Natural Organic Cosmetics Market Size, Share, Trends, Growth 2032

Natural Organic Cosmetics Market By End-User (Female, Male, and Unisex), By Product Type (Lip Products, Face Products, Hair Products, and Others), By Means of Distribution (Non Store-Based and Store-Based), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

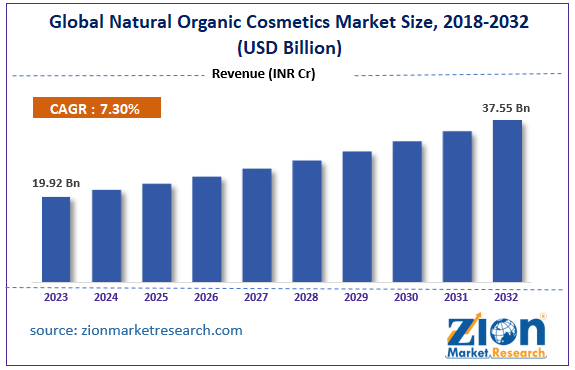

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 19.92 Billion | USD 37.55 Billion | 7.30% | 2023 |

Natural Organic Cosmetics Industry Prospective:

The global natural organic cosmetics market size was worth around USD 19.92 billion in 2023 and is predicted to grow to around USD 37.55 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.30% between 2024 and 2032.

Natural Organic Cosmetics Market: Overview

Natural organic cosmetic products are beauty items that do not contain any form of chemical or petrochemical ingredients. There is a fine line that distinguishes natural cosmetics from organic counterparts. Although these two types of products may deliver the perception that they are the same, both these categories are separate. The distinction lies in the ingredients used in formulations and the origin of the ingredients. Natural cosmetics are items that are made using natural products originating from minerals, animals, or plants. However, in natural products, there is a 5% window for the use of chemical ingredients. A key point to note is the permissible list of chemicals that can be used in natural cosmetics.

On the other hand, organic products do not have any scope for chemical ingredients. They are made of naturally derived ingredients and do not accept the use of genetically modified organisms (GMOs). Simply put, natural products may or may not be organic in nature whereas all forms of organic cosmetic items can be considered natural. Natural cosmetic items are regulated through regional laws however, there have been several incidents of companies working around the legal mandates and falsely promoting the items as natural. Organic cosmetics follow strict regulatory and implementing laws. Natural organic cosmetics are items that fit both the criteria and can be considered as a special segment of the clean products industry.

Key Insights:

- As per the analysis shared by our research analyst, the global natural organic cosmetics market is estimated to grow annually at a CAGR of around 7.30% over the forecast period (2024-2032)

- In terms of revenue, the global natural organic cosmetics market size was valued at around USD 19.92 billion in 2023 and is projected to reach USD 37.55 billion, by 2032.

- The market is projected to grow at a significant rate due to the rise in the number of players offering natural organic products

- Based on end-user segmentation, the female segment was predicted to show maximum market share in the year 2023

- Based on means of distribution segmentation, the store-based segment was the leading segment in 2023

- On the basis of region, Asia-Pacific was the leading revenue generator in 2023

Request Free Sample

Request Free Sample

Natural Organic Cosmetics Market: Growth Drivers

Rise in the number of players offering natural organic products will drive market demand

The global natural organic cosmetics market is expected to grow due to the rise in the number of players offering natural organic items. During the early 2000s, cosmetic items made using petrochemicals such as oxybenzone, phthalates, or parabens became extremely common and enjoyed subsequent popularity. These solutions with chemical ingredients delivered beyond customer expectations and hence enjoyed acceptance among a large part of the consumers. However, the last decade has become influential in highlighting the impact of chemical cosmetics on the skin of customers when used over longer periods. Several studies were published linking certain chemicals with serious health implications including neurological harm, cancer, delay in development, and reproductive concerns. This led to the promotion of an emerging class of cosmetics providers that used only natural organic ingredients. Since these items do not contain chemicals in any form, they cannot be harmful to the users.

In some cases, the reactions of chemical cosmetics are milder such as in the form of skin irritation and allergies. However, such risks are also eliminated in the case of natural organic cosmetics. As more players have entered the industry and initiated offering products across the range, more customers opt for natural and safe cosmetic items. In October 2023, popular color cosmetic brand CMYK announced the launch of 7 new vegan lipsticks through its ‘limitless natural’ range with each product priced at USD 28. In May 2023, Colorbar, another cosmetic giant launched an eco-friendly and first-of-its-kind 3-in-1 lipstick range named ‘Take Me As I Am’.

Increased consumer awareness about the ecological impact of environmentally-friendly products will produce more revenue

During the forecast period, the global natural organic cosmetics market will be further impacted by the rising awareness among customers about the several ecological and personal benefits associated with chemical-free skincare and hair care products. A recent official report indicated that the natural cosmetics market in India was growing 2.49% times faster than its chemical counterpart.

Natural Organic Cosmetics Market: Restraints

False claims by companies and loopholes in labeling protocols may limit market expansion

The global industry for natural organic cosmetics is expected to be limited due to the existing loopholes in the labeling regulations in several parts of the world. For instance, certain brands use the word ‘Natural’ on the outer packaging. Customers with limited information and knowledge may be unable to distinguish between genuine natural organic products and falsely claimed items.

A recent highlighting of the issue of false marketing was observed when, in March 2024, Sephora, a leading retailer of cosmetic products, was proven not guilty in an alleged proposition stating that the products marketed under ‘Clean at Sephora’ were making false claims.

Natural Organic Cosmetics Market: Opportunities

Rise in customers with specific needs in terms of cosmetic products will generate higher growth opportunities

During the forecast period, the global natural organic cosmetics market is expected to gain high momentum due to the growing number of consumers who are seeking specific products, especially in terms of cosmetic items. Consumer demands have evolved over the years driven by the large-scale availability of information facilitated by the universal Internet. This has also contributed to higher consumer alertness.

The growing number of cosmetic providers in the market has aided customers to become more confident in their choices resulting in buyers opting for products that meet their specific needs. The growth in such consumer groups will likely promote higher demand for natural organic cosmetic items.

Stringency showcased by regulatory bodies in ensuring ingredient and formulation transparency will further benefit the industry players

The global industry for natural organic cosmetics will generate high revenue as a result of regulatory bodies undertaking more stringent regulatory and implementation policies defining guidelines for companies to maintain transparency. Customers have to be informed about the production process, resource origin, ingredients, the exact quantities of the ingredients, and other aspects of the supply and production chain. The Modernization of Cosmetics Regulation Act of 2022 (MoCRA) replacing the older Cosmetic Act is a prime example of one such step.

Natural Organic Cosmetics Market: Challenges

Competition from other alternatives and their higher market share will challenge market expansion

The global natural organic cosmetics market will be challenged during the projection period by the presence of a large market share of competing products. The global cosmetic industry is mainly dominated by products made using chemical products.

Additionally, there is a large market for either natural or organic cosmetics. It is difficult to gain access to products that are natural and organic thus limiting the market growth rate.

Natural Organic Cosmetics Market: Segmentation

The global natural organic cosmetics market is segmented based on end-user, product type, means of distribution, and region.

Based on end-user, the global market segments are female, male, and unisex. In 2023, the highest growth was observed in the female segment. The cosmetic industry primarily serves the female population as historically women are known to use more types of cosmetic items. In recent times, the male segment has witnessed a higher growth rate, especially in the entertainment segment. Official reports indicate that nearly 80% of women globally use some form of cosmetic items.

Based on product type, the global natural organic cosmetics industry is divided into lip products, face products, hair products, and others.

Based on means of distribution, the global market divisions are non-store-based and store-based. In 2023, the highest demand was observed in the non-store-based segment. Customers prefer to buy cosmetic items in person since it helps them understand the exact color, texture, and overall quality of the products. The high influx of new product launches has encouraged more customers to visit offline stores for purchase. Official research reports indicate that more than 50% of women buy cosmetics in stores.

Natural Organic Cosmetics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Natural Organic Cosmetics Market |

| Market Size in 2023 | USD 19.92 Billion |

| Market Forecast in 2032 | USD 37.55 Billion |

| Growth Rate | CAGR of 7.30% |

| Number of Pages | 216 |

| Key Companies Covered | Dr. Hauschka, Burt's Bees, Juice Beauty, The Body Shop, Herbivore Botanicals, Lush, 100% Pure, Weleda, Kjaer Weis, Tata Harper Skincare, ILIA Beauty, Beautycounter, Alima Pure, RMS Beauty, Pacifica Beauty., and others. |

| Segments Covered | By End-User, By Product Type, By Means of Distribution, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Natural Organic Cosmetics Market: Regional Analysis

Asia-Pacific to register the highest growth rate during the forecast period

The natural organic cosmetics market will be dominated by Asia-Pacific during the forecast period. The reason for the higher regional market growth rate is the strong presence of the cosmetics manufacturing ecosystem in China. Additionally, it is one of the largest consumer markets in the world. China manufactures large quantities of cosmetic products including natural organic items. The rise in middle-income consumers along with the higher sale of products through e-commerce portals has resulted in Asia-Pacific dominating over the largest part of the global industry share. India is witnessing a rise in consumer awareness with the introduction of several domestic players experimenting with essential ingredients.

Asian countries are popular for using naturally derived resources for several consumer products including cosmetic items. The increased focus of international players toward Asian countries is expected to help the region gain higher revenue in the coming years. Europe is the second-largest cosmetics market globally. It has the presence of large cosmetic giants that dominate the global stage. The increased domestic demand for natural organic cosmetics and the need to remain competitive will encourage European players to experiment with natural organic ingredients in cosmetic items.

Natural Organic Cosmetics Market: Competitive Analysis

The global natural organic cosmetics market is led by players like:

- Dr. Hauschka

- Burt's Bees

- Juice Beauty

- The Body Shop

- Herbivore Botanicals

- Lush

- 100% Pure

- Weleda

- Kjaer Weis

- Tata Harper Skincare

- ILIA Beauty

- Beautycounter

- Alima Pure

- RMS Beauty

- Pacifica Beauty.

The global natural organic cosmetics market is segmented as follows:

By End-User

- Female

- Male

- Unisex

By Product Type

- Lip Products

- Face Products

- Hair Products

- Others

By Means of Distribution

- Non Store-Based

- Store-Based

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Natural organic cosmetic products are beauty items that do not contain any form of chemical or petrochemical ingredients.

The global natural organic cosmetics market is expected to grow due to the rise in the number of players offering natural organic items.

According to study, the global natural organic cosmetics market size was worth around USD 19.92 billion in 2023 and is predicted to grow to around USD 37.55 billion by 2032.

The CAGR value of natural organic cosmetics market is expected to be around 7.30% during 2024-2032.

The natural organic cosmetics market will be dominated by Asia-Pacific during the forecast period.

The global natural organic cosmetics market is led by players like Dr. Hauschka, Burt's Bees, Juice Beauty, The Body Shop, Herbivore Botanicals, Lush, 100% Pure, Weleda, Kjaer Weis, Tata Harper Skincare, ILIA Beauty, Beautycounter, Alima Pure, RMS Beauty, and Pacifica Beauty.

The report explores crucial aspects of the natural organic cosmetics market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed