Nuclear Decommissioning Services Market Size, Share, Analysis, Trends, Growth Report, 2030

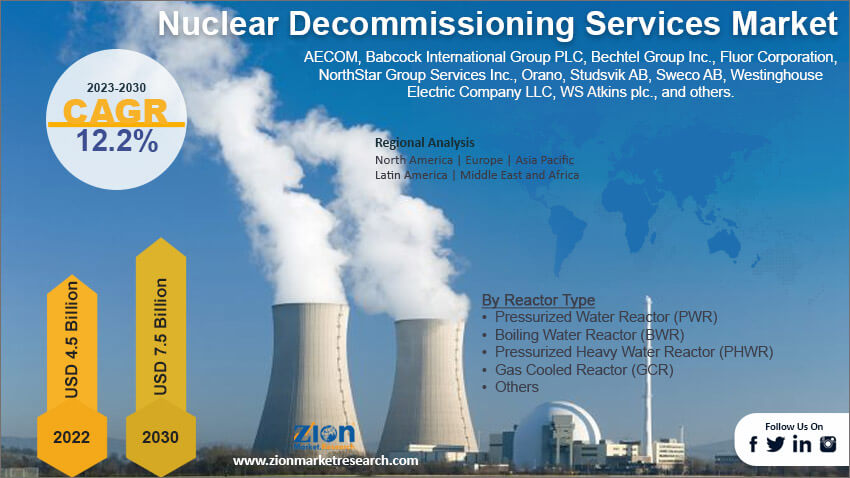

Nuclear Decommissioning Services Market By Reactor Type (Pressurized Water Reactor, BWR: Boiling Water Reactor, PHWR: Pressurized Heavy Water Reactor, GCR: Gas Cooled Reactor, and Other Reactors), By Strategy (Immediate Dismantling, Deferred Dismantling, and Entombment), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030

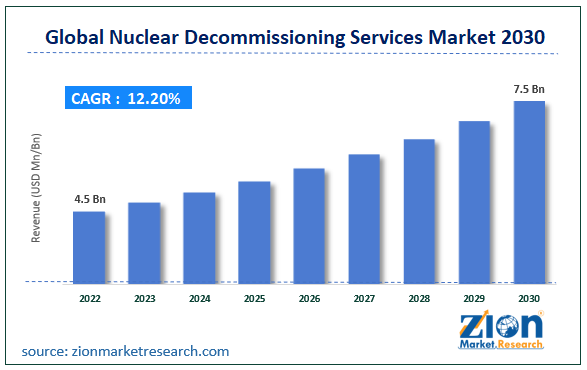

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.5 Billion | USD 7.5 Billion | 12.2% | 2022 |

Nuclear Decommissioning Services Industry Prospective:

The global nuclear decommissioning services market size was worth around USD 4.5 billion in 2022 and is predicted to grow to around USD 7.5 billion by 2030 with a compound annual growth rate (CAGR) of roughly 12.2% between 2023 and 2030.

Nuclear Decommissioning Services Market: Overview

Nuclear decommissioning services involve the safe and systematic shutdown and dismantling of nuclear facilities, including power plants, research reactors, and other nuclear installations, once they have reached the end of their operational life or are no longer in use. This process is crucial for ensuring public safety, protecting the environment, and managing radioactive waste. The key stages of nuclear decommissioning services typically include initial planning and assessment, followed by the removal of nuclear fuel & radioactive materials, decontamination of equipment & structures, and the safe disposal of radioactive waste.

This is often followed by the physical dismantling and demolition of the facility, and finally, the restoration of the site to a condition suitable for alternative use. Specialized teams of engineers, scientists, and technicians with expertise in nuclear physics, radiation protection, and environmental management are involved in executing these services. They work under strict regulatory guidelines and employ advanced technologies to minimize risks associated with radioactive materials. Additionally, decommissioning projects require comprehensive documentation, regulatory compliance, and stakeholder engagement to ensure transparency and accountability. Properly managed decommissioning services play a vital role in the transition to a post-nuclear era, allowing for the safe repurposing of valuable land and resources, while upholding the highest standards of safety and environmental protection.

Key Insights

- As per the analysis shared by our research analyst, the global nuclear decommissioning services industry is estimated to grow annually at a CAGR of around 12.2% over the forecast period (2023-2030).

- In terms of revenue, the global nuclear decommissioning services market size was valued at around USD 4.5 billion in 2022 and is projected to reach USD 7.5 billion by 2030.

- The global nuclear decommissioning services market is projected to grow at a significant rate due to the increasing number of aging nuclear power plants that have reached the end of their operational lifespans.

- Based on reactor type segmentation, pressurized water reactor was predicted to hold maximum market share in the year 2022.

- Based on strategy segmentation, immediate dismantling was the leading revenue generator in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Nuclear Decommissioning Services Market: Growth Drivers

Increasing number of aging nuclear power plants likely to fuel the demand for nuclear decommissioning services.

The global nuclear decommissioning services market is experiencing a notable upswing, primarily driven by the rising number of aging nuclear power plants that have exceeded their operational lifespans. Many of these facilities were constructed several decades ago and have now reached a stage where their continued operation is no longer economically viable or safe. As a result, there is a pressing need to decommission these plants in a safe, efficient, and environmentally responsible manner. This has spurred a surge in demand for specialized services that can effectively manage the dismantling and disposal of radioactive materials, ensuring that these facilities are closed down in compliance with stringent regulatory standards. Furthermore, the escalating concerns surrounding nuclear safety and environmental risks have further accelerated the market growth.

Governments and regulatory bodies around the world are imposing stricter guidelines to ensure the proper handling of radioactive materials and the safe closure of nuclear sites. This regulatory environment has prompted power plant operators and stakeholders to seek out expert decommissioning services to navigate the complexities and ensure full compliance. As the global community places a greater emphasis on sustainability and the transition to cleaner energy sources, the responsible decommissioning of nuclear facilities is becoming an integral part of the energy landscape, further propelling the expansion of the nuclear decommissioning services market. According to the International Atomic Energy Agency (IAEA), there are over 400 nuclear power reactors in operation in 33 countries around the world. Of these reactors, over 100 are more than 40 years old and over 40 are more than 50 years old. As these reactors age, they become more susceptible to accidents and failures. This is why it is important to decommission these reactors safely and efficiently.

Nuclear Decommissioning Services Market: Restraints

High cost associated with the decommissioning process may slow down the market growth.

The nuclear decommissioning services industry faces a significant constraint in the form of the high costs involved in the decommissioning process. The comprehensive nature of decommissioning, which includes activities such as decontamination, waste management, and site restoration, demands substantial financial resources. This expense can be particularly daunting for both public and private entities, as it requires careful allocation of funds and long-term financial planning. Moreover, accurately estimating decommissioning costs can be challenging due to uncertainties in factors such as regulatory requirements, technological advancements, and unforeseen complications during the decommissioning process.

This can lead to potential budget overruns and delays in project execution, further impeding market growth. The financial burden of decommissioning can be particularly acute for older or smaller nuclear facilities, which may have limited resources allocated for this purpose. In some cases, this can lead to extended periods of operation beyond the intended operational lifespan, potentially raising safety concerns. Therefore, addressing the cost challenge is critical for the sustainable development of the nuclear decommissioning services market, and innovations in cost-effective decommissioning technologies & strategies are essential to alleviate this constraint and drive market growth.

Nuclear Decommissioning Services Market: Opportunities

Regulatory support and streamlined approval processes to provide growth opportunities

Regulatory support and streamlined approval processes represent a significant growth opportunity for the nuclear decommissioning services market. Clear and well-defined regulatory frameworks create a stable and predictable environment for industry participants. When regulatory requirements are transparent and consistent, it reduces uncertainty for stakeholders involved in decommissioning projects. This, in turn, encourages investment and participation in the market, as companies can have confidence that they are operating within established guidelines.

Moreover, a supportive regulatory environment can expedite the approval process for decommissioning projects, allowing them to move forward in a timely manner. This is particularly important as timely decommissioning helps mitigate potential risks associated with aging nuclear facilities. Additionally, regulatory support can facilitate collaboration and knowledge-sharing between industry players and regulatory bodies. Open communication channels allow for a better understanding of compliance requirements, enabling companies to proactively address any potential issues. It also provides a platform for stakeholders to work together to develop innovative approaches and best practices for decommissioning. Overall, a regulatory framework that is conducive to the needs of the nuclear decommissioning service industry creates an environment where companies can thrive, leading to sustainable growth and advancement in decommissioning practices.

Nuclear Decommissioning Services Market: Challenges

Radioactive waste management and disposal to challenge market growth

The management and disposal of radioactive waste represent a formidable challenge that can potentially impede the growth of the nuclear decommissioning services market. Safely handling and storing radioactive materials generated during decommissioning is a complex and critical task. Identifying suitable sites for the long-term storage of high-level radioactive waste, which remains hazardous for thousands of years, requires meticulous planning and adherence to stringent regulatory standards. Moreover, developing and implementing advanced technologies for the treatment and containment of radioactive materials is paramount to ensure the protection of the environment and public health.

The complexity of radioactive waste management also brings about financial and logistical challenges. The high costs associated with the construction and maintenance of secure waste storage facilities, as well as the ongoing monitoring and maintenance required over extended periods, can strain project budgets. Additionally, gaining public acceptance and regulatory approval for waste disposal sites can be a protracted process, often subject to rigorous scrutiny and public engagement efforts. Overcoming these challenges necessitates ongoing innovation and collaboration within the industry to develop sustainable and effective solutions for the responsible management and disposal of radioactive waste.

Nuclear Decommissioning Services Market: Segmentation

The global nuclear decommissioning services market is segmented based on reactor type, strategy, and region.

Based on reactor type, the global market segments are pressurized water reactor, BWR: boiling water reactor, PHWR: pressurized heavy water reactor, GCR: gas cooled reactor and others at present, the global market is dominated by the pressurized water reactor segment. Pressurized Water Reactors (PWRs) are one of the most widely used types of nuclear reactors for commercial electricity generation. They operate by using high-pressure water as both a coolant and neutron moderator, allowing for a controlled nuclear fission chain reaction. In a PWR, water flows through the reactor core, absorbing the heat generated by nuclear reactions.

This hot water then transfers its thermal energy to a separate, lower-pressure water loop, which drives a turbine to generate electricity. PWRs are known for their inherent safety features, including multiple redundant safety systems, which make them highly reliable. Additionally, the use of pressurized water allows for efficient heat transfer and helps maintain a stable operating temperature. This design has made PWRs a popular choice for many nuclear power plants around the world, contributing significantly to global electricity production while adhering to stringent safety standards and regulatory requirements.

Based on strategy the global nuclear decommissioning services industry is categorized as immediate dismantling, deferred dismantling, and entombment. Out of these, immediate dismantling was the largest shareholding segment in the global market in 2022. The large share of immediate dismantling is due to its proactive approach in swiftly dismantling and decontaminating nuclear facilities after shutdown. This strategy prioritizes the reduction of long-term risks associated with radioactive materials, ensuring a safer and more secure environment. Additionally, immediate dismantling aligns with stringent regulatory requirements and provides a quicker path toward repurposing valuable land and resources, which is economically advantageous in the long run. This preference for immediate action reflects a commitment to upholding the highest standards of safety and environmental protection in the decommissioning process, making it the largest shareholding segment in the market.

Nuclear Decommissioning Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Nuclear Decommissioning Services Market |

| Market Size in 2022 | USD 4.5 Billion |

| Market Forecast in 2030 | USD 7.5 Billion |

| Growth Rate | CAGR of 12.2% |

| Number of Pages | 218 |

| Key Companies Covered | AECOM, Babcock International Group PLC, Bechtel Group Inc., Fluor Corporation, NorthStar Group Services Inc., Orano, Studsvik AB, Sweco AB, Westinghouse Electric Company LLC, WS Atkins plc., and others. |

| Segments Covered | By Reactor Type, By Strategy, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Nuclear Decommissioning Services Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

The Asia Pacific region is poised to take the lead in the global nuclear decommissioning services market during the forecast period. This can be attributed to several key factors. Firstly, the region has a significant number of aging nuclear facilities that are approaching the end of their operational lifespan, creating a growing demand for decommissioning services. Secondly, countries in the Asia Pacific, including Japan, South Korea, and China, have ambitious plans to expand their nuclear energy capacity, which will lead to an increased need for decommissioning services in the future. Presently around 35-40 projects are under construction, and another 55-60 projects are in the pipeline. Furthermore, there are numerous additional projects in the proposal stage. Additionally, stringent regulatory frameworks in the region emphasize the safe and responsible closure of nuclear facilities, driving the demand for specialized decommissioning expertise. Lastly, advancements in technology and expertise in the region further position the Asia Pacific as a leader in the nuclear decommissioning services market.

Key Developments

In 2023, Holtec International announced a contract to decommission the Indian Point Nuclear Power Plant in New York State. This is one of the largest nuclear decommissioning projects in the United States.

In 2022, CH2M Hill was awarded a contract to decommission the Pilgrim Nuclear Power Plant in Massachusetts. This project is expected to take 10 years to complete.

In 2021, Fluor Corporation was awarded a contract to decommission the Fort Calhoun Nuclear Power Plant in Nebraska. This project is expected to take 12 years to complete.

Nuclear Decommissioning Services Market: Competitive Analysis

The global nuclear decommissioning services market is dominated by players like:

- AECOM

- Babcock International Group PLC

- Bechtel Group, Inc.

- Fluor Corporation

- NorthStar Group Services, Inc.

- Orano

- Studsvik AB

- Sweco AB

- Westinghouse Electric Company LLC

- WS Atkins plc

The global nuclear decommissioning services market is segmented as follows:

By Reactor Type

- Pressurized Water Reactor (PWR)

- Boiling Water Reactor (BWR)

- Pressurized Heavy Water Reactor (PHWR)

- Gas Cooled Reactor (GCR)

- Others

By Strategy

- Immediate Dismantling

- Deferred Dismantling

- Entombment

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Nuclear decommissioning services involve the safe and systematic shutdown and dismantling of nuclear facilities, including power plants, research reactors, and other nuclear installations, once they have reached the end of their operational life or are no longer in use. This process is crucial for ensuring public safety, protecting the environment, and managing radioactive waste.

The global nuclear decommissioning services market cap may grow owing to the due to increasing number of aging nuclear power plants that have reached the end of their operational lifespans.

According to study, the global nuclear decommissioning services market size was worth around USD 4.5 billion in 2022 and is predicted to grow to around USD 7.5 billion by 2030.

The CAGR value of the nuclear decommissioning services market is expected to be around 12.2% during 2023-2030.

The global nuclear decommissioning services market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to the large presence of aging nuclear facilities.

The global nuclear decommissioning services market is led by players like AECOM, Babcock International Group PLC, Bechtel Group, Inc., Fluor Corporation, NorthStar Group Services, Inc., Orano, Studsvik AB, Sweco AB, Westinghouse Electric Company LLC, and WS Atkins plc.

The report analyzes the global nuclear decommissioning services market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the nuclear decommissioning services industry.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed