Mutual Fund Assets Market Size, Share, Growth, Trends, and Forecast 2030

Mutual Fund Assets Market By Investment Strategy Analysis(Equity Strategy, Fixed Income Strategy, Multi-asset, Balanced Strategy, Sustainable Strategy, Money Market Strategy, Others), By Investor Type Analysis(Institutional, Individual), By Distribution Channel Analysis(Banks, Financial Advisors, Broker-dealer, Direct Sales, Others), and by region: Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2023-2030

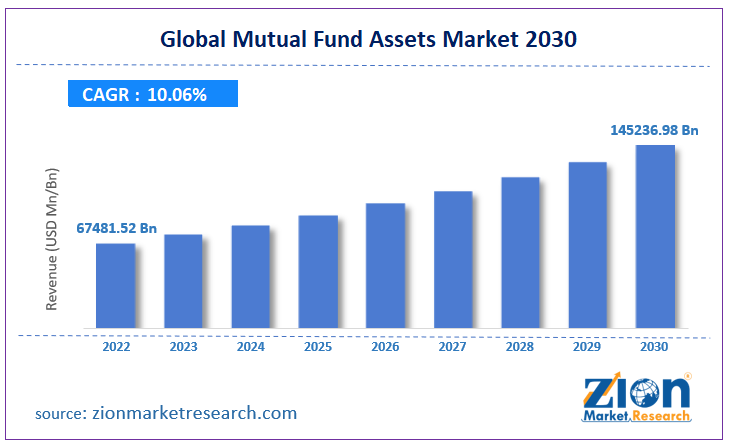

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 67.48 Trillion | USD 145.23 Trillion | 10.06% | 2022 |

Description

The global mutual fund assets market size was worth around USD 67481.52 Billion in 2022 and is predicted to grow to around USD 145236.98 Billion by 2030 with a compound annual growth rate (CAGR) of roughly 10.06% between 2023 and 2030.

Request Free SampleGlobal Mutual Fund Assets Market: Overview

Request Free SampleGlobal Mutual Fund Assets Market: Overview

A mutual fund offers one of the best investment alternatives to small investors. A mutual fund is like a financial vehicle that is made up of money collected from several investors. These funds or money is utilized to invest in securities like bonds, stocks, money market instruments, and other assets. These mutual funds are handled by professional money managers who study and distribute the funds' assets accordingly and try to produce capital expansions or income for the fund's investors. Mutual fund assets provide a convenient way to invest in mutual funds, hence high growth in mutual fund investment has been observed in the last decade.

Global Mutual Fund Assets Market: Growth Factors

The global mutual fund assets market is growing at a significant rate. The factors contributing to the growth of the market include rising disposable income in countries such as China & India in the Asia Pacific region, increasing awareness about the healthy investments in employee working in the private sector, and growing investments by major players in the market. Additionally, government initiatives in many countries are also anticipated to spur the growth of the mutual fund assets market over the forecast period. People around the world are looking for investment options that can assist them to handle financial burden within a short period or assist after retirement which is why people around the world are now heavily investing in mutual funds. A mutual fund offers several ways of investment which is why the investment in this sector is increasing at a rapid rate, thereby fueling the growth of the mutual fund assets market.

On the other hand, investment risk associated with share market stability may hamper the global mutual fund assets market growth over the forecast period. However, safe transactions offered by many market players in this industry and growing acceptance toward market risk is anticipated to provide better growth opportunities for the growth of the market.

COVID-19 pandemic situation has severely affected the global economy and its effect can be seen on share markets. Due to the halt on industrial activities, investments in mutual funds were reduced at a significant rate. Furthermore, the shutdown of many sectors resulted in heavy lay off; this, in turn, resulted in a shortage of funds from new investors. Overall, due to global economic crises, mutual fund assets market is currently going through a rough phase. However, as the economy gets back to its normal track more investment in this sector is expected to rise at a significant rate.

Global Mutual Fund Assets Market: Segmentation

The global mutual fund assets market is bifurcated into fund type, distribution channel, investor type, ad region. Based on the fund type, the global mutual fund assets market is divided into bond funds, money market funds, equity funds, and hybrid & other funds. Based on the distribution channel, the global mutual fund assets market is categorized into financial advisors or brokers, banks, direct sellers, and others. The investor type segment is split into individual and institutional.

By Investment Strategy Analysis

- Equity Strategy

- Fixed Income Strategy

- Multi-asset

- Balanced Strategy

- Sustainable Strategy

- Money Market Strategy

- Others

By Investor Type Analysis

- Institutional

- Individual

By Distribution Channel Analysis

- Banks

- Financial Advisors

- Broker-dealer

- Direct Sales

- Others

Mutual Fund Assets Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mutual Fund Assets Market |

| Market Size in 2022 | USD 67.48 Trillion |

| Market Forecast in 2030 | USD 145.23 Trillion |

| Growth Rate | CAGR of 10.06% |

| Number of Pages | 215 |

| Key Companies Covered | Capital Group, BlackRock, Inc., Citigroup Inc., BNP Paribas Mutual Fund, Goldman Sachs, PIMCO, JPMorgan Chase & Co., State Street Corporation, Morgan Stanley, and The Vanguard Group, Inc, among others. |

| Segments Covered | By Investment Strategy Analysis, By Investor Type Analysis, By Distribution Channel Analysis, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Mutual Fund Assets Market: Regional Analysis

North America is anticipated to be the highest revenue generator in the global mutual fund assets market. Factors such as the presence of a large number of investors, strong economical hold over the global market, and presence of key mutual fund players in the region are expected to fuel the mutual fund assets market growth in North America over the forecast period. Europe is expected to keep its market dominance followed by North America in terms of market share during the forecast period. However, the Asia Pacific is anticipated to be the most lucrative market over the forecast period. Factors expected to contribute to rapid growth of the market in this region include a rise in disposable income, growing awareness about investments in mutual funds, and a rapidly growing economy.

Global Mutual Fund Assets Market: Competitive Players

Major players operating in the global mutual fund assets market are

- Capital Group

- BlackRock, Inc.

- Citigroup Inc.

- BNP Paribas Mutual Fund

- Goldman Sachs

- PIMCO

- JPMorgan Chase & Co.

- State Street Corporation

- Morgan Stanley

- and The Vanguard Group, Inc

- among others.

Global Mutual Fund Assets Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

The report analyzes the global mutual fund assets market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the mutual fund assets industry.

Table Of Content

Choose License Type

FrequentlyAsked Questions

The global mutual fund assets market is growing at a significant rate. The factors contributing to the growth of the market include, rising disposable income in countries such as China & India in the Asia Pacific region, increasing awareness about the healthy investments in employee working in the private sector, and growing investments by major players in the market. Furthermore, the safe transactions offered by many market players in this industry and growing acceptance toward market risk is anticipated to provide better growth opportunities for the growth of the market.

Major players operating in the global mutual fund assets market are Capital Group, BlackRock, Inc., Citigroup Inc., BNP Paribas Mutual Fund, Goldman Sachs, PIMCO, JPMorgan Chase & Co., State Street Corporation, Morgan Stanley, and The Vanguard Group, Inc., among others.

North America is anticipated to be the highest revenue generator in the global mutual fund assets market. Factors such as the presence of a large number of investors, strong economical hold over the global market, and presence of key mutual fund players in the region are expected to fuel the mutual fund assets market growth in North America over the forecast period.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed