Metal Strips Market Size, Share, Analysis, Trends, Growth, 2032

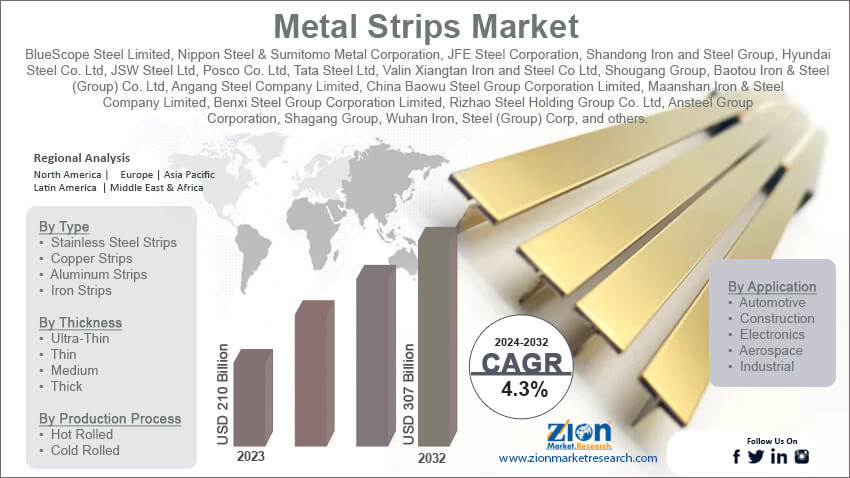

Metal Strips Market By Type (Stainless Steel Strips, Copper Strips, Aluminum Strips, Iron Strips, and Others), By Thickness (Ultra-Thin, Thin, Medium, and Thick), By Production Process (Hot Rolled, Cold Rolled and Others), By Application (Automotive, Construction, Electronics, Aerospace, Industrial, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

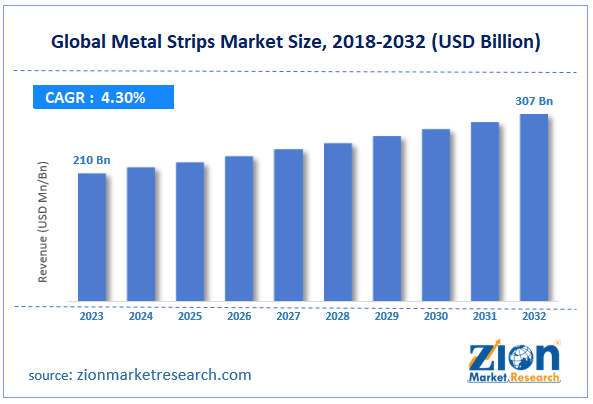

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 210 Billion | USD 307 Billion | 4.3% | 2023 |

Metal Strips Industry Prospective:

The global metal strips market size was worth around USD 210 billion in 2023 and is predicted to grow to around USD 307 billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.3% between 2024 and 2032.

Metal Strips Market: Overview

Rolling is a widely used technique to create metal strips, which are thin, flat sections of metal. They are manufactured from different kinds of materials like brass, copper, stainless steel, and aluminum.

Each of them has different properties. The material is first hot rolled to a minimum thickness of 2 millimeters, and then it is cold rolled to the exact thickness that is required.

Due to their extensive use in cold forming techniques such as deep drawing, stretch forming, and bending, low-carbon strip steels go through a final recrystallization anneal.

Metal strips have been used more and more in industries, including consumer goods, construction, electronics, and automotive, which has increased demand and helped the metal strips market expand globally.

Key Insights

- As per the analysis shared by our research analyst, the global metal strips market is estimated to grow annually at a CAGR of around 4.3% over the forecast period (2024-2032).

- In terms of revenue, the global metal strips market size was valued at around USD 210 billion in 2023 and is projected to reach USD 307 billion by 2032.

- The increasing construction industry is expected to drive the metal strips industry over the forecast period.

- Based on type, the stainless steel strips segment is expected to capture the largest market share over the projected period.

- Based on application, the automotive segment is expected to grow at the highest CAGR during the forecast period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Metal Strips Market: Growth Drivers

Construction and infrastructure growth drives market growth

Since metal strips are crucial parts of many construction applications, the metal strips market gains a lot from the expansion of the infrastructure and construction industries. Metal strips are frequently used for structural supports, roofing, cladding, and concrete reinforcement.

The need for reliable and flexible metal strips has increased significantly as more buildings, bridges, and other infrastructure projects are underway, especially in emerging nations. Furthermore, the growing popularity of sustainable building techniques is increasing demand for easily recyclable and reusable eco-friendly metals like copper and aluminum.

These materials are frequently cut into strips and utilized in sustainable cladding, energy-efficient windows, and doors. For instance, according to the Press Information Bureau, over the past ten years, India's national highways have advanced remarkably, with a notable rise in funding and development speed.

The funding for highway and road transportation has increased by 500% since 2014, which has significantly improved infrastructure construction. The record for the fastest highway construction in India was set in 2020–21, when the construction speed hit an astounding 37 km/day.

Metal Strips Market: Restraints

Fluctuation in the raw material price hinders market growth

Fluctuation in the raw material prices acted as a major restraint for the expansion of the metal strips industry. Changes in mining output, trade taxes, and movements in global demand all affect the price of important metals used in metal strips, such as copper, aluminum, and steel.

Unexpected price increases can squeeze profit margins because they raise production expenses, which producers may not always be able to pass on to consumers. For instance, trading on a contract for difference (CFD) that tracks the benchmark market for aluminum shows that the metal has risen 264.50 USD/ton, or 11.09%, since the start of 2024.

Metal Strips Market: Opportunities

The growing product launch offers a lucrative opportunity for market growth

The increasing product launch is expected to offer a potential opportunity for the metal strips market. For instance, in May 2021, a new product from ArcelorMittal Europe—Flat Products—is intended for use in harsh environments.

The newest pre-painted steel in ArcelorMittal's organic coated Granite® line is Granite® HDXtreme. It has a coating technique that offers excellent corrosion and UV protection.

The steel's performance is guaranteed for up to 40 years and is intended for use on the roofs and façades of structures close to the sea. Granite® HDXtreme is completely recyclable, free of chromates and heavy metals, and has a reduced carbon impact than other materials like aluminum.

Customers who order Granite® HDXtreme can also report a comparable decrease in their Scope 3 emissions by purchasing XCarb® green steel certificates in addition to their physical steel order.

Metal Strips Market: Challenges

Competition from alternative materials poses a major challenge to market expansion

Alternative materials, including composites, plastics, and sophisticated polymers, are becoming more and more popular in industries that prioritize lightweight and affordable solutions, posing a threat to the metal strips market. Fuel economy and emission reduction are major priorities in the automotive and aerospace sectors.

Compared to metals, materials like high-strength polymers and carbon fiber composites have comparable strength at a much reduced weight.The need for metal strips has decreased as a result of this change, especially for parts where weight reduction is crucial.

Furthermore, even without specific coatings, some cutting-edge polymers and composites provide superior resistance to corrosion and environmental stress compared to metals.

Because of this, they are a better option for outdoor applications or chemically exposed settings, while metal strips could need extra treatments to remain effective. Thus hampering the expansion of the market.

Metal Strips Market: Segmentation

The global metal strips industry is segmented based on type, thickness, production process, application, and region.

Based on the type, the global metal strips market is segmented into stainless steel strips, copper strips, aluminum strips, iron strips, and others.

The stainless steel strips segment is expected to capture the largest market share over the projected period, owing to the increasing demand from the automotive sector.

Stainless steel strips are used in vehicle manufacture for parts like fuel tanks, exhaust systems, and cosmetic trims that require a high level of resistance to heat, corrosion, and mechanical stress.

Because of its strength and conductive qualities, stainless steel is preferred for battery enclosures, wiring components, and other vital parts in electric vehicles (EVs), which helps boost revenue growth.

Based on the thickness, the global metal strips industry is bifurcated into ultra-thin, thin, medium, and thick.

Based on the production process, the global metal strips market is bifurcated into hot rolled, cold rolled, and others.

Based on the application, the global metal strips industry is bifurcated into automotive, construction, electronics, aerospace, industrial, and others.

The automotive segment is expected to grow at the highest CAGR during the forecast period. The market expansion is attributed to the growing automotive sector.

Metal Strips Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Metal Strips Market |

| Market Size in 2023 | USD 210 Billion |

| Market Forecast in 2032 | USD 307 Billion |

| Growth Rate | CAGR of 4.3% |

| Number of Pages | 228 |

| Key Companies Covered | BlueScope Steel Limited, Nippon Steel & Sumitomo Metal Corporation, JFE Steel Corporation, Shandong Iron and Steel Group, Hyundai Steel Co. Ltd, JSW Steel Ltd, Posco Co. Ltd, Tata Steel Ltd, Valin Xiangtan Iron and Steel Co Ltd, Shougang Group, Baotou Iron & Steel (Group) Co. Ltd, Angang Steel Company Limited, China Baowu Steel Group Corporation Limited, Maanshan Iron & Steel Company Limited, Benxi Steel Group Corporation Limited, Rizhao Steel Holding Group Co. Ltd, Ansteel Group Corporation, Shagang Group, Wuhan Iron, Steel (Group) Corp, and others. |

| Segments Covered | By Type, By Thickness, By Production Process, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Metal Strips Market: Regional Analysis

Asia Pacific dominates the market over the projected period

The Asia Pacific is expected to lead the global metal strip market growth. The rapid rate of urbanization taking place throughout the Asia Pacific region's diversified geography is closely related to the rise in demand for building materials, especially metal strips.

The necessity for strong infrastructure and modern structures is evident as urban areas grow and residents congregate in urban regions, which fuels the demand for building materials like metal strips.

However, Europe is expected to hold a significant metal strip industry share over the forecast period. Across European nations, large investments in wind and solar energy infrastructure are driving the regional industry.

The essential function of metal strips as the cornerstone of renewable energy systems demonstrates the region's unwavering dedication to sustainable energy.

Furthermore, Germany holds the highest market share in the metal strips industry, while the UK is the European market with the highest rate of growth.

Metal Strips Market: Competitive Analysis

The global metal strips market is dominated by players like:

- BlueScope Steel Limited

- Nippon Steel & Sumitomo Metal Corporation

- JFE Steel Corporation

- Shandong Iron and Steel Group

- Hyundai Steel Co. Ltd

- JSW Steel Ltd

- Posco Co. Ltd

- Tata Steel Ltd

- Valin Xiangtan Iron and Steel Co Ltd

- Shougang Group

- Baotou Iron & Steel (Group) Co. Ltd

- Angang Steel Company Limited

- China Baowu Steel Group Corporation Limited

- Maanshan Iron & Steel Company Limited

- Benxi Steel Group Corporation Limited

- Rizhao Steel Holding Group Co. Ltd

- Ansteel Group Corporation

- Shagang Group

- Wuhan Iron

- Steel (Group) Corp

The global metal strips market is segmented as follows:

By Type

- Stainless Steel Strips

- Copper Strips

- Aluminum Strips

- Iron Strips

- Others

By Thickness

- Ultra-Thin

- Thin

- Medium

- Thick

By Production Process

- Hot Rolled

- Cold Rolled

- Others

By Application

- Automotive

- Construction

- Electronics

- Aerospace

- Industrial

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Rolling is a widely used technique which is used to create metal strips, which are thin, flat sections of metal. They are manufactured from different kinds of materials like brass, copper, stainless steel, and aluminum. Each of them has different properties. The material is first hot rolled to a minimum thickness of 2 millimeters, and then it is cold rolled to the exact thickness that is required. Due to their extensive use in cold forming techniques such as deep drawing, stretch forming, and bending, low-carbon strip steels go through a final recrystallization anneal. Metal strips have been used more and more in industries including consumer goods, construction, electronics, and automotive, which has increased demand and helped the metal strips market expand globally.

The metal strips market growth is driven by several factors, including increasing construction and infrastructure growth, rising innovative product launches, technological advancements, increasing automotive sector, and others.

According to the report, the global metal strips market size was worth around USD 210 billion in 2023 and is predicted to grow to around USD 307 billion by 2032.

The global metal strips market is expected to grow at a CAGR of 4.3% during the forecast period.

The global metal strips market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market due to the increasing automotive sector.

The global metal strips market is dominated by players like BlueScope Steel Limited, Nippon Steel & Sumitomo Metal Corporation, JFE Steel Corporation, Shandong Iron and Steel Group, Hyundai Steel Co. Ltd, JSW Steel Ltd, Posco Co. Ltd, Tata Steel Ltd, Valin Xiangtan Iron and Steel Co Ltd, Shougang Group, Baotou Iron & Steel (Group) Co. Ltd, Angang Steel Company Limited, China Baowu Steel Group Corporation Limited, Maanshan Iron & Steel Company Limited, Benxi Steel Group Corporation Limited, Rizhao Steel Holding Group Co. Ltd, Ansteel Group Corporation, Shagang Group and Wuhan Iron and Steel (Group) Corp. among others.

The metal strips market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed