Meat Speciation Testing Market Size, Share, Trends, Growth Report and Forecast 2028

Meat Speciation Testing Market By Species (Cow, Swine, Chicken, Horse, Sheep, and Others), By Technology (PCR, ELISA, and Others), By Form (Raw, Cooked, and Processed), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028-

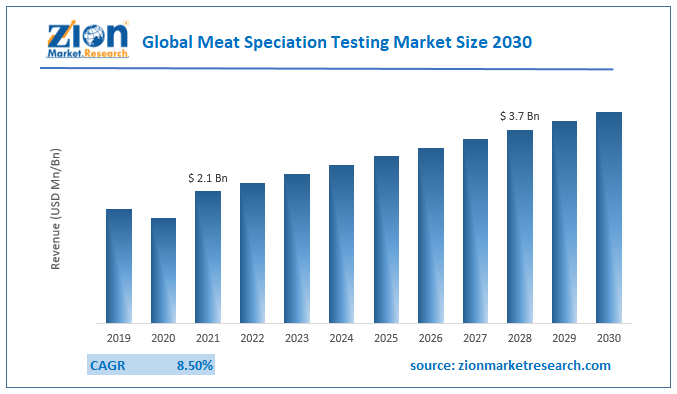

The global Meat Speciation Testing market size was valued USD 2.1 billion in 2021 and is expected to rise to USD 3.7 billion by 2028 at a CAGR of 8.5%.

Industry Prospective:

The global meat speciation testing market size was worth around USD 2.1 billion in 2021 and is predicted to grow to around USD 3.7 billion by 2028 with a compound annual growth rate (CAGR) of roughly 8.5% between 2022 and 2028. The report analyzes the global meat speciation testing market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the meat speciation testing market.

Meat Speciation Testing Market: Overview

Meat speciation is accomplished on both cooked and raw meat products. Product label claims are confirmed by meat speciation testing systems, confirming the authenticity of meat and meat products and maintaining consumer safety. The growing number of meat eaters worldwide, along with recent scandals involving meat mislabeling, has increased demand for meat speciation testing. Meat is one of the most widely consumed foods worldwide. As new products have entered the meat food sector, it is more crucial than ever to guarantee the food is of the greatest quality.

Meat speciation testing uses diagnostic methods like PCR, ELISA, etc. to measure relative levels of animal DNA in the total meat. There is a considerable push for technological developments in the speciation testing market as a result of the severe scrutiny placed on the food production business, to produce high-quality products at lower production costs. As a result, the market for meat speciation testing also experiences strong demand.

Key Insights

- As per the analysis shared by our research analyst, the global meat speciation testing market is estimated to grow annually at a CAGR of around 8.5% over the forecast period (2022-2028).

- In terms of revenue, the global meat speciation testing market size was valued at around USD 2.1 billion in 2021 and is projected to reach USD 3.7 billion, by 2028.

- Due to a variety of driving factors, the market is predicted to rise at a significant rate. The global meat speciation testing market is projected to grow owing to the increasing consumption of meat across the globe.

- Based on species, the chicken segment is expected to grow at a significant rate during the forecast period.

- Based on technology, the PCR segment is expected to dominate the market during the forecast period.

- Based on the form, the raw segment accounted for the largest market share in 2021.

- Based on region, Europe is projected to dominate the market during the forecast period.

Meat Speciation Testing Market: Growth Drivers

Increasing meat production to drive the market growth

The increasing meat production is expected to drive the global meat speciation testing market during the forecast period. For instance, according to the USDA, the global production of pork amounted to about 114.59 million metric tons in 2019. Due to the demand for packaged and processed beef, production is rising. Consumer awareness of adulteration procedures and worries about the health and safety of final products have increased along with demand. Meat and meat products make up the majority of the cases of food adulteration. As a result, the need for meat speciation testing is growing to prevent such incidents.

Meat speciation testing systems check product labels and authenticate the authenticity of the meat and meat products, ensuring customer safety. To comply with regulatory requirements, meat product manufacturers are spending money on research and development. Thus, driving the market growth.

Meat Speciation Testing Market: Restraints

Intense competition in the industry impedes the market

Meat testing is gaining importance due to the increasing laws and regulations ensuring food safety. Some small organizations and laboratories are now introducing their meat testing services. Major players are focusing on strengthening their presence in the market by investing in research and developments to innovate new testing techniques. For instance, in July 2020, to improve brand label claims' transparency and integrity, Niman presented Food In-Depth, or FoodID, a new scientific food testing firm.

The FoodID platform screens for seven medication families, which together make up 95% of the most popular beta-agonists and antibiotics used in feed and water. The start-up claims that its technology is quick, operating at a rate comparable to that of contemporary animal production. Therefore, the intense competition in the industry is expected to impede the growth of the market during the forecast period.

Meat Speciation Testing Market: Opportunities

Growing food trade across emerging markets is expected to provide lucrative opportunities for the market expansion

The potential for global meat speciation market growth is expanded by increased food trade across borders of emerging markets. Food meat speciation testing is essential due to the rise in food-borne infections, poor hygienic conditions, and processing conditions in some nations. It is anticipated that the need for testing services in emerging economies will rise as a result of the implementation of rules, the ability to prohibit the import and supply of contaminated food, and enforce food recalls.

Meat Speciation Testing Market: Segmentation

The global meat speciation testing market is segmented based on the species, technology, form, and region

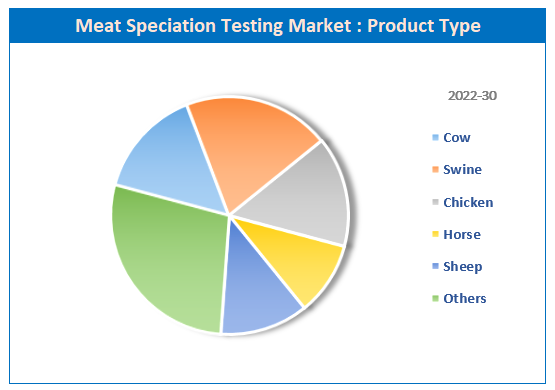

Based on the species, the global market is bifurcated into cow, swine, chicken, horse, sheep, and others. The chicken segment is expected to grow at a significant rate during the forecast period. The segment growth is attributed to the rising cost of chicken, several meat producers and processors are engaging in fraudulent business methods, including adulteration, the fraudulent substitution of chicken with pork, and contamination of other species. The global market for chicken (Gallus gallus) is expanding as a result of several incidences of adulterated chicken flesh being found.

On the other hand, the swine segment is expected to grow during the forecast period owing to the Increased quality control for meat products is desired as a result of the rise in the number of cases of mixing pig meat with chicken and horse meat.

Based on technology, the market is segmented into PCR, ELISA, and Others. The PCR segment is expected to dominate the market during the forecast period. A specific DNA segment can be quickly multiplied (amplified) into millions or billions of copies using the polymerase chain reaction (PCR), allowing for more in-depth analysis. In PCR, a section of the genome to be amplified is chosen using short synthetic DNA fragments called primers.

Multiple rounds of DNA synthesis are then used to amplify that segment. Besides, the ELISA segment is expected to grow at the highest CAGR over the forecast period. The segment growth is attributed to the increasing uses of this technology in particular horse meat speciation. Moreover, these technologies are designed to qualitatively determine animal species content in cooked and canned meat, meat products, processed foods and meat, and bone meals.

Based on form, the global meat speciation testing market is bifurcated into raw, cooked, and processed. The raw meat segment accounted for the largest market share in 2021 and is expected to show its dominance during the forecast period. The growth in the segment is attributed to the domestic consumption of meat in raw form is very high. For instance, according to secondary sources, the global consumption of meat has more than doubled since 1990, reaching over 328 million metric tons in 2021. Between 1990 and 2021, the volume of poultry consumed worldwide increased from 34.6 million metric tons to more than 132 million metric tons. Thus, these facts supported the market growth during the forecast period.

Recent Developments:

- In January 2021, Lansing-based Company Neogen Corp., which creates and sells devices for ensuring the safety of food and animals, created a quicker test to identify meat speciation in raw meat and ambient samples. The "Reveal" test, which checks for horse, beef, sheep, and poultry, gives results after a water extraction in five minutes. In raw meat or raw processed samples, the test can identify as little as 0.5 percent of the target species. They have also been approved for use with rinse water and environmental swabs. The test is added to Neogen's current test for pork.

- In May 2021, Eurofins Food and Water Testing UK & Ireland have announced the acquisition of the independent contract testing laboratory Alliance Technical Laboratories (ATL) Ltd. The move will enhance the company’s food, water, and feed testing service provider in the South East and is part of its planned strategic growth agenda.

Meat Speciation Testing Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Meat Speciation Testing Market Research Report |

| Market Size in 2021 | USD 2.1 Billion |

| Market Forecast in 2028 | USD 3.7 Billion |

| Compound Annual Growth Rate | CAGR of 8.5% |

| Number of Pages | 182 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Eurofins Scientific, VWR International, LLC, Rapid Test Methods Ltd., AB Sciex Pte. Ltd., LGC Limited, Neogen Corporation, ALS, BioCheck, Inc., EnviroLogix, EMSL Analytical, Inc., among others. |

| Segments Covered | By Species, By Technology, By Form and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

To know more about this report, request a sample copy.

Meat Speciation Testing Market: Regional Analysis

Europe region is expected to dominate the market during the forecast period

Europe is currently the global leader in the meat speciation testing industry, owing to an increase in severe food laws, consumer awareness, and an increase in the meat trade in the region. Another reason driving the increased interest in meat speciation testing in Europe is the growing customer desire for certified products that are regarded to be authentic and by Islamic and Jewish requirements of halal and kosher. Companies are developing new technology to evaluate the authenticity of meat and to meet customer demands.

For instance, in June 2015, Eurofins launched an innovative analytical method, based on DNA chip technology, which enables simultaneous detection and identification of up to 21 animal species in feed and food products. On the other hand, the Asia Pacific region is expected to grow at the highest CAGR during the forecast period. The growth in the region is attributed to the increasing consumption of meat products in the countries like India, China, and others. For instance, according to OECD data, China presently eats about 30% of the world's meat, including half of the world's pork. In 2016, meat consumption per capita in China reached 50kg, with pork meat accounting for 31.3 kg/capita, poultry meat accounting for 11.7 kg/capita, beef and veal accounting for 3.9 kg/capita, and sheep meat accounting for 3.0 kg/capita. Three decades ago, China's per capita meat consumption was only 13 kg.

Meat Speciation Testing Market: Competitive Analysis

The global meat speciation testing market is dominated by players like Eurofins Scientific, VWR International, LLC, Rapid Test Methods Ltd., AB Sciex Pte. Ltd., LGC Limited, Neogen Corporation, ALS, BioCheck, Inc., EnviroLogix, EMSL Analytical, Inc., among others.

The global meat speciation testing market is segmented as follows:

By Species

- Cow

- Swine

- Chicken

- Horse

- Sheep

- Others

By Technology

- PCR

- ELISA

- Others

By Form

- Raw

- Cooked

- Processed

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The growth of the global meat speciation testing market is driven by the rising health concern among the consumers and high demand for packaged meat. Moreover, the increasing consumption of meat across the globe positively influenced the market growth during the forecast period.

According to the report, the global meat speciation testing market size was worth around USD 2.1 billion in 2021 and is predicted to grow to around USD 3.7 billion by 2028 with a compound annual growth rate (CAGR) of roughly 8.5% between 2022 and 2028.

The global meat speciation testing market growth is expected to be driven by Europe. It is currently the world’s highest revenue-generating market owing to an increase in severe food laws, consumer awareness, and an increase in the meat trade in the region.

The global meat speciation testing market is dominated by players like Eurofins Scientific, VWR International, LLC, Rapid Test Methods Ltd., AB Sciex Pte. Ltd., LGC Limited, Neogen Corporation, ALS, BioCheck, Inc., EnviroLogix, EMSL Analytical, Inc., among others.

Choose License Type

List of Contents

Industry Prospective:OverviewKey InsightsGrowth DriversIncreasing meat production to drive the market growthRestraintsIntense competition in the industry impedes the market OpportunitiesGrowing food trade across emerging markets is expected to provide lucrative opportunities for the market expansionSegmentationThe global meat speciation testing market is segmented based on the species, technology, form, and regionRecent Developments:Market Report Scope:To know more about this report,request a sample copy.Regional AnalysisEurope region is expected to dominate the market during the forecast periodCompetitive AnalysisThe global meat speciation testing market is segmented as follows:By SpeciesBy TechnologyBy FormBy RegionRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed