Minimally Invasive Spine Surgery Devices Market Size, Share, Trends, Growth 2030

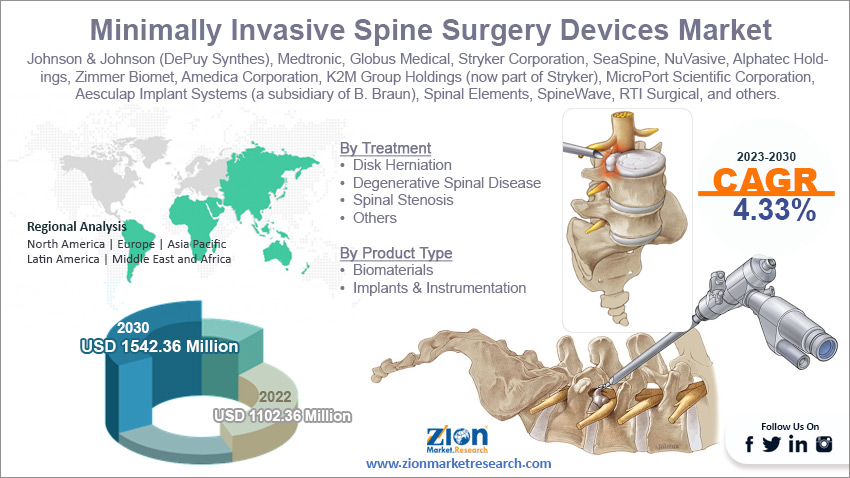

Minimally Invasive Spine Surgery Devices Market By Treatment (Disk Herniation, Degenerative Spinal Disease, Spinal Stenosis, and Others), By Product Type (Biomaterials and Implants & Instrumentation), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

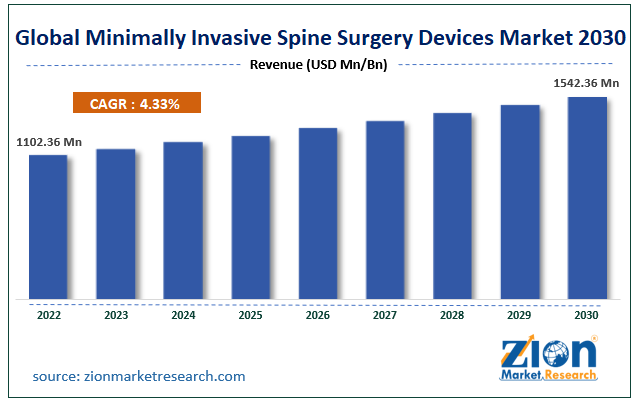

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1102.36 Million | USD 1542.36 Million | 4.33% | 2022 |

Minimally Invasive Spine Surgery Devices Industry Prospective:

The global minimally invasive spine surgery devices market size was worth around USD 1102.36 million in 2022 and is predicted to grow to around USD 1542.36 million by 2030 with a compound annual growth rate (CAGR) of roughly 4.33% between 2023 and 2030.

Minimally Invasive Spine Surgery Devices Market: Overview

Minimally invasive spine (MIS) surgery devices are medical equipment used for treating specific conditions related to the spinal cord. The main goal of MIS surgeries is to either relieve spinal nerves under pressure or vertebral bone stabilization. These conditions can be caused by other medical issues such as bone spurs, spinal instability, spinal tumors, scoliosis, or herniated disks. Medical machines used for achieving this form of treatment are called minimally invasive spine surgery devices. Open spine surgery is often associated with higher risk and patients take a longer time to recover. However, in the case of MIS surgeries, they are considered safer and can be completed in a shorter duration.

In minimally invasive spine surgeries, medical professionals do not have to conduct longer operations and hence the recovery time is also reduced. The increasing number of patients requiring MIS operations is causing higher demand for minimally invasive spine surgery devices. However, the growing cost of healthcare across the globe is expected to create barriers for players operating in the minimally invasive spine surgery devices industry. Some of the most common device technologies used during these procedures are portals, minimally invasive tubular retractors (MITR), endoscopes, laparoscopes, and fluoroscopes.

Key Insights:

- As per the analysis shared by our research analyst, the global minimally invasive spine surgery devices market is estimated to grow annually at a CAGR of around 4.33% over the forecast period (2023-2030)

- In terms of revenue, the global minimally invasive spine surgery devices market size was valued at around USD 1102.36 million in 2022 and is projected to reach USD 1542.36 million, by 2030.

- The minimally invasive spine surgery devices market is projected to grow at a significant rate due to the growing number of patients requiring MIS surgeries

- Based on treatment segmentation, disk herniation was predicted to show maximum market share in the year 2022

- Based on product type segmentation, implants & instrumentation was the leading SEGMENT 2 in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Minimally Invasive Spine Surgery Devices Market: Growth Drivers

Growing number of patients requiring MIS surgeries to drive market growth

The global minimally invasive spine surgery devices market is projected to grow owing to the increasing number of patients globally who require MIS surgeries. One of the leading reasons for growing demand is the surging number of patients with herniated disks. As per Mayo Clinic, several risk factors are involved that can lead to the onset of a herniated disk. For instance, excess body weight is a primary cause alongside other conditions such as genetics, frequent driving, sedentary lifestyle, and occupation. The increasing remote work culture has led to many employees working in desk job roles sitting in one place for long hours.

This, in turn, impacts other aspects of an individual’s lifestyle. For instance, sedentary life and excess weight are often correlated while there may be other reasons for a person gaining weight such as hormonal imbalance and frequent exposure to extreme stress. As per official research, a herniated disk is an extremely common medical condition and almost 80% of the world’s population is expected to suffer from the condition at least once in their lifestyle thus causing higher demand for MIS surgery and the equipment set used for such operations.

Increasing investments and initiatives to provide primary medical care to the underprivileged section of the population may trigger high demand

The international healthcare agencies along with crucial support from the regional government are working toward improving healthcare access in remote areas or the underprivileged population segment. This could directly impact the global minimally invasive spine surgery devices market as government-managed hospitals continue to grow. In 2021, the UK government announced that it was planning to invest in 8 new hospitals in the country.

Minimally Invasive Spine Surgery Devices Market: Restraints

Growing cost of healthcare and lack of medical reimbursement policies could restrict market expansion

The global minimally invasive spine surgery industry is expected to be restricted due to the growing healthcare expenses worldwide. Surgeries such as MIS and other operational procedures are becoming expensive caused by an increased demand for healthcare services but limited supply. Countries are registering a shortage of resources including skilled medical professionals, supporting infrastructure, and facilities along with access to medical equipment. As per the Centers for Medicare & Medicaid Services (CMS), the cost of healthcare in the US reached USD 4.4 trillion as of October 2023.

Minimally Invasive Spine Surgery Devices Market: Opportunities

Growing research & development (R&D) in the industry to create expansion possibilities

The growth rate in the global minimally invasive spine surgery devices market will be led by a steady rise in the research & development strategies adopted by the market players. Companies producing devices for MIS surgeries are increasingly investing in integrating advanced technologies such as Artificial Intelligence, the Internet of Things (IoT), and others to deliver more efficient tools that ultimately lead to enhanced medical care. In August 2023, Orthofix Medical, a leading player in the MIS surgery devices industry, announced the launch of the 7D Flash navigation system percutaneous module 2.0. The company also stated that the product has already delivered successful applications in real-world scenarios in the US.

The tool will leverage attributes of visible light to create a 3-dimensional (3D) image of the surgical site in a few seconds. Medical professionals will be able to reduce surgical risks even further using the 2.0 version of the 7D flash navigation system. Investments are directed toward improved handling capabilities and image-display techniques. In September 2021, Medtronic plc announced the expansion of its existing line of minimally invasive spine surgery devices. At the time of the launch, Medtronic became the only company that provides extensive products and services to patients and surgeons as it incorporated AI-powered data, robotics, navigation, biologics, and spinal implants under one roof.

Minimally Invasive Spine Surgery Devices Market: Challenges

Risks involved with MIS surgeries are challenges that need more attention

The global minimally invasive spine surgery devices market faces challenges in terms of the risks involved with MIS surgeries. Some of the complications that may arise after the surgery or during the procedure are the development of blood clots, infection, complications caused by anesthesia, nerve damage, and spinal fluid leakage. The risks are further dependent on the age and the overall health of the patient. Market players and healthcare professionals must work toward minimizing the risks to develop greater confidence among the patients.

Minimally Invasive Spine Surgery Devices Market: Segmentation

The global minimally invasive spine surgery devices market is segmented based on treatment, product, and region.

Based on treatment, the global market is divided into disk herniation, degenerative spinal disease, spinal stenosis, and others. The highest growth was observed in the disk herniation segment in 2022 due to the extremely high frequency of the condition among the general population. As per details by the National Institutes of Health (NIH), people in the age group starting from 30 years and 50 years are most vulnerable to this condition. disk herniation affects the rubbery disk that is placed between spinal bones. The segmental growth in degenerative spinal disease is also significant.

Based on type, the global market is segmented into biomaterials and implants & instrumentation. In 2022, the most dominating segment was implants & instrumentation. The segment consists of a large number of devices used throughout minimally invasive spine surgeries. They are essential for carrying out operations without any errors. The most common biomaterials used in MIS surgeries are titanium, ceramics, and bioabsorbable materials. Research suggests that almost 500,000 lumbar spine surgeries are conducted every year in the US.

Minimally Invasive Spine Surgery Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Minimally Invasive Spine Surgery Devices Market |

| Market Size in 2022 | USD 1102.36 Million |

| Market Forecast in 2030 | USD 1542.36 Million |

| Growth Rate | CAGR of 4.33% |

| Number of Pages | 212 |

| Key Companies Covered | Johnson & Johnson (DePuy Synthes), Medtronic, Globus Medical, Stryker Corporation, SeaSpine, NuVasive, Alphatec Holdings, Zimmer Biomet, Amedica Corporation, K2M Group Holdings (now part of Stryker), MicroPort Scientific Corporation, Aesculap Implant Systems (a subsidiary of B. Braun), Spinal Elements, SpineWave, RTI Surgical, and others. |

| Segments Covered | By Treatment, By Product Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Minimally Invasive Spine Surgery Devices Market: Regional Analysis

North America is the largest market share holder

The global minimally invasive spine surgery devices market is currently led by North America. During the projection period, it will continue exhibiting its dominance led by several favorable factors. The US is one of the leading exporters of medical devices across the globe. In 2021, as per The Observatory of Economic Complexity, the US exported medical devices worth USD 30.2 billion. It is home to some of the leading manufacturers of medical equipment including MIS surgery devices.

In October 2022, DePuy Synthes, the orthopedic division of Johnson & Johnson Medtech firm, announced that it had received the US Food & Drugs Administration (FDA) clearance for the TELIGEN™ System. It is a modern platform facilitating MIS transforaminal lumbar interbody fusion (TLIF) processes using technological tools for access and visualization. The growing demand for US-made medical devices as well as increased investments by regional players toward innovation will fuel regional growth during the forecast period. For instance, in 2022, GE Healthcare spent nearly US$ 2.8 billion on R&D.

Minimally Invasive Spine Surgery Devices Market: Competitive Analysis

The global minimally invasive spine surgery devices market is led by players like:

- Johnson & Johnson (DePuy Synthes)

- Medtronic

- Globus Medical

- Stryker Corporation

- SeaSpine

- NuVasive

- Alphatec Holdings

- Zimmer Biomet

- Amedica Corporation

- K2M Group Holdings (now part of Stryker)

- MicroPort Scientific Corporation

- Aesculap Implant Systems (a subsidiary of B. Braun)

- Spinal Elements

- SpineWave

- RTI Surgical

The global minimally invasive spine surgery devices market is segmented as follows:

By Treatment

- Disk Herniation

- Degenerative Spinal Disease

- Spinal Stenosis

- Others

By Product Type

- Biomaterials

- Implants & Instrumentation

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Minimally invasive spine (MIS) surgery devices are medical equipment used for treating specific conditions related to the spinal cord.

The global minimally invasive spine surgery devices market is projected to grow owing to the increasing number of patients globally who require MIS surgeries.

According to study, the global minimally invasive spine surgery devices market size was worth around USD 1102.36 million in 2022 and is predicted to grow to around USD 1542.36 million by 2030.

What will be the CAGR value of the minimally invasive spine surgery devices market during 2023-2030?

The CAGR value of minimally invasive spine surgery devices market is expected to be around 4.33% during 2023-2030.

The global minimally invasive spine surgery devices market is currently led by North America.

The global minimally invasive spine surgery devices market is led by players like Johnson & Johnson (DePuy Synthes), Medtronic, Globus Medical, Stryker Corporation, SeaSpine, NuVasive, Alphatec Holdings, Zimmer Biomet, Amedica Corporation, K2M Group Holdings (now part of Stryker), MicroPort Scientific Corporation, Aesculap Implant Systems (a subsidiary of B. Braun), Spinal Elements, SpineWave, RTI Surgical.

The report explores crucial aspects of the minimally invasive spine surgery devices market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed