Mine Backfill Services Market Size, Share, Analysis, Trends, Growth, 2032

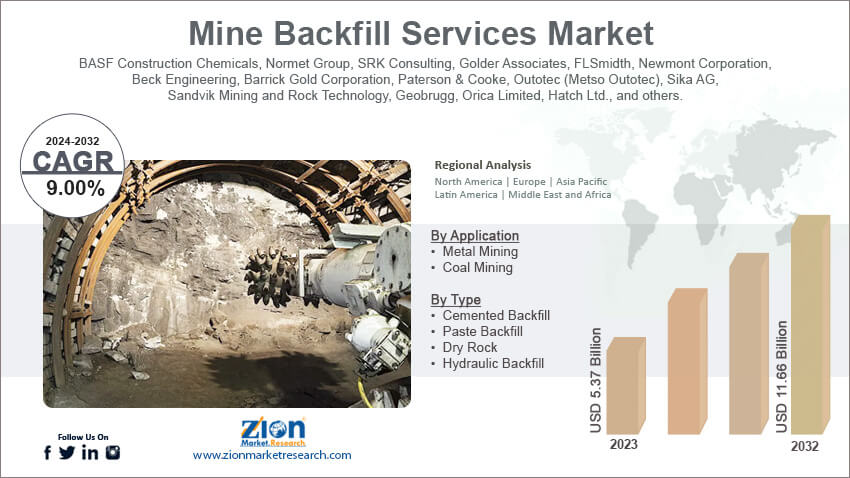

Mine Backfill Services Market By Application (Metal Mining and Coal Mining), By Type (Cemented Backfill, Paste Backfill, Dry Rock, Hydraulic Backfill), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

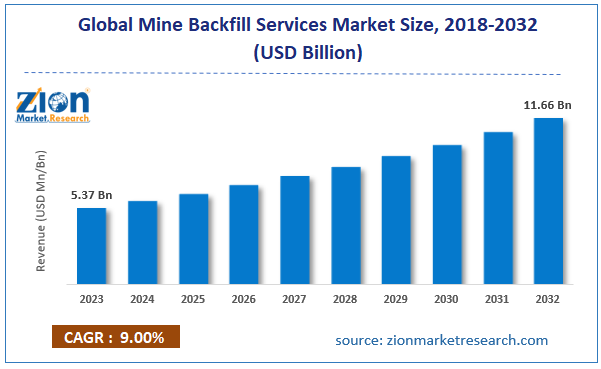

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.37 Billion | USD 11.66 Billion | 9.00% | 2023 |

Mine Backfill Services Industry Prospective:

The global mine backfill services market size was worth around USD 5.37 billion in 2023 and is predicted to grow to around USD 11.66 billion by 2032 with a compound annual growth rate (CAGR) of roughly 9.00% between 2024 and 2032.

Mine Backfill Services Market: Overview

Mine backfilling is a part of modern mining operations. It deals with filling the cavities caused by underground mining with materials. Companies may use it as a means of disposing of sludge and tailing. These materials sometimes contain hazardous components. Thus mine backfilling assists in reducing the negative impact on the surface environment. In addition to this, in the case of the use of non-hazardous material for mine backfilling, companies can improve operational efficiency thus enhancing process productivity. Some of the most common materials used during mine backfilling services include cement, fly ash, and gravel. The number of companies offering assistance in mine backfilling has increased over the years. A major reason for the higher demand for service provided during mine backfilling is the increased demand for solutions that reduce the environmental impact of mining activities. However, undertaking such services can be expensive as mine backfilling is a complex process. The surge in globalization and increased partnerships between geographically divided companies are projected to generate more growth opportunities for the mine backfill services industry during the projection period.

Key Insights:

- As per the analysis shared by our research analyst, the global mine backfill services market is estimated to grow annually at a CAGR of around 9.00% over the forecast period (2024-2032)

- In terms of revenue, the global mine backfill services market size was valued at around USD 5.37 billion in 2023 and is projected to reach USD 11.66 billion, by 2032.

- The mine backfill services market is projected to grow at a significant rate due to the increased investments in the mining sector

- Based on the application, the metal mining segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the type, the cemented backfill segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Mine Backfill Services Market: Growth Drivers

Increased investments in the mining sector will fuel the market demand rate

The global mine backfill services market is expected to grow due to the growing investments in the mining sector worldwide. The increase in consumption and application of essential metals, minerals, and energy sources is driving investments toward mining projects globally. For instance, in 2023, South Africa’s capital investment in the mining sector grew by over 133.01%. The total investment reached a 5-year high, mounting up to over USD 1985 million. In the second quarter of 2024, Zimbabwe has achieved total investments worth over USD 1.801 billion as per official records. Around USD 282.71 million are solely for mining activities. Such projects have gained higher momentum in emerging countries. Nations that are recording high infrastructure development projects are investing heavily in domestic and international mining operations to meet materials and energy demands. These large-scale mining projects can deliver successful results by enlisting the assistance of mine backfill service providers.

Surge in demand for electric vehicles to deliver higher mining needs during the projection period

The global automotive industry is undergoing revolutionary changes. The introduction of electric vehicles (EVs) across commercial and personal space is accelerating the demand for battery metals, particularly lithium-ion batteries. The urgent need to reduce dependence on non-renewable and heavily polluting energy sources such as petrol, natural gas, and diesel has propelled the need to develop and use EVs across sectors. Lithium-ion batteries run on metals such as nickel, lithium, manganese, and cobalt. Mine backfilling service providers become essential as the demand for materials required for EV production surges. Europe, for instance, registered sales of more than 3.19 million units of EVs in 2023. Factors such as the rise in government subsidies for EV users along with critical infrastructure development to support electric vehicle use have encouraged more people to opt for EVs over conventional vehicles. Recent reports indicate that China has spent more than USD 231 billion to develop the regional EV sector. Such investments can prove beneficial for the global mine backfill services market.

Mine Backfill Services Market: Restraints

High cost of services related to mine backfilling will limit the industry’s growth rate

The global mine backfilling services industry is expected to be limited due to the high cost associated with solution providers. Mine backfilling services require extensive planning and flawless execution. These services are resource-intensive since large volumes of hazardous or non-hazardous material have to be transported and filled in the mined cavities. Moreover, mine backfilling operations depend heavily on energy for running complex machines, processing plants, and other equipment. The cost may further increase in case of backfilling an underground facility thus discouraging potential service seekers from opting for the solution providers.

Mine Backfill Services Market: Opportunities

Increased accountability of mining companies in rising environmental pollution may generate extensive growth opportunities

The global mine backfill services market is anticipated to come across several new expansion possibilities during the projection period. The mining sector is one of the largest environmental polluters caused by business operations. The after-effects of mining projects are also intense on the surface ecosystem. More governments worldwide and environmental agencies are emphasizing the mining industry’s impact on degrading environmental conditions. For instance, in July 2024, India launched a draft called the Offshore Areas Mineral Conservation and Development Rules 2024. The regulations describe guidelines for ensuring sustainable and responsible mining. It covers essential aspects such as pollution control protocols, safety measures, and mineral deposit development. In February 2024, South Africa launched a novel sustainability report at the Mining Indaba conference for the mining companies in the region. In April 2024, the United Nations launched a new panel focusing on critical energy transition minerals. The panel will be responsible for managing the environmental impact of mining operations along with other similar activities. Moreover, the association will focus on a fair transition to renewable sources thus protecting the economic interest of participating communities.

Mine Backfill Services Market: Challenges

Regulatory hurdles caused when operating across international borders may challenge the market expansion rate

The global industry for mine backfill services faces challenges due to stringent regulatory hurdles. Companies operating across international borders may have to deal with dynamic and complex legal requirements including environmental regulations, workplace safety processes, permissible procedures or machinery, and others. Non-adherence to the regulations may lead to penalties including monetary faults.

Mine Backfill Services Market: Segmentation

The global mine backfill services market is segmented based on application, type, and region.

Based on the application, the global market segments are metal mining and coal mining. In 2023, the highest growth was witnessed in the metal mining segment. The growth in infrastructure development investments has fueled demand for high-grade metals and alloys. Some of the most widely used metals include aluminum, steel, copper, titanium, magnesium, iron, and zinc. In 2023, India finished steel consumption at more than 136.05 million tonnes. Similarly, other nations recorded higher production and usage rates of infrastructural metals.

Based on the type, the mine backfill services industry divisions are cemented backfill, paste backfill, dry rock, and hydraulic backfill. In 2023, cemented backfill became the highest revenue-generating segment. This process deals with the use of cement over waste and tailing. It helps fill cavities and binds the material to avoid any disruption in the future. Moreover, cement backfilling is known to be more environmentally friendly. In most cases, mine backfill cost is around 30% of the total mining expense.

Mine Backfill Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mine Backfill Services Market |

| Market Size in 2023 | USD 5.37 Billion |

| Market Forecast in 2032 | USD 11.66 Billion |

| Growth Rate | CAGR of 9.00% |

| Number of Pages | 225 |

| Key Companies Covered | BASF Construction Chemicals, Normet Group, SRK Consulting, Golder Associates, FLSmidth, Newmont Corporation, Beck Engineering, Barrick Gold Corporation, Paterson & Cooke, Outotec (Metso Outotec), Sika AG, Sandvik Mining and Rock Technology, Geobrugg, Orica Limited, Hatch Ltd., and others. |

| Segments Covered | By Application, By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mine Backfill Services Market: Regional Analysis

North America is to be led by Canada region during the projection period

The global mine backfill services market is expected to be led by North America during the forecast period. Canada is likely to drive the regional market revenue since the region hosts several companies providing global mine backfilling services. For instance, Canada is currently hosting the Giant Mine Remediation Project which was finalized in 2022. As per recent updates, it is expected to continue until 2038. The site treats more than 700,000m3 of water each season among other activities. In addition to this, Canada focuses heavily on reducing and eliminating the environmental impact of mining activities. The province of British Columbia updated its regulations on 9th May 2024. The new laws are expected to protect the environment and the people working in the mining sector. The growing investments in the US in the country’s mining sector may further fuel the regional demand.

Europe is expected to deliver exceptional results in the mine backfill services industry during the projection period. In May 2024, the Portuguese Environment Agency approved the assessment of the environmental impact of the project proposed by Savannah. The assessment also includes green steps such as landscaping and backfilling mines after the cessation of ore extraction. Europe expects to achieve carbon neutrality by 2050 which will directly impact the demand for mine backfill services in the region.

Mine Backfill Services Market: Competitive Analysis

The global mine backfill services market is led by players like:

- BASF Construction Chemicals

- Normet Group

- SRK Consulting

- Golder Associates

- FLSmidth

- Newmont Corporation

- Beck Engineering

- Barrick Gold Corporation

- Paterson & Cooke

- Outotec (Metso Outotec)

- Sika AG

- Sandvik Mining and Rock Technology

- Geobrugg

- Orica Limited

- Hatch Ltd.

The global mine backfill services market is segmented as follows:

By Application

- Metal Mining

- Coal Mining

By Type

- Cemented Backfill

- Paste Backfill

- Dry Rock

- Hydraulic Backfill

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Mine backfilling is a part of modern mining operations. It deals with filling the cavities caused by underground mining with materials.

The global mine backfill services market is expected to grow due to the growing investments in the mining sector worldwide.

According to study, the global mine backfill services market size was worth around USD 5.37 billion in 2023 and is predicted to grow to around USD 11.66 billion by 2032.

The CAGR value of the mine backfill services market is expected to be around 9.00% during 2024-2032.

The global mine backfill services market is expected to be led by North America during the forecast period.

The global mine backfill services market is led by players like BASF Construction Chemicals, Normet Group, SRK Consulting, Golder Associates, FLSmidth, Newmont Corporation, Beck Engineering, Barrick Gold Corporation, Paterson & Cooke, Outotec (Metso Outotec), Sika AG, Sandvik Mining and Rock Technology, Geobrugg, Orica Limited and Hatch Ltd.

The report explores crucial aspects of the mine backfill services market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed