Global Oil Storage Market Size, Share, Growth Analysis Report - Forecast 2034

Oil Storage Market By Product (Open Top, Fixed Roof, Floating Roof and Others), By Application (Crude Oil, Middle Distillates, Gasoline, Aviation Fuel and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

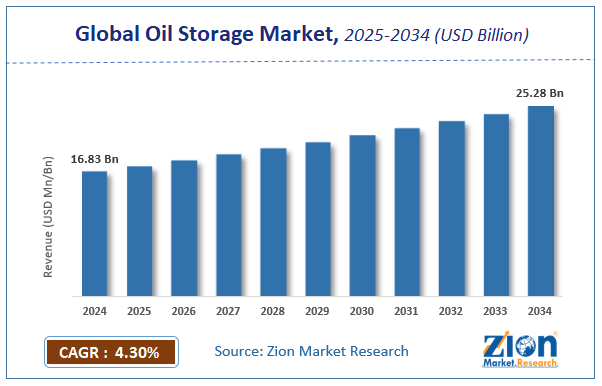

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 16.83 Billion | USD 25.28 Billion | 4.3% | 2024 |

Oil Storage Market Size

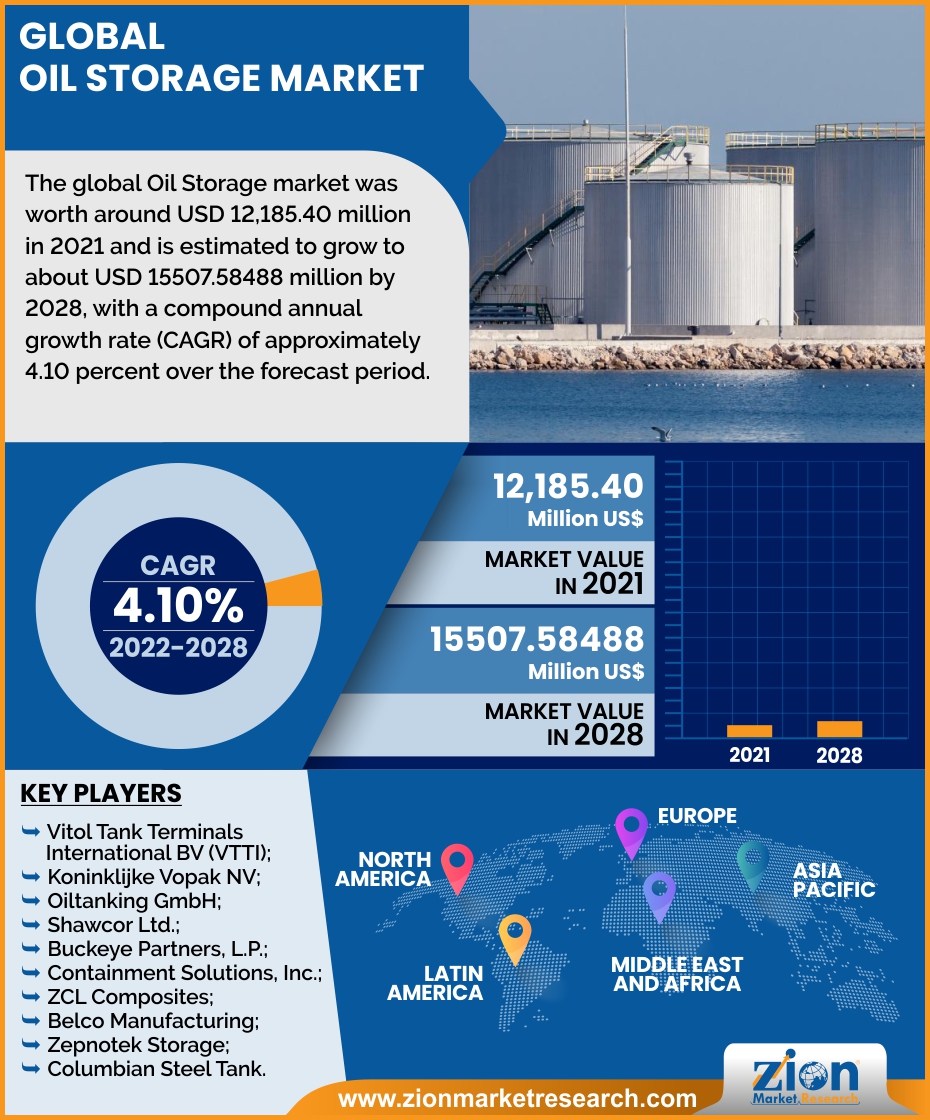

The global oil storage market size was worth around USD 16.83 Billion in 2024 and is predicted to grow to around USD 25.28 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.3% between 2025 and 2034.

The report analyzes the global oil storage market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the oil storage industry.

Oil Storage Market: Overview

Petroleum products require the use of oil storage tanks during the production, refining, and distribution processes. The tank selection process can be influenced by product operating conditions, storage capacity, and specific design issues. The types of products used to feed the world's refineries have undergone significant changes in the petroleum industry. Because of the increased use of petroleum products, the industry has been forced to look for alternative supply sources. Product, physical, and chemical property changes present new challenges to the storage tank industry. Environmental and safety concerns are still a major consideration in the selection and design of petroleum storage tanks industry.

Open-top tanks (OTT), fixed-roof tanks (FRT), external floating-roof tanks (EFRT), and internal floating-roof tanks (IFRT) are the most common types of atmospheric storage tanks (AST) in use (IFRT). A closed floating-roof tank (CFRT) may be chosen depending on the product. Over the forecast period, the market is expected to be driven by an increase in oil and gas production activities and a surge in demand for crude oil in several end-use sectors. Due to rising crude oil demand and the need to store large amounts of crude oil, suppliers are concentrating on inventories and infrastructure development. Furthermore, fluctuating crude oil prices have resulted in oil-importing countries bolstering their energy security by increasing oil storage.

Key Insights

- As per the analysis shared by our research analyst, the global oil storage market is estimated to grow annually at a CAGR of around 4.3% over the forecast period (2025-2034).

- Regarding revenue, the global oil storage market size was valued at around USD 16.83 Billion in 2024 and is projected to reach USD 25.28 Billion by 2034.

- The oil storage market is projected to grow at a significant rate due to fluctuating crude oil prices and increasing energy consumption.

- Based on Product, the Open Top segment is expected to lead the global market.

- On the basis of Application, the Crude Oil segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Middle East & Asia-Pacific is predicted to dominate the global market during the forecast period.

Oil Storage Market: Growth Drivers

Driver: Demand for Various Crude Oil derived products is supporting the growth of Terminals

A petroleum refinery's outputs include petroleum products obtained from crude oil, such as diesel, petroleum, aviation fuel, lubricants, and others. Every barrel of crude oil processed at a typical refinery yields a diverse range of products. Propane and butane are the most often produced refined products that are used as feedstock for ethylene cracking and then mixed into Liquefied Petroleum Gas (LPG) for use as a fuel. In industrial facilities and commercial/residential heating, industrial gasoline is utilized as a furnace fuel. Remaining oil is also used as a bunker fuel in power plants and huge ocean-going ships. These reasons have increased demand for diesel, petroleum, oils, and other products, all of which directly drive the demand for more crude oil.

Restraint: Emphasis on Adoption of Renewable Energy Resources to Alter Oil Industry Growth

The increased adoption of renewable energy sources for electricity generation is a major restraint on the oil storage terminals market. Because renewable fuels are often less polluting, environmental concerns have surpassed energy security as the primary motivation of government efforts to encourage them. Oil and natural gas-based fuels, biofuels generated from vegetable matter such as ethanol or biodiesel, electric vehicles (EVs), and hydrogen-based fuel cells have all been the focus of alternative automotive-fuel research and development in recent years. Another factor limiting the growth of the oil storage terminal industry is the high cost of construction and maintenance necessary during the terminal's operational lifetime.

Opportunity: Difference between crude oil demand and supply

Crude oil is used as a raw material in the production of refined products, hence demand for crude oil is closely related to demand for petroleum products. The demand for crude oil has been impacted by a decrease in the use of refined products. As a result, the volume of oil stored increased, necessitating the construction of crude oil storage facilities. As a result, during the projected period, a mismatch between crude oil demand and supply is expected to provide profitable prospects for the global oil storage market.

Challenge: Investments are decreasing, mostly in the energy and power sectors

The market saw a major drop in investment, particularly in the energy and electricity sectors. Investments in the energy and electricity sectors are expected to fall by 10% in 2021, according to the International Energy Agency's estimates. This reflects the current state of the global marketplace as well as the significant challenges that it faces.

Global Oil Storage Market: Segmentation

The global Oil Storage market is segregated based on Application Outlook and Product Outlook.

By Application Outlook, the market is classified into Crude Oil, Middle Distillates, Gasoline, Aviation Fuel and Others. This category had a significant share in 2021 and is expected to maintain its dominance throughout the forecast period. The global oil storage market is dominated by the crude oil segment. Crude oil is the raw material for many of the goods that are created and utilized around the world, including diesel, gasoline, aviation fuel, kerosene, and others. In recent years, the vehicle sector has experienced exponential growth, and new goods such as liquefied natural gas have applications in this field. The demand for storage terminals has risen as LPG has become more widely adopted in emerging countries.

By Product Outlook, the market is divided into Open Top, Fixed Roof, Floating Roof and Others. The global oil storage market is dominated by floating roof tanks. In pumping stations and terminals where crude oil is stabilized at vapour pressures less than 11.1 psia, floating roof tanks are commonly employed. The cylindrical floating roof tank is suspended above the ground. External floating roof tanks and internal floating roof tanks are the two types of floating roof tanks. A cylindrical steel shell with an open top serves as the exterior floating roof tank. The roof is afloat on the liquid's surface. Depending on the liquid level, the ceiling rises and falls.

Oil Storage Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Oil Storage Market |

| Market Size in 2024 | USD 16.83 Billion |

| Market Forecast in 2034 | USD 25.28 Billion |

| Growth Rate | CAGR of 4.3% |

| Number of Pages | 188 |

| Key Companies Covered | Vitol Tank Terminals International BV (VTTI); Koninklijke Vopak NV; Oiltanking GmbH; Shawcor Ltd.; Buckeye Partners, L.P.; Containment Solutions Inc, ZCL Composites; Belco Manufacturing; Zepnotek Storage; and Columbian Steel Tank, and others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In July 2021, Oil tanking is pleased to announce that it has acquired Antwerp Gas Terminal N.V., one of Europe's major independent LPG and petrochemical gas terminals, strengthening its position as a leading global independent gas storage partner.

- In December 2020, Oiltanking successfully concluded an online electronic auction for Jet Fuel/USLD storage capacity at the Oiltanking Copenhagen site in collaboration with Matrix Global ("Matrix"). The auction resulted in the sale of 77,150 cbm of storage capacity each month for Calendar 2021.

Oil Storage Market: Regional Analysis

Due to the sheer strong demand for oil storage across the region, North America held a substantial market share in 2021. The need for oil storage is directly influenced by rising exploration and production operations linked with shale gas reserves. The presence of a substantial US strategic petroleum reserve is expected to boost regional growth even further.

Over the forecast period, Asia Pacific is expected to have the second-fastest growth rate, with China accounting for the greatest share of the regional market. The APAC market is expected to be driven by rising oil and gas demand from key markets such as China and India, as well as increased investments in offshore and onshore operations.

Oil Storage Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the oil storage market on a global and regional basis.

The global oil storage market is dominated by players like:

- Vitol Tank Terminals International BV (VTTI)

- Koninklijke Vopak NV

- Oiltanking GmbH

- Shawcor Ltd.

- Buckeye Partners

- L.P.

- Containment Solutions Inc

- ZCL Composites

- Belco Manufacturing

- Zepnotek Storage

- and Columbian Steel Tank

The global oil storage market is segmented as follows;

By Product

- Open Top

- Fixed Roof

- Floating Roof and Others

By Application

- Crude Oil

- Middle Distillates

- Gasoline

- Aviation Fuel and Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Leading players in the global oil storage market include Vitol Tank Terminals International BV (VTTI); Koninklijke Vopak NV; Oiltanking GmbH; Shawcor Ltd.; Buckeye Partners, L.P.; Containment Solutions Inc, ZCL Composites; Belco Manufacturing; Zepnotek Storage; and Columbian Steel Tank, among others.

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed