Global Next Generation Sequencing (NGS) Market Size, Share, Analysis, Trends, Growth Report, 2030

Global Next Generation Sequencing (NGS) Market By Offering Type (Instruments, Consumables, and Services), By Application (Diagnostics, Biomarker Discovery, Precision Medicine, Drug Discovery, Agriculture & Animal Research, and Other Applications) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

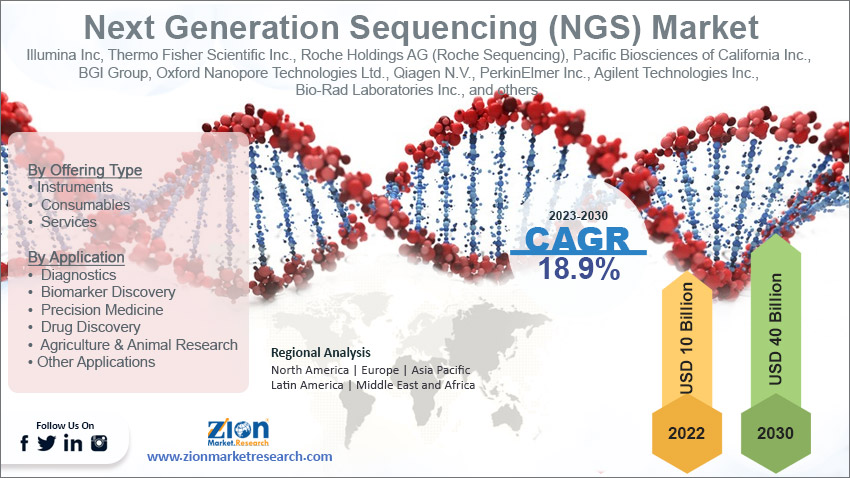

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10 Billion | USD 40 Billion | 18.9% | 2022 |

Next Generation Sequencing (NGS) Industry Prospective:

The global next generation sequencing (NGS) market size was worth around USD 10 billion in 2022 and is predicted to grow to around USD 40 billion by 2030 with a compound annual growth rate (CAGR) of roughly 18.9% between 2023 and 2030.

Global Next Generation Sequencing (NGS) Market: Overview

Next Generation Sequencing (NGS) has transformed genomic research by sequencing DNA and RNA quickly and cheaply. Unlike Sanger sequencing, NGS can sequence millions of DNA fragments simultaneously, allowing researchers to study genomes, transcriptomes, and epigenomes at unprecedented speed and depth. This cutting-edge approach has accelerated genomics research, helping to understand genetic diversity, disease-linked mutations, and complex biological processes.

Illumina, Ion Torrent, and Pacific Biosciences use synthesis and ligation sequencing technologies. This cutting-edge technology affects clinical diagnostics, personalized medicine, and agriculture. NGS's ability to generate massive amounts of sequencing data has enabled groundbreaking projects like the Human Genome Project, solidifying its role as a vital genomics tool and a key driver of advances in medicine, agriculture, and evolutionary biology.

Key Insights

- As per the analysis shared by our research analyst, the global next generation sequencing (NGS) industry is estimated to grow annually at a CAGR of around 18.9% over the forecast period (2023-2030).

- In terms of revenue, the global next generation sequencing (NGS) market size was valued at around USD 10 billion in 2022 and is projected to reach USD 40 billion, by 2030.

- The global next generation sequencing (NGS) market is projected to grow at a significant rate due to the growing precision medicine usage and the expansion of NGS applications in clinical diagnosis and research.

- Based on offering type segmentation, instruments were predicted to hold maximum market share in the year 2022.

- Based on application segmentation, diagnostics was the leading revenue generator in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Global Next Generation Sequencing (NGS) Market: Growth Drivers

Increasing demand for precision medicine to boost market growth

NGS technology offers full genomic profiling, permitting researchers and physicians to uncover genetic variants linked to illnesses at the individual level. This advancement is critical for personalizing treatment regimens based on a patient's unique genetic composition, improving therapeutic efficacy, and reducing side effects. As the healthcare industry shifts towards increasingly personalized approaches, the demand for Next Generation Sequencing (NGS) technology in precision medicine applications continues to rise. This has propelled NGS to the forefront of diagnostics and targeted medicine advancements. Its expanding range of applications beyond genomics research has also contributed to its growth in the industry. NGS is now rapidly utilized in various fields such as cancer treatment, infectious diseases, rare genetic disorders, and reproductive health. Thanks to its versatility, rapid pace, and affordability, NGS has become a crucial tool in drug development, biomarker discovery, and agricultural genomics.

The continuous progress of NGS platforms, boasting improved precision and reduced sequencing expenses, has greatly expedited its usage in numerous fields, solidifying its role as a prominent force driving the ever-changing landscape of genomic technology.

Global Next Generation Sequencing (NGS) Market: Restraints

Complexity and challenges associated with data interpretation and analysis hamper market growth

For effective interpretation of the massive amounts of data generated by NGS technology, specialized bioinformatics tools and expertise are required. The complexities of processing genomic data, such as identifying important variations, interpreting clinical relevance, and integrating with other biological data, provide significant obstacles. The necessity for competent bioinformaticians and computing resources, as well as standardized data analysis pipelines, might stymie NGS adoption, particularly in clinical settings where correct and rapid findings are critical. Addressing these issues is critical for realizing NGS's full promise in providing actionable insights for tailored treatment and research. Another key impediment is the accompanying high upfront expenditures and recurring expenses. While NGS technologies provide unparalleled potential, the initial financial expenditure necessary for purchase is prohibitively expensive.

These budgetary constraints may limit NGS access to smaller research institutes and healthcare facilities, hence affecting the democratization of genetic research and personalized treatment. Efforts to lower the total cost of NGS, increase cost-effectiveness, and encourage resource-sharing programs are critical for overcoming this barrier and guaranteeing widespread use in a variety of research and clinical contexts.

Global Next Generation Sequencing (NGS) Market: Opportunities

Continuous evolution and expansion of applications to offer growth opportunities

By providing full genetic information for illness diagnosis, prognosis, and therapy selection, NGS technologies have the potential to change healthcare. The growing understanding of illnesses' genetic foundation, together with advances in bioinformatics and data interpretation, positions NGS as a strong tool for enabling more precise and individualized clinical decision-making. As sequencing costs continue to fall and technology becomes more accessible, there is a huge possibility for NGS to become a common element of clinical workflows, leading to improved patient outcomes and a paradigm shift toward precision medicine.

Furthermore, incorporating NGS into population-scale genomics programs and efforts is a game changer for large-scale genomic research. National biobanks, precision health initiatives, and research collaborations that use NGS can help us understand population genetics, disease prevalence, and treatment responses better. This plethora of genetic data may be used to develop new biomarkers, advance medication research, and improve public health policies. Because of its scalability and efficiency, next-generation sequencing (NGS) is a critical facilitator for such large-scale endeavors, with the potential for significant discoveries and improvements in our understanding of human biology and health.

Global Next Generation Sequencing (NGS) Market: Challenges

Ongoing issues of data management and analysis might challenge the market growth

The massive amount of data generated by NGS systems offers significant storage, processing, and interpretation issues. The complexity of genetic data needs modern bioinformatics tools and competent workers for effective analysis, and a lack of defined techniques can result in discrepancies in results across laboratories and platforms. As the demand for NGS grows, there is an increasing need for effective data management techniques, such as data storage solutions, computing infrastructure, and standardized analytic pipelines, to assure the reliability and repeatability of NGS results. Overcoming these obstacles is critical to enhancing the value of NGS in a variety of applications ranging from clinical diagnostics to research. Another challenging obstacle is the ethical and regulatory environment around genetic data.

Privacy issues about storing and sharing sensitive genomic information, along with developing regulatory frameworks, provide roadblocks to NGS adoption, particularly in clinical and research contexts. To strike a balance between promoting data sharing for scientific advancement and respecting individuals' privacy rights, continual efforts in defining rigorous ethical norms and maintaining compliance with shifting rules are required. Addressing these issues is critical to realizing NGS's full promise in genomics research and healthcare applications.

Global Next Generation Sequencing (NGS) Market: Segmentation

The global next generation sequencing (NGS) market is segmented based on offering type, application, and region.

Based on offering type, the global industry segments are instruments, consumables, and services. The global market is presently dominated by the instruments sector, which is being pushed by the increased use of sophisticated sequencing platforms like Illumina and others. The expanding uses of genome sequencing in research, diagnostics, and personalized medicine are driving demand for cutting-edge NGS tools. While consumables and services are important components of the NGS workflow, the significant initial capital investment associated with instrument acquisitions adds to the instruments segment's dominance in the current market environment.

Based on application the global next generation sequencing (NGS) industry is categorized as diagnostics, biomarker discovery, precision medicine, drug discovery, agriculture & animal research, and other applications. Diagnostics was the largest shareholder sector in the global market. The increasing integration of NGS technology in clinical diagnostics for discovering genetic mutations, assessing disease indicators, and supporting individualized treatment methods is ascribed to its significance. NGS diagnostic applications are critical in fields such as cancer, infectious illnesses, and genetic disorders, and they contribute considerably to the industry's growth. NGS's accuracy and depth of genetic information make it a great tool for enhancing diagnostic capabilities, fueling its dominance in the diagnostics section of the global NGS market.

Next Generation Sequencing (NGS) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Next Generation Sequencing (NGS) Market |

| Market Size in 2022 | USD 10 Billion |

| Market Forecast in 2030 | USD 40 Billion |

| Growth Rate | CAGR of 18.9% |

| Number of Pages | 214 |

| Key Companies Covered | Illumina Inc, Thermo Fisher Scientific Inc., Roche Holdings AG (Roche Sequencing), Pacific Biosciences of California Inc., BGI Group, Oxford Nanopore Technologies Ltd., Qiagen N.V., PerkinElmer Inc., Agilent Technologies Inc., Bio-Rad Laboratories Inc., and others. |

| Segments Covered | By Offering Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Next Generation Sequencing (NGS) Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

The Asia Pacific region is expected to dominate the global next generation sequencing (NGS) industry during the projected period, owing to a number of factors that contribute to its rapid expansion. One significant factor is the region's expanding use of NGS technology in genomics research and clinical applications. Rising investments in healthcare infrastructure, R&D, and the incorporation of genetics into clinical procedures are promoting the wider usage of NGS systems. Furthermore, the Asia Pacific area is seeing an increase in population genomics projects, precision medicine programs, and collaborative research activities, which is boosting demand for NGS technology.

Furthermore, the Asia Pacific region's big and diversified patient population generates a sizable business for NGS in diagnostics and customized treatment. Asia Pacific is a prominent participant in the global NGS market due to the region's dedication to increasing life sciences research, as well as government programs encouraging genomics and biotechnology. With an increasing emphasis on precision healthcare, the Asia Pacific region is likely to drive advancements and investments in NGS applications, positioning it as the industry's leader throughout the forecast period.

Key Developments

July 2023, With the release of the QIAseq Normalizer kits, Qiagen expanded its next-generation sequencing services. This development is intended to speed up the process of balancing DNA concentrations across different next-generation sequencing libraries.

May 2023: Telesis Bio reached a critical milestone in May 2023 when it began commercial shipments of their BioXp NGS Library Prep kit designed for plasmid sequencing, demonstrating the company's dedication to improving genomic research.

In March 2023, through a strategic technological integration deal with SOPHiA genetics, Qiagen strengthened its position in the genomics environment. This cooperation intends to seamlessly integrate QIAseq reagent technology into the SOPHiA DDMTM digital analytics platform, boosting next-generation sequencing capabilities through a synergistic approach.

Global Next Generation Sequencing (NGS) Market: Competitive Analysis

The global next generation sequencing (NGS) market is dominated by players like:

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Roche Holdings AG (Roche Sequencing)

- Pacific Biosciences of California, Inc.

- BGI Group

- Oxford Nanopore Technologies, Ltd.

- Qiagen N.V.

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

The global next generation sequencing (NGS) market is segmented as follows:

By Offering Type

- Instruments

- Consumables

- Services

By Application

- Diagnostics

- Biomarker Discovery

- Precision Medicine

- Drug Discovery

- Agriculture & Animal Research

- Other Applications

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Next generation sequencing (NGS) has transformed genomic research by enabling high-throughput and low-cost DNA and RNA sequencing. Unlike traditional Sanger sequencing, next-generation sequencing (NGS) allows for the parallel sequencing of millions of DNA fragments, allowing researchers to investigate complete genomes, transcriptomes, and epigenomes at unprecedented speed and depth.

The global next generation sequencing (NGS) market cap may grow owing to the due to the growing precision medicine usage and the expansion of NGS applications in clinical diagnosis and research.

According to study, the global next generation sequencing (NGS) market size was worth around USD 10 billion in 2022 and is predicted to grow to around USD 40 billion by 2030.

The CAGR value of the global next generation sequencing (NGS) market is expected to be around 18.9% during 2023-2030.

The global next generation sequencing (NGS) market growth is expected to be driven by Asia Pacific. Because of the rising usage of NGS technology in genomics research and clinical applications across the area, it is now the world's greatest revenue-generating market.

The global next generation sequencing (NGS) market is led by players like Illumina, Inc, Thermo Fisher Scientific, Inc., Roche Holdings AG (Roche Sequencing), Pacific Biosciences of California, Inc., BGI Group, Oxford Nanopore Technologies, Ltd., Qiagen N.V., PerkinElmer, Inc.Agilent Technologies, Inc., and Bio-Rad Laboratories, Inc.

The report analyzes the global next generation sequencing (NGS) market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Next Generation Sequencing (NGS) industry.

Choose License Type

List of Contents

Next Generation Sequencing (NGS)Industry Prospective:GlobalOverviewKey InsightsGlobalGrowth DriversGlobalRestraintsGlobalOpportunitiesGlobalChallengesGlobalSegmentationNext Generation Sequencing (NGS) Report ScopeGlobalRegional AnalysisKey DevelopmentsGlobalCompetitive AnalysisThe global next generation sequencing (NGS) market is segmented as follows:By RegionRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed

-market-size.png)