Microchip Market Size, Share, Industry Analysis, Trends, Growth, Forecasts 2030

Microchip Market By Application (Automotive, Consumer Electronics, Aerospace & Defense, Medical Equipment, and Others), By Type (Memory Microchips and Logic Microchips), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

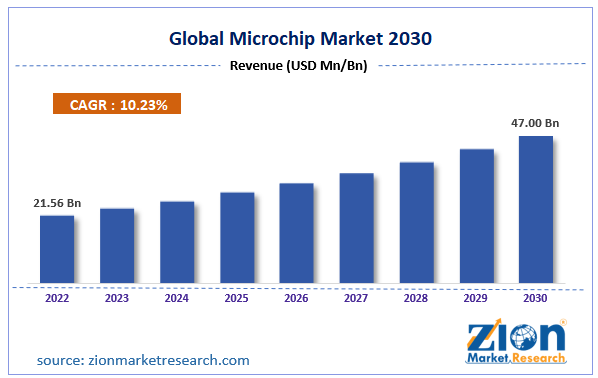

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 21.56 Billion | USD 47.00 Billion | 10.23% | 2022 |

Microchip Industry Prospective:

The global microchip market size was worth around USD 21.56 billion in 2022 and is predicted to grow to around USD 47.00 billion by 2030 with a compound annual growth rate (CAGR) of roughly 10.23% between 2023 and 2030.

Microchip Market: Overview

A microchip, also known as an integrated circuit (IC), is used to facilitate the flow of electric signals in modern electronic products. IC is a crucial part of integrated circuitry. It is manufactured using a semiconductor which in most cases is silicone but in certain cases, germanium may be used. A microchip is equipped with critical electronic components including resistors and transistors that are connected to each other using intricate connections and the microchip supports the flow of electricity between these components.

Elements or a microchip are measured in nanometers (nm) but some components are known to be less than 10 nm in size. Hence a chip can sometimes be etched with billions of components. One of the key raw materials that currently forms the basis of the microchip industry is the availability of silicone. Since the material is found in abundant quantities and does not cost as high as other alternatives. Over the years of silicon’s extensive application, it has been found to perform exceptionally well across end-user applications. The other 4 main components of a microchip are diodes, capacitors, resistors, and transistors with each component responsible for performing a certain function.

Key Insights:

- As per the analysis shared by our research analyst, the global microchip market is estimated to grow annually at a CAGR of around 10.23% over the forecast period (2023-2030)

- In terms of revenue, the global microchip market size was valued at around USD 21.56 billion in 2022 and is projected to reach USD 47.00 billion, by 2030.

- The microchip market is projected to grow at a significant rate due to the increasing government-backed investments in the chip industry

- Based on application segmentation, consumer electronics was predicted to show maximum market share in the year 2022

- Based on type segmentation, memory microchips was the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Microchip Market: Growth Drivers

Increasing government-backed investments in the chip industry to propel market growth

The global microchip market is projected to grow driven by the increasing investments in the overall chip industry on a global scale. These large-scale investments are mostly backed by regional governments that are trying to put their respective companies on the global map as essential suppliers of modern and complex microchips. In September 2023, China announced that it aims to raise USD 40 billion through its recent state-backed investment fund. The amount raised will be used to promote the country’s semiconductor sector which is eyeing to beat all of its competitors in the global semiconductor industry. On the other hand, in July 2023, US-based leading semiconductor giant Microchip Technology announced that it would invest USD 300 million in the Indian market to expand its operational base in the emerging economy. Similar moves were observed from other leading semiconductor companies such as Applied Materials, Micron, and Lam Research.

Growing application of advanced microchips in the aerospace and defense sectors to create more demand

Advanced microchips or ICs are the backbone of the aerospace and defense industries. The ability to miniaturize electrical and electronic components leveraging the small sizes of microchips has been important to the ways in which modern aircraft and defense technologies function. They are used in all aviation-related systems including radar technology, satellite systems, space exploration, and unmanned aerial vehicles(UAVs). In June 2023, Taiwan’s military team showcased its latest defense and armaments technology, which it developed domestically, at the Taiwan Aerospace & Defense Technology Expo (TADTE). The country’s top research unit the National Chung-Shan Institute of Science and Technology (NCSIST) displayed the ‘suicide drone’ which is similar to the AeroVironment Switchblade 300 made in the US.

Microchip Market: Restraints

Growing concerns and cases of disputes related to intellectual property (IP) rights may restrict market growth

The global microchip market growth trend is likely to be affected by the growing number of legal cases between industry players over IP rights. Many companies have claimed that the competing firms have copied their technology resulting in million-dollar legal cases being filed in courts. In November 2022, Intel, a leading tech giant was fined with a verdict of USD 949 million by a Texas federal jury. The company has to pay the amount to VLSI Technology LLC since the latter won a case against Intel for infringing computer chips that were earlier patented by VLSI.

In addition to this, since the semiconductor industry is currently the world’s most influential sector, the growing number of trade disputes between countries could further create more limitations. In 2022, China requested consultation from the World Trade Organization (WTO) in matters related to export control and other measures issued by the US with respect to the production of advanced computer microchips.

Microchip Market: Opportunities

Growing innovation and development in the microchip industry to create higher growth possibilities

The microchip industry players are expected to come across excellent growth opportunities driven by the increasing development and innovation in the field of microchip technology. For instance, in 2021, IBM announced the launch of a microchip that is based on 2 nm technology. It is smaller than the width of the human deoxyribonucleic acid (DNA). As per estimates, around 50 billion transistors can be placed on this microchip. In November 2021, China hosted the World Conference on Integrated Circuits. The conference was filled with a wide range of activities including an IC-themed expo, contests related to chip designing and testing, and other events.

Increasing collaboration between market players to facilitate expansion trend

The giants operating in the microchip business are seeking measures to expand business operations so that all the participating parties can benefit from strategic collaborations. In September 2022, Siemens Digital Industries Software announced partnering with United Microelectronics (UMC), a leading semiconductor foundry. The companies, in a joint effort, will develop and execute a revolutionary project for UMC. They will work to create a novel workflow for the planning, assembly validation, and parasitic extraction (PEX) of a new multi-chip 3D integrated circuit (IC).

Microchip Market: Challenges

Managing the environmental impact of microchip manufacturing to create challenges

Studies indicate that the semiconductor industry is responsible for almost 31% of the global greenhouse gas emissions. Several concerns have been raised by environmental agencies and regional governments over the impact of microchip manufacturing on climate change which is currently one of the leading universal issues faced by almost all countries. The global microchip market players will have to invest in developing more effective ways to reduce the impact of microchip production on the environment which can be challenging given the high dependence of the modern world on ICs.

Microchip Market: Segmentation

The global microchip market is segmented based on application, type, and region.

Based on application, the global market divisions are automotive, consumer electronics, aerospace & defense, medical equipment, and others. In 2022, the highest growth was observed in the consumer electronics segment owing to the increased sales of smartphones, laptops, tablets, television sets, and wearables. More than 1.3 billion smartphones were sold in 2022 mainly driven by the use of consumer electronics for educational purposes. Other factors such as increased disposable income, higher access to consumer electronics, and product availability across price boards may have triggered higher growth.

Based on type, the microchip industry is divided into memory microchips and logic microchips. In 2022, the highest revenue was generated by the memory microchips segment as a result of high demand and consumption in 2021. These chips are used for storing data and they only function with the aid of a constant source of power. The most common application of logic chips is a central processing unit (CPU). During the forecast period, both segments will contribute significantly since the preference for one variant over the other is completely based on a company’s requirements.

Microchip Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Microchip Market |

| Market Size in 2022 | USD 21.56 Billion |

| Market Forecast in 2030 | USD 47.00 Billion |

| Growth Rate | CAGR of 10.23% |

| Number of Pages | 222 |

| Key Companies Covered | Samsung Electronics, Intel Corporation, Advanced Micro Devices (AMD), Taiwan Semiconductor Manufacturing Company (TSMC), Micron Technology, NVIDIA Corporation, Broadcom Inc., Qualcomm Incorporated, STMicroelectronics, Texas Instruments Incorporated, NXP Semiconductors, SK Hynix, Infineon Technologies AG, Analog Devices Inc., Renesas Electronics Corporation., and others. |

| Segments Covered | By Application, By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Microchip Market: Regional Analysis

Asia-Pacific to register the highest growth during the projected timeline

The global microchip market will witness the highest growth in Asia-Pacific. The region is home to some of the largest manufacturers of microchips. This includes countries such as China, Taiwan, Japan, and South Korea. In 2022, over 50% of the global market share was led by China alone which makes it the highest-ranking chip manufacturer in Asia as well. As per the latest reports, the country continues to spend on its existing production capacity. However, in 2022, certain export bans were laid on China by the US owing to the aggressive production rate and dominance of one country in the global semiconductor market. Nonetheless, China continues to have large domestic and international demand for microchips mainly driven by the consumer electronics and automotive sectors. Japan, on the other hand, has over 100 chip-making facilities. It also has a higher presence in terms of the automotive industry in the international market further pushing its production rate for microchips. Growing innovation, increasing end-user consumption, and higher partnerships between trading economies in Asia are likely to boost regional market growth.

Microchip Market: Competitive Analysis

The global microchip market is led by players like:

- Samsung Electronics

- Intel Corporation

- Advanced Micro Devices (AMD)

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Micron Technology

- NVIDIA Corporation

- Broadcom Inc.

- Qualcomm Incorporated

- STMicroelectronics

- Texas Instruments Incorporated

- NXP Semiconductors

- SK Hynix

- Infineon Technologies AG

- Analog Devices Inc.

- Renesas Electronics Corporation.

The global microchip market is segmented as follows:

By Application

- Automotive

- Consumer Electronics

- Aerospace & Defense

- Medical Equipment

- Others

By Type

- Memory Microchips

- Logic Microchips

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A microchip, also known as an integrated circuit (IC), is used to facilitate the flow of electric signals in modern electronic products.

The global microchip market is projected to grow driven by the increasing investments in the overall chip industry on a global scale.

According to study, the global microchip market size was worth around USD 21.56 billion in 2022 and is predicted to grow to around USD 47.00 billion by 2030.

The CAGR value of the microchip market is expected to be around 10.23% during 2023-2030.

The global microchip market will witness the highest growth in Asia-Pacific. The region is home to some of the largest manufacturers of microchips.

The global microchip market is led by players like Samsung Electronics, Intel Corporation, Advanced Micro Devices (AMD), Taiwan Semiconductor Manufacturing Company (TSMC), Micron Technology, NVIDIA Corporation, Broadcom Inc., Qualcomm Incorporated, STMicroelectronics, Texas Instruments Incorporated, NXP Semiconductors, SK Hynix, Infineon Technologies AG, Analog Devices, Inc., and Renesas Electronics Corporation.

The report explores crucial aspects of the microchip market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed