MRO Distribution Market Size, Share, Analysis, Trends, Growth, 2032

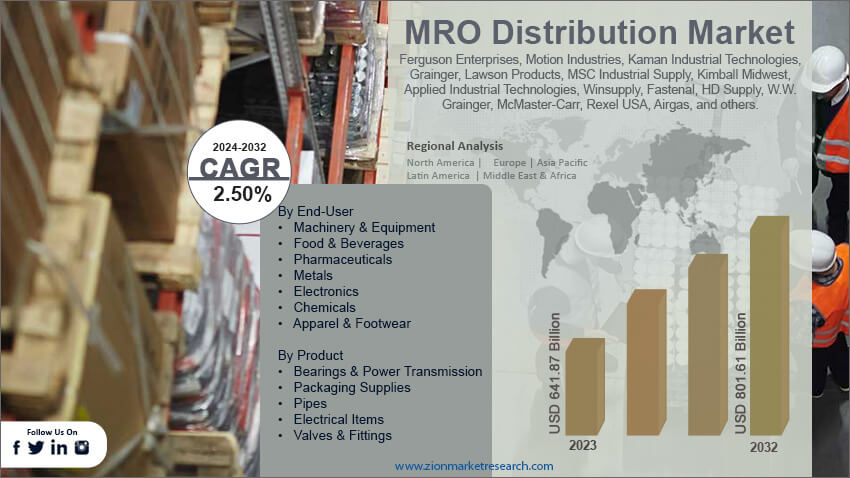

MRO Distribution Market By End-User (Machinery & Equipment, Food & Beverages, Pharmaceuticals, Metals, Electronics, Chemicals, Apparel & Footwear, and Others), By Product (Bearings & Power Transmission, Packaging Supplies, Pipes, Electrical Items, Valves & Fittings, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

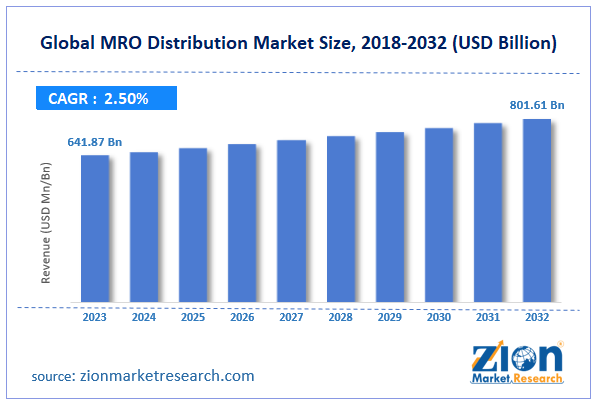

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 641.87 Billion | USD 801.61 Billion | 2.50% | 2023 |

MRO Distribution Industry Perspective:

The global MRO distribution market size was worth around USD 641.87 billion in 2023 and is predicted to grow to around USD 801.61 billion by 2032 with a compound annual growth rate (CAGR) of roughly 2.50% between 2024 and 2032.

MRO Distribution Market: Overview

MRO distribution is the process of designing and implementing supply chains for the maintenance, repair, and operations (MRO) of industrial facilities, machinery, and systems. MRO distribution is an important part of the maintenance industry. In certain cases, MRO is also referred to as Maintenance, Repair, and Overhaul. The main objective of MRO distribution is to ensure that companies and businesses do not run out of materials required for operational purposes.

Companies invest millions of dollars in establishing a facility. Lack of access to even a small component can lead to industrial machinery sitting idle for days. Such events led to a halt in business operations, ultimately translating to monetary and non-monetary losses. In the existing competitive commercial market, companies cannot afford to neglect the importance of a well-defined and robust MRO distribution network.

Maintenance, repair, and operations materials and products can range from basic day-to-day supplies in the office to parts of machinery worth millions. The demand for MRO distribution is growing rapidly led by a surge in infrastructure development. However, the complexity of the supply chain could limit the MRO distribution industry’s growth rate during the projection period.

Key Insights:

- As per the analysis shared by our research analyst, the global MRO distribution market is estimated to grow annually at a CAGR of around 2.50% over the forecast period (2024-2032)

- In terms of revenue, the global MRO distribution market size was valued at around USD 641.87 billion in 2023 and is projected to reach USD 801.61 billion by 2032.

- The MRO distribution market is projected to grow at a significant rate due to the surge in infrastructure development projects worldwide

- Based on the end-user, the machinery & equipment segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the product, the bearings & power transmission segment is anticipated to command the largest market share

- Based on region, the North American region of the US is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

MRO Distribution Market: Growth Drivers

Surge in infrastructure development projects worldwide will drive the market demand rate

The global MRO distribution market is expected to be driven by the surge in infrastructure development projects across the globe. Large-scale development of infrastructure drives the need to have continuous access to essential materials and machinery. Regional governments are constantly investing in launching new infrastructure-related projects to contribute to the region’s overall economic growth.

Additionally, the existence of steady infrastructure systems promotes foreign investment along with domestic growth. The construction of new residential places for citizens, upgrades in legacy architecture, and improving overall urban or rural areas are of prime importance for the governments. These investments are worth more than millions and sometimes billions of dollars. Partnering bodies and stakeholders invest large sums of money and expect deliverables to be achieved within a set time frame. Disruption in the supply chain of materials for such projects can bring the development to a halt.

For instance, the Union Road Transport & Highways Ministry of India broke ground for 29 national highway (NH) projects in the Odisha region. These projects will be completed on a budget of INR 6,600 crore. As per market research, Middle Eastern countries such as Dubai and Abu Dhabi are some of the leading nations in terms of the development of smart cities.

E-commerce industry to contribute to market growth rate during the projection period

MRO distribution can be seamlessly integrated with the existing and thriving e-commerce sector. Companies in the Maintenance, Repair, and Operations distribution industry can leverage the global reach of e-commerce companies and online platforms. Furthermore, potential clients can learn product profiles with a single click of a button. Furthermore, using online platforms for delivering products can help MRO companies reduce inventory costs. The surge in investments in the e-commerce sector worldwide must be leveraged by MRO distribution businesses to generate higher revenue. Online solutions offered specifically targeting the rapidly rising fashion & apparel industry will contribute to the global MRO distribution market revenue.

MRO Distribution Market: Restraints

High initial cost of the investment may limit the industry’s growth rate

The global industry for MRO distribution is projected to be restricted due to the high cost of initial setup. The cost increases since MRO distributions invest in developing a comprehensive inventory to meet client needs. MRO distribution companies cannot fail to deliver ordered products on time. Additionally, MRO companies use highly advanced digital systems such as inventory and supply chain management tools. Some of these programs are specially customized as per MRO company’s requirements, leading to added expenses.

MRO Distribution Market: Opportunities

Expansion into new markets and growing partnerships to generate extensive growth opportunities

The global MRO distribution market is expected to generate more growth opportunities during the projection period. The expansion trajectory will gain more momentum as a consequence of business expansion strategies adopted by MRO distribution players by entering emerging markets. In January 2025, Boeing, a leading US aircraft maker, announced the launch of a new warehousing facility in the Uttar Pradesh state of India. The distribution center spans 36,000-sq ft and will be operated with the aid of DB Schenker, a third-party logistics provider. Boeing is expected to provide support to regional aviation clients in optimizing fleet utilization. It is one of the 8 distribution centers owned by the company around the world.

In January 2024, V-Line Middle East, the regional segment of the global V-Line Group, an MRO supply chain solutions provider, announced a partnership with Verizon to aid regional companies in optimizing procurement, inventory management, and reducing risks. Verusen is a US-based AI-powered MRO solutions provider. Such strategic measures will generate a more collaborative and comprehensive market environment, which will further promote innovation and growth.

MRO Distribution Market: Challenges

Accurate demand forecasting is the most challenging aspect for market companies

The global MRO distribution industry players face one of the most significant challenges in the form of accurate demand forecasting. The MRO field is highly unpredictable, especially in current times when global order and international trade relationships are evolving. Companies face the risk of understocking or overstocking in the absence of an accurate demand forecast, which could lead to heavy losses. Furthermore, managing supplier relationships is an added growth inhibitor since a delay from suppliers can affect the entire supply chain.

MRO Distribution Market: Segmentation

The global MRO distribution market is segmented based on end-user, product, and region.

Based on the end-user, the global market segments are machinery & equipment, food & beverages, pharmaceuticals, metals, electronics, chemicals, apparel & footwear, and others. In 2023, the highest growth was witnessed in the machinery & equipment segment driven by the growing use of advanced machinery across some of the largest sectors such as the automotive and aviation industry. The surge in investment in these sectors will drive the segment further. The global aviation sector is currently valued at USD 3.51 trillion.

Based on the product, the global market divisions are bearings & power transmission, packaging supplies, pipes, electrical items, valves & fittings, and others. In 2023, the highest demand was registered in the bearings & power transmission segment. These are some of the most essential parts of industrial machinery. The surge in demand for bearings & power transmission products across energy, automotive, and manufacturing sectors. During the forecast period, the global power generation market is projected to grow at a CAGR of 8.05%.

MRO Distribution Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | MRO Distribution Market |

| Market Size in 2023 | USD 641.87 Billion |

| Market Forecast in 2032 | USD 801.61 Billion |

| Growth Rate | CAGR of 2.50% |

| Number of Pages | 231 |

| Key Companies Covered | Ferguson Enterprises, Motion Industries, Kaman Industrial Technologies, Grainger, Lawson Products, MSC Industrial Supply, Kimball Midwest, Applied Industrial Technologies, Winsupply, Fastenal, HD Supply, W.W. Grainger, McMaster-Carr, Rexel USA, Airgas, and others. |

| Segments Covered | By End-User, By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

MRO Distribution Market: Regional Analysis

The US will lead the North American region during the projection period

The global MRO distribution market will be led by North America during the forecast period. More than 50% of the regional revenue is anticipated to be contributed by the US. The country is headquartered by some of the largest and most dominant MRO distributors with a global presence. In July 2024, US-based Vallen Distribution, a leading MRO distributor, announced the acquisition of Eastland Engineering Supply (EES), owned by MML Growth Capital Partners Ireland.

With this move, the company plans to expand its global reach. EES is currently Ireland’s largest company of its kind and has been in the market for over 3 decades. In February 2024, W.W. Grainger, another important regional player, announced its plans to invest in a 1.2 million-square-foot distribution center (DC) in Texas. The facility is expected to become operational by 2026 and is called Houston Texas Distribution Center.

Europe is an important market for MRO distribution. Countries such as the UK, Germany, and France are the leading regional revenue generators. For instance, the Würth Industry North America (WINA) of the Germany-based Würth Additive Group launched a new inventory management product called Digital Inventory Services (DIS). The software will allow secure transmission of Intellectual Property (IP) across locations, enabling controlled distribution and quality assurance checks.

MRO Distribution Market: Competitive Analysis

The global MRO distribution market is led by players like:

- Ferguson Enterprises

- Motion Industries

- Kaman Industrial Technologies

- Grainger

- Lawson Products

- MSC Industrial Supply

- Kimball Midwest

- Applied Industrial Technologies

- Winsupply

- Fastenal

- HD Supply

- W.W. Grainger

- McMaster-Carr

- Rexel USA

- Airgas

The global MRO distribution market is segmented as follows:

By End-User

- Machinery & Equipment

- Food & Beverages

- Pharmaceuticals

- Metals

- Electronics

- Chemicals

- Apparel & Footwear

- Others

By Product

- Bearings & Power Transmission

- Packaging Supplies

- Pipes

- Electrical Items

- Valves & Fittings

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

MRO distribution is the process of designing and implementing supply chains for the maintenance, repair, and operations (MRO) of industrial facilities, machinery, and systems.

The global MRO distribution market is expected to be driven by the surge in infrastructure development projects across the globe.

According to study, the global MRO distribution market size was worth around USD 641.87 billion in 2023 and is predicted to grow to around USD 801.61 billion by 2032.

The CAGR value of the MRO distribution market is expected to be around 2.50% during 2024-2032.

The global MRO distribution market will be led by North America during the forecast period.

The global MRO distribution market is led by players like Ferguson Enterprises, Motion Industries, Kaman Industrial Technologies, Grainger, Lawson Products, MSC Industrial Supply, Kimball Midwest, Applied Industrial Technologies, Winsupply, Fastenal, HD Supply, W.W. Grainger, McMaster-Carr, Rexel USA, and Airgas.

The report explores crucial aspects of the MRO distribution market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed