Offshore Decommissioning Market Size, Share, Analysis, Trends, Growth, 2032

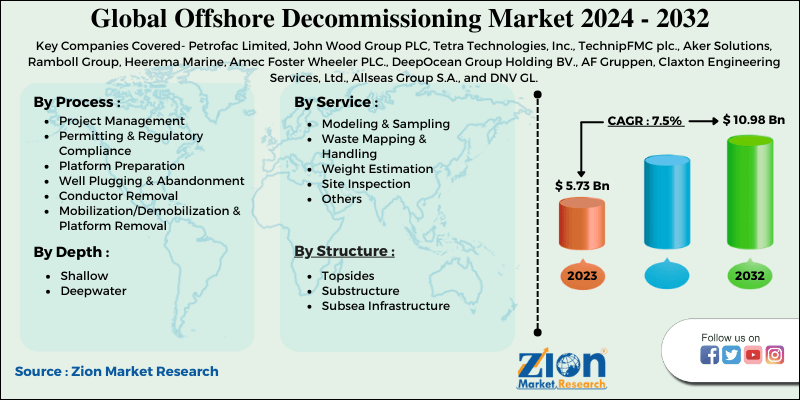

Offshore Decommissioning Market by Process (Project Management, Permitting & Regulatory Compliance, Platform Preparation, Well Plugging & Abandonment, Conductor Removal, Mobilization/Demobilization & Platform Removal) by Service (Modelling & Sampling, Waste Mapping & Handling, Weight Estimation, Site Inspection, Others) by Depth (Shallow, Deepwater) by Structure (Topsides, Substructure, Subsea Infrastructure): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.73 Billion | USD 10.98 Billion | 7.5% | 2023 |

Offshore Decommissioning Market Insights

Zion Market Research has published a report on the global Offshore Decommissioning Market, estimating its value at USD 5.73 Billion in 2023, with projections indicating that it will reach USD 10.98 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 7.5% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Offshore Decommissioning Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Global Offshore Decommissioning Market: Overview

Decommissioning is the method of putting an end to offshore oil and gas activities on the offshore platform and restoring the ocean and seafloor to their pre-lease status. The Outer Continental Shelf Lands Act (OCSLA) and the implementing regulations set out the decommissioning responsibilities that an operator must fulfill when signing an offshore lease under the OCSLA, including the need to apply for and receive a license for the subsequent removal of platforms.

In Outer Continental Shelf (OCS) leases, the operator is expected to clear seafloor obstacles, like offshore platforms, before the end of the specified lease term, if the Department of the Interior (DOI) or the operator finds the structure dangerous, redundant, or no longer operational.

The OCSLA regulatory and lease standards for decommissioning offshore platforms are intended to reduce the safety and environmental risks associated with leaving abandoned facilities in the ocean, as well as disputes with other Federal OCS users (i.e., military activities, commercial fishing/aquaculture, oil and gas/renewable energy operations, transportation industry, others.)

The common step in decommissioning an offshore platform includes engineering, and planning, project management, permitting and regulatory compliance, well plugging and abandonment, platform preparation, conductor removal, platform removal, mobilization/demobilization of derrick barges, materials disposal, power cable and pipeline decommissioning, and site clearance.

Operators must apply for approval of the platform removal technique before removing the platform, according to OCSLA regulations controlled by the Bureau of Safety and Environmental Compliance (BSEE). For each removal application, the Bureau of Ocean Energy Management (BOEM) conducts a site-specific environmental review on behalf of BSEE to meet National Environmental Policy Act requirements. As a condition of permit approval, BSEE guarantees that the evaluation is satisfactory and imposes any appropriate protective mitigation measures.

Offshore Decommissioning Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Offshore Decommissioning Market |

| Market Size in 2023 | USD 5.73 Billion |

| Market Forecast in 2032 | USD 10.98 Billion |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 110 |

| Key Companies Covered | Petrofac Limited, John Wood Group PLC, Tetra Technologies, Inc., TechnipFMC plc., Aker Solutions, Ramboll Group, Heerema Marine, Amec Foster Wheeler PLC., DeepOcean Group Holding BV., AF Gruppen, Claxton Engineering Services, Ltd., Allseas Group S.A., and DNV GL |

| Segments Covered | By Type,By end-user, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Offshore Decommissioning Market: Growth Factors

Strengthened and obligatory legal standards for offshore oil and gas operations defined by regulatory authorities of respective regions are significant drivers for the offshore decommissioning industry. Another factor driving the offshore decommissioning market is the presence of aging oil reserves and neglected wells in matured offshore oil fields across the globe. Chemical spills or leaks from these abandoned oil and gas wells pose a major risk of ocean water contamination, endangering the marine environment.

This complicates the removal and rehabilitation of an oil spill, as well as the decommissioning of the well following such an incident. Decommissioning such damaged oil wells or platforms increases costs. This raises a variety of technological difficulties. Another factor driving the global offshore decommissioning market is the discovery and growth of new offshore oil reserves, specifically in deep water areas worldwide. New offshore oil discoveries, such as the Liza field in Guyana, the Tupi offshore oil field in Brazil, and the Offshore Kutch basin in India, refer to future oil production potential in these offshore fields, which would likely demand decommissioning services after abandonment.

Global Offshore Decommissioning Market: Segmentation

Engineering and planning, and project management for offshore decommissioning usually start three years before the well runs dry. The procedure entails the analysis of contractual obligations, engineering, operational planning, and contracting.

Obtaining a license to decommission an offshore rig might take up to three years finish. Operators also employ local consulting firms to verify that all licenses are in order before decommissioning, so they are familiar with the regulatory system of their regions.

Plugging and abandonment are one of the main costs of the decommissioning process and can be segmented into two stages. The well-plugging planning phase involves data collection, preliminary review, evaluation of abandonment methods, and submission of a Bureau of Ocean Energy Management, Regulation, and Enforcement (BOEMRE) approval application.

Global Offshore Decommissioning Market: Regional Analysis

By Geography, the offshore decommissioning market is segmented into North America, Europe, Latin America, Asia Pacific, and the Middle East and Africa.

North America is projected to be a big part of this market given the presence of offshore oil reserves in the Gulf of Mexico. Europe is also expected to make a major contribution to the offshore decommissioning market, as its offshore oilfields in the North Sea are aging.

Latin America has large offshore oil reserves that are proven undeveloped in countries like Brazil, Guyana, and Venezuela. The region is also expected to be a promising place for offshore decommissioning in the coming years. The Middle East & Africa has a significant amount of fossil fuel wealth; therefore, the region is projected to be a key contributor to the decommissioning market.

In the Asia Pacific, Malaysia, Thailand, and Indonesia are hosting mature shallow water operations and are predicted to be key drivers for the growth of the offshore decommissioning market in the region. Supply chain issues and lack of technical knowledge will impede the rapid monitoring of decommissioning operations. The market is thus expected to grow at a steady pace over the forecast period.

Global Offshore Decommissioning Market: Competitive Players

The major players in the global offshore decommissioning market include

- Petrofac Limited

- John Wood Group PLC

- Tetra Technologies. Inc.

- TechnipFMC plc.

- Aker Solutions

- Ramboll Group

- Heerema Marine

- Amec Foster Wheeler PLC.

- DeepOcean Group Holding BV.

- AF Gruppen

- Claxton Engineering Services. Ltd.

- Allseas Group S.A.

- DNV GL

- among others.

The report segment of the global offshore decommissioning market is as follows:

By Process Segment Analysis

- Project Management

- Permitting & Regulatory Compliance

- Platform Preparation

- Well Plugging & Abandonment

- Conductor Removal

- Mobilization/Demobilization & Platform Removal

By Service Segment Analysis

- Modeling & Sampling

- Waste Mapping & Handling

- Weight Estimation

- Site Inspection

- Others

By Depth Segment Analysis

- Shallow

- Deepwater

By Structure Segment Analysis

- Topsides

- Substructure

- Subsea Infrastructure

Global Offshore Decommissioning Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Strengthened and obligatory legal standards for offshore oil and gas operations defined by regulatory authorities of respective regions are a significant driver for the offshore decommissioning industry. Another factor driving the offshore decommissioning market is the presence of ageing oil reserves and neglected wells in matured offshore oil fields across the globe.

According to Zion Market Research, the global Offshore Decommissioning Market, estimating its value at USD 5.73 Billion in 2023, with projections indicating that it will reach USD 10.98 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 7.5% over the forecast period 2024-2032.

Which region will make notable contributions towards global Offshore Decommissioning Market revenue?

North America is projected to be a big part of this market given the presence of offshore oil reserves in the Gulf of Mexico. Europe is also expected to make a major contribution to the offshore decommissioning market, as its offshore oilfields in the North Sea are ageing. Latin America has large offshore oil reserves that are proved undeveloped in countries like Brazil, Guyana, and Venezuela.

The major players in the global offshore decommissioning market include Petrofac Limited, John Wood Group PLC, Tetra Technologies, Inc., TechnipFMC plc., Aker Solutions, Ramboll Group, Heerema Marine, Amec Foster Wheeler PLC., DeepOcean Group Holding BV., AF Gruppen, Claxton Engineering Services, Ltd., Allseas Group S.A., and DNV GL among others.

Choose License Type

List of Contents

Market InsightsOverviewReport ScopeGrowth FactorsGlobalOffshore DecommissioningSegmentationGlobalOffshore DecommissioningMarket:Regional AnalysisGlobalOffshore DecommissioningCompetitive PlayersThe report segment of the global offshore decommissioning market is as follows:By Process Segment AnalysisBy Service Segment AnalysisBy Depth Segment AnalysisBy Structure Segment AnalysisHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed