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed