Orthopedics Instruments Market Size, Share, Trends, Growth 2032

Orthopedics Instruments Market By End-User (Outpatient Facilities and Hospitals), By Product (Trauma, Sports Medicine, Joint Replacement, Orthobiologics, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

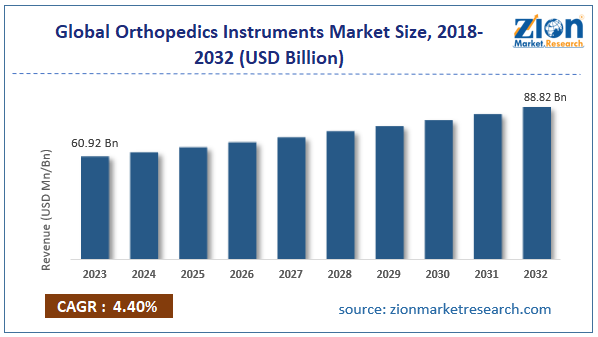

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 60.92 Billion | USD 88.82 Billion | 4.40% | 2023 |

Orthopedics Instruments Industry Prospective:

The global orthopedics instruments market size was worth around USD 60.92 billion in 2023 and is predicted to grow to around USD 88.82 billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.40% between 2024 and 2032.

Orthopedics Instruments Market: Overview

Orthopedics instruments are medical devices and tools used by medical professionals for treating conditions related to the musculoskeletal systems. These instruments are designed to meet the non-surgical and surgical requirements of patients including sports injuries, musculoskeletal trauma, infections, and other conditions. Orthopedic instruments are essential tools used for treating conditions related to bones, ligaments, joints, and muscles. A major segment of orthopedic instruments is related to implants that can replace a bone, a joint, or a deformity-induced cartilage. Currently, multiple types of orthopedic implants exist in the medical community including ceramics-based, metal alloys-based, and polymer-based. The rising number of geriatric populations that are often vulnerable to several forms of orthopedic conditions has been driving the demand for orthopedic instruments. The most commonly used products in the industry used for orthopedic surgeries or treatment processes include bone plates, bone saws, surgical forceps, screws & pins, drills, rasps & files, and arthroscopic instruments. The rising interest of the medical community to integrate innovative solutions such as Artificial Intelligence (AI) for medical diagnosis and treatment is expected to contribute to the industry’s growth trends in the coming years.

Key Insights:

- As per the analysis shared by our research analyst, the global orthopedics instruments market is estimated to grow annually at a CAGR of around 4.40% over the forecast period (2024-2032)

- In terms of revenue, the global orthopedics instruments market size was valued at around USD 60.92 billion in 2023 and is projected to reach USD 88.82 billion, by 2032.

- The market is projected to grow at a significant rate due to the growing population of senior citizens globally

- Based on the end-user, the hospitals segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the product, the joint replacement segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Orthopedics Instruments Market: Growth Drivers

Growing population of senior citizens globally will drive the market demand

The global orthopedics instrument market is expected to grow due to the increasing number of senior citizens across the globe. In medical terms, people over the age of 65 years are considered in the group of geriatric population. Elderly people are at a higher risk of developing or facing bone-related medical issues also known as orthopedic conditions. Problems related to bones and joints do not appear suddenly but gradually progress with time. Hence, with age, the symptoms of underlying orthopedic conditions become more apparent. Some of the most common orthopedic problems in the elderly are fractures, osteoarthritis, dislocations, and osteoporosis. As per official information, 1 in every 3 people over the age of 65 years are prone to be affected by osteoarthritis. The condition is degenerative in nature and affects areas such as fingers, ankles, hands, knees, and spine. It leads to the patient finding it difficult to carry out everyday tasks. On the other hand, as bone density decreases with time, people in the higher age group are more likely to experience fractures since their vision gets blurred and they may lose balance frequently. According to the World Health Organization (WHO), the number of people over the age of 60 years is likely to reach 2.1 billion by 2050.

Rising healthcare expenditure and improved access to medical care will be beneficial for the industry’s growth rate

Global healthcare expenditure has improved in the last decade. Factors such as increased disposable income, higher awareness about the benefits of healthcare policies, and efforts by regional governments to improve access to national welfare schemes are some of the primary reasons for increased healthcare expenditure globally. For instance, in April 2024, the Indian government announced that every citizen over the age of 70 years will be eligible for the Ayushman Bharat scheme allowing the elderly population to gain access to free medical treatment worth INR 5 lakh. Additionally, the United Aram Emirates announced the launch of the Care initiative in 2022. Until May 2023, the country provided around 11,681 exhaustive health services to the country’s older population as per official reports. Other such projects have been launched globally thus creating greater growth scope for the global orthopedics instruments market. International welfare agencies are working toward investing sources in helping people belonging to the underprivileged segment of society to obtain medical care.

Orthopedics Instruments Market: Restraints

Lack of improper training or understanding about the actual cost of instruments among physicians or medical professionals may restrict the market expansion

The global orthopedics instruments market faces a key limitation in the form of a lack of awareness among medical professionals about ways in which they can obtain the actual cost of orthopedics instruments, especially implants. Physicians are considered key influencers in determining around 60% of total healthcare costs incurred by a patient. Orthopedic implants are typically expensive and medical professionals control the cost by inquiring about more options available in the market thus delivering informed patient care. Moreover, this can also help them reduce the overall cost of the implant and subsequently the overall treatment. In addition to this, comprehensive access to quality medical care still remains a major cause of concern among the global healthcare community.

Orthopedics Instruments Market: Opportunities

Increasing research on developing transformative technologies for orthopedic care holds high expansion possibilities

The global orthopedics instruments market is projected to generate significant growth opportunities during the forecast period. The orthopedic industry is witnessing a surge in the launch of new transforming devices that are expected to change the ways in which medical care for orthopedic conditions is provided. Orthopedic instrument developers are focusing on three essential aspects while developing novel solutions. These aspects are improving recovery outcomes, reducing surgeon burnout, and increasing the overall accuracy of the surgeries. The AI technology is expected to become pivotal in bringing radical changes in the orthopedic instruments segment. A 2021 study published in The Journal of Arthroplasty delved deeper into understanding the ways AI can assist in identifying Arthroplasty implants using knee radiographs. As per the research, deep learning algorithms could effectively differentiate between 9 accounts of knee arthroplasty implants with an accuracy rate of 99%. The technology could achieve this feat using plain radiographs. Furthermore, AI is also being explored for developing artificial intelligence-powered diagnostic tools for accurate diagnosis.

Rising sports injury segment may help with the industry’s steadily rising growth trajectory

Orthopedic instruments are used for diagnosis and treating sports-related injuries. The rise in the number of sports events as well as the surging addition of players in the sports industry is expected to become significant growth contributors to orthopedics instruments demand. As per Johns Hopkins Medicine, around 3.5 billion children below the age of 14 years are exposed to sports injuries. The most common types of these medical problems are dislocations, cartilage ribs, and broken bones contributing to the global orthopedics instruments market.

Orthopedics Instruments Market: Challenges

Circulation of substandard products in the market could be challenging for the industry players

The global industry for orthopedics instruments is expected to be challenged by the presence of a growing number of substandard product sellers. While the medical devices sector is widely regulated, there have been several reports indicating a sharp rise in the low-quality retailers of orthopedic instruments. In 2018, accusations were made against Medtronic, a leading provider of surgical tools, for defrauding government health programs, paying doctors for favorable studies, promoting unauthorized uses of products, and price fixing.

Orthopedics Instruments Market: Segmentation

The global orthopedics instruments market is segmented based on end-user, product, and region.

Based on the end-user, the global market segments are outpatient facilities and hospitals. In 2023, the highest growth was observed in the hospitals segment. It accounted for more than 65.6% of the total segmental share. The growing access to hospitals with an increase in the number of private and public medical care facilities can be attributed to the essential reason for higher revenue in the segment. Additionally, these facilities offer patient-friendly medical reimbursement policies thus attracting a higher patient base.

Based on the product, the global market segments are trauma, sports medicine, joint replacement, orthobiologics, and others. In 2023, the highest growth was observed in the joint replacement segment as it held control over 47.25% of the total share. The increase in the number of patients undergoing joint replacement procedures is driving the segmental demand. According to the American College of Rheumatology, more than 790,000 knee replacement surgeries are conducted in the US annually.

Orthopedics Instruments Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Orthopedics Instruments Market |

| Market Size in 2023 | USD 60.92 Billion |

| Market Forecast in 2032 | USD 88.82 Billion |

| Growth Rate | CAGR of 4.40% |

| Number of Pages | 230 |

| Key Companies Covered | Integra LifeSciences, B. Braun, Stryker Corporation, Globus Medical, Zimmer Biomet, Medtronic, Boston Scientific, DePuy Synthes (Johnson & Johnson), Arthrex, Orthofix, Smith+Nephew, ATEC Spine, Enovis (formerly DJO Global), Össur, NuVasive., and others. |

| Segments Covered | By End-User, By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Orthopedics Instruments Market: Regional Analysis

North America to continue its dominance streak during the projection period

The global orthopedics instruments market will be dominated by North America. In 2023, the region generated around 44% of the global market revenue. North America has the presence of multiple medical device makers that dominate the regional and international markets. In July 2023, USA-based Stryker announced the launch of the Ortho Q Guidance system. The novel technology will assist in delivering advanced surgical planning and assistance for knee and hip procedures. The surgeons will be able to control the process from the sterile area. It is built using a state-of-the-art and highly advanced camera powered by algorithms. In September 2022, Kaliber Labs, a new company focusing on surgical AI, especially for orthopedic surgery solutions, launched its first software which is powered by AI and will be used for patient communication thus helping medical professionals deliver personalized patient care. North America also has a high rate of joint replacement procedures conducted annually. The rising number of sports injuries as well as the growing demand for affordable implants is likely to boost the regional market growth rate. Asia-Pacific may witness significant revenue driven by increasing patient rates in countries such as India and China. The growing number of elderly population in the country as well as surging healthcare expenditure may prompt higher revenue market share in the coming years.

Orthopedics Instruments Market: Competitive Analysis

The global orthopedics instruments market is led by players like:

- Integra LifeSciences

- B. Braun

- Stryker Corporation

- Globus Medical

- Zimmer Biomet

- Medtronic

- Boston Scientific

- DePuy Synthes (Johnson & Johnson)

- Arthrex

- Orthofix

- Smith+Nephew

- ATEC Spine

- Enovis (formerly DJO Global)

- Össur

- NuVasive.

The global orthopedics instruments market is segmented as follows:

By End-User

- Outpatient Facilities

- Hospitals

By Product

- Trauma

- Sports Medicine

- Joint Replacement

- Orthobiologics

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Orthopedics instruments are medical devices and tools used by medical professionals for treating conditions related to the musculoskeletal systems.

The global orthopedics instrument market is expected to grow due to the increasing number of senior citizens across the globe.

According to study, the global orthopedics instruments market size was worth around USD 60.92 billion in 2023 and is predicted to grow to around USD 88.82 billion by 2032.

The CAGR value of orthopedics instruments market is expected to be around 4.40% during 2024-2032.

The global orthopedics instruments market will be dominated by North America.

The global orthopedics instruments market is led by players like Integra LifeSciences, B. Braun, Stryker Corporation, Globus Medical, Zimmer Biomet, Medtronic, Boston Scientific, DePuy Synthes (Johnson & Johnson), Arthrex, Orthofix, Smith+Nephew, ATEC Spine, Enovis (formerly DJO Global), Össur and NuVasive.

The report explores crucial aspects of the orthopedics instruments market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed