Mobile Payment Technology Market Share, Size, Growth Report 2028

Mobile Payment Technology Market - By Technology (Near Field Communication, Direct Mobile Billing, Mobile Web Payment, SMS, Interactive Voice Response System, Mobile App, and Others), By Type (B2B, B2C, B2G, and Others), By Location (Remote Payment and Proximity Payment), By End-User (BFSI, Healthcare, IT & Telecom, Media & Entertainment, Retail & E-commerce, Transportation, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 40,289.8 Million | USD 235,347.8 Million | 34.2% | 2021 |

Mobile Payment Technology Market: Industry Perspective

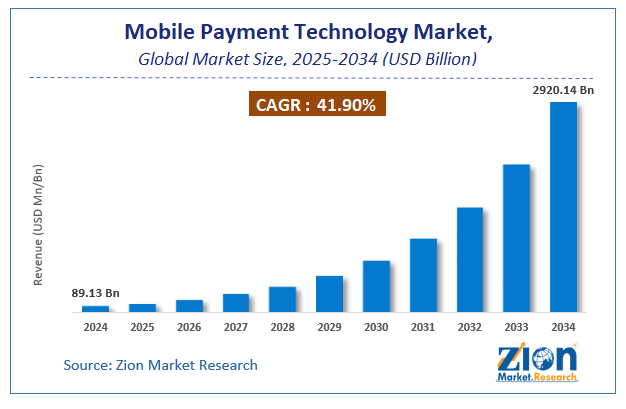

The global mobile payment technology market size was worth around USD 40,289.8 million in 2021 and is predicted to grow to around USD 235,347.8 million by 2028 with a compound annual growth rate (CAGR) of roughly 34.2% between 2022 and 2028.

The report analyzes the global mobile payment technology market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the mobile payment technology industry.

Mobile Payment Technology Market: Overview

Technological proliferation across the world has increased substantially, and this trend is projected to be a prominent one driving the mobile payment technology market growth over the forecast period. Increasing penetration of smartphones and rising internet infrastructure across the world will boost the mobile payment technology market potential through 2028.

Mobile payment technology enables users to make payments from anywhere in the world at the touch of their fingertips and in this ever-growing fast-paced world, this will be a majorly lucrative factor propelling mobile payment technology market growth. However, security concerns and reluctance to adopt are expected to have a hindering effect on the global mobile payment technology market potential.

Lockdown restrictions across the world restricted outdoor activity and hence largely affected the cash flow statistics as well which led to a substantial increase in demand for online payment solutions and this also propelled the mobile payment technology market potential in this period. The mobile payment technology market growth is expected to make a comeback in the post-pandemic era and is expected to see an exponential rise over the forecast period as technological proliferation increases substantially on a global scale.

Mobile Payment Technology Market: Growth Drivers

Increasing Technological proliferation to Boost mobile payment technology market growth

Advancements in technology have transformed the world and this is also true with the mobile payment technology trend which is gaining popularity due to the high penetration of smartphones on a global scale. Moreover, an increase in internet infrastructure, rapid urbanization, and increasing demand for digitization are some other factors that drive the mobile payment technology market growth over the forecast period.

Mobile Payment Technology Market: Restraints

Concerns about the adoption of this technology among the general population

The world has been cash-operated for a while now and most people across the globe are used to that mode of transaction and are reluctant to adopt this new method which also has raised some major security concerns amidst the increasing prevalence of fraud and cybercrime activity that resulted in multiple payment frauds. The rising number of data breaches and other factors that risk the security of the financial and personal data of customers will also restrain market potential over the forecast period.

Mobile Payment Technology Market: Segmentation

The global mobile payment technology market is segmented based on technology, type, location, end-user, and region.

By Technology, the market is divided into near-field communication, direct mobile billing, mobile web payment, SMS, interactive voice response systems, mobile apps, and others. The mobile web payment segment held a dominant stance in the market in 2021 and is expected to continue this dominance over the forecast period. The security and flexibility that this payment offers are what make it a dominant segment and are the major factors that will help this segment maintain its significant market share despite the emergence of other advanced technologies.

By Type, the mobile payment technology market is segmented into B2B, B2C, B2G, and others. The B2B segment will emerge as the leading segment in the market over the forecast period and will account for a major market share of around 60% in the global mobile payment technology industry landscape by the end of 2028.

In terms of Location, the global mobile payment technology market is divided into remote payment and proximity payment.

Based on End-users, the global mobile payment technology market is bifurcated into BFSI, healthcare, IT & telecom, media & entertainment, retail & e-commerce, transportation, and others.

Mobile Payment Technology Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mobile Payment Technology Market |

| Market Size in 2021 | USD 40,289.8 Million |

| Market Forecast in 2028 | USD 235,347.8 Million |

| Growth Rate | CAGR of 34.2% |

| Number of Pages | 185 |

| Key Companies Covered | Google (Alphabet Inc.), Alibaba Group Holdings Limited, Amazon.com Inc., Apple Inc., American Express Company, M Pesa, Money Gram International, PayPal Holdings Inc., Samsung Electronics Co. Ltd., Visa Inc., WeChat (Tencent Holdings Limited), and others. |

| Segments Covered | By Technology, By Type, By Location, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2021 |

| Historical Year | 2018 to 2021 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mobile Payment Technology Market: Regional Landscape

Asia Pacific region will lead the global mobile payment technology market in terms of revenue and volume share and this is expected to be majorly driven by the high proliferation of smartphones in this region and the increasing population that is adopting online payment solutions owing to rising technological proliferation. China and India which are leading markets in this region will be driven by rapid urbanization and digitization in these nations and emerge as highly lucrative markets for mobile payment technology providers through the forecast period.

The market for mobile payment technology in North America is also expected to provide highly beneficial opportunities for mobile payment technology providers owing to rising technology adoption and the presence of key mobile payment technology companies in this region. The United States and Canada will be the leading markets for mobile payment technology over the forecast period in this region.

Recent Developments

- In May 2020 – network airlines UATP announced a collaboration with CITCON that was aimed at providing a mobile-based payment solution using multiple payment gateways such as Alipay, UnionPay, and WeChat Pay to customers residing in China.

Mobile Payment Technology Market: Competitive Landscape

Some of the main competitors dominating the global mobile payment technology market include -

- Google (Alphabet Inc.)

- Alibaba Group Holdings Limited

- Amazon.com Inc.

- Apple Inc.

- American Express Company

- M Pesa

- Money Gram International

- PayPal Holdings Inc.

- Samsung Electronics Co. Ltd.

- Visa Inc.

- WeChat (Tencent Holdings Limited)

The global mobile payment technology market is segmented as follows:

By Technology

- Near Field Communication

- Direct Mobile Billing

- Mobile Web Payment

- SMS

- Interactive Voice Response System

- Mobile App

- Others

By Type

- B2B

- B2C

- B2G

- Others

By Location

- Remote Payment

- Proximity Payment

By End-User

- BFSI

- Healthcare

- IT & Telecom

- Media & Entertainment

- Retail & E-commerce

- Transportation

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Increasing smartphone proliferation, growing internet infrastructure and rapid digitization some major trends that guide mobile payment technology market growth.

According to the Zion Market Research report, the global mobile payment technology market was worth about US$ 40,289.8 million in 2021 and is predicted to grow to around US$ 235,347.8 million by 2028, with a compound annual growth rate (CAGR) of around 34.2%.

Asia Pacific is expected to dominate the mobile payment technology market over the forecast period.

Leading players in the global mobile payment technology market include Google (Alphabet Inc.), Alibaba Group Holdings Limited, Amazon.com Inc., Apple Inc., American Express Company, M Pesa, Money Gram International, PayPal Holdings Inc., Samsung Electronics Co. Ltd., Visa Inc., and WeChat (Tencent Holdings Limited), among others.

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed