Global Medical Exoskeleton Market Size, Share, Growth Analysis Report - Forecast 2034

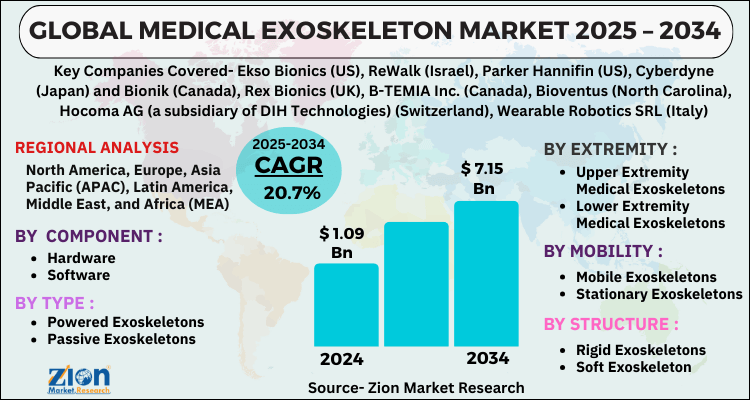

Medical Exoskeleton Market By Component (Hardware and Software), By Type (Powered Exoskeletons and Passive Exoskeletons), Extremity (Upper Extremity Medical Exoskeletons, Lower Extremity Medical Exoskeletons, Full Body), Mobility (Mobile Exoskeletons and Stationary Exoskeletons), Structure (Rigid Exoskeletons and Soft Exoskeleton), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

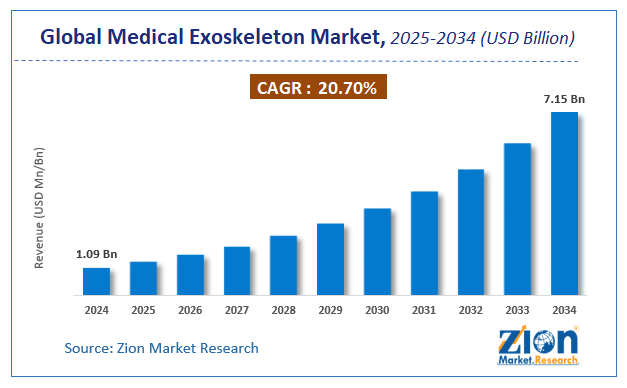

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.09 Billion | USD 7.15 Billion | 20.7% | 2024 |

Medical Exoskeleton Market: Industry Perspective

The global medical exoskeleton market size was worth around USD 1.09 Billion in 2024 and is predicted to grow to around USD 7.15 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 20.7% between 2025 and 2034.

The report analyzes the global medical exoskeleton market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the medical exoskeleton industry.

Medical Exoskeleton Market: Overview

Exoskeletons are used to increase a person's physical strength by helping limb movements with additional strength. Medical exoskeletons help persons who are physically disabled, such as those who have had a spinal cord injury, have a neurological condition, is paralyzed, or are elderly. Physiotherapy and rehabilitation institutes employ some medical human exoskeletons for treatment of the lower and upper extremities. The increase in the number of orthopaedic operations, the rise in the geriatric population, and the rising rates of road accidents are all contributing to the worldwide medical exoskeleton market's growth. However, the exorbitant expense of the product, as well as regulatory issues, is the main roadblocks to commercial expansion. As a result, the limbs have increased mobility, strength, and endurance as a result of this construction.

The global demand for effective rehabilitation procedures, including the use of cutting-edge technology and goods, is increasing. In all main regions, this is seen as a positive indicator of the medical exoskeleton market's growth. As a result, you might have an impact on market dynamics during the forecast period. Furthermore, the increasing number of persons with physical limitations will have a significant impact on the medical exoskeleton market's growth. Additionally, rising geriatric population and increased access to medical exoskeleton insurance coverage in various nations are major factors boosting the growth of the medical exoskeleton market. Furthermore, an increase in the number of traffic accidents, serious injuries, and strokes will boost the market's growth rate. Increased spending on healthcare infrastructure is one of the primary industry drivers that will propel the medical exoskeleton market forward.

In the last decade, production and development of different robotic technologies that amplify human strength have been one of the major trends in the robotics sector. Many industry players have introduced technologically advanced human exoskeletons, which have many industrial and medical applications. Human exoskeletons are also called wearable robots provide a skeleton outside a person’s body that acts as a body extension. These extensions help humans to produce more power like a machine. These exoskeletons are gaining popularity due to their ability to support humans in dynamic conditions. They can assist a disabled person in carrying out different activities. These devices could reduce back injuries and other mishaps in industries, where injuries are a common thing. Various human exoskeleton prototypes and models are being used in physical therapy and are being deployed in several rehabilitation centers, for lower and upper limb therapy. Growing adoption of human exoskeletons in rehabilitation therapy for disabled and elderly patients around the world is expected to fuel the growth of medical exoskeletons in the upcoming years.

Key Insights

- As per the analysis shared by our research analyst, the global medical exoskeleton market is estimated to grow annually at a CAGR of around 20.7% over the forecast period (2025-2034).

- Regarding revenue, the global medical exoskeleton market size was valued at around USD 1.09 Billion in 2024 and is projected to reach USD 7.15 Billion by 2034.

- The medical exoskeleton market is projected to grow at a significant rate due to rising prevalence of neurological and musculoskeletal disorders, increasing demand for rehabilitation solutions, advancements in robotics and wearable technology, and growing adoption in elderly and disabled patient mobility assistance.

- Based on Component, the Hardware segment is expected to lead the global market.

- On the basis of Type, the Powered Exoskeletons segment is growing at a high rate and will continue to dominate the global market.

- Based on the Extremity, the Upper Extremity Medical Exoskeletons segment is projected to swipe the largest market share.

- By Mobility, the Mobile Exoskeletons segment is expected to dominate the global market.

- In terms of Structure, the Rigid Exoskeletons segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Medical Exoskeleton Market: Growth Drivers

An increasing number of people with physical disabilities and subsequent growth in the demand for effective rehabilitation approaches to drive global market growth

Globally, the number of persons with physical disabilities is on the rise, owing to causes such as an aging population, an increase in the frequency of road accidents and severe trauma injuries, and an increase in the prevalence of stroke, among others. The worldwide old population is expected to rise steadily in the following years, from 703 million in 2019 to 1.5 billion by 2050, according to the US Census Bureau. The number of people with impairments is rising as the geriatric population grows, as the elderly are more vulnerable to illnesses like stroke and severe musculoskeletal injuries from falls. The huge increase in the senior population not only means that there will be more potential customers for medical exoskeletons in the future, but it also means that there will be fewer active people to care for the elderly and disabled. As a result, there is a growing demand for efficient rehabilitation methods that include the use of innovative and modern technology and goods all over the world.

Medical Exoskeleton Market: Restraints

Regulatory Challenges for securing approvals for medical applications of exoskeletons in Medical Exoskeletons hamper the market growth

During product testing, the manufacturer's technical design skills and knowledge can make a difference. Exoskeletons designed for healthcare applications must be properly scrutinized because the failure of medical equipment can have life-threatening repercussions. There are currently just a few standards that directly apply to the exoskeleton sector. Only items that have received regulatory approvals can be marketed on the market, and the FDA recognizes ISO standards that are applicable to relevant industries. Although powered lower-limb exoskeletons have advanced significantly, users are still having difficulty handling sloped or slippery surfaces. Because the prototypes can't handle twisting motions yet, users turning while carrying goods may quickly tire out, causing undesirable outcomes such as skin and tissue damage and bone fractures. As a result, regulatory organizations have set in place a stringent licensing process for such devices to ensure that the wearer's safety is not jeopardized by the high-power output of actuators utilized in them.

Medical Exoskeleton Market: Opportunities

Increasing insurance coverage for medical exoskeletons in several countries to bring growth opportunities for the global market

Assistive technology is an important element of healthcare. Many rehabilitation institutions in numerous nations rely on assistive devices supplied by government agencies, special agencies, insurance firms, and charity and non-governmental groups. Exoskeleton technology is currently covered by insurance companies in only a few countries. Companies, on the other hand, are working on developing policies and forming strategic partnerships and agreements with a variety of public and commercial insurance providers to cover the costs of medical exoskeleton equipment. Ekso Bionics, for example, is addressing the Centers for Medicare and Medicaid Services as well as third-party insurers, as they are expected to play a key role in the Ekso GT device's long-term commercial adoption.

Medical Exoskeleton Market: Segmentation Analysis

The global medical exoskeleton market is segmented based on Component, Type, Extremity, Mobility, Structure, and region.

Based on Component, the global medical exoskeleton market is divided into Hardware and Software.

On the basis of Type, the global medical exoskeleton market is bifurcated into Powered Exoskeletons and Passive Exoskeletons.

By Extremity, the global medical exoskeleton market is split into Upper Extremity Medical Exoskeletons, Lower Extremity Medical Exoskeletons, Full Body.

In terms of Mobility, the global medical exoskeleton market is categorized into Mobile Exoskeletons and Stationary Exoskeletons.

By Structure, the global Medical Exoskeleton market is divided into Rigid Exoskeletons and Soft Exoskeleton.

Medical Exoskeleton Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Exoskeleton Market |

| Market Size in 2024 | USD 1.09 Billion |

| Market Forecast in 2034 | USD 7.15 Billion |

| Growth Rate | CAGR of 20.7% |

| Number of Pages | 199 |

| Key Companies Covered | Ekso Bionics (US), ReWalk (Israel), Parker Hannifin (US), Cyberdyne (Japan) and Bionik (Canada), Rex Bionics (UK), B-TEMIA Inc. (Canada), Bioventus (North Carolina), Hocoma AG (a subsidiary of DIH Technologies) (Switzerland), Wearable Robotics SRL (Italy), Gogoa Mobility Robots SL (Spain), ExoAtlet (Luxembourg), Meditouch (Israel), Suit X (US), P&S Mechanics (South Korea), Marsi Bionics (Spain), Rehab Robotics (Hong Kong), Myomo (US), Focal Meditech (Netherlands), Honda Motors (Japan), Watercraft (France), BAMA Teknoloji (Turkey), Medeco Robotics (Hong Kong), Fourier Intelligence (China), TWICE (Switzerland),, and others. |

| Segments Covered | By Component, By Type, By Extremity, By Mobility, By Structure, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- March 2021 - HAL Single Joint Type got medical device certification from the Thai Food and Medical Products Approval Authority (Thai FDA). Patients with limited mobility in their upper and lower limbs due to muscle weakness or paralysis should use this product.

- June 2020 - The US Food and Drug Administration (FDA) granted Ekso Bionics 501(k) authorization to market their EksoNR robotic exoskeleton for patients with acquired brain damage (ABI).

Medical Exoskeleton Market: Regional Landscape

With a market share of 44.4 percent in 2020, North America is predicted to dominate the industry. The rising senior population, rising demand for self-assist exoskeletons, the high frequency of stroke, and the rising number of spinal cord injuries (SCI) are all pushing the medical exoskeleton market in this region. Due to an increase in the manufacturing of medical exoskeletons for the defense sector, Asia-Pacific is expected to have a high CAGR in the global market. Furthermore, China, Japan, and South Korea are predicted to be the key revenue-generating economies in the emerging world.

Medical Exoskeleton Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the medical exoskeleton market on a global and regional basis.

The global medical exoskeleton market is dominated by players like:

- Ekso Bionics (US)

- ReWalk (Israel)

- Parker Hannifin (US)

- Cyberdyne (Japan) and Bionik (Canada)

- Rex Bionics (UK)

- B-TEMIA Inc. (Canada)

- Bioventus (North Carolina)

- Hocoma AG (a subsidiary of DIH Technologies) (Switzerland)

- Wearable Robotics SRL (Italy)

- Gogoa Mobility Robots SL (Spain)

- ExoAtlet (Luxembourg)

- Meditouch (Israel)

- Suit X (US)

- P&S Mechanics (South Korea)

- Marsi Bionics (Spain)

- Rehab Robotics (Hong Kong)

- Myomo (US)

- Focal Meditech (Netherlands)

- Honda Motors (Japan)

- Watercraft (France)

- BAMA Teknoloji (Turkey)

- Medeco Robotics (Hong Kong)

- Fourier Intelligence (China)

- TWICE (Switzerland)

The global medical exoskeleton market is segmented as follows;

By Component

- Hardware

- Software

By Type

- Powered Exoskeletons

- Passive Exoskeletons

By Extremity

- Upper Extremity Medical Exoskeletons

- Lower Extremity Medical Exoskeletons

- Full Body

By Mobility

- Mobile Exoskeletons

- Stationary Exoskeletons

By Structure

- Rigid Exoskeletons

- Soft Exoskeleton

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global medical exoskeleton market is expected to grow due to increasing prevalence of neurological disorders, the rising geriatric population, and technological advancements that enhance mobility and rehabilitation options.

According to a study, the global medical exoskeleton market size was worth around USD 1.09 Billion in 2024 and is expected to reach USD 7.15 Billion by 2034.

The global medical exoskeleton market is expected to grow at a CAGR of 20.7% during the forecast period.

North America is expected to dominate the medical exoskeleton market over the forecast period.

Leading players in the global medical exoskeleton market include Ekso Bionics (US), ReWalk (Israel), Parker Hannifin (US), Cyberdyne (Japan) and Bionik (Canada), Rex Bionics (UK), B-TEMIA Inc. (Canada), Bioventus (North Carolina), Hocoma AG (a subsidiary of DIH Technologies) (Switzerland), Wearable Robotics SRL (Italy), Gogoa Mobility Robots SL (Spain), ExoAtlet (Luxembourg), Meditouch (Israel), Suit X (US), P&S Mechanics (South Korea), Marsi Bionics (Spain), Rehab Robotics (Hong Kong), Myomo (US), Focal Meditech (Netherlands), Honda Motors (Japan), Watercraft (France), BAMA Teknoloji (Turkey), Medeco Robotics (Hong Kong), Fourier Intelligence (China), TWICE (Switzerland),, among others.

The report explores crucial aspects of the medical exoskeleton market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed