Offshore Wind Market Size & Share, Growth, Forecast Report 2034

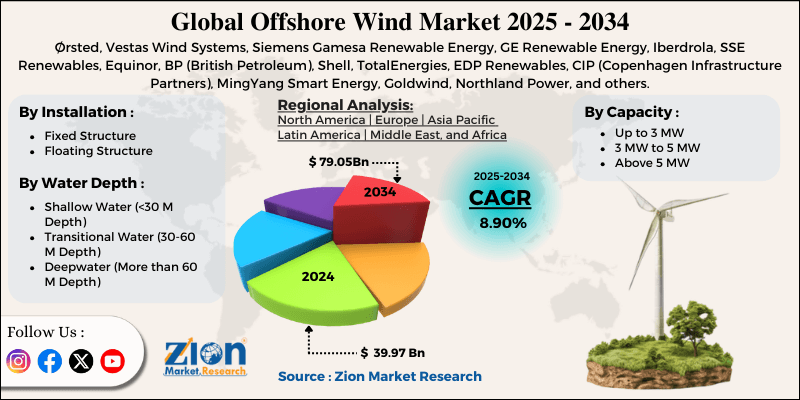

Offshore Wind Market By Installation (Fixed Structure, Floating Structure), By Capacity (Up to 3 MW, 3 MW to 5 MW, Above 5 MW), By Water Depth (Shallow Water [<30 M Depth], Transitional Water [30-60 M Depth], Deepwater [More than 60 M Depth]), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

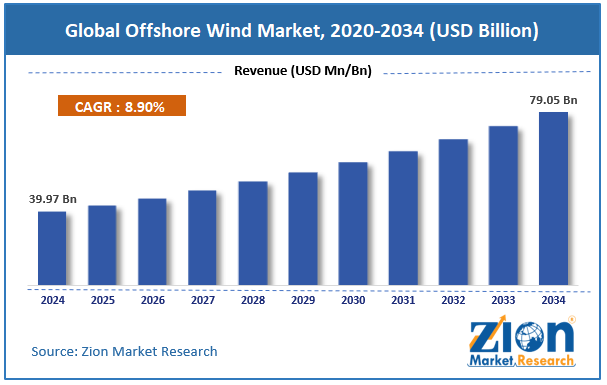

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 39.97 Billion | USD 79.05 Billion | 8.90% | 2024 |

Offshore Wind Industry Perspective:

The global offshore wind market size was approximately USD 39.97 billion in 2024 and is projected to reach around USD 79.05 billion by 2034, with a compound annual growth rate (CAGR) of approximately 8.90% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global offshore wind market is estimated to grow annually at a CAGR of around 8.90% over the forecast period (2025-2034)

- In terms of revenue, the global offshore wind market size was valued at around USD 39.97 billion in 2024 and is projected to reach USD 79.05 billion by 2034.

- The offshore wind market is projected to grow significantly due to surging global demand for renewable energy, rising concerns about energy security, and the expansion of offshore grid infrastructure.

- Based on installation, the fixed structure segment is expected to lead the market, while the floating structure segment is expected to grow considerably.

- Based on capacity, the above 5 MW segment is the dominating segment, while the 3 MW to 5 MW segment is projected to witness sizeable revenue over the forecast period.

- Based on water depth, the shallow water (<30 M Depth) segment is expected to lead the market compared to the transitional water (30-60 M Depth) segment.

- Based on region, Europe is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Offshore Wind Market: Overview

Offshore wind refers to the generation of electricity using wind turbines installed in water bodies, typically in large lakes or oceans, where wind speeds are more consistent and stronger than on land. It is a vital renewable energy technology that reduces carbon emissions and dependency on fossil fuels. The global offshore wind market is poised for significant growth, driven by surging global demand for clean energy, government incentives and policy support, as well as advancements in turbine design technology. Countries worldwide are increasing their investments in renewable energy to meet the targets of achieving carbon neutrality. The said sector benefits significantly, as it offers large-scale power generation with minimal land use. The IEA reports that offshore wind capacity is expected to reach 280 GW by 2040, indicating strong policy backing. Subsidies, renewable energy targets, and feed-in-tariffs are propelling offshore wind projects.

For example, the United States plans to install 30 GW of offshore wind by 2030, while the European Union plans to install 300 GW by 2050, presenting ambitious policy commitments. Also, next-generation turbines surpassing 15 MW capacity, like GE's Haliade-X, enhance efficacy and decrease the (LCOE) levelized cost of electricity. Floating platforms enable deployment in deeper waters, offering access to fresh markets with robust wind resources.

Nevertheless, the global market faces limitations due to factors such as challenging maintenance and installation, as well as grid connectivity issues. Extreme weather conditions and marine environments make installation and maintenance technically demanding and costly. Downtime for repairs may result in significant revenue losses. Furthermore, integrating offshore wind power into onshore grids needs advanced HVDC transmission systems and long-distance subsea cables, which are costly and may experience permitting delays.

Still, the global offshore wind industry benefits from several favorable factors, like floating offshore wind technology and hybrid offshore wind-solar farms. Floating turbines enable deployment in deep waters (over 60m), unlocking vast wind resources in regions such as California, Norway, and Japan. This technology could register for 10% of offshore capacity by 2030. Additionally, combining offshore wind with floating solar platforms enhances grid stability and increases energy output. This hybrid technique is gaining prominence in nations like the Netherlands and Singapore.

Offshore Wind Market: Growth Drivers

How are supply chain industrialization and localization driving the offshore wind market growth?

The offshore wind supply chain is undergoing significant industrialization, driven by local content policies and the need to meet growing global demand. Economies like Japan and the United States need domestic manufacturing, resulting in multi-billion-dollar investments in turbine factories, specialized installation vessels, and blade production plants.

For instance, Siemens Gamesa and GE Renewable Energy have declared growth strategies in Asia and the United States to satisfy the ever-increasing regional demands. Nonetheless, this rapid scaling presents short-term complexities, such as post-infrastructure barriers and monopole scarcity. Supporting supply-chain growth with auction timelines is vital to avert cost inflation and project delays, thus propelling the development of the offshore wind market.

How do the grid integration and transmission upgrades drive the global offshore wind market?

Offshore wind farms need strong grid infrastructure, comprising interconnection hubs and HVDC export lines to deliver energy to demand centers. Economies are highly investing in grid strengthening projects to elude adverse price events and curtailment risks. For instance, the Netherlands and Germany are introducing offshore grid hubs and multi-terminal HVDC systems to incorporate large-scale projects. Delays in grid development may derail projects, reduce investor confidence, and increase costs. Hence, governments are now coordinating grid expansion plans with offshore wind roadmaps, assuring system reliability and smooth integration.

Offshore Wind Market: Restraints

Environmental and permitting challenges hamper the market progress

Navigating complex permitting procedures and securing environmental clearances majorly delay offshore wind projects. Developers should comply with stringent regulations regarding marine biodiversity, coastal ecosystems, and fishing activities, which often require multi-year impact evaluations.

For example, the United States' offshore projects, such as Vineyard Wind, experienced multi-year delays due to federal reviews and environmental lawsuits. In Europe, similar issues arose with concerns over marine habitats and bird migration, slowing the pace of fresh auction rounds. These regulatory barriers raise project schedules and financing risks.

Offshore Wind Market: Opportunities

How do corporate PPAs and green hydrogen integration create promising avenues for offshore wind industry growth?

Large corporations are signing (PPAs) Power Purchase Agreements for offshore wind to meet sustainability targets. Companies like Microsoft, Amazon, and Google have already committed to offshore wind agreements. Additionally, integrating offshore wind with green hydrogen production presents a fresh revenue stream by supplying renewable power for electrolysis. Europe plans to produce 10 million tonnes of renewable hydrogen by 2030, with offshore wind being a leading contributor. This dual-use opportunity enhances project economics and accelerates decarbonization, which is favorable for the offshore wind industry.

Offshore Wind Market: Challenges

Inflationary pressures and cost overruns limit the market growth

Despite a falling LCOE, offshore wind remains capital-intensive, and the newest supply chain inflation has fueled costs. Developers like Vattenfall and Ørsted reported price hikes of 20-40% in 2023, resulting in cancellations or project delays. Surging steel prices and the high cost of installing vessels contribute to this increase in costs. These overruns create hesitation and challenges for project viability and investor confidence in the industry.

Offshore Wind Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Offshore Wind Market |

| Market Size in 2024 | USD 39.97 Billion |

| Market Forecast in 2034 | USD 79.05 Billion |

| Growth Rate | CAGR of 8.90% |

| Number of Pages | 217 |

| Key Companies Covered | Ørsted, Vestas Wind Systems, Siemens Gamesa Renewable Energy, GE Renewable Energy, Iberdrola, SSE Renewables, Equinor, BP (British Petroleum), Shell, TotalEnergies, EDP Renewables, CIP (Copenhagen Infrastructure Partners), MingYang Smart Energy, Goldwind, Northland Power, and others. |

| Segments Covered | By Installation, By Capacity, By Water Depth, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Offshore Wind Market: Segmentation

The global offshore wind market is segmented based on installation, capacity, water depth, and region.

Based on installation, the global offshore wind industry is divided into fixed structure and floating structure. The fixed structure segment held a dominating share of the market. These structures, such as jacket foundations and monopiles, are highly suitable for shallow waters with depths of nearly 60 meters. Their cost efficiency and proven technology increase their preference for large-scale projects in China and the European regions. With well-developed supply chains and installation techniques, fixed structures will continue to lead in the coming period.

Based on capacity, the global offshore wind market is segmented into up to 3 MW, 3 MW to 5 MW, and above 5 MW. The above 5 MW segment held leadership in the industry due to the industry's inclination towards larger turbines for cost reduction and higher efficiency. Turbines in this segment majorly reduce the levelized cost of energy by producing more energy per unit installed. Several novel offshore projects in China, Europe, and the United States are now utilizing next-generation turbines, such as GE's Haliade-X (14 MW), which are becoming mainstream.

Based on water depth, the global market is segmented into shallow water (<30 M Depth), transitional water (30-60 M Depth), and deepwater (More than 60 M Depth). The shallow water (<30m depth) segment held the leading share of the market, as it is cost-efficient and technologically advanced. A majority of fixed-bottom wind farms are deployed in these depths, especially in the Baltic Sea, North Sea, and Chinese coastal waters. Easier installation, strong wind resources, and low maintenance costs increase the segmental dominance. Accordingly, the majority of operational offshore wind capacity across the globe lies in shallow waters.

Offshore Wind Market: Regional Analysis

What gives Europe a competitive edge in the global Offshore Wind Market?

Europe is projected to maintain its dominant position in the global offshore wind market due to its technological dominance, early adoption, supportive geography and wind resources, and advanced grid infrastructure. Europe was the pioneer in offshore wind development, with the primary offshore wind farm constructed in 1991 in Denmark. This early start aided the region's well-established supply chains and provided a technological benefit. Currently, Europe accounts for more than 50% of the global offshore wind capacity, with regions such as Germany, the UK, and the Netherlands dominating the change.

Moreover, the Baltic Sea and North Sea offer suitable conditions for offshore wind, comprising high wind speeds and shallow waters. These regions enable cost-efficient fixed-bottom installations, decreasing project risks. This geographic benefit has enabled the region to build large-scale wind farms surpassing 1 GW each. Furthermore, Europe has an advanced and integrated grid network that supports the integration of significant offshore wind power. High-voltage direct current (HVDC) and cross-border interconnections enhance export capabilities and energy security. For instance, Denmark and Germany share interconnectors to balance the distribution of offshore wind power effectively.

The Asia Pacific region maintains its position as the second-largest in the global offshore wind industry, driven by rapid coastal urbanization and increasing power demand, as well as China's dominance in offshore wind deployment, its domestic supply chain, and manufacturing strength. The Asia Pacific region is home to densely populated coastal areas with rapidly rising electricity demand. Offshore wind offers an ideal solution for clean energy generation that does not require the use of valuable land. Economies such as Japan, South Korea, and China are investing rigorously in offshore projects to meet the rising energy demands. China is the largest offshore wind sector worldwide, exceeding Europe in annual installations in recent years.

In 2023, China held more than 30 GW of installed offshore wind capacity, accounting for over half of the worldwide total that year. Local manufacturing capabilities and favorable policies support this development. Japan, India, and China have robust domestic manufacturing bases for foundations, turbines, and subsea cables, which lower project costs and ensure faster deployment. Local players, such as Mingyang and Goldwind, are developing next-generation turbines that exceed 10 MW. This localized supply chain reinforces APAC's ranking in the global market.

Offshore Wind Market: Competitive Analysis

The leading players in the global offshore wind market are:

- Ørsted

- Vestas Wind Systems

- Siemens Gamesa Renewable Energy

- GE Renewable Energy

- Iberdrola

- SSE Renewables

- Equinor

- BP (British Petroleum)

- Shell

- TotalEnergies

- EDP Renewables

- CIP (Copenhagen Infrastructure Partners)

- MingYang Smart Energy

- Goldwind

- Northland Power

Offshore Wind Market: Key Market Trends

Integration with green hydrogen production:

Offshore wind is often paired with electrolyzers to generate green hydrogen for the transportation and industrial sectors. Countries such as South Korea, Japan, and the EU are focusing on this trend to decarbonize their heavy industries. Projects like Ørsted’s SeaH2Land present how offshore wind will fuel the hydrogen economy.

Predictive maintenance and digitalization:

The use of IoT, AI, and advanced analytics for real-time monitoring and predictive maintenance is becoming essential in offshore wind projects. These solutions optimize performance, reduce downtime, and extend the lifespan of turbines. Companies are actively investing in digital twin technology to lower O&M costs and improve operational efficiency.

The global offshore wind market is segmented as follows:

By Installation

- Fixed Structure

- Floating Structure

By Capacity

- Up to 3 MW

- 3 MW to 5 MW

- Above 5 MW

By Water Depth

- Shallow Water (<30 M Depth)

- Transitional Water (30-60 M Depth)

- Deepwater (More than 60 M Depth)

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Offshore wind refers to the generation of electricity using wind turbines installed in water bodies, typically in large lakes or oceans, where wind speeds are more consistent and stronger than on land. It is a vital renewable energy technology that reduces carbon emissions and dependency on fossil fuels.

The global offshore wind market is projected to grow due to government subsidies and incentives, increasing awareness of carbon neutrality goals, and improvements in turbine design.

According to study, the global offshore wind market size was worth around USD 39.97 billion in 2024 and is predicted to grow to around USD 79.05 billion by 2034.

The CAGR value of the offshore wind market is expected to be around 8.90% during 2025-2034.

The Above 5 MW capacity segment is expected to dominate the offshore wind market by 2034, fueled by the adoption of next-generation turbines for lower costs and higher efficiency.

High installation costs, harsh marine conditions, grid connectivity issues, supply chain constraints, and environmental concerns are the key challenges hindering the growth of the offshore wind market.

Europe is expected to lead the global offshore wind market during the forecast period.

Macroeconomic factors, such as interest rate hikes, inflation, and currency fluctuations, will increase project financing costs and impact investment timelines in the offshore wind market.

The key players profiled in the global offshore wind market include Ørsted, Vestas Wind Systems, Siemens Gamesa Renewable Energy, GE Renewable Energy, Iberdrola, SSE Renewables, Equinor, BP (British Petroleum), Shell, TotalEnergies, EDP Renewables, CIP (Copenhagen Infrastructure Partners), MingYang Smart Energy, Goldwind, and Northland Power.

The report examines key aspects of the offshore wind market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed