Mobile Banking Market Size, Share Report, Analysis, Trends, Growth, 2032

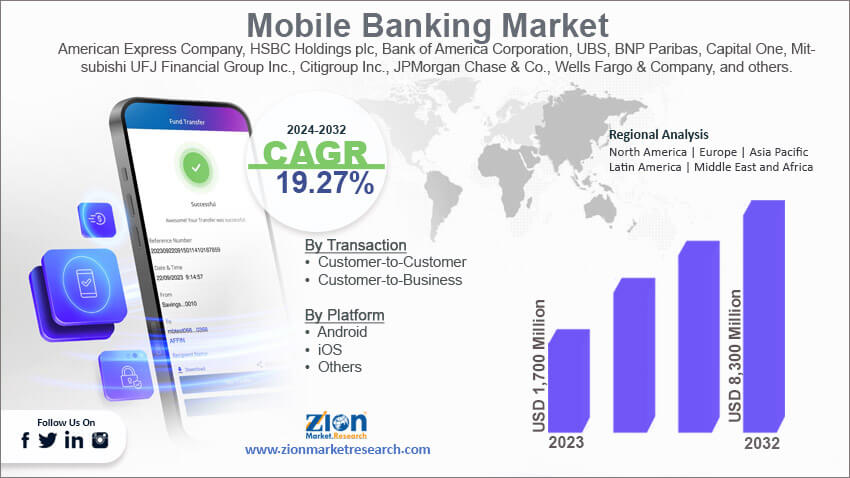

Mobile Banking Market By Transaction (Customer-to-Customer and Customer-to-Business), By Platform (Android, iOS, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

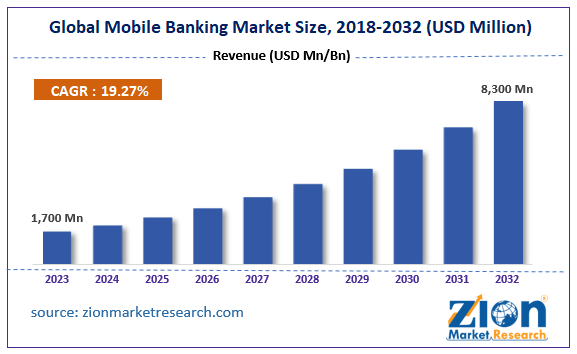

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,700 Million | USD 8,300 Million | 19.27% | 2023 |

Mobile Banking Industry Prospective:

The global mobile banking market size was evaluated at $1,700 million in 2023 and is slated to hit $8,300 million by the end of 2032 with a CAGR of nearly 19.27% between 2024 and 2032.

Mobile Banking Market: Overview

Mobile banking is a type of service that helps customers perform a slew of financial deals and effectively handles their accounts through the use of mobile equipment. Moreover, mobile banking activities provide persons with an easy and secure way of accessing their bank accounts along with performing a slew of banking transactions without the need to physically visit a branch.

Key Insights

- As per the analysis shared by our research analyst, the global mobile banking market is projected to expand annually at the annual growth rate of around 19.27% over the forecast timespan (2024-2032)

- In terms of revenue, the global mobile banking market size was evaluated at nearly $1,700 million in 2023 and is expected to reach $8,300 million by 2032.

- The global mobile banking market is anticipated to grow rapidly over the forecast timeline owing to the escalating popularity of convenient online banking activities and surging smartphone demand.

- In terms of transactions, the customer-to-business segment is slated to register the highest CAGR over the forecast period.

- Based on platform, the Android segment is predicted to lead the segmental space in the upcoming years.

- Region-wise, the Asia-Pacific mobile banking industry is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

Mobile Banking Market: Growth Factors

Growing demand for online banking with the use of mobile apps can trigger the growth of the global market

The escalating popularity of convenient online banking activities and surging smartphone demand are likely to proliferate the expansion of the global mobile banking market. Reportedly, mobile banking helps end-users check their account balances, review financial deals, and make payments 24/7. Moreover, mobile banking solutions help save time, thereby driving the global market trends.

Furthermore, an increase in the consciousness of personal finance management is likely to boost the growth of the market globally. Humungous demand for fast, convenient, and round-the-clock products & services will embellish the expansion of the global market. Launching new technologies for fraud detection and real-time customer support to customers will provide impetus to the expansion of the market globally.

Mobile Banking Market: Restraints

Growing data security issues can retard the expansion of the global industry over the forecast period

An increase in data security concerns & data privacy is predicted to hinder the expansion of the global mobile banking industry. Growing fear of identity theft as well as security breaches and the rise in online banking frauds is going to impact the expansion of the global industry.

Mobile Banking Market: Opportunities

Rise in the online banking activities in the BFSI sector will proliferate the growth of the market globally by 2032

The thriving BFSI sector leading to on-the-go banking solutions along with round-the-clock accessibility of the accounts on smartphones through mobile apps such as iMobile app is predicted to create new growth avenues for the global mobile banking market. The onset of AI can bring a paradigm shift in mobile banking activities, thereby assisting the market to ascend new heights of growth in the near future.

Mobile Banking Market: Challenges

A surge in the cases of cyber-terrorism is anticipated to pose a huge challenge to global industry expansion by 2032

An increase in cyber-attacks and hacking as well as a surge in the cases of data violations is anticipated to pose a huge challenge to the global mobile banking industry expansion in the years ahead.

Mobile Banking Market: Segmentation

The global mobile banking market is divided into transaction, platform, and region.

In transaction terms, the mobile banking market across the globe is segregated into customer-to-customer and customer-to-business segments. Furthermore, the customer-to-customer segment, which acquired nearly 70% of the global market revenue in 2023, is anticipated to record the fastest rate of growth in the next seven years. The expansion of the segment in the forecast period can be due to a rise in the use of mobile banking apps by customers for routine fund transfers for a slew of purchases. Apart from this, mobile banking apps also offer the facility of monthly installments on the purchase of various kinds of electronic goods, thereby steering the growth of the customer-to-business segment.

On the basis of platform, the global mobile banking industry is segmented into Android, iOS, and other segments. Additionally, the Android segment, which amassed a key share of the global industry in 2023, is forecast to dominate the segment in the ensuing years. The segmental surge from 2024 to 2032 can be owing to the rise in the use of smartphones and touchscreen products that have the Android operating system embedded in them. Moreover, the Android system is cost-efficient and is used in smartphones which are available at reasonable costs. Apart from this, android supports many end-user applications, thereby steering the growth of the segment across the globe in the years ahead.

Mobile Banking Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mobile Banking Market |

| Market Size in 2023 | USD 1,700 Million |

| Market Forecast in 2032 | USD 8,300 Million |

| Growth Rate | CAGR of 19.27% |

| Number of Pages | 220 |

| Key Companies Covered | American Express Company, HSBC Holdings plc, Bank of America Corporation, UBS, BNP Paribas, Capital One, Mitsubishi UFJ Financial Group Inc., Citigroup Inc., JPMorgan Chase & Co., Wells Fargo & Company, and others. |

| Segments Covered | By Transaction, By Platform, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mobile Banking Market: Regional Insights

North America is predicted to maintain the leading position in the global Mobile Banking market in the upcoming years

North America, which accounted for nearly 55% of the global mobile banking market proceeds in 2023, is expected to set up a dominant position in the next decade. Additionally, the regional market expansion in the upcoming years can be ascribed to a rise in awareness about personal finance management in countries such as the U.S. and Canada. An increase in fintech startups in the region is anticipated to steer the growth of the market in North America in the coming years.

The Asia-Pacific Mobile Banking industry is slated to record the fastest CAGR in the forecast timespan. The progress of the industry in the region can be attributed to the rise in the use and sale of smartphones in countries such as India and China. Additionally, the presence of key smartphone manufacturers in countries such as China, Japan, South Korea, and Taiwan is likely to spur the expansion of the industry in the APAC zone.

Key Developments

- In August 2023, Yes Bank, introduced an all-in-one IRIS mobile banking solution application with a view of improving the consumer experience in mobile banking activities.

- In the first quarter of 2024, N26, a digital bank, introduced instant banking in nearly 13 newer markets in Europe. Such moves will boost the expansion of the market in Europe in the upcoming years.

Mobile Banking Market: Competitive Space

The global mobile banking market profiles key players such as:

- American Express Company

- HSBC Holdings plc

- Bank of America Corporation

- UBS

- BNP Paribas

- Capital One

- Mitsubishi UFJ Financial Group Inc.

- Citigroup Inc.

- JPMorgan Chase & Co.

- Wells Fargo & Company

The global mobile banking market is segmented as follows:

By Transaction

- Customer-to-Customer

- Customer-to-Business

By Platform

- Android

- iOS

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Mobile banking is a type of service that helps the customers for performing a slew of financial deals and effectively handles their accounts through use of mobile equipment.

The global mobile banking market growth over forecast period can be owing to mobile banking helps the end-users in checking their account balances, reviewing financial deals, and making payments 24 X 7.

According to a study, the global mobile banking industry size was $1,700 million in 2023 and is projected to reach $8,300 million by the end of 2032.

The global mobile banking market is anticipated to record a CAGR of nearly 19.27% from 2024 to 2032.

Asia-Pacific mobile banking industry is set to register the fastest CAGR over the forecasting timeline owing to rise in the use and sale of smartphones in the countries such as India and China. Additionally, presence of key smartphone manufacturers in the countries such as China, Japan, South Korea, and Taiwan is likely to spur the expansion of the industry in the APAC zone.

The global mobile banking market is led by players such as American Express Company, HSBC Holdings plc, Bank of America Corporation, UBS, BNP Paribas, Capital One, Mitsubishi UFJ Financial Group, Inc., Citigroup Inc., JPMorgan Chase & Co., and Wells Fargo & Company.

The global mobile banking market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed