Military Land Vehicles Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

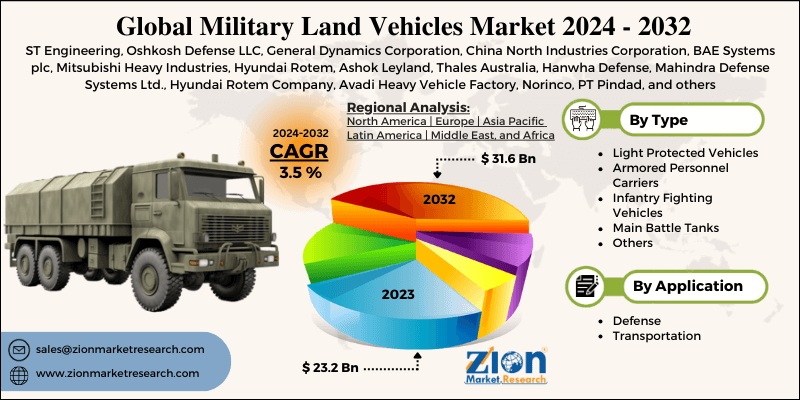

Military Land Vehicles Market By Type (Light Protected Vehicles, Armored Personnel Carriers, Infantry Fighting Vehicles, Main Battle Tanks, and Others), By Application (Defense and Transportation), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

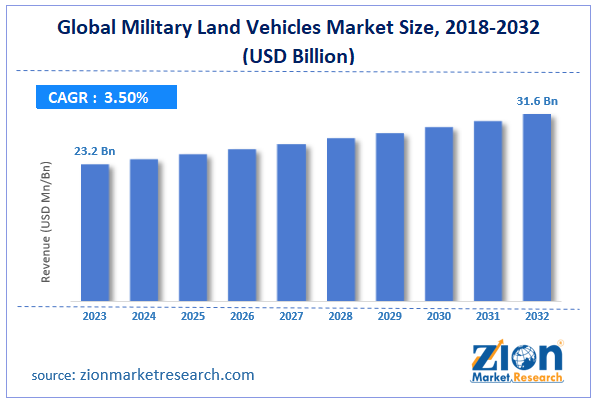

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 23.2 Billion | USD 31.6 Billion | 3.5% | 2023 |

Military Land Vehicles Industry Prospective:

The global military land vehicles market size was worth around USD 23.2 billion in 2023 and is predicted to grow to around USD 31.6 billion by 2032 with a compound annual growth rate (CAGR) of roughly 3.5% between 2024 and 2032.

Military Land Vehicles Market: Overview

Military land vehicles are specific vehicles employed by military forces for land-based missions. Their intended use spans warfare, transportation, reconnaissance, logistics, and medical assistance among other things. Often armored and furnished with cutting-edge technologies, weapons, and communication systems to improve survivability, mobility, and operational effectiveness in varied and demanding environments, these modern armed forces cannot function without military ground vehicles, which provide flexibility, protection, and strategic benefits in both defensive and offensive operations.

The military land vehicles market is driven by several variables, such as increasing defense budgets, modernization of military fleets, technological advancements, increasing collaboration among defense contractors, and others. However, the high development and acquisition costs hamper the expansion of the military land vehicles market over the analysis period.

Key Insights

- As per the analysis shared by our research analyst, the global military land vehicles market is estimated to grow annually at a CAGR of around 3.5% over the forecast period (2024-2032).

- In terms of revenue, the global military land vehicles market size was valued at around USD 23.2 billion in 2023 and is projected to reach USD 31.6 billion by 2032.

- The growing collaboration is expected to drive the military land vehicles market over the forecast period.

- Based on type, the infantry fighting vehicles segment is expected to capture the largest market share over the forecast period.

- Based on application, the defense segment is expected to dominate the market over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Military Land Vehicles Market: Growth Drivers

Rising asymmetric warfare and counterinsurgency operations drive market growth

The rising practice of irregular warfare, asymmetric warfare, and counterinsurgency operations is a crucial element driving the expansion of the military land vehicles industry. Other militant groups and non-state players sometimes employ unpredictable strategies in modern wars.

Furthermore, specialized land vehicles enable militaries to boost their mobility, safety, and adaptability qualities vital for handling the several kinds of threats outlined there. Among these are light tactical vehicles, mine-resistant ambush-protected (MRAP) vehicles, and unmanned ground vehicles (UGVs) developed for a wide spectrum of conditions and various mission profiles. This covers vehicles for direct fire in a setting of irregular warfare, troop movement, and surveillance.

Additionally, asymmetric strategies especially need vehicles that respond fast, adapt easily, and survive; the growing demand in Afghanistan and Iraq has put pressure on the Western military to raise the capacity of its ground, including their vehicles and aircraft.

Military Land Vehicles Market: Restraints

High development and acquisition cost hinders market growth

Among the major limitations in the military land vehicle market are high development and cost of acquisition. Modern military land vehicles require innovative technology, including electronic warfare systems, autonomous capabilities, artificial intelligence-powered targeting systems, and improved communication networks. Integrating these complex systems requires both testing to guarantee reliability and performance as well as extensive research and development (R&D).

Specialized components and software required to operate in combat settings drive advanced technologies such as active protection systems (APS) and networked communication capabilities, increasing the cost of production. Military land vehicles also have to be thoroughly tested to satisfy strict military and government requirements.

Among other vital performance criteria, these tests include ballistic protection, blast resistance, mobility, and other areas. Costly and time-consuming testing and certification are needed for specific facilities and staff. Vehicles have to show their performance in simulated combat environments, sometimes resulting in iterative design and testing cycles, therefore prolonging the development timeframe and increasing expenses.

Military Land Vehicles Market: Opportunities

Growing collaboration in the sector offers a lucrative opportunity for market growth

The increasing collaboration in the sector is expected to offer a lucrative opportunity for the military land vehicles industry. For instance, in December 2023, a Memorandum of Understanding (MOU) was established between Jankel, a British global leader in the design, integration, manufacturing, and maintenance of high-specification defense systems, and GM Defense LLC, a division of General Motors (GM).

The MOU creates a framework for cooperatively pursuing business prospects for government and defense clients utilizing GM Defense mobility solutions, such as the Integrated Armored Vehicle (IAV), an international version of the Heavy-Duty Sport Utility Vehicle (HD SUV). Along with support work in the UK, Europe, and other places where Jankel has a proven support capability, the partnership will also involve support work in the United States.

Military Land Vehicles Market: Challenges

Shift towards autonomous and unmanned systems poses a major challenge to market expansion

Some armed forces are reconsidering their usual investments in manned vehicles due to the increasing interest in autonomous and unmanned ground vehicles (UGVs). As the fund is diverted toward autonomous capabilities, this change may reduce the necessity for traditional manned vehicles.

The deployment of UGVs is being slowed down, and traditional vehicle sales are becoming reluctant due to the extensive testing, regulatory permissions, and resolving trust concerns associated with fully autonomous combat vehicles. Thus, the growing shift towards autonomous and unmanned systems poses a major challenge for the military land vehicles market.

Military Land Vehicles Market: Segmentation

The global military land vehicles industry is segmented based on type, application, and region.

Based on the type, the global military land vehicles market is segmented into light-protected vehicles, armored personnel carriers, infantry fighting vehicles, main battle tanks, and others. The infantry fighting vehicles segment is expected to capture the largest market share over the forecast period.

These specialized military vehicles are crucial to modern combat operations since they are made to carry men to the battlefield while offering direct fire support. With their strong weapons systems, advanced turrets with high-caliber cannons, missile systems, and remote firing stations, IFVs are adaptable and extremely effective in a variety of combat situations.

The IFV sector dominates the military land vehicle market due to several variables. Since they provide infantry forces with significant firepower and protected mobility on the battlefield, IFVs are essential to modern combat. The combat effectiveness of ground forces is significantly boosted by their capacity to engage enemy targets and securely transfer soldiers.

Based on application, the global military land vehicles industry is bifurcated into defense and transportation. The defense segment is expected to dominate the market over the projected period. The growing global defense budget is responsible for segment expansion.

To strengthen their military capabilities, several nations are raising their defense spending, with a sizable amount going toward modernizing and growing their fleets of ground vehicles. The need for new, high-performance military land vehicles is driven by rising defense spending by nations including the US, China, Russia, India, and several European countries.

For automakers, this increase in spending implies new contracts and procurement opportunities. For instance, according to the Stockholm International Peace Research Institutes, the total amount spent on the military worldwide increased 6.8% in real terms from 2022 to $2443 billion in 2023.

Military Land Vehicles Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Military Land Vehicles Market |

| Market Size in 2023 | USD 23.2 Billion |

| Market Forecast in 2032 | USD 31.6 Billion |

| Growth Rate | CAGR of 3.5% |

| Number of Pages | 222 |

| Key Companies Covered | ST Engineering, Oshkosh Defense LLC, General Dynamics Corporation, China North Industries Corporation (NORINCO), BAE Systems plc, Mitsubishi Heavy Industries (MHI), Hyundai Rotem, Ashok Leyland, Thales Australia, Hanwha Defense, Mahindra Defense Systems Ltd., Hyundai Rotem Company, Avadi Heavy Vehicle Factory (HVF), Norinco (China North Industries Corporation), PT Pindad , and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Military Land Vehicles Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the military land vehicles market during the forecast period. Market growth is fueled by well-defined defense budgets that prioritize technological innovation. As the largest and most important contributor to this category, the United States is accountable for huge resources devoted to synchronizing the advantages of both strategic and tactical capability in its modern military vehicles.

In addition, the region's strong defense industry base and extensive research & development initiatives enable the continuous introduction of new land vehicles.

The introduction of autonomous and hybrid vehicles is also fueling modernization activities in North America, allowing the area to maintain its dominant position. The region also has top defense contractors and manufacturers, which accelerates the market and results in the continuing development of high-tech military land vehicles.

Military Land Vehicles Market: Competitive Analysis

The global military land vehicles market is dominated by players like:

- ST Engineering

- Oshkosh Defense LLC

- General Dynamics Corporation

- China North Industries Corporation (NORINCO)

- BAE Systems plc

- Mitsubishi Heavy Industries (MHI)

- Hyundai Rotem

- Ashok Leyland

- Thales Australia

- Hanwha Defense

- Mahindra Defense Systems Ltd.

- Hyundai Rotem Company

- Avadi Heavy Vehicle Factory (HVF)

- Norinco (China North Industries Corporation)

- PT Pindad

The global military land vehicles market is segmented as follows:

By Type

- Light Protected Vehicles

- Armored Personnel Carriers

- Infantry Fighting Vehicles

- Main Battle Tanks

- Others

By Application

- Defense

- Transportation

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Military land vehicles are specific vehicles employed by military forces for land-based missions. Their intended use spans warfare, transportation, reconnaissance, logistics, and medical assistance among other things. Often armored and furnished with cutting-edge technologies, weapons, and communication systems to improve survivability, mobility, and operational effectiveness in varied and demanding environments, these Modern armed forces cannot function without military ground vehicles, which provide flexibility, protection, and strategic benefits in both defensive and offensive operations.

The military land vehicles market is driven by several variables, such as increasing defense budgets, modernization of military fleets, technological advancements, increasing collaboration among defense contractors and others.

According to the report, the global military land vehicles market size was worth around USD 23.2 billion in 2023 and is predicted to grow to around USD 31.6 billion by 2032.

The global military land vehicles market is expected to grow at a CAGR of 3.5% during the forecast period.

The global military land vehicles market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the growing defense budgets.

The global military land vehicles market is dominated by players like ST Engineering, Oshkosh Defense, LLC, General Dynamics Corporation, China North Industries Corporation (NORINCO), BAE Systems plc, Mitsubishi Heavy Industries (MHI), Hyundai Rotem, Ashok Leyland, Thales Australia, Hanwha Defense, Mahindra Defense Systems Ltd., Hyundai Rotem Company, Avadi Heavy Vehicle Factory (HVF), Norinco (China North Industries Corporation), and PT Pindad among others.

The military land vehicles market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed