Oil Country Tubular Goods (OCTG) Market Size, Share, Industry Analysis, Trends, Growth, 2032

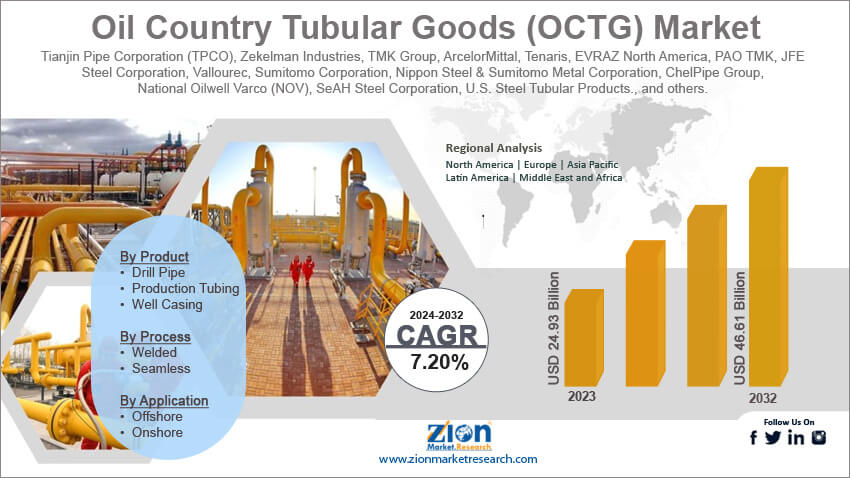

Oil Country Tubular Goods (OCTG) Market By Product (Drill Pipe, Production Tubing, Well Casing, and Others), By Process (Welded and Seamless), By Application (Offshore and Onshore), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

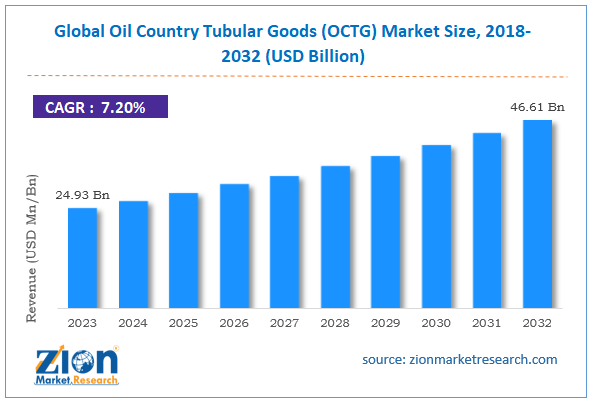

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 24.93 Billion | USD 46.61 Billion | 7.20% | 2023 |

Oil Country Tubular Goods (OCTG) Industry Prospective:

The global oil country tubular goods (OCTG) market size was worth around USD 24.93 billion in 2023 and is predicted to grow to around USD 46.61 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.20% between 2024 and 2032.

Oil Country Tubular Goods (OCTG) Market: Overview

Oil country tubular goods (OCTG) are the backbone of the modern oil & gas industry. These products refer to goods such as tubing, casing, pipelines, and piping used in the global petroleum sector. They are used in the exploration and production of petroleum products thus acting as the basic materials required for harnessing one of the world’s most crucial sources of energy. Moreover, they are also used in the secure and efficient transportation of oil & gas products to the final market. OCTG has found definitions in the International Specifications Organization (ISO), American Petroleum Institute (API) specifications, and others. Each component is used for specific reasons and has a crucial role to play in exploring, producing, and transporting products from the oil & gas industry. For instance, a drill pipe is used for circulating drilling fluid during drilling procedures. Casing, on the other hand, is used as protective equipment as its main role is to prevent the hole from collapsing. Tubing is used for the process involving oil & gas extraction thus acting as a component used in the final stages of oil & gas extraction. The forecast period is expected to help the oil country tubular goods market players generate extensive growth due to the growing investments in the oil & gas industry.

Key Insights:

- As per the analysis shared by our research analyst, the global oil country tubular goods (OCTG) market is estimated to grow annually at a CAGR of around 7.20% over the forecast period (2024-2032)

- In terms of revenue, the global oil country tubular goods (OCTG) market size was valued at around USD 24.93 billion in 2023 and is projected to reach USD 46.61 billion, by 2032.

- The oil country tubular goods market is projected to grow at a significant rate due to the rising investments in the oil & gas industry

- Based on the product, the well casing segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the application, the onshore segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Oil Country Tubular Goods (OCTG) Market: Growth Drivers

Rising investments in the oil & gas industry will drive the market growth rate

The global oil country tubular goods (OCTG) goods market is expected to witness high growth due to the growing investments in the global oil & gas industry. It is one of the most prominent industries of the modern world on which a large number of novel technologies rely. For instance, the oil & gas sector provides energy and power which are the most important basic necessities of the current world. Some of the leading products obtained from the oil & gas sector include natural gas, crude oil, petrochemicals, petroleum products, liquid natural gas (LNG), refinery products, and natural gas liquids (NGLs). Each of these products is used across industries and global locations. For instance, natural gas is critical for generating energy and electricity. Crude oil, on the other hand, is further refined to produce diesel, gasoline, lubricants, and other items.

The extensive rate of urbanization along with rapid industrialization and commercialization has led to increased energy and power demands. As per World Oil Statistics, around 97,103,871 barrels of crude oil are used every day across the globe. According to the US Energy Information Administration (EIA), the US natural gas production rate was around 36.35 trillion cubic feet in 2022. The rising energy demands have led to governments and private companies investing in more exploration and production (E&P) activities in the oil sector. In May 2024, the Iranian government announced that it would launch over USD 4.6 billion worth of oil projects in the coming years. The region plans to expand its oil production rate. Similarly, in the same month, Saudi Arabia announced that it will soon launch a USD 10 billion Aramco offer thus attracting more players in the regional oil market.

Growing launch of new and improved solutions may contribute to the market’s growth rate

The producers and suppliers of oil country tubular goods are actively investing in developing more efficient solutions as the demands and requirements of the oil sector continue to evolve. For instance, the resources that were once abundant are now depleting and oil producers must invest in finding novel ways to explore new resources for oil & gas products. In addition to this, they are also under pressure to minimize environmental damage that is caused by business operations. The growing integration of digital technologies in the global oil country tubular goods (OCTG) market may generate extended revenue during the forecast period

Oil Country Tubular Goods (OCTG) Market: Restraints

High initial investment required to build operational OCT goods may limit the market’s expansion rate

The global industry for oil country tubular goods (OCTG) is projected to be restricted due to the high cost involved in the initial stages of material procurement and development of the materials. Moreover, the operational cost of OCTG is considerably high. The changing global economic conditions and fluctuating oil demands worldwide pose severe threats to the producers of OCTG. The current ongoing war between Russia and Ukraine as well as the violent attacks between Israel and Hamas have disrupted the oil & gas supply chain across several nations thus impacting the OCTG industry growth rate.

Oil Country Tubular Goods (OCTG) Market: Opportunities

Accelerating interest in offshore oil drilling projects will generate massive growth opportunities

The global oil country tubular goods market players are expected to gain tremendous revenue due to the accelerating interest of the global oil giants in offshore oil drilling projects. These activities deal with the exploration of petroleum reserves situated beneath the surface of the oceans instead of the traditional mainland reserves. In the past few years, offshore drilling projects have soared at an excellent rate. The majority part of the known ocean remains unexplored and scientists are of the view that the surface beneath the oceans holds massive quantities of essential petroleum reserves. This has led to an increased interest of regional governments and private companies to invest in offshore drilling. In May 2024, TotalEnergies EP Angola launched a new final investment decision (FID) aiming to divert its resources for a project related to deepwater oil in Block 20. The region is located in the Kwanza Basin offshore Angola. In May 2024, Woodside, an Australian energy company signed a Memorandum of Understanding (MoU) with Japan Bank for International Cooperation (JBIC). Woodside is expected to use the fund for its giant gas project that will be situated off the Western Australian coast. In January 2024, the Oil & Natural Gas Corporation (ONGC) of India signed contracts related to 10 oil & gas exploration blocks. The contracts were signed during the Open Acreage Licensing Policy (OALP-VIII) bid.

Oil Country Tubular Goods (OCTG) Market: Challenges

Extreme pressure on oil & gas industry to reduce environmental impact could create challenges for the industry players

The global oil country tubular goods industry players are expected to face certain challenges during the forecast period. The primary concern will be related to the extreme pressure on the oil companies to mitigate the environmental impact of the business operations. The oil & gas sector is one of the largest environmental polluters. Moreover, it is also known to impact the ecological structure of the environment. This is one of the main reasons for an increase in resistance against deep-sea mining of offshore drilling activities since these events can lead to catastrophic impacts on the global environment.

Oil Country Tubular Goods (OCTG) Market: Segmentation

The global oil country tubular goods (OCTG) market is segmented based on product, process, application, and region.

Based on the product, the global market segments are drill pipe, production tubing, well casing, and others. In 2023, the highest growth was observed in the well-casing segment. These tools are essential for the successful exploration and extraction of oil and natural gas. Well, casings are used for preventing accidents by eliminating the risk of the well collapsing. Moreover, it maintains the overall structural integrity of the well during the entire extraction duration. The average cost of a well casing is around USD 40 to USD 350 per foot.

Based on the process, the global oil country tubular goods market divisions are welded and seamless.

Based on the application, the global market divisions are offshore and onshore. In 2023, the highest growth was observed in the onshore segment of the oil country tubular goods industry. Majority part of the oil & gas industry is currently conducted across the mainland. The rising expenditure on new reserves exploration is fueling the segment demand. Additionally, oil companies are spending on improving the overall production rate which could trigger a higher segmental growth rate. In 2020, the Middle East had more than 113.2 billion metric tons of oil reserves.

Oil Country Tubular Goods (OCTG) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Oil Country Tubular Goods (OCTG) Market |

| Market Size in 2023 | USD 24.93 Billion |

| Market Forecast in 2032 | USD 46.61 Billion |

| Growth Rate | CAGR of 7.20% |

| Number of Pages | 214 |

| Key Companies Covered | Tianjin Pipe Corporation (TPCO), Zekelman Industries, TMK Group, ArcelorMittal, Tenaris, EVRAZ North America, PAO TMK, JFE Steel Corporation, Vallourec, Sumitomo Corporation, Nippon Steel & Sumitomo Metal Corporation, ChelPipe Group, National Oilwell Varco (NOV), SeAH Steel Corporation, U.S. Steel Tubular Products., and others. |

| Segments Covered | By Product, By Process, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Oil Country Tubular Goods (OCTG) Market: Regional Analysis

North America to witness the highest growth rate during the projection period

The global oil country tubular goods (OCTG) market is expected to be led by North America during the forecast period. The US will lead the regional market growth trend due to its sheer dominance in the global oil & gas sector. The US is the leading producer of oil & gas. It is also one of the largest investors in oil extraction and exploration activities. In April 2023, the current US government approved a new regulation that could provide around USD 7 billion in new insurance bonds from the companies operating in the oil & gas sector. The regulation is aimed at cleaning up abandoned wells and platforms in case an offshore oil company files bankruptcy. Furthermore, the region also has a high demand for oil and natural gas due to the presence of a massive industrialization environment. In March 2024, MCF Energy Ltd. announced new updates on the drilling progress that is undergoing in Austria in the Welchau-1 exploration well.

Europe is anticipated to register accelerated growth during the projection period. The growth rate will be a result of increased oil & gas spending, especially in the offshore segment. Recent reports suggest that Norway has witnessed record investments in the oil & gas sector in 2024.

Oil Country Tubular Goods (OCTG) Market: Competitive Analysis

The global oil country tubular goods (OCTG) market is led by players like:

- Tianjin Pipe Corporation (TPCO)

- Zekelman Industries

- TMK Group

- ArcelorMittal

- Tenaris

- EVRAZ North America

- PAO TMK

- JFE Steel Corporation

- Vallourec

- Sumitomo Corporation

- Nippon Steel & Sumitomo Metal Corporation

- ChelPipe Group

- National Oilwell Varco (NOV)

- SeAH Steel Corporation

- U.S. Steel Tubular Products.

The global oil country tubular goods (OCTG) market is segmented as follows:

By Product

- Drill Pipe

- Production Tubing

- Well Casing

By Process

- Welded

- Seamless

By Application

- Offshore

- Onshore

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Oil country tubular goods (OCTG) are the backbone of the modern oil & gas industry.

The global oil country tubular goods (OCTG) goods market is expected to witness high growth due to the growing investments in the global oil & gas industry.

According to study, the global oil country tubular goods (OCTG) market size was worth around USD 24.93 billion in 2023 and is predicted to grow to around USD 46.61 billion by 2032.

The CAGR value of the oil country tubular goods (OCTG) market is expected to be around 7.20% during 2024-2032.

The global oil country tubular goods (OCTG) market is expected to be led by North America during the forecast period.

The global oil country tubular goods (OCTG) market is led by players like Tianjin Pipe Corporation (TPCO), Zekelman Industries, TMK Group, ArcelorMittal, Tenaris, EVRAZ North America, PAO TMK, JFE Steel Corporation, Vallourec, Sumitomo Corporation, Nippon Steel & Sumitomo Metal Corporation, ChelPipe Group, National Oilwell Varco (NOV), SeAH Steel Corporation and U.S. Steel Tubular Products.

The report explores crucial aspects of the oil country tubular goods (OCTG) market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed