Neo and Challenger Bank Market Size, Share, Trends, Growth 2032

Neo and Challenger Bank Market By Type (Neo Bank and Challenger Bank) and By Application (Personal and Business): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

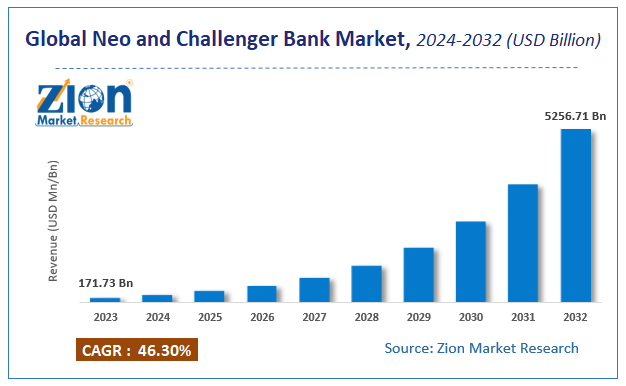

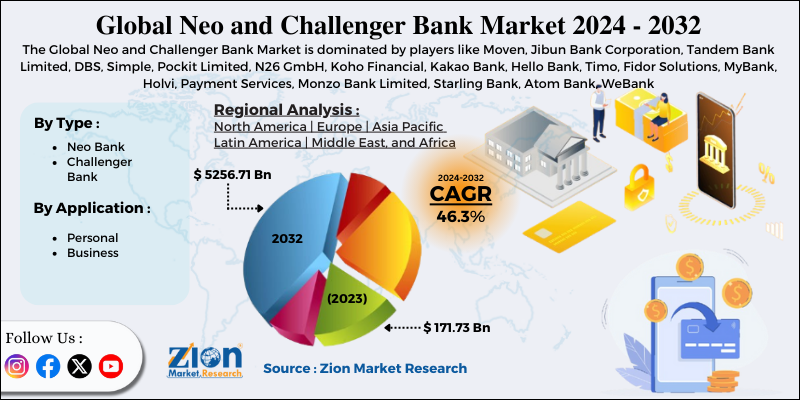

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 171.73 Billion | USD 5256.71 Billion | 46.3% | 2023 |

Neo and Challenger Bank Market Insights

According to a report from Zion Market Research, the global Neo and Challenger Bank Market was valued at USD 171.73 Billion in 2023 and is projected to hit USD 5256.71 Billion by 2032, with a compound annual growth rate (CAGR) of 46.3% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Neo and Challenger Bank Market industry over the next decade.

Neo and Challenger Bank Market Size & Overview

The report offers valuation and analysis of Neo and Challenger Bank market on a global as well as regional level. The study offers a comprehensive assessment of the industry competition, limitations, sales estimates, avenues, current & emerging trends, and industry-validated market data. The report offers historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on value (USD Billion).

The neo and challenger banks are two different terminologies. Challenger banks aim to create a new pricing model and offer data-driven banking experience to become fully-licensed banks, whereas neo banks offer a mobile-first banking experience in cooperation with a traditional bank. Some banks use novel technology to deliver banking services with a more innovative and cost-effective way. The new market players might get banking licenses under the present regulatory systems and own the client relationship or might partner with traditional banks.

Neo and Challenger Bank Market: Growth Drivers

Neobank is a type of digital bank that performs various banking operations online without having any branches established at physical locations. In addition to this, Neobank is consumer-centric and offer personalized online services to its customers. Precisely, these banks are FinTech firms offering only internet-based financial services to tech-savvy consumers. They provide value-added banking services, insurance, remittances, mobile payment services, money transfer services, and mortgage services to its customers online. Some of the examples of Neobank include Google Pay, Stash, PhonePe, Pockit, Cleo, Karat, Qube, and PayTm.

On other hand, Challenger banks are small and currently created retail financial institutions operating in the countries like the UK. They are the FinTech firms performing online-only operations without having any physical presence across the globe. These banks offer services like credit cards, mobile banking, lending, purchase & sale of cryptocurrency, and insurance products to the end-users.

Features like easy accessibility, simplicity, speed, cost-effectiveness, and improved functionality offered to the customers by neo and challenger banks are driving the neo and challenger bank market globally. The wide variety of products offered by a neo and challenger bank is almost limitless, which is also expected to fuel the neo and challenger bank market development over the forecast time period. Additionally, the growing smartphone penetration in both developed and developing countries globally is also boosting the demand for online and app-based banking. However, to convince customers to shift from traditional bank to app-based banking is a difficult task, which may hamper this global market, as a large number of customers do not find mobile solutions helpful and would rather prefer to have a face-to-face interaction or a telephonic conversation.

Easy & quick access to the online banking services, real-time financial transactions, personalized online financial services, and high rate of interest offered by neo and challenger banks are expected to provide new growth avenues for the market over the forthcoming years. Apart from this, escalating smartphone demand and onset of innovative technologies like IoT, Big Data, and AI are likely to serve as major tools of growth for the neo and challenger bank market over the forthcoming years. In addition to this, huge unexplored market growth potential in emerging economies is going to be one of the major factors that will determine the business growth over the next couple of years.

Furthermore, service industry has dominated the overall economy and has accounted majorly towards GDP share of both developed countries as well as developing economies. Moreover, Neo and challenger bank industry is no exception to this and its online services have resulted in value creation for the customers. This, in turn, is likely to result in immense business growth over the years ahead.

Neo and Challenger Bank Market: Segmentation

The global neo and challenger bank market is segmented on the basis of type and application.

By type, the global neo and challenger bank market includes neo and challenger banks. The neo bank segment dominated the global market in 2018, in terms of revenue share. This segment is also expected to register a high CAGR over the forecast time period. Personal and business comprise the application segment of this global market. The business segment dominated the global market in terms of revenue in 2018.

Neo and Challenger Bank Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Neo and Challenger Bank Market |

| Market Size in 2023 | USD 171.73 Billion |

| Market Forecast in 2032 | USD 5256.71 Billion |

| Growth Rate | CAGR of 46.3% |

| Number of Pages | 110 |

| Key Companies Covered | Moven, Jibun Bank Corporation, Tandem Bank Limited, DBS, Simple, Pockit Limited, N26 GmbH, Koho Financial, Kakao Bank, Hello Bank, Timo, Fidor Solutions, MyBank, Holvi, Payment Services, Monzo Bank Limited, Starling Bank, Atom Bank, WeBank |

| Segments Covered | By Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Neo and Challenger Bank Market: Regional Analysis

The growth of the regional market over the forecast timespan is due to massive presence of these financial institutions in the countries like the UK. Apart from this, the country possesses largest number of small & medium-sized enterprises in Europe and is succeeded by Germany.

By region, the European neo and challenger bank market is anticipated to remain the leading region over the forecast time period. This regional dominance can be attributed to the fact that most of these banks are based in UK, which is the hub for neo and challenger banks. Furthermore, UK has the largest number of SMEs in Europe (5.2 million), followed by Germany. Additionally, the U.S. and China dominate the global market with 28 million and 42 million SMEs, respectively.

Key Market Players & Competitive Landscape

Key players leveraging the market growth include

- Moven

- Jibun Bank Corporation

- Tandem Bank Limited

- DBS

- Simple

- Pockit Limited

- N26 GmbH

- Koho Financial

- Kakao Bank

- Hello Bank

- Timo

- Fidor Solutions

- MyBank

- Holvi Payment Services

- Monzo Bank Limited

- Starling Bank

- Atom Bank

- WeBank.

This report segments the global neo and challenger bank market into:

Global Neo and Challenger Bank Market: Type Analysis

- Neo Bank

- Challenger Bank

Global Neo and Challenger Bank Market: Application Analysis

- Personal

- Business

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Operating without any physical branches, neo banks are entirely digital ones. They offer banking services just via mobile apps and web sites.

Demand for digital banking solutions is resulting from growing use of cellphones and internet penetration. Neo and challenger banks are positioned to profit from the trend towards mobile-first offerings.

According to a report from Zion Market Research, the global Neo and Challenger Bank Market was valued at USD 171.73 Billion in 2023 and is projected to hit USD 5256.71 Billion by 2032.

According to a report from Zion Market Research, the global Neo and Challenger Bank Market a compound annual growth rate (CAGR) of 46.3% during the forecast period 2024-2032.

The growth of the regional market over the forecast timespan is due to massive presence of these financial institutions in the countries like the UK. Apart from this, the country possesses largest number of small & medium-sized enterprises in Europe and is succeeded by Germany.

Moven, Jibun Bank Corporation, Tandem Bank Limited, DBS, Simple, Pockit Limited, N26 GmbH, Koho Financial, Kakao Bank, Hello Bank, Timo, Fidor Solutions, MyBank, Holvi, Payment Services, Monzo Bank Limited, Starling Bank, Atom Bank, WeBank

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed