Meat, Poultry, and Seafood Packaging Market Size, Share, Trends, Growth and Forecast 2032

Meat, Poultry, and Seafood Packaging Market By Material (Plastic, Paper, Metal, and Glass), By Packaging Type (Rigid Packaging, Flexible Packaging, and Semi-Rigid Packaging), By Application (Frozen Meats, Fresh Meats, Processed Meats, Poultry, and Seafood), By End Use (Retail, Food Service, and Industrial), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

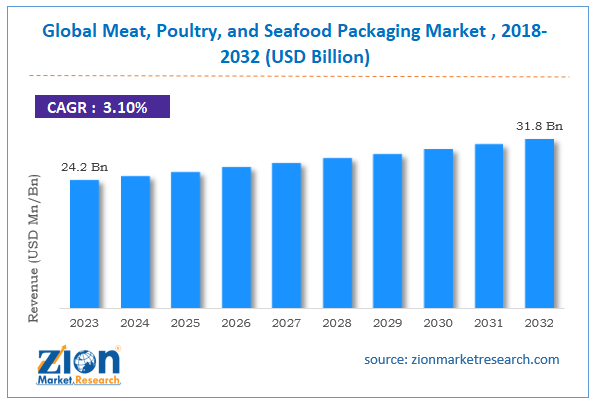

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 24.2 Billion | USD 31.8 Billion | 3.1% | 2023 |

Meat, Poultry and Seafood Packaging Industry Prospective:

The global meat, poultry, and seafood packaging market size was worth around USD 24.2 billion in 2023 and is predicted to grow to around USD 31.8 billion by 2032, with a compound annual growth rate (CAGR) of roughly 3.1% between 2024 and 2032.

Meat, Poultry and Seafood Packaging Market: Overview

Certain packaging styles employed to preserve, store, and extend the shelf life of goods obtained from fresh, frozen, and processed meat, poultry, and seafood are referred to as "meat, poultry, and seafood packaging." This packaging determines whether the supply chain is kept clean, contamination is avoided, and product quality is preserved.

Rising demand for processed and packaged goods, the expansion of online grocery shopping and e-commerce, and the growing popularity of sustainable packaging are just a few of the several elements driving the meat, poultry, and seafood packaging industry. However, the high cost of modern packing methods is hindering industry growth.

Key Insights

- As per the analysis shared by our research analyst, the global meat, poultry, and seafood packaging market is estimated to grow annually at a CAGR of around 3.1% over the forecast period (2024-2032).

- In terms of revenue, the global meat, poultry, and seafood packaging market size was valued at around USD 24.2 billion in 2023 and is projected to reach USD 31.8 billion by 2032.

- The growing seafood consumption is expected to drive the meat, poultry, and seafood packaging market over the forecast period.

- Based on the material, the plastic segment is expected to hold the largest market share over the forecast period.

- Based on the packaging type, the flexible packaging segment is expected to dominate the market over the forecast period.

- Based on the application, the frozen meats segment is expected to hold the largest market share during the forecast period.

- Based on the end use, the food service segment is expected to hold the largest revenue share over the analysis period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Meat, Poultry and Seafood Packaging Market: Growth Drivers

Growing trends of convenience and busy lifestyles drive market growth

Consumer lifestyles, which are marked by hectic schedules, dual-income households, and a need for convenience, have had a substantial impact on the need for meat packaging solutions that satisfy consumers' on-the-go eating habits. Packaging is essential to meeting consumers' changing needs as they seek quick cures and simple meal preparation. The average yearly income for dual-income households with children is USD 130,000, whereas the average income for those without children is USD 138,000. Compared to DIWKs, DINKs contribute more than 9% more to retirement funds annually. Convenience-focused packaging for pre-packaged and ready-to-eat beef meals appeals to consumers seeking quick cures.

Fully prepared meal packages, pre-marinated meats, and individually wrapped deli slices are products that make cooking easier. According to the Trendspotter Panel of the Specialty Food Association (SFA), convenience is expected to be a major trend in 2023.

Another method portion-controlled packaging meets consumer convenience is through pre-portioned beef products. Single-serving or clearly labeled serving packets appeal to consumers who want to reduce food waste and simplify meal prep. Market trends demonstrating the growth of convenience foods, consumer preferences for straightforward products, and the impact on packaging designs all point to convenience as a key driver in meat packaging. The meat packaging industry is keeping up with consumer needs for convenience by developing innovative packaging alternatives that accommodate hectic lifestyles.

Meat, Poultry and Seafood Packaging Market: Restraints

Environmental concerns and sustainability hinder market growth

One of the biggest issues faced by the meat, poultry, and seafood packaging industry is the growing global awareness of environmental sustainability and the negative effects of plastic waste. In an attempt to reduce the packaging industry's detrimental environmental effects, consumers, authorities, and environmental organizations have called for more environmentally friendly packaging solutions.

In March 2022, nearly 175 nations decided to draft a legally binding pact to limit plastic pollution. The UN has been investigating strategies to lessen the quantity of plastic waste since 2017. To complete discussions by 2024, the United Nations Intergovernmental Negotiating Committee convened in Paris in May 2023.

Every nation in the world is making efforts to cut back on the usage of single-use plastics. The Single-Use Plastics Directive of the European Union, for instance, aims to reduce the environmental impact of particular plastic products, like the packaging for food and beverages

. In a similar vein, plastic bags in India would have to be at least 120 microns thick as of January 1, 2023. The manufacture, importation, storage, distribution, sale, and use of plastic bags with a thickness of less than 120 microns are also forbidden by the Plastic Waste Management (Amendment) Rules, 2021. Thus, the aforementioned stats hamper the market expansion.

Meat, Poultry and Seafood Packaging Market: Opportunities

Growing demand for processed meat and seafood products offers a lucrative opportunity for market growth

There is a lot of potential for packaging innovation, considering the meat industry's rapid e-commerce growth. Adapting packaging solutions to the unique requirements of e-commerce can enhance the overall consumer experience while maintaining product integrity throughout distribution, especially as more people purchase meat online.

Longer journey times and shifting climatic conditions during delivery are common features of e-commerce systems. Meat products, especially perishables, are kept at the proper temperature during delivery, thanks to temperature-controlled packaging.

In 2023, online meat sales in the US had risen from zero to two percent. A meat delivery service based in Bengaluru, Licious provides cold cuts, seafood, beef, and ready-to-eat alternatives. Operating revenue for Licious rose 9.5% to INR 748 Cr in 2022–2023 from INR 682.5 Cr in the prior fiscal year. Thus driving the meat, poultry, and seafood packaging market over the forecast period.

Meat, Poultry and Seafood Packaging Market: Challenges

The high cost of advanced packaging solutions poses a major challenge to market expansion

For manufacturers, suppliers, and end users, the high price of sophisticated packaging solutions continues to be a major obstacle in the meat, poultry, and seafood packaging industry.

Advanced packaging methods frequently have greater material, production, and operating expenses, even if they are necessary to preserve freshness, safety, and longer shelf life. It is expensive to employ high-performance plastics for vacuum and modified atmosphere packaging (MAP), such as EVOH, PVDC, and bioplastics.

Additionally, to prevent contamination and preserve hygiene, advanced packaging materials are required by regulatory standards (such as those set forth by the FDA, EFSA, and FSSAI), which raises R&D and production costs. Costs of materials and processing are increased by the requirement that packaging be BPA-free, leak-proof, and tamper-resistant.

Meat, Poultry, and Seafood Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Meat, Poultry, and Seafood Packaging Market |

| Market Size in 2023 | USD 24.2 Billion |

| Market Forecast in 2032 | USD 31.8 Billion |

| Growth Rate | CAGR of 3.1% |

| Number of Pages | 220 |

| Key Companies Covered | Nippon Meat Packers, Ready Pac Foods, Perdue Farms, Pinnacle Foods, JBS, Seaboard Corporation, Marfrig, Cargill, Weston Foods, Burgers' Smokehouse, Tyson Foods, Hormel Foods, Cloverdale Foods, Smithfield Foods, Schwans Company, and others. |

| Segments Covered | By Material, By Packaging Type, By Application, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Meat, Poultry and Seafood Packaging Market: Segmentation

The global meat, poultry, and seafood packaging industry is segmented based on material, packaging type, application, end-use, and regions.

Based on the material, the global meat, poultry, and seafood packaging market is bifurcated into plastic, paper, metal, and glass. The plastic segment is expected to hold the largest market share over the forecast period. The segment expansion is due to its superior performance characteristics, including durability, flexibility, and cost-effectiveness. These attributes make it a preferred choice for preserving the quality and extending the shelf life of meat, poultry, and seafood products.

Based on the packaging type, the global meat, poultry, and seafood packaging industry is segmented into rigid packaging, flexible packaging, and semi-rigid packaging. The flexible packaging segment is expected to dominate the market over the forecast period. The lightweight nature of flexible packaging can lead to lower transportation costs and improved handling efficiency, driving the segment growth.

Based on the application, the global meat, poultry, and seafood packaging market is segmented into frozen meats, fresh meats, processed meats, poultry, and seafood. The frozen meat segment is expected to hold the largest market share during the forecast period. There's a rising demand for convenient meal solutions that offer extended shelf life without compromising quality.

Based on the end use, the global meat, poultry, and seafood packaging industry is segmented into retail, food service, and industrial. The food service segment is expected to hold the largest revenue share over the analysis period. This demand is influenced by the need for packaging solutions that ensure product quality, safety, and convenience.

Meat, Poultry, And Seafood Packaging Market: Regional Analysis

Asia Pacific dominates the market over the projected period

The Asia Pacific is expected to dominate the global meat, poultry, and seafood packaging market during the forecast period. The growing populations of China and India are the main causes of the segment expansion. The market is anticipated to expand as a result of the expanding use of both rigid and flexible packaging in the packing of meat, poultry, and seafood.

Additionally, the primary drivers of the growth of the meat, poultry, and seafood packaging sector in the region include changing lifestyle habits, increased health consciousness, and rising per capita income. The region has a wealth of raw materials for making aluminum, plastic, and thermoforming packaging. Thus driving the market growth.

Meat, Poultry and Seafood Packaging Market: Competitive Analysis

The global meat, poultry, and seafood packaging market is dominated by players like:

- Nippon Meat Packers

- Ready Pac Foods

- Perdue Farms

- Pinnacle Foods

- JBS

- Seaboard Corporation

- Marfrig

- Cargill

- Weston Foods

- Burgers' Smokehouse

- Tyson Foods

- Hormel Foods

- Cloverdale Foods

- Smithfield Foods

- Schwans Company

The global meat, poultry, and seafood packaging market is segmented as follows:

By Material

- Plastic

- Paper

- Metal

- Glass

By Packaging Type

- Rigid Packaging

- Flexible Packaging

- Semi-Rigid Packaging

By Application

- Frozen Meats

- Fresh Meats

- Processed Meats

- Poultry

- Seafood

By End Use

- Retail

- Food Service

- Industrial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Certain packaging styles employed to preserve, store, and extend the shelf life of goods obtained from fresh, frozen, and processed meat, poultry, and seafood are referred to as "meat, poultry, and seafood packaging."

The meat, poultry, and seafood packaging market is driven by an increasing demand for seafood, growing global trade, rising R&D investment, and product innovations.

According to the report, the global meat, poultry, and seafood packaging market size was worth around USD 24.2 billion in 2023 and is predicted to grow to around USD 31.8 billion by 2032.

The global meat, poultry, and seafood packaging market is expected to grow at a CAGR of 3.1% during the forecast period.

The global meat, poultry, and seafood packaging market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market due to the rising urbanization and increasing number of manufacturers.

The global meat, poultry, and seafood packaging market is dominated by players like Nippon Meat Packers, Ready Pac Foods, Perdue Farms, Pinnacle Foods, JBS, Seaboard Corporation, Marfrig, Cargill, Weston Foods, Burgers' Smokehouse, Tyson Foods, Hormel Foods, Cloverdale Foods, Smithfield Foods and Schwans Company among others.

The meat, poultry, and seafood packaging market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

Choose License Type

List of Contents

Meat, Poultry and Seafood Packaging Industry Prospective:Meat, Poultry and Seafood Packaging OverviewKey InsightsMeat, Poultry and Seafood Packaging Growth DriversMeat, Poultry and Seafood Packaging RestraintsMeat, Poultry and Seafood Packaging OpportunitiesMeat, Poultry and Seafood Packaging ChallengesReport ScopeMeat, Poultry and Seafood Packaging SegmentationMeat, Poultry, And Seafood Packaging Regional AnalysisMeat, Poultry and Seafood Packaging Competitive AnalysisHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed