Marine Coatings Market Trend, Share, Growth, Size, Analysis and Forecast 2030

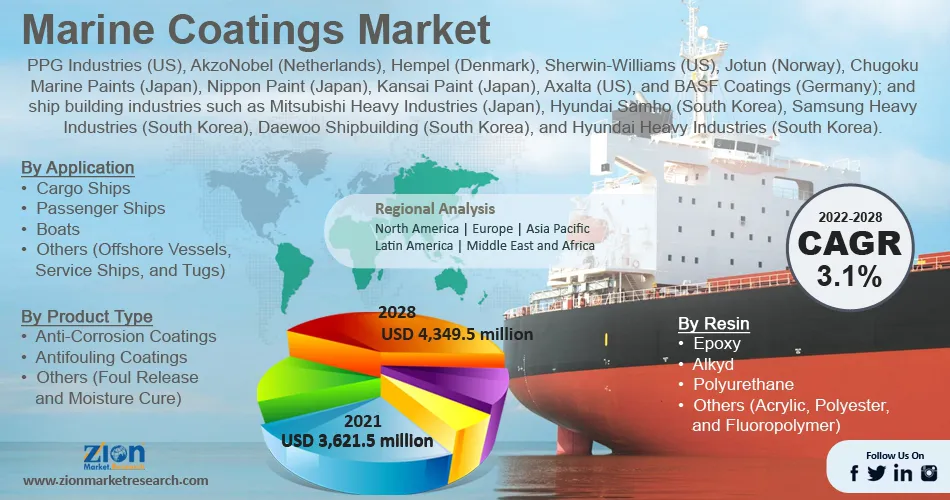

Marine Coatings Market By Resin (Epoxy, Alkyd, Polyurethane, and Others (Acrylic, Polyester, and Fluoropolymer). By Product Type (Anti-Corrosion Coatings, Antifouling Coatings, and Others (Foul Release and Moisture Cure)). By Application (Cargo Ships, Passenger Ships, Boats, and Others (Offshore Vessels, Service Ships, and Tugs)). and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3,621.5 Billion | USD 4,349.5 Billion | 3.1% | 2021 |

Marine Coatings Market Size And Industry Analysis

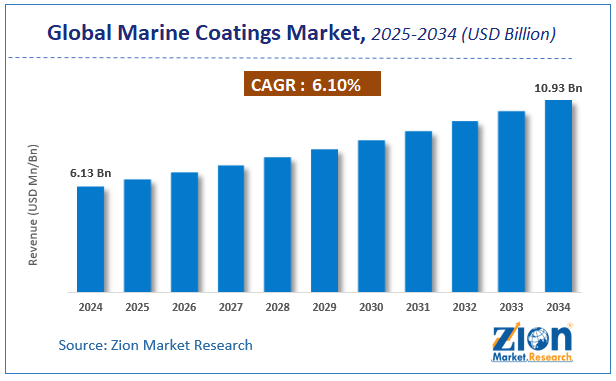

The Marine Coatings Market size was worth around USD 3,621.5 million in 2021 and is estimated to grow to about USD 4,349.5 million by 2028, with a compound annual growth rate (CAGR) of approximately 3.1 percent over the forecast period. The report analyzes the Marine Coatings Market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Marine Coatings Market.

Marine Coatings Market: Overview

Marine coatings are mostly utilized as protective coatings that are applied to the surfaces of ships, cruise ships, yachts, oil rigs, and bridges, among other things. These coatings are used to extend the shelf life of offshore structures and marine vessels by protecting them against corrosion and fouling. Marine coatings protect surfaces from UV radiation above the waterline as well as corrosion and fouling below the waterline. The increasing number of shipbuilding activities in emerging economies, the increase in production of leisure boats and cruise ships, rising ship repairs and maintenance activities, and changing customer preference for sustainable products as a result of increased environmental regulation and restrictions are some of the major factors driving the market's growth during the forecast period.

In addition, the increased use of sea routes for international trade has led to an increase in demand for container ships, bulk carriers, and cargo ships, as well as advancements in marine coating technologies, all of which will contribute to the growth of the marine coatings market in the coming years. The Increased production of leisure boats and cruise ships, as well as increased ship repairs and maintenance activities, are fuelling market expansion. Moreover, innovations to improve ship fuel efficiency and reduce emissions are expected to present a business opportunity in the future.

COVID-19 Impact:

The ongoing COVID-19 crisis has had a negative impact on the business outlook, with a significant decline in demand for marine coatings as a result of restrictions imposed on sea-based trade. COVID-19 has caused disruptions in several industrial verticals that use marine coating, as well as reduced production rates. The government's strict rules have had an impact on the functioning of the manufacturing plants.

The marine sector was also impacted in terms of production and operation, and the countries' economic conditions have deteriorated as a result of the pandemic. These issues act as primary restrictions on the growth of the marine coatings industry. However, the industry is resuming operations and growing steadily, thanks to increased demand for regular repair from vessels in dry dock. Moreover, developing technological developments in the marine coatings industry, as well as better economic conditions, are likely to boost the marine coatings industry's overall growth during the projection period.

Marine Coatings Market: Driver

Ships encounter a significant degree of frictional resistance inside the water when they go from one location to another due to tangential fluid forces. This resistance can lead to ship depreciation, which is extremely detrimental to the marine vehicle industry. This is why ships are meticulously sprayed with anti-corrosion coatings, which protect the hull from any potential harm. This is propelling the global marine coatings market and ensuring its vital expansion.

The world's population is growing at an alarming rate. When combined with an increase in disposable income, this creates a powerful growth driver for the worldwide marine coatings industry. People are vacationing on yachts and cruise ships for leisure activities, which is growing the marine industry and increasing ship production. It is critical for corporations to attract customers by increasing the aesthetically pleasing aspect of ships by putting anti-fouling paints to them.

Marine Coatings Market: Restraint

The shipbuilding industries have recently seen a slowdown as a result of the extensive use of COVID, and the economic slump in some countries, such as China, has also hampered the growth of the marine coatings business. On the other hand, the government intends to reduce the subsidies supplied to the shipping industry in order to balance the economic situation caused by an oversupply of ships at the manufacturing facilities. These issues are regarded as major restrictions on the growth of the marine coatings industry.

The industrialized countries are working on developing eco-friendly products and enforcing tight rules to reduce emissions into bodies of water. This is regarded as a major impediment to the expansion of the marine coatings market.

Marine Coatings Market: Opportunities

Some of the critical elements driving ship manufacturers and key market players to invest in effective marine coatings are friction and corrosion of the hull, as well as other degradation issues. The deterioration of marine vessels could result in significant losses for the marine industry and traders. As a result, potential market participants are boosting their investments in developing unique technologies and introducing new products into the sector, which is likely to drive the marine coatings market growth throughout the forecast period.

Due to the industrialized countries' economic situation and consumers' spending income, they invest in ship production and soliciting yacht and cruise ships. Additionally, buyers are seeking ways to improve the aesthetics of maritime vessels. These factors are also projected to promote the growth of the marine coatings market over the forecast period.

Marine Coatings Market: Challenges

Some of the significant concerns associated to the marine coatings industry, such as instability in raw material costs and manufacturing issues, are regarded as important challenges for the growth of the marine coatings market.

The significant difficulties for the marine coatings market expansion are the health dangers produced by the fumes emitted during manufacture and the faults and failures that occur during application such as orange peel runs, sags, mud cracks, over sprays, and others. Similarly, the wastage of product during application, which rates around 20% for each application, is seen as the key hurdle for the growth of the marine coatings market.

Marine Coatings Market: Segmentation

The Marine Coatings Market is segregated based on Resin, Product Type, and Application.

By Product Type, the market is classified into Anti-Corrosion Coatings, Antifouling Coatings, and Others (Foul Release and Moisture Cure). The anti-corrosion category accounts for over half of the total revenue in the marine coatings market. Anti-corrosion marine coatings, which protect metal portions of vessels from oxidation, salt spray, and moisture, are gaining popularity in the sector. Expanding product demand is prompting industry participants to provide more innovative goods in order to meet rising demand and attract a broader consumer base. During the projection period, the anti-fouling marine coatings segment will expand substantially. These are used on marine vessels to limit subaquatic growth, resulting in a smoother hull and greater fuel economy. Manufacturers are investing in research and development to provide more efficient anti-fouling coatings.

By Application, the market is classified into Cargo Ships, Passenger Ships, Boats, and Others (Offshore Vessels, Service Ships, and Tugs). Offshore oil and gas production has expanded dramatically in recent years, driving up demand for offshore vessels. These vessels serve an important role in the transfer of cargo, equipment, and tools, as well as providing logistical support for offshore oil platforms and other offshore constructions. Corrosion attacks on vital assets such as offshore oil and gas platforms and other maritime assets pose a persistent threat to the national and global economies. While developing new anti-corrosion coatings for marine and offshore applications, producers are under constant pressure to meet higher environmental standards while also providing long-term, cost-effective corrosion protection for assets. The offshore vessels category is predicted to have the greatest market share due to rising product demand.

Marine Coatings Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Marine Coatings Market Size Report |

| Market Size in 2021 | USD 3,621.5 Million |

| Market Forecast in 2028 | USD 4,349.5 Million |

| Growth Rate | CAGR of 3.1% |

| Number of Pages | 188 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | PPG Industries (US), AkzoNobel (Netherlands), Hempel (Denmark), Sherwin-Williams (US), Jotun (Norway), Chugoku Marine Paints (Japan), Nippon Paint (Japan), Kansai Paint (Japan), Axalta (US), and BASF Coatings (Germany); and ship building industries such as Mitsubishi Heavy Industries (Japan), Hyundai Samho (South Korea), Samsung Heavy Industries (South Korea), Daewoo Shipbuilding (South Korea), and Hyundai Heavy Industries (South Korea) |

| Segments Covered | By Product Type, By Application, By Resin And By Region |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In 2021, Chugoku Marine Painting Ltd., one of the market's top players, has created a fuel-efficient and anti-fouling coating for marine boats, which is specifically designed for trading vessels that travel the globe. The product is known as the SEAFLO NEO M1 PLUS, and the range has been renamed the SEALO NEO range. This product launch has aided vessels with varying trading patterns and also minimizes friction produced by ships operating against powerful water.

Marine Coatings Market: Regional Landscape

The Asia Pacific region has the highest revenue share in the marine coatings industry because of the various ship construction industries in countries such as China, Japan, and South Korea. Furthermore, nations like China and India are known for their skilled and inexpensive workforce, which creates favorable conditions for the expansion of the marine coatings market in these regions. The presence of a number of advantageous conditions has encouraged shipbuilding businesses to boost their investment and create business and manufacturing operations in these countries. On the other hand, favorable geographical conditions such as efficient and seamless sea trade, as well as financial backing from governmental organizations, are supporting shipbuilding businesses and, as a result, increasing the total expansion of the marine coatings sector.

North America is witnessing slower but continuous expansion in the marine coatings industry because of its geographical location and effective options for trading and other enterprises. The presence of notable boat manufacturers, as well as big freight and passenger ship fleets that provide logistics solutions for a variety of industries in the region, is a crucial component enhancing the outlook of the North American marine coatings market. Various manufacturers in the region are investing much in the creation of eco-friendly coatings that will allow operators to meet severe marine transport standards, which will drive in the future.

Marine Coatings Market: Competitive Landscape

Some of the main competitors dominating the Marine Coatings Market include:

- PPG Industries (US)

- AkzoNobel (Netherlands)

- Hempel (Denmark)

- Sherwin-Williams (US)

- Jotun (Norway)

- Chugoku Marine Paints (Japan)

- Nippon Paint (Japan)

- Kansai Paint (Japan)

- Axalta (US)

- BASF Coatings (Germany)

- Mitsubishi Heavy Industries (Japan)

- Hyundai Samho (South Korea)

- Samsung Heavy Industries (South Korea)

- Daewoo Shipbuilding (South Korea)

- Hyundai Heavy Industries (South Korea)

Marine Coatings Market is segmented as follows:

By Resin

- Epoxy

- Alkyd

- Polyurethane

- Others (Acrylic, Polyester, and Fluoropolymer)

By Product Type

- Anti-Corrosion Coatings

- Antifouling Coatings

- Others (Foul Release and Moisture Cure)

By Application

- Cargo Ships

- Passenger Ships

- Boats

- Others (Offshore Vessels, Service Ships, and Tugs)

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The increasing number of shipbuilding activities in emerging economies, the increase in production of leisure boats and cruise ships, rising ship repairs and maintenance activities, and changing customer preference for sustainable products as a result of increased environmental regulation and restrictions are some of the major factors driving the market's growth during the forecast period.

According to the Market Research report, the Marine Coatings Market size was worth about 3,621.5 (USD million) in 2021 and is predicted to grow to around 4,349.5 (USD million) by 2028, with a compound annual growth rate (CAGR) of around 3.1 percent.

The Asia Pacific region has the highest revenue share in the marine coatings industry because of the various ship construction industries in countries such as China, Japan, and South Korea. Furthermore, nations like China and India are known for their skilled and inexpensive workforce, which creates favorable conditions for the expansion of the marine coatings market in these regions.

Some of the main competitors dominating the Marine Coatings Market include - PPG Industries (US), AkzoNobel (Netherlands), Hempel (Denmark), Sherwin-Williams (US), Jotun (Norway), Chugoku Marine Paints (Japan), Nippon Paint (Japan), Kansai Paint (Japan), Axalta (US), and BASF Coatings (Germany); and ship building industries such as Mitsubishi Heavy Industries (Japan), Hyundai Samho (South Korea), Samsung Heavy Industries (South Korea), Daewoo Shipbuilding (South Korea), and Hyundai Heavy Industries (South Korea).

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed