Military Aircrafts Market Size, Share, Industry Analysis, Trends, Growth, 2032

Military Aircrafts Market By Technology (Autonomous Systems, Stealth Capabilities, and Advanced Avionics), By Type (Unmanned Aerial Vehicles (UAVs) and Fighter Helicopters, Jets, & Transportation Planes), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

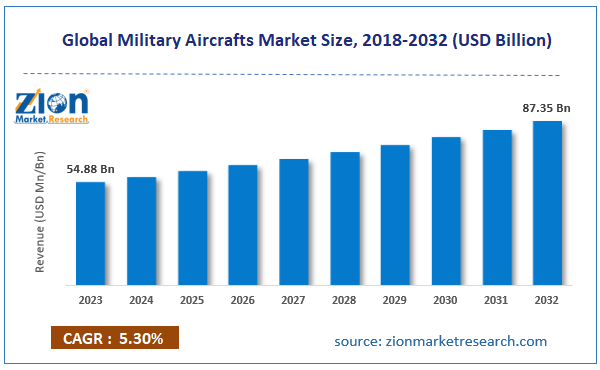

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 54.88 Billion | USD 87.35 Billion | 5.30% | 2023 |

Military Aircrafts Industry Prospective:

The global military aircrafts market size was worth around USD 54.88 billion in 2023 and is predicted to grow to around USD 87.35 billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.30% between 2024 and 2032.

Military Aircrafts Market: Overview

A military aircraft is defined as any rotary-wing or fixed-wing aircraft that is used specifically by a rebel or a legal military body. There are two main types of military aircrafts namely non-combat aircraft and combat aircraft. The former type includes aircrafts such as tankers and transports. These airplanes do not directly or actively participate in military combat events but are used mainly for transporting goods and military personnel. On the other hand, combat aircrafts include bodies such as bombers and fighters. Their main aim is to harm or destroy enemy weapons and other ammunition. These aircrafts are legally used by national defense teams. All decisions related to the production, transportation, application, and procurement related to military aircrafts are undertaken by regional official bodies. The technology used for designing military crafts is mainly a concern of intellectual property rights.

However, military aircraft technologies are constantly vulnerable to cyber attacks and other forms of compromise by unauthorized parties. These airplanes are highly advanced air-borne technologies equipped with sophisticated avionics, propulsion systems, and stealth features. Additionally, they also carry critical defense-related information in the form of communication systems and military personnel onboard. Hence, national defense authorities continue to spend on developing cutting-edge military aircrafts. The forecast period is expected to open new avenues for growth as national security concerns are on the rise.

Key Insights:

- As per the analysis shared by our research analyst, the global military aircrafts market is estimated to grow annually at a CAGR of around 5.30% over the forecast period (2024-2032)

- In terms of revenue, the global military aircrafts market size was valued at around USD 54.88 billion in 2023 and is projected to reach USD 87.35 billion, by 2032.

- The market is projected to grow at a significant rate due to the increasing global partnership between economies

- Based on the technology, the stealth capabilities segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the type, the fighter helicopters, jets, and transportation planes segment is anticipated to command the largest market share

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Military Aircrafts Market: Growth Drivers

Increasing global partnerships between economies may boost the market’s growth rate

The global military aircrafts market is expected to grow due to the increasing global partnership among economies. In recent times, there has been a significant rise in international collaborations aiming at procurement or joint innovation-related activities. In April 2024, Argentina signed a contract with Denmark. As per the partnership, Argent will receive 24 F-16 jets from the Danish Air Force and the deal is worth USD 300 million. With this move, Argentina has managed to achieve transcendental growth in its national security policies. In February 2024, Mahindra Aerospace, an Indian company belonging to the Mahindra Group, signed a Memorandum of Understanding (MoU) with Embraer Defense & Security, a provider of advanced aircrafts.

The companies will jointly work to complete the acquisition of 390 Millennium multi-mission aircraft designed for the Indian Air Force. The deal will be carried out as per the Medium Transport Aircraft (MTA) procurement project. In January 2024, in a similar partnership, the Czech Republic announced that it would be purchasing 24 F-35 fifth-generation fighters from the United States. As per the Czech Republic, this arrangement is regarded as the most crucial project in the overall history of the Czech Republic Armed Forces. In December 2022, Germany announced a new deal with the US for the procurement of 35 F-35 fighter jets. The project is worth USD 8.4 billion. International partnerships for military aircraft procurement or innovation are likely to promote higher revenue in the industry.

Rising military spending globally may prompt higher revenue in the market

Military spending globally is increasing at a rapid rate. The growth trends in military expenditure are influenced by several domestically originating or cross-border factors. For instance, in February 2024, the Indian government announced the new military budget for the financial year 2024-2025. The country has allocated INR 6.2 lakh crore for modernizing the regional military. In April 2024, official reports indicated that the global military budget has reached a record high of over USD 2439 billion in 2023 with China and the US labeled as the two largest military spenders globally. The global military aircrafts market will benefit from such investments.

Military Aircrafts Market: Restraints

Exorbitant prices of military aircrafts including development or procurement may restrict the market growth rate

The global industry for military aircrafts is expected to be restricted due to the high prices associated with the development or procurement of aviation solutions used by military segments. Highly advanced technologies are used for developing high-performance military aircraft. They are produced in limited numbers, unlike commercial aircrafts. Moreover, the research and overall development of military aircrafts include resource-intensive procedures and take years for production. While the exact price of military aircrafts is difficult to determine, several reports indicate a range in which the cost of military aircrafts can fall. For instance, Rafael fighter jets can cost between USD 100 to USD 120 per unit as per official data.

Military Aircrafts Market: Opportunities

Increasing security concerns and geopolitical tensions globally may help the industry thrive during the forecast period

The global military aircrafts market is projected to generate growth opportunities due to the increasing security concerns across the globe. In the last 3 years, the world has witnessed the commencement of two military wars that have led to significant losses including human fatalities and economic setbacks. For instance, the Russia-Ukraine war began in 2014 but the events escalated in 2022 when Russia invaded Ukraine. Several fatalities have been reported from both sides and these events further led to changes in global relationships as other economies chose to side with one country over the other while some refrained from taking sides. As per the Russian Ministry of Defense, around 6000 soldiers have been killed in combat as of 2022. Similar statistics have been reported by Ukraine. The Israel-Hamas war is more recent and has led to the destruction of several habitats across both countries. While these two wars are more discussed, other countries are facing similar issues domestically caused by radical groups and separatists. These events have led to an increased need for upgrading military systems and technologies deployed for national security. Military aircrafts including combat and non-combat versions are key assets owned by regional defense teams leading to greater investments.

Increasing the use of military aircrafts for managing the impact of natural disasters could be beneficial for the industry

Military aircrafts are regularly used for non-combat-related activities, especially during events of natural calamities such as meteorological or geological disasters. Regional governments are investing in military aircrafts equipped to handle medical crises. These aircrafts are known as medicalized versions and may deliver excellent growth opportunities for the players in the global military aircrafts market.

Military Aircrafts Market: Challenges

Stringent export regulations for military aircrafts may challenge the market expansion rate

The global military aircrafts industry is likely to be challenged due to the presence of stringent regulatory concerns associated with the export of warplanes. These aircrafts are equipped with highly advanced technologies and governments want to ensure retain the intellectual property rights of the aircrafts. Moreover, the industry is regulated to reduce or eliminate the risk of potential regional tensions that may further escalate due to military aircraft-related partnerships.

Military Aircrafts Market: Segmentation

The global military aircrafts market is segmented based on technology, type, and region.

Based on the technology, the global market segments are autonomous systems, stealth capabilities, and advanced avionics. In 2023, the highest growth was observed in the stealth capabilities segment. These technologies help in reducing the risk of aircraft detection and hence more countries are investing in developing military versions that will not be easily detected by enemy radar or detection systems. The cost of one F-35 fighter jet is around USD 100,00The autonomous systems segment is projected to register a significant growth rate in the coming years.

Based on the type, the global market divisions are unmanned aerial vehicles (UAVs) and fighter helicopters, jets, and transportation planes. The highest growth in 2023 was registered in the latter type. Fighter helicopters, jets, and transportation planes are some of the most commonly used aircraft types in combat and non-combat activities. The increasing rate of international partnerships for the procurement of fighter helicopters, jets, and transportation planes will help the segmental growth rate. China controls more than 2500 combat aircrafts as per the latest reports.

Military Aircrafts Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Military Aircrafts Market |

| Market Size in 2023 | USD 54.88 Billion |

| Market Forecast in 2032 | USD 87.35 Billion |

| Growth Rate | CAGR of 5.30% |

| Number of Pages | 218 |

| Key Companies Covered | HAL (Hindustan Aeronautics Limited), Airbus Defense and Space, Sukhoi Company (JSC), General Dynamics Corporation, Leonardo S.p.A., Chengdu Aircraft Industry Group, Boeing Defense, Space & Security, Dassault Aviation SA, Mitsubishi Heavy Industries Ltd., Lockheed Martin Corporation, Embraer Defense & Security, Raytheon Technologies Corporation, Northrop Grumman Corporation, Saab AB, BAE Systems plc., and others. |

| Segments Covered | By Technology, By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Military Aircrafts Market: Regional Analysis

Asia-Pacific to emerge as a winner by the end of the projection period

The global military aircrafts market is led by Asia-Pacific and will continue the same trend during the forecast period. Growth in Asia-Pacific is driven by countries such as India and China. The latter is the world’s second-largest military spender in the world. China has witnessed a steady rise in military spending over the years. The country has been investing in research & development (R&D) of modern military aircrafts. In May 2024, the third largest aircraft carrier owned by China headed to the sea for the first time. As per reports, the Type 003 carrier is the second of its type equipped with an electromagnetic aircraft launch system (EMALS). In January 2024, the country unveiled the look of its next-generation aircraft carrier. In January 2024, reports emerged suggesting that Pakistan was planning to buy FC-31 stealth fighter jets made by China. India, on the other hand, with its 2024-2025 military modernization budget, became the fourth largest spender on military expenses. In March 2024, India’s Cabinet Committee on Security (CCS) approved a project worth INR 15000 crore for the development of Advanced Medium Combat Aircraft (AMCA). It will be the country’s fifth-generation fighter multirole fighter jet.

Military Aircrafts Market: Competitive Analysis

The global military aircrafts market is led by players like:

- HAL (Hindustan Aeronautics Limited)

- Airbus Defense and Space

- Sukhoi Company (JSC)

- General Dynamics Corporation

- Leonardo S.p.A.

- Chengdu Aircraft Industry Group

- Boeing Defense

- Space & Security

- Dassault Aviation SA

- Mitsubishi Heavy Industries Ltd.

- Lockheed Martin Corporation

- Embraer Defense & Security

- Raytheon Technologies Corporation

- Northrop Grumman Corporation

- Saab AB

- BAE Systems plc.

The global military aircrafts market is segmented as follows:

By Technology

- Autonomous Systems

- Stealth Capabilities

- Advanced Avionics

By Type

- Unmanned Aerial Vehicles (UAVs)

- Fighter Helicopters

- Jets

- Transportation Planes

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A military aircraft is defined as any rotary-wing or fixed-wing aircraft that is used specifically by a rebel or a legal military body.

The global military aircrafts market is expected to grow due to the increasing global partnership among economies.

According to study, the global military aircrafts market size was worth around USD 54.88 billion in 2023 and is predicted to grow to around USD 87.35 billion by 2032.

The CAGR value of military aircrafts market is expected to be around 5.30% during 2024-2032.

The global military aircrafts market is led by Asia-Pacific and will continue the same trend during the forecast period.

The global military aircrafts market is led by players like HAL (Hindustan Aeronautics Limited), Airbus Defense and Space, Sukhoi Company (JSC), General Dynamics Corporation, Leonardo S.p.A., Chengdu Aircraft Industry Group, Boeing Defense, Space & Security, Dassault Aviation SA, Mitsubishi Heavy Industries, Ltd., Lockheed Martin Corporation, Embraer Defense & Security, Raytheon Technologies Corporation, Northrop Grumman Corporation, Saab AB and BAE Systems plc.

The report explores crucial aspects of the military aircrafts market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed