Packaging Testing Market Size, Share, Analysis, Trends, Growth, 2032

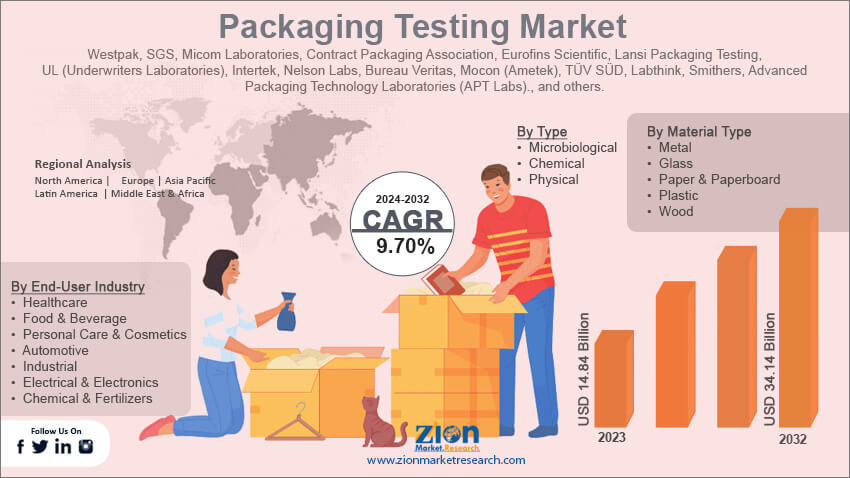

Packaging Testing Market By Material Type (Metal, Glass, Paper & Paperboard, Plastic, Wood, and Others), By Type (Microbiological, Chemical, and Physical), By End-User Industry (Healthcare, Food & Beverage, Personal Care & Cosmetics, Automotive, Industrial, Electrical & Electronics, Chemical & Fertilizers, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

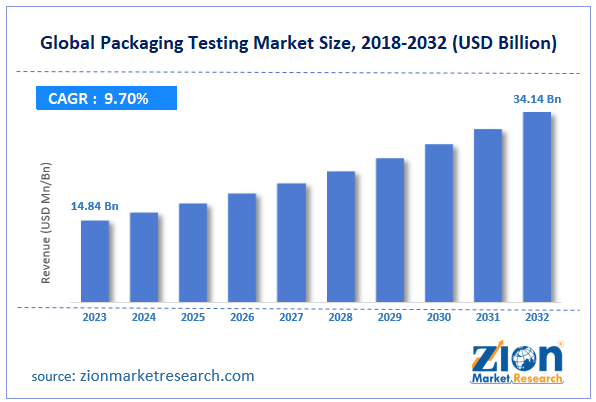

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14.84 Billion | USD 34.14 Billion | 9.70% | 2023 |

Packaging Testing Industry Prospective:

The global packaging testing market size was worth around USD 14.84 billion in 2023 and is predicted to grow to around USD 34.14 billion by 2032 with a compound annual growth rate (CAGR) of roughly 9.70% between 2024 and 2032.

Packaging Testing Market: Overview

Packaging testing is an integral part of the logistics and manufacturing sector. It is used for determining the quality and functionality of packaging solutions across industries. It assesses parameters such as material, design, and effectiveness in protecting, preserving, and presenting the packaged goods. The demand for testing packaging solutions has grown over the years due to the formulation of stringent regulations globally governing the outer and internal packaging of products such as healthcare and food items.

Apart from its application as a branding source, packaging plays a significant role in improving the shelf life of products. It ensures protection against external environmental factors such as changes in temperature, exposure to water or humidity, and compression caused by outer pressure. Effective packaging is necessary for delivering optimum product quality. The packaging testing industry is led by several types of testing, such as vibration testing, humidity testing, shock testing, and others. During the forecast period, the global food & beverages (F&B) sector will act as an essential market growth driver. However, the lack of standard testing procedures may impact the market growth trends.

Key Insights:

- As per the analysis shared by our research analyst, the global packaging testing market is estimated to grow annually at a CAGR of around 9.70% over the forecast period (2024-2032)

- In terms of revenue, the global packaging testing market size was valued at around USD 14.84 billion in 2023 and is projected to reach USD 34.14 billion by 2032.

- The packaging testing market is projected to grow at a significant rate due to the surging demand for superior-quality packaging solutions in the F&B industry

- Based on the material type, the plastic segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the end-user industry, the food & beverage segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Packaging Testing Market: Growth Drivers

Surging demand for superior quality packaging solutions in the F&B industry will drive the market demand rate

The global packaging testing market is expected to be driven by the growing applications in the F&B sector. The global food & beverages industry is one of the largest consumers of packaging testing solutions. The quality of packaged food depends on the quality of the material and the packaging technique used for transporting, storing, and distributing food products. Packaging edible and drink items is a complicated process since it deals with several layers of packaging. The outer layer, for instance, is typically used for branding activities.

However, it also forms an integral part of the overall product enclosing design. The packaging should be functional even when the product has been sold to the customers. The rising innovation trend in food packaging will generate more demand for effective testing techniques.

For instance, in May 2024, Mondi, one of the leading F&B companies globally, announced the launch of a novel secondary paper packaging solution called TrayWrap. It is expected to replace plastic shrink film used for bundling drinks and food products. TrayWrap is produced using 100% Kraft paper and provides highly secure packaging for coffee packs. Expansion of the global food industry across regions will further promote higher demand for packaging testing.

Healthcare industry to generate demand for error-free packaging testing techniques

The global healthcare industry is witnessing stringency in healthcare-related products ranging from medical devices to medicines. Ineffective or poor packaging of medicine-related products poses significant health risks for patients, including humans and animals. According to the Arthritis Foundation, exposure to extreme temperatures, humidity, and light can make medicines less effective. In some cases, they may even become toxic. In January 2024, Dr Reddy's Laboratories had to recall 8,000 bottles of Tacrolimus capsules from the US. The products were generic drugs, and the action was a result of a packaging error. According to the US Food & Drugs Administration (FDA), a 1 mg Tacrolimus capsules bottle was found to have only 0.5 mg Tacrolimus capsules. Such events will promote higher application of the global packaging testing market.

Packaging Testing Market: Restraints

Lack of standard policies in the industry will limit the market’s growth rate

The global industry for packaging testing is expected to be restricted due to a lack of standard policies worldwide. Depending on the sector and region, packaging testing technique continues to vary. In addition, every region has specific criteria that describe packaging testing techniques to be used for each industry. Due to dynamic packaging testing regulations and guidelines, the safety and quality of packaging suffer from several vulnerabilities. Additionally, companies may struggle to comply with changing packaging testing guidelines.

Packaging Testing Market: Opportunities

Use of advanced digital solutions to improve testing outcomes will generate growth opportunities

The global packaging testing market is projected to generate growth opportunities due to the growing use of advanced technologies during testing procedures. Sophisticated digital solutions that are expected to emerge as significant contributors to the industry include non-destructive testing (NDT), digital imaging & vision systems, automated testing systems, environmental simulation testing, and others. In August 2022, Testronix, one of Asia’s leading testing instrument manufacturers, announced the launch of next-generation packaging testing instruments. The company will offer its services to the growing paper and packaging industry with the help of a Box Compressor Tester to determine the compressive strength of cartons and boxes. Advancements in digital imaging systems will further assist the industry players grow at a higher momentum. In July 2024, the US government announced an investment of USD 1.6 billion to be used for researching next-generation semiconductor packaging. This will automatically generate more investment for the coherent development of packing testing techniques. The global automotive sector, driven by the rise of electric vehicles, will also be crucial for future market trends.

Packaging Testing Market: Challenges

Gap in the supply of skilled workforce and technical experts will challenge the market expansion rate

The global packaging industry is expected to be challenged by the gap in demand and supply of skilled workforce. Packaging testing solutions and techniques are designed or operated by technical experts. However, the lack of sufficient training facilities and public awareness is a major growth limitation for the industry. Economic volatility and disruptions in the supply chain could also lead to loss of revenue.

Packaging Testing Market: Segmentation

The global packaging testing market is segmented based on material type, type, end-user industry, and region.

Based on the material type, the global market segments are metal, glass, paper & paperboard, plastic, wood, and others. In 2023, the highest growth was observed in the plastic segment. A large portion of the global packaging industry is dominated by plastic since the material is highly versatile and offers significant protection against external contaminants. According to market research, the global packaging industry uses more than 140 million tons of plastic every year. The emergence of biodegradable plastic could provide growth opportunities in the coming years.

Based on type, the global plastic testing industry is divided into microbiological, chemical, and physical.

Based on the end-user industry, the global market segments are healthcare, food & beverage, personal care & cosmetics, automotive, industrial, electrical & electronics, chemical & fertilizers, and others. In 2023, the highest growth was observed in the food & beverage sector. The F&B sector has been growing at a rapid rate due to rising population and globalization. Strict regulatory requirements for food packaging are also crucial to segmental revenue. The global food industry uses more than 35.01% of total single-use packaging, as per market research.

Packaging Testing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Packaging Testing Market |

| Market Size in 2023 | USD 14.84 Billion |

| Market Forecast in 2032 | USD 34.14 Billion |

| Growth Rate | CAGR of 9.70% |

| Number of Pages | 230 |

| Key Companies Covered | Westpak, SGS, Micom Laboratories, Contract Packaging Association, Eurofins Scientific, Lansi Packaging Testing, UL (Underwriters Laboratories), Intertek, Nelson Labs, Bureau Veritas, Mocon (Ametek), TÜV SÜD, Labthink, Smithers, Advanced Packaging Technology Laboratories (APT Labs)., and others. |

| Segments Covered | By Material Type, By Type, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Packaging Testing Market: Regional Analysis

North America to register the highest revenue during the projection period

The global packaging testing market will be led by North America during the forecast period. The higher demand in the packaging sector across North American countries will drive the regional revenue rate. The packaging industry in North America is heavily regulated, especially in the food and healthcare sectors. In February 2023, the US Federal Trade Commission, an independent government agency working in the consumer protection segment, launched the largest-ever penalty for misleading ‘Made in USA’ claims. The penalty was against Kubota North America Corporation. Canada is also taking tremendous strides in ensuring consumer protection.

Europe is a thriving region in the packaging testing industry with significant control over global revenue. The growing advancements in packaging testing solutions along with the rise of strategic partnerships among industry players are driving the regional demand rate. In March 2024, Silicon Box announced a partnership with the Italian government. Silicon Box is a highly advanced panel-level packaging foundry and plans to invest USD 3.6 billion in the Italian market for further expansion. Additionally, drafting stricter regulations against non-competitive packaging solutions will force market players to adopt effective packaging testing methods.

Packaging Testing Market: Competitive Analysis

The global packaging testing market is led by players like:

- Westpak

- SGS

- Micom Laboratories

- Contract Packaging Association

- Eurofins Scientific

- Lansi Packaging Testing

- UL (Underwriters Laboratories)

- Intertek

- Nelson Labs

- Bureau Veritas

- Mocon (Ametek)

- TÜV SÜD

- Labthink

- Smithers

- Advanced Packaging Technology Laboratories (APT Labs).

The global packaging testing market is segmented as follows:

By Material Type

- Metal

- Glass

- Paper & Paperboard

- Plastic

- Wood

- Others

By Type

- Microbiological

- Chemical

- Physical

By End-User Industry

- Healthcare

- Food & Beverage

- Personal Care & Cosmetics

- Automotive

- Industrial

- Electrical & Electronics

- Chemical & Fertilizers

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Packaging testing is an integral part of the logistics and manufacturing sector.

The global packaging testing market is expected to be driven by the growing applications in the F&B sector.

According to study, the global packaging testing market size was worth around USD 14.84 billion in 2023 and is predicted to grow to around USD 34.14 billion by 2032.

The CAGR value of the packaging testing market is expected to be around 9.70% during 2024-2032.

The global packaging testing market will be led by North America during the forecast period.

The global packaging testing market is led by players like Westpak, SGS, Micom Laboratories, Contract Packaging Association, Eurofins Scientific, Lansi Packaging Testing, UL (Underwriters Laboratories), Intertek, Nelson Labs, Bureau Veritas, Mocon (Ametek), TÜV SÜD, Labthink, Smithers and Advanced Packaging Technology Laboratories (APT Labs).

The report explores crucial aspects of the packaging testing market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed