Military Fitness Training Equipment Market Size, Share, Trends, Growth 2034

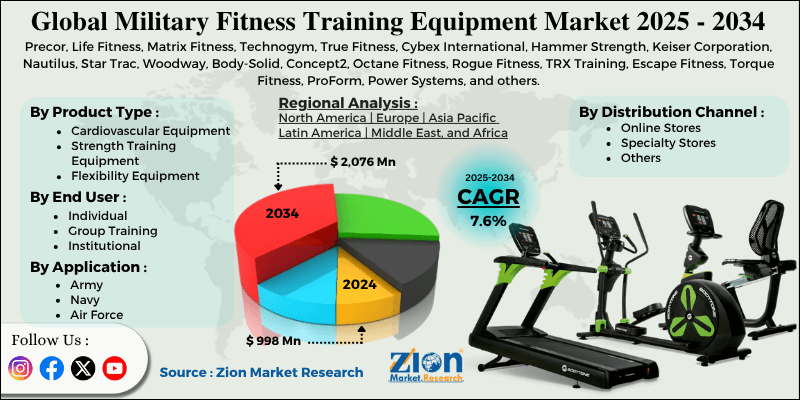

Military Fitness Training Equipment Market By Product Type (Cardiovascular Equipment, Strength Training Equipment, Flexibility Equipment, and Others), By Application (Army, Navy, Air Force, and Others), By Distribution Channel (Online Stores, Specialty Stores, and Others), By End-User (Individual, Group Training, and Institutional), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

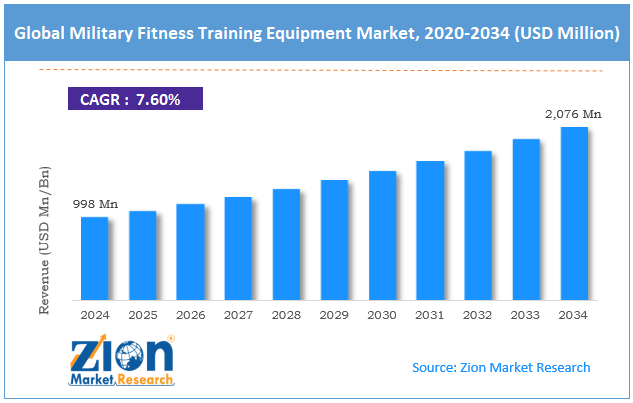

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 998 Million | USD 2076 Million | 7.60% | 2024 |

Military Fitness Training Equipment Industry Perspective:

The global military fitness training equipment market size was worth around USD 998 million in 2024 and is predicted to grow to around USD 2076 million by 2034, with a compound annual growth rate (CAGR) of roughly 7.6% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global military fitness training equipment market is estimated to grow annually at a CAGR of around 7.6% over the forecast period (2025-2034).

- In terms of revenue, the global military fitness training equipment market size was valued at around USD 998 million in 2024 and is projected to reach USD 2076 million by 2034.

- The increasing military expenditure is expected to drive the military fitness training equipment market over the forecast period.

- Based on the product type, the strength training equipment segment is expected to capture the largest market share over the projected period.

- Based on the application, the army segment holds the major market share.

- Based on the distribution channel, the specialty stores segment holds the largest market share over the projected period.

- Based on the end-user, the group training is expected to hold the prominent market share during the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Military Fitness Training Equipment Market: Overview

Military fitness training equipment is a tool, instrument, and device that simulates the physical demands and movements associated with military service. It focuses on outdoor training, functional strength, and endurance. This equipment prepares people for unexpected, real-life circumstances by requiring them to perform tasks such as carrying heavy weights, navigating obstacles, and working in various settings. The purpose of this equipment is to prepare soldiers for the physical demands of their profession, which sometimes include dealing with unexpected situations and require them to be strong, adaptable, and have a high level of stamina to handle their duties and issues in the field.

Several factors, including the increasing emphasis on military readiness & physical fitness, rising defense & military modernization budgets, technological advancements and innovation, a focus on holistic wellness, injury prevention & well-being, among others, drive the military fitness training equipment market. However, the high cost of technology & maintenance is expected to hamper the military fitness training equipment industry.

Military Fitness Training Equipment Market Dynamics

Growth Drivers

How does the increasing emphasis on military readiness & physical fitness drive the military fitness training equipment market growth?

The military fitness training equipment market is expanding as a growing number of individuals focus on preparing for military service and maintaining their physical fitness. This is because armed forces worldwide are striving to prepare their personnel for operating environments that are constantly evolving and physically demanding. Today, military groups recognize that being in the best physical shape possible enables missions to proceed more smoothly, reduces the risk of harm, and ensures that missions are completed on schedule.

Fitness is an essential part of being prepared for modern military conflicts, as soldiers often must perform demanding tasks at high levels of intensity. The US Department of Defense spends billions of dollars annually on fitness programs and equipment, underscoring the importance of this subject. There is a growing need for advanced, specialized training equipment to support comprehensive fitness tests and new, mission-specific training programs, such as the Army Combat Fitness Test.

Restraints

Why does the high cost of technology & maintenance hinder the military fitness training equipment market growth?

The military fitness training equipment market may not grow as quickly as it should, as the equipment is challenging to acquire and maintain for extended periods, especially in countries or organizations with limited defense expenditures. Using modern training technology, such as innovative equipment with sensors or virtual reality systems, can be expensive upfront and requires ongoing maintenance, software updates, and the hiring of experts.

Due to budget constraints, many military services can't afford the newest technology. This implies that new weapons take longer to be adopted and utilized on a smaller scale. When money is spent on fixing or maintaining expensive equipment, there is less money available to create additional gyms or acquire new equipment. Military training gear is also often used in dangerous, remote regions, which causes it to wear out and incur higher maintenance costs. Repairs may require new parts, specialized knowledge, and time-consuming processes, all of which make running the firm more expensive.

Additionally, fitness technology is evolving rapidly, which can render equipment less valid more quickly. As a result, businesses are cautious about investing a significant amount of money in technology that can quickly become outdated. This limits their purchasing options and slows down market growth.

Opportunities

How does the rising campaign by key market players offer a potential opportunity for growth in the military fitness training equipment industry?

Rising campaigns and strategic efforts by key market players create significant opportunities for expansion in the military fitness training equipment business, driving innovation, increasing awareness, and enhancing procurement among defense agencies worldwide. For instance, in October 2025, HOTWORX®, the groundbreaking 24-hour infrared training studio chain, kicked off its annual Workouts for Heroes campaign, a nationwide fundraising program that runs from October 1 to November 30. This year's efforts will benefit both the Sacred Mountain Retreat Center (SMRC), which offers healing retreats for veterans and first responders, and the National Breast Cancer Foundation's (NBCF) Military Women's Patient Relief Fund, which helps cover essential non-medical expenses for military women battling breast cancer.

Challenges

Complex procurement processes & regulatory barriers pose a major challenge to market expansion

The military fitness training equipment market isn't growing as quickly as it should, as purchasing items is challenging and regulations are strict. These factors make it more difficult to buy goods, raise prices, and create confusion, which slows down market growth and the dissemination of new ideas. When the military purchases something, it typically requires extensive paperwork, multiple levels of approval, and rigorous testing cycles to ensure that all operational and strategic needs are met. These lengthy decision-making processes can make it more challenging to purchase items, render equipment obsolete before it is utilized, and hinder the adoption of new technologies.

Additionally, unclear accountability, complex program management standards, and difficulties aligning purchases with broader strategic goals can all lead to financial losses and inefficiencies.

Military Fitness Training Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Military Fitness Training Equipment Market |

| Market Size in 2024 | USD 998 Million |

| Market Forecast in 2034 | USD 2,076 Million |

| Growth Rate | CAGR of 7.6% |

| Number of Pages | 214 |

| Key Companies Covered | Precor, Life Fitness, Matrix Fitness, Technogym, True Fitness, Cybex International, Hammer Strength, Keiser Corporation, Nautilus, Star Trac, Woodway, Body-Solid, Concept2, Octane Fitness, Rogue Fitness, TRX Training, Escape Fitness, Torque Fitness, ProForm, Power Systems, and others. |

| Segments Covered | By Product Type, By Application, By Distribution Channel, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Military Fitness Training Equipment Market: Segmentation

The global military fitness training equipment industry is segmented based on product type, application, distribution channel, end-user, and region.

Based on the product type, the global military fitness training equipment market is bifurcated into cardiovascular equipment, strength training equipment, flexibility equipment, and others. The strength training equipment segment is expected to capture the largest market share over the projected period. People really want strength training equipment, such as free weights, resistance machines, and functional rigs. This is because modern military fitness programs focus on developing core strength, endurance, and agility to meet the demanding requirements of battle and operations. Additionally, the growing awareness of the direct link between soldiers' physical strength and their readiness for missions has led to the establishment of mandated fitness standards and coordinated strength training programs across all branches of the military.

Based on the application, the global military fitness training equipment industry is bifurcated into army, navy, air force, and others. The army segment holds the major market share. Growing adoption of portable, modular training solutions allows the army to maintain fitness continuity in remote and war-zone deployments, thereby expanding equipment demand.

Based on the distribution channel, the global military fitness training equipment market is bifurcated into online stores, specialty stores, and others. The specialty stores segment is expected to hold the largest market share over the projected period. Specialty stores often have established relationships with military procurement departments, enabling them to offer customization options and maintenance services critical for equipment longevity in demanding military environments.

Based on the end-user, the global military fitness training equipment industry is bifurcated into individual, group training, and institutional. The group training is expected to hold the prominent market share during the projected period. Rising awareness of the benefits of group fitness, combined with increased modernization spending, drives revenue growth in the military fitness training equipment industry's group training segment, fueling overall market expansion.

Military Fitness Training Equipment Market: Regional Analysis

Why does North America dominate the military fitness training equipment market over the projected period?

North America is expected to dominate the global military fitness training equipment market due to increased demand from the country's military. The United States dominates North America's Military Fitness Training Equipment Market. The deployment of US soldiers in various parts of the world as a result of the US's involvement in numerous global crises is one of the key factors driving the North American region's market share increase. US Army members must undergo mandatory fitness tests. The US Army Physical Fitness Program consists of two parts: the weigh-in and the Army Physical Fitness Test (APFT). Army troops must take the APFT twice a year and meet the minimum qualifications to be considered for promotions and transfers. By 2028, the United States intends to increase both the number of military members and the service's fitness standards.

For instance, the new Army Combat Fitness Test (ACFT) became official in September 2022, after a 12-year development period. The Army Combat Fitness Test (ACFT) is a new fitness test created by the United States Army, consisting of a deadlift, standing power throw, hand-release push-up, sprint-drag-carry, leg tuck or plank, and a 2-mile run. The ACFT is designed to assess several key fitness components necessary for combat tasks. Thus, driving the market growth in the area.

Military Fitness Training Equipment Market: Competitive Analysis

The global military fitness training equipment market is dominated by players like:

- Precor

- Life Fitness

- Matrix Fitness

- Technogym

- True Fitness

- Cybex International

- Hammer Strength

- Keiser Corporation

- Nautilus

- Star Trac

- Woodway

- Body-Solid

- Concept2

- Octane Fitness

- Rogue Fitness

- TRX Training

- Escape Fitness

- Torque Fitness

- ProForm

- Power Systems

The global military fitness training equipment market is segmented as follows:

By Product Type

- Cardiovascular Equipment

- Strength Training Equipment

- Flexibility Equipment

- Others

By Application

- Army

- Navy

- Air Force

- Others

By Distribution Channel

- Online Stores

- Specialty Stores

- Others

By End User

- Individual

- Group Training

- Institutional

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Military fitness training equipment is a tool, instrument, and device that simulates the physical demands and movements associated with military service. It focuses on outdoor training, functional strength, and endurance.

Several factors, including the increasing emphasis on military readiness & physical fitness, rising defense & military modernization budgets, technological advancements and innovation, a focus on holistic wellness, injury prevention & well-being, among others, drive the military fitness training equipment market.

The high cost of technology & maintenance is expected to hamper the military fitness training equipment industry.

Based on the end-user, the group training segment is expected to dominate the military fitness training equipment market growth during the projected period.

The increasing product innovation and rising awareness regarding fitness pose a major impact factor for the military fitness training equipment industry's growth over the projected period.

According to the report, the global military fitness training equipment market size was worth around USD 998 million in 2024 and is predicted to grow to around USD 2076 million by 2034.

The global military fitness training equipment market is expected to grow at a CAGR of 7.6% during the forecast period.

The global military fitness training equipment industry growth is expected to be driven by the North American region. It is currently the world’s highest revenue-generating market due to the presence of major players and increasing expenditure on military training.

The global military fitness training equipment market is dominated by players like Precor, Life Fitness, Matrix Fitness, Technogym, True Fitness, Cybex International, Hammer Strength, Keiser Corporation, Nautilus, Star Trac, Woodway, Body-Solid, Concept2, Octane Fitness, Rogue Fitness, TRX Training, Escape Fitness, Torque Fitness, ProForm, and Power Systems, among others.

The military fitness training equipment market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed