Missile Composite Parts Market Size, Share, Trends, Growth 2030

Missile Composite Parts Market By Material (Ceramic Mix Composites, Glass-Fiber Reinforced Composites, and Carbon Fiber Reinforced Composites), By Type (Cruise Missile and Ballistic Missile), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 13.62 Million | USD 190.27 Million | 3.52% | 2022 |

Missile Composite Parts Industry Prospective:

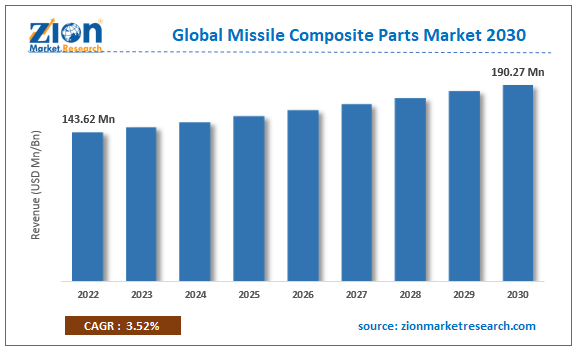

The global missile composite parts market size was worth around USD 143.62 million in 2022 and is predicted to grow to around USD 190.27 million by 2030 with a compound annual growth rate (CAGR) of roughly 3.52% between 2023 and 2030.

Missile Composite Parts Market: Overview

Missile composite parts are structural components of a missile made of composite materials. These elements are made by combining two or more different types of materials that exhibit extremely different mechanical, physical, chemical, and other properties. The intention is to create a unique material with superior attributes by incorporating the strengths of each individual material and avoiding the non-desirable qualities. Missiles, on the other hand, are airborne weapons that can travel specific distances using guided means and are capable of taking flight by means of self-propulsion by a rocket motor or a jet engine. Missiles are an important set of arms and ammunition as they can deliver explosive and intense warheads with utmost accuracy even at high speeds. The primary goal of using composite material to manufacture missile parts is to improve the overall performance of the missile in terms of strength, speed, range, and accuracy. There are several other advantages of using composite material as an alternative to traditional metals as parts made with composite elements are customizable and have enhanced stealth capabilities.

Key Insights:

- As per the analysis shared by our research analyst, the global missile composite parts market is estimated to grow annually at a CAGR of around 3.52% over the forecast period (2023-2030)

- In terms of revenue, the global missile composite parts market size was valued at around USD 143.62 million in 2022 and is projected to reach USD 190.27 million, by 2030.

- The missile composite parts market is projected to grow at a significant rate due to the rising investments in the development of advanced missiles

- Based on material segmentation, the carbon fiber reinforced composites segment was predicted to show maximum market share in the year 2022

- Based on type segmentation, a ballistic missile was the leading type in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Missile Composite Parts Market: Growth Drivers

Rising investments in the development of advanced missiles may deliver higher growth

The global missile composite parts market is expected to witness higher demand owing to the increasing investments observed in the research and development of advanced and high-performance missiles. Warheads made of composite parts offer several advantages. For instance, they are lightweight and are developed keeping in view the harsh environment they are subject to during war. Moreover, certain composites such as carbon fiber have proven to show low radar reflectivity. This means that the chances of a carbon fiber missile being detected by radar are low as compared to missiles with traditional material parts. These attributes have resulted in greater demand for highly advanced missiles made of composite materials. In December 2022, India managed to successfully complete the night trial of the Agni-V missile which is 20% lighter than its previous counterparts owing to the lightweight composite material used in place of maraging steel, Moreover, the missile reached beyond 7000 km during the trial.

Increasing application in emerging economies to assist in delivering better results

Emerging economies such as India and China along with several other developed nations such as Japan and South Korea have increased their military budget in the last few years. These countries along with other nations are working toward becoming self-reliant in terms of military-grade missiles and other ammunition. For instance, Japan’s defense ministry has requested USD 52.67 billion for the fiscal year 2024. The national government intends to increase the defense budget by 43 trillion yen in the next five years, as per reports.

Missile Composite Parts Market: Restraints

Technical complexities involved in the development of composite parts to create growth barriers

Manufacturing composite parts for defense ammunition such as missiles is technically complex. It requires superior expertise and intensive research & innovation. These factors further lead to an increase in the overall cost of producing composite materials and subsequent parts. Additionally, there are a limited number of skilled professionals working in the industry thus leading to a crunch in terms of human labor availability. All these factors combined may impact the global missile composite parts market growth during the forecast period.

Missile Composite Parts Market: Opportunities

Changing geopolitical partnerships to create further opportunities

In the last two years, there has been a significant shift in terms of geopolitical relationships. The Russia-Ukraine war has crossed the 550-day mark and there are no signs of the war stopping from progressing further. During this time, several other countries, each backing either Ukraine or Russia, have also witnessed a change in their trade outlook, further causing a rise in political tension between several countries. Such events have led to an increase in investment toward the development of new missiles as each country prepares for any form of collateral damage and keeps its citizens safe from such events in the future. Furthermore, terrorist and extremist attacks have increased as several terrorist groups are now armed with advanced military-grade ammunition pushing regional government and defense units to constantly upgrade their warheads with the latest technology and target-hitting capabilities.

Increased efforts toward optimizing resources involved in building missiles to generate higher demand for composite parts

With increasing prices of raw materials, end-users are seeking ways to ensure resource optimization that can be achieved by using composite parts since they are not high maintenance, promote less transportation cost, show higher energy efficiency, and can be recycled when not in use. These factors are likely to contribute to higher demand in the missile composite parts industry by 2030.

Missile Composite Parts Market: Challenges

Lengthy trial procedures are a crucial challenge for product users

Missiles made with composite material have to undergo rigorous testing and multiple trials over a long period since every trial is highly resource-intensive. Until the missile has completed all essential trial sessions, they cannot be put to use in a real environment and these trials can extend for multiple years. The period between idea generation and final use is extremely lengthy and creates multiple challenges for the players operating in the global market as the missile-manufacturing industry is extremely dynamic and volatile.

Missile Composite Parts Market: Segmentation

The global missile composite parts market is segmented based on material, type, and region.

Based on material, the global market segments are ceramic mix composites, glass-fiber reinforced composites, and carbon fiber reinforced composites. In 2022, the most significantly used composite materials were carbon fiber-reinforced composites. They are a combination of polymer matrix and carbon fiber. Hence, they are proven to have exceptional strength-to-weight ratio which is a desired quality for missile composite parts. Their strength ranges from 1,000 to 5,000 MPa/g and may go even higher depending on the quality of the initial raw materials. Carbon fiber composites are highly durable and stiff which means they can survive harsh environments. Other advantages of this material type include high resistance to fatigue, low thermal expansion index, and reduced vibrations.

Based on type, the missile composite parts industry is divided into cruise missile and ballistic missile with the latter showing dominance in 2022. These missiles are generally propelled with the help of rocket engines and head straight up into the atmosphere. After reaching a certain height they start moving toward their target guided by the earth’s gravitational pull. They are highly popular for military operations owing to their speed and accuracy. There are ongoing research projects aimed at developing longer-range missiles that can go undetected by radar and other tracking systems. The Trident II missile made by the US has a maximum range of 7800 k when loaded to full capacity making it one of the most sophisticated missiles.

Missile Composite Parts Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Missile Composite Parts Market |

| Market Size in 2022 | USD 143.62 Million |

| Market Forecast in 2030 | USD 190.27 Million |

| Growth Rate | CAGR of 3.52 |

| Number of Pages | 221 |

| Key Companies Covered | BAE Systems plc, Northrop Grumman Corporation, Raytheon Technologies Corporation, Lockheed Martin Corporation, Thales Group, The Boeing Company, Mitsubishi Heavy Industries Ltd., MBDA, Aerojet Rocketdyne Holdings Inc., Safran Group, Hanwha Corporation, General Dynamics Corporation, L3Harris Technologies Inc., Rafael Advanced Defense Systems Ltd., Tata Advanced Systems Limited., and others. |

| Segments Covered | By Material, By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Missile Composite Parts Market: Regional Analysis

Asia-Pacific to continue generating high revenue

The global missile composite parts market is projected to be dominated by Asia-Pacific led by the increasing adoption of composite materials by several Asian countries to manufacture missiles used for defense purposes. China, India, Japan, Iran, and South Korea are the most dominant nations. India, in recent times, has increased its defense budget and is focusing on building trade relationships with European and US-based missile providers along with working on developing powerful missiles on the home ground. For instance, the latest Agni-V missiles cost USD 7 million per unit and are being developed by the Defense Research & Development Organization in association with Bharat Dynamic Limited. In May 2023, the military wing of Iran unveiled the Khorramshahr. It is the country’s most powerful missile with the airframe being made of the stronger composite material. There are several new additions made to the missile including a mid-phase navigation system and smaller tanks.

Missile Composite Parts Market: Competitive Analysis

The global missile composite parts market is led by players like:

- BAE Systems plc

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- Thales Group

- The Boeing Company

- Mitsubishi Heavy Industries Ltd.

- MBDA

- Aerojet Rocketdyne Holdings Inc.

- Safran Group

- Hanwha Corporation

- General Dynamics Corporation

- L3Harris Technologies Inc.

- Rafael Advanced Defense Systems Ltd.

- Tata Advanced Systems Limited.

The global missile composite parts market is segmented as follows:

By Material

- Ceramic Mix Composites

- Glass-Fiber Reinforced Composites

- Carbon Fiber Reinforced Composites

By Type

- Cruise Missile

- Ballistic Missile

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Missile composite parts are structural components of a missile made of composite materials. These elements are made by combining two or more two different types of materials that exhibit extremely different mechanical, physical, chemical, and other properties.

The global missile composite parts market is expected to witness higher demand owing to the increasing investments observed in the research and development of advanced and high-performance missiles.

According to study, the global missile composite parts market size was worth around USD 143.62 million in 2022 and is predicted to grow to around USD 190.27 million by 2030.

The CAGR value of the missile composite parts market is expected to be around 3.52% during 2023-2030.

The global missile composite parts market is projected to be dominated by Asia-Pacific led by the increasing adoption of composite materials by several Asian countries to manufacture missiles used for defense purposes.

The global missile composite parts market is led by players like BAE Systems plc, Northrop Grumman Corporation, Raytheon Technologies Corporation, Lockheed Martin Corporation, Thales Group, The Boeing Company, Mitsubishi Heavy Industries, Ltd., MBDA, Aerojet Rocketdyne Holdings, Inc., Safran Group, Hanwha Corporation, General Dynamics Corporation, L3Harris Technologies, Inc., Rafael Advanced Defense Systems Ltd., and Tata Advanced Systems Limited.

The report explores crucial aspects of the missile composite parts market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed