Mitigation Banking Market Size, Share, Growth, Forecast 2030

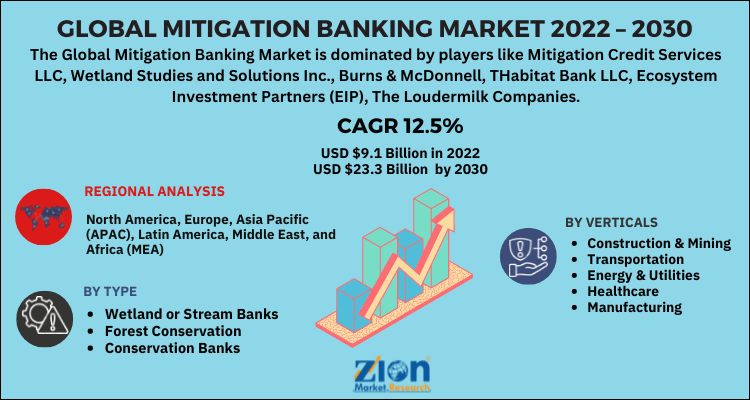

Mitigation Banking Market By Type (Wetland or Stream Banks, Forest Conservation, and Conservation Banks), By Verticals (Construction & Mining, Transportation, Energy & Utilities, Healthcare, and Manufacturing) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

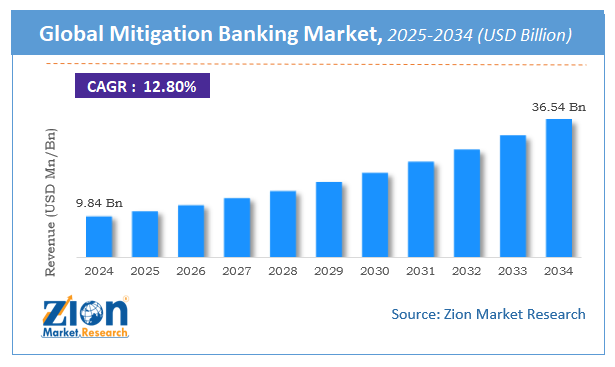

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.1 Billion | USD 23.3 Billion | 12.5% | 2022 |

Mitigation Banking Industry Prospective:

The global mitigation banking market size was worth around USD 9.1 billion in 2022 and is predicted to grow to around USD 23.3 billion by 2030 with a compound annual growth rate (CAGR) of roughly 12.5% between 2023 and 2030.

Mitigation Banking Market: Overview

A wetland, stream, or other area with aquatic resources that has been restored, created, improved, or (in certain cases) preserved to compensate for unavoidable impacts to aquatic resources allowed under Section 404 or a comparable state or local wetland regulation is known as a mitigation bank. When a government agency, business, NGO, or other institution does these tasks by a written contract with a regulatory body, a mitigation bank may be established. The mitigation banking industry is impacted by several important factors that support its expansion and evolution. These forces are brought about by environmental laws, financial factors, and a rising consciousness of the significance of ecosystem preservation.

Key Insights

- As per the analysis shared by our research analyst, the global Mitigation Banking market is estimated to grow annually at a CAGR of around 12.5% over the forecast period (2023-2030).

- In terms of revenue, the global Mitigation Banking market size was valued at around USD 9.1 billion in 2022 and is projected to reach USD 23.3 billion, by 2030.

- The growing construction and mining sectors are expected to drive mitigation banking market growth during the forecast period.

- Based on the type, the wetland or stream banks segment is expected to dominate the market during the forecast period.

- Based on the verticals, the construction & mining segment is expected to hold a significant market share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Mitigation Banking Market: Growth Drivers

Increasing concerns about protecting biodiversity drive market growth

Throughout the projected period, rising government concerns about biodiversity conservation are anticipated to fuel the expansion of the mitigation banking industry. Protections in the political, social, economic, and environmental spheres strengthen the nation's negotiating position and income potential. In turn, this promotes significant inflows of foreign investment and plays a crucial role in safeguarding the nation's biodiversity. Natural diversity may be preserved by mitigation banking. It aids in reducing the negative effects that increased industrialization has on streams, wetlands, and other natural habitats.

Mitigation Banking Market: Restraints

Regulatory complexity hinders market growth

Mitigation banking is governed by a complicated regulatory structure that often changes. Both mitigation lenders and developers may find it difficult to navigate through different federal, state, and municipal requirements, which can cause delays and uncertainty. Additionally, acquiring approvals for mitigation banking initiatives can take a long time and need a lot of paperwork as well as contact with regulatory bodies. Delays in permit approval may make it difficult to create mitigation banks on time. Thus, this is expected to limit the global mitigation banking market growth over the forecast period.

Mitigation Banking Market: Opportunities

Growing government initiatives offer a lucrative opportunity for market growth

The growing government initiatives are expected to offer a lucrative opportunity for mitigation banking market growth during the forecast period. For instance, in May 2021, the America the Beautiful program was started by the Biden-Harris Administration as a ten-year effort to promote locally driven and voluntary conservation and restoration activities around the nation to address the climate and biodiversity challenges as well as unequal access to nature. President Biden created the target when he took office and issued Executive Order 14008 in Tackling the Climate Crisis at Home and Abroad, which is the first-ever national conservation objective for the United States to protect at least 30% of its lands and waterways by 2030. Additionally, in April 2022, the Global Environment Facility's eighth replenishment (GEF-8) will be supported by a contribution from the United States of $600.8 million over the following four years. The amount pledged to the GEF by the US is the highest ever. The Biden-Harris Administration's commitment to combating climate change, protecting important ecosystems that act as global carbon sinks and other carbon sinks, restoring the health of our oceans, and halting biodiversity loss is supported by this pledge, which also coincides with ongoing U.S. initiatives.

Mitigation Banking Market: Challenges

Fluctuation of inaccurate economic or monetary value poses a major challenge to market growth

It can be difficult for regulatory authorities to assign a precise economic or monetary value to ecological harm, especially when utilizing environmental assessment methodologies. Mitigation banks are commonly placed far from the actual impact area, even though they must be in the same watershed as the effect to be considered appropriate compensation. Retaining the original value and function is therefore difficult. The biggest obstacle that regulatory bodies have when accurately quantifying ecological losses in commercial or monetary terms is the efficiency of mitigation banks.

Mitigation Banking Market: Segmentation

The global Mitigation Banking industry is segmented based on type, verticals, and region.

Based on the type, the global mitigation banking market is bifurcated into wetland or stream banks, forest conservation, and conservation banks. The wetland or stream banks segment is expected to dominate the market during the forecast period. Wetland mitigation banks offer several advantages, such as the preservation of important ecosystems, better water quality, flood mitigation, and assistance with biodiversity. They also make the application process for permits for developers simpler by providing a standardized and trustworthy mitigation alternative. Thereby, driving the segment growth.

Based on the verticals, the global mitigation banking industry is bifurcated into construction & mining, transportation, energy & utilities, healthcare, and manufacturing. The construction & mining segment is expected to hold a significant market share over the forecast period. The broad application of the mitigation banking system in the mining and construction sectors is responsible for the segment's expansion. Mitigation banks provide several practical economic benefits in mining and construction, promoting growth. Instead of partitioning a development site into less-than-ideal property uses, they allow a developer to make the best use of the available space. Thus, this is expected to drive the market growth.

Mitigation Banking Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mitigation Banking Market |

| Market Size in 2022 | USD 9.1 Billion |

| Market Forecast in 2030 | USD 23.3 Billion |

| Growth Rate | CAGR of 12.5% |

| Number of Pages | 208 |

| Key Companies Covered | Mitigation Credit Services LLC, Wetland Studies and Solutions Inc., Burns & McDonnell, THabitat Bank LLC, Ecosystem Investment Partners (EIP), The Loudermilk Companies, The Wetlandsbank Company (TWC), EarthBalance, Weyerhaeuser, WRA Inc. LLC, Alafia River Wetland Mitigation Bank Inc., Wildwood Environmental Credit Company, The Mitigation Banking Group Inc., Great Ecology, LJA Environmental Services Inc., Ecosystem Services LLC, and others. |

| Segments Covered | By Type, By Verticals, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mitigation Banking Market: Regional Analysis

North America is expected to dominate the market over the forecast period

North America is expected to dominate the global mitigation banking market over the forecast period. This growth is driven by increasing development activities, stricter environmental regulations, and a growing recognition of the ecological and economic benefits of mitigation banking. Federal organizations like the Environmental Protection Agency (EPA) and the U.S. Army Corps of Engineers (USACE) manage the mitigation banking process in the United States, which has a well-established regulatory framework. Additionally, state-level organizations are involved in approving and regulating mitigation banks. Moreover, the growing product launches by the key players in the region propel the market expansion.

For instance, in April 2023, a new sustainable time deposit product was introduced by Citi® to help U.S. institutional clients invest excess cash while advancing their sustainability objectives. Citi's new Sustainable Time Deposit (TD) will offer competitive returns and support initiatives determined by Citi's frameworks for green and social bonds. Additionally, the money may be used to build, renovate, or preserve homes for people with low and moderate incomes, who are often limited to renters with an income of 60% or less of the area median income, as well as to finance or refinance affordable housing projects in the United States. Numerous other housing communities kinds, each with a unique social effect and advantages, maybe a part of such initiatives.

Mitigation Banking Market: Competitive Analysis

The global Mitigation Banking market is dominated by players like:Mitigation Credit Services LLC

- Wetland Studies and Solutions Inc.

- Burns & McDonnell

- THabitat Bank LLC

- Ecosystem Investment Partners (EIP)

- The Loudermilk Companies

- The Wetlandsbank Company (TWC)

- EarthBalance

- Weyerhaeuser

- WRA Inc. LLC

- Alafia River Wetland Mitigation Bank Inc.

- Wildwood Environmental Credit Company

- The Mitigation Banking Group Inc.

- Great Ecology

- LJA Environmental Services Inc.

- Ecosystem Services LLC

The global Mitigation Banking market is segmented as follows:

By Type

- Wetland or Stream Banks

- Forest Conservation

- Conservation Banks

By Verticals

- Construction & Mining

- Transportation

- Energy & Utilities

- Healthcare

- Manufacturing

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A wetland, stream, or other area with aquatic resources that has been restored, created, improved, or (in certain cases) preserved to compensate for unavoidable impacts to aquatic resources allowed under Section 404 or a comparable state or local wetland regulation is known as a mitigation bank. When a government agency, business, NGO, or other institution does these tasks by a written contract with a regulatory body, a mitigation bank may be established.

The mitigation banking industry is impacted by several important factors that support its expansion and evolution. These forces are brought about by environmental laws, financial factors, and a rising consciousness of the significance of ecosystem preservation.

According to the report, the global mitigation banking market size was worth around USD 9.1 billion in 2022 and is predicted to grow to around USD 23.3 billion by 2030.

The global Mitigation Banking market is expected to grow at a CAGR of 12.5% during the forecast period.

The global Mitigation Banking market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the supportive regulations.

The global Mitigation Banking market is dominated by players like Mitigation Credit Services LLC, Wetland Studies and Solutions Inc., Burns & McDonnell, THabitat Bank LLC, Ecosystem Investment Partners (EIP), The Loudermilk Companies, The Wetlandsbank Company (TWC), EarthBalances, Weyerhaeuser, WRA Inc. LLC, Alafia River Wetland Mitigation Bank Inc., Wildwood Environmental Credit Company, The Mitigation Banking Group Inc., Great Ecology, LJA Environmental Services Inc. and Ecosystem Services LLC among others.

The Mitigation Banking market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed