Luxury Jewelry Market Size, Share, Trends, Growth and Forecast 2032

Luxury Jewelry Market By Product Type (Pearl Jewelry, Gemstone Jewelry, Diamond Jewelry, Platinum Jewelry, Gold Jewelry, and Others), By Sales Channel (Offline and Online), By End-User (Women and Men), By Product (Bracelets, Necklaces, Ring, Earrings, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

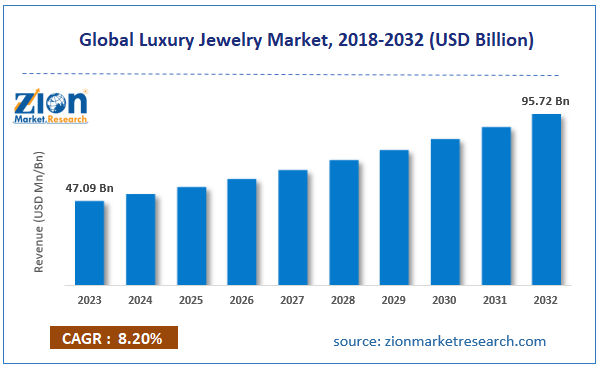

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 47.09 Billion | USD 95.72 Billion | 8.20% | 2023 |

Luxury Jewelry Industry Prospective:

The global luxury jewelry market size was worth around USD 47.09 billion in 2023 and is predicted to grow to around USD 95.72 billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.20% between 2024 and 2032.

Luxury Jewelry Market: Overview

Luxury jewelry is derived from precious or expensive metals. The term ‘luxury’ is subjective; however, in most cases, luxury jewelry is relatively higher priced than regular or affordable counterparts. The extravagance of luxury jewelry is a result of the extensive use of highly sought-after metals and gemstones.

Furthermore, the final price of luxury jewelry is influenced by the overall design, cuts, and rating of the stones embedded in the jewelry. Expensive accessories are designed to last longer. In some cases, they can be passed on through generations crossing centuries. Luxury jewelry generally requires extensive maintenance and superior grade management to ensure that the overall quality of the accessory is maintained throughout its lifestyle. Luxury jewelry cannot be easily repaired in case of damage and the process can be expensive as well.

Furthermore, recent trends indicate an increased demand for exclusive and vintage jewelry that holds historical and cultural value. The demand for luxury jewelry is expected to continue growing in the coming years due to changing consumer lifestyles and buying patterns. Moreover, easier access to luxury jewelry through online portals or pre-loved segments will further help the industry flourish in the coming years. The high cost of luxury jewelry and difficulties in maintaining them could impact the final revenue in the luxury jewelry industry during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global luxury jewelry market is estimated to grow annually at a CAGR of around 8.20% over the forecast period (2024-2032)

- In terms of revenue, the global luxury jewelry market size was valued at around USD 47.09 billion in 2023 and is projected to reach USD 95.72 billion by 2032.

- The luxury jewelry market is projected to grow at a significant rate due to the changing consumer lifestyle and increased demand for luxury goods.

- Based on product type, the gold segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on end-user, the women segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Luxury Jewelry Market: Growth Drivers

Changing consumer lifestyle and increased demand for luxury goods to drive market revenue

The global luxury jewelry market is expected to grow due to the changing consumer lifestyle and buying patterns. Market analysis indicates a growing trend of increased demand for luxury goods, including expensive jewelry. Factors such as increased job opportunities, a rise in disposable income, and higher awareness have helped create a growing consumer group for luxury items. Expensive accessories were initially considered affordable only by the elite or higher-income groups. However, exposure to luxury products available in the global market has encouraged more buyers to save their earnings and splurge once in a while on luxury items such as jewelry products.

Furthermore, social media influence has been pivotal in shaping the trends of the current luxury jewelry industry. Platforms such as Instagram, YouTube, Pinterest, and others have played a crucial role in generating awareness and influencing consumer spending habits. According to market research, over 54.01% of millennials actively invested in luxury purchases in 2023, while over 66% of GenXers followed the same trend. Such trends indicate a thriving consumer group for expensive jewelry.

Online methods of customer reach will be critical to the industry’s future growth rate

According to market analysis, one of the key methods by which market players can attract more consumers is by leveraging the advantages of online sales platforms. Brand web-based pages and online channels can help companies reach a global audience and cater to customized needs. Official statistics indicate an increased rate of collaboration between luxury jewelry companies and e-commerce giants with large-scale presence, thus helping the global luxury jewelry market thrive.

In May 2024, BigCommerce, a leading provider of a Software-as-a-Service (SaaS) e-commerce platform for business-to-business (B2B) and business-to-customer (B2C) brands, announced the launch of L’azurde Company for Jewelry on the BigCommerce platform. L’azurde Company for Jewelry is one of the largest jewelry designers in the Middle East.

Luxury Jewelry Market: Restraints

High cost of the jewelry and selective market group to limit the industry’s expansion rate

The global luxury jewelry industry is projected to be restricted by the high cost of accessories. Luxury jewelry is curated to cater to the wants of a niche group of audience which includes people belonging to the higher income group. In addition, the expenses and complexities associated with the maintenance of luxury jewelry are equally high.

For instance, the average cost of a Cartier Love bracelet can range between USD 5000 and USD 62,000 depending on the width, metal, and style. Furthermore, once the products are worn, the price of the jewelry diminishes significantly, leading to a loss of the overall product’s value.

Luxury Jewelry Market: Opportunities

Increasing the market for pre-loved products to create market growth opportunities in the future

The global luxury jewelry market is expected to generate growth opportunities in the form of a growing market for pre-loved products. The items that fall in the pre-owned category have had a previous owner or multiple owners. Generally, they are priced lower than their brand-new counterparts. The pre-loved segment is increasingly getting organized with the addition of several authorized resellers, which is further helping the segment generate customer loyalty.

In November 2023, Uncut Gems Company announced the launch of FABRILL. It is the first platform in South Korea that specializes in selling pre-owned luxury jewelry. The brand handles popular luxury jewelry companies such as Cartier, Van Cleef & Arpels, Tiffany & Co., Boucheron, and Chanel. Fabrill is designed to create a highly secure, transparent, and reliable platform for buyers and sellers.

In September 2023, Rocksbox, a US-based jewelry subscription service provider, announced that it would start selling pre-owned fine jewelry. Rockbox is owned by Signet Jewelers, and the move has allowed the company to strengthen its foothold in the secondary luxury market. In addition, there is a surge in demand for antique or vintage jewelry. Although the consumer group for exquisite vintage jewelry is highly limited, these products are valued at billions of dollars.

Luxury Jewelry Market: Challenges

Consumer fragmentation and increased sale of counterfeit products are major challenges for the industry

The global industry for luxury jewelry is projected to be challenged by the extreme case of consumer fragmentation. The presence of a broader market for affordable jewelry including fast-fashion accessories has led to extreme consumer division. In addition to this, there are a growing number of cases concerning the increased sale of counterfeit products which causes theft of intellectual property (IP) rights and diminished brand value.

Request Free Sample

Request Free Sample

Luxury Jewelry Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Luxury Jewelry Market |

| Market Size in 2023 | USD 47.09 Billion |

| Market Forecast in 2032 | USD 95.72 Billion |

| Growth Rate | CAGR of 8.20% |

| Number of Pages | 218 |

| Key Companies Covered | Harry Winston, Hermès, Cartier, David Yurman, Dior Joaillerie, Bvlgari, Chaumet, Chopard, Mikimoto, Van Cleef & Arpels, Buccellati, Graff, Boucheron, Piaget, Tiffany & Co., and others. |

| Segments Covered | By Product Type, By Sales Channel, By End-User, By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Luxury Jewelry Market: Segmentation

The global luxury jewelry market is segmented based on product type, sales channel, end-user, product, and region.

Based on product type, the global market segments are pearl jewelry, gemstone jewelry, diamond jewelry, platinum jewelry, gold jewelry, and others. In 2023, the highest growth was listed in the gold segment. During the forecast period, it is projected to grow at a CAGR of over 8.21%. Gold jewelry is widely popular among Asian and Middle Eastern consumers. The material offers excellent returns on investment (ROI) over time. Furthermore, it is also considered a lucrative medium for long-term investment.

Based on sales channel, the global luxury jewelry industry is divided into offline and online.

Based on end-user, the global market divisions are women and men. In 2023, the highest growth was listed in the women segment. It is expected to deliver a CAGR of over 7.65% during the forecast period. The surge in the number of working women population worldwide has helped the segment thrive in the last few years. In addition, jewelry designed especially for women has cultural and historical significance. The men segment is expected to grow at a steady pace during the projection period.

Based on product, the global market divisions are bracelets, necklaces, rings, earrings, and others.

Luxury Jewelry Market: Regional Analysis

Asia-Pacific to continue dominating the industry during the forecast period

The global luxury jewelry market will be dominated by Asia-Pacific during the forecast period. It is projected to generate a CAGR of nearly 8.5% in the coming years, with countries such as China, India, Hongkong, and Japan delivering the most optimal results. China, for instance, is the world’s largest customer of luxury jewelry.

According to official statistics, in 2023, buyers of luxury jewelry in China spent nearly USD 1400 on fine jewelry. Asian countries have deep-rooted cultural associations with jewelry of all types. They are often associated with personal wealth and social standing.

In addition, Asia-Pacific is witnessing a surge in the number of international brands entering emerging Asian countries such as China and India. In December 2024, Jewelbox, a popular brand for lab-grown diamonds, announced the launch of a new store in the Gurugram region of India.

North America is projected to generate a CAGR of 6.45%. The region's large population of high-income groups and increased demand for luxury goods are helping it deliver excellent results. Furthermore, the presence of several influential players in the region’s luxury jewelry segment will be essential for future growth. North America is witnessing a rising trend of pre-loved luxury jewelry, which is expected to assist the region in flourishing in the coming years.

Luxury Jewelry Market: Competitive Analysis

The global luxury jewelry market is led by players like:

- Harry Winston

- Hermès

- Cartier

- David Yurman

- Dior Joaillerie

- Bvlgari

- Chaumet

- Chopard

- Mikimoto

- Van Cleef & Arpels

- Buccellati

- Graff

- Boucheron

- Piaget

- Tiffany & Co.

The global luxury jewelry market is segmented as follows:

By Product Type

- Pearl Jewelry

- Gemstone Jewelry

- Diamond Jewelry

- Platinum Jewelry

- Gold Jewelry

- Others

By Sales Channel

- Offline

- Online

By End-User

- Women

- Men

By Product

- Bracelets

- Necklaces

- Ring

- Earrings

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Luxury jewelry is derived from precious or expensive metals. The term ‘luxury’ is subjective; however, in most cases, luxury jewelry is relatively higher priced than regular or affordable counterparts.

The global luxury jewelry market is expected to grow due to the changing consumer lifestyle and buying patterns.

According to study, the global luxury jewelry market size was worth around USD 47.09 billion in 2023 and is predicted to grow to around USD 95.72 billion by 2032.

The CAGR value of the luxury jewelry market is expected to be around 8.20% during 2024-2032.

The global luxury jewelry market will be dominated by Asia-Pacific during the forecast period.

The global luxury jewelry market is led by players like Harry Winston, Hermès, Cartier, David Yurman, Dior Joaillerie, Bvlgari, Chaumet, Chopard, Mikimoto, Van Cleef & Arpels, Buccellati, Graff, Boucheron, Piaget and Tiffany & Co.

The report explores crucial aspects of the luxury jewelry market, including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed