Paper Card Gift Market Size, Share, Trends, Growth and Forecast 2034

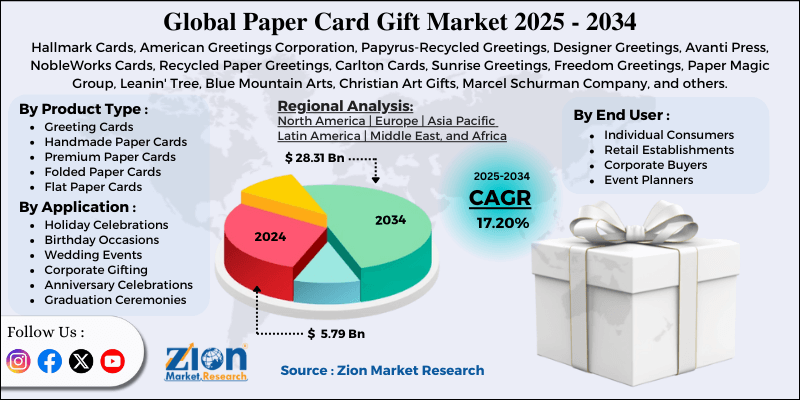

Paper Card Gift Market By Application (Holiday Celebrations, Birthday Occasions, Wedding Events, Corporate Gifting, Anniversary Celebrations, Graduation Ceremonies), By Product Type (Greeting Cards, Gift Cards with Paper Backing, Handmade Paper Cards, Premium Paper Cards, Folded Paper Cards, Flat Paper Cards), By End-User (Individual Consumers, Retail Establishments, Corporate Buyers, Event Planners, Educational Institutions, Non-profit Organizations), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

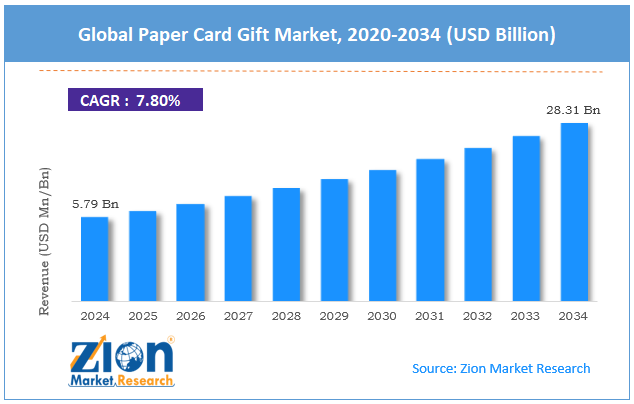

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.79 Billion | USD 28.31 Billion | 17.20% | 2024 |

Paper Card Gift Industry Perspective:

The global paper card gift market size was worth approximately USD 5.79 billion in 2024 and is projected to grow to around USD 28.31 billion by 2034, with a compound annual growth rate (CAGR) of roughly 17.20% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global paper card gift market is estimated to grow annually at a CAGR of around 17.20% over the forecast period (2025-2034).

- In terms of revenue, the global paper card gift market size was valued at approximately USD 5.79 billion in 2024 and is projected to reach USD 28.31 billion by 2034.

- The paper card gift market is projected to grow significantly due to the expansion of personalized gifting trends.

- Based on application, the holiday celebrations segment is expected to lead the market, while the corporate gifting segment is anticipated to experience significant growth.

- Based on product type, the greeting cards is the dominating segment, while the premium paper cards segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the individual consumers segment is expected to lead the market compared to the non-profit organizations segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Paper Card Gift Market: Overview

Paper card gifts represent a traditional yet evolving segment of the consumer goods industry, encompassing various greeting cards, gift cards with paper backing, and specialty paper-based gifting solutions. These cards are made from many types of paper, such as recycled paper, high-quality cardstock, and textured or decorative paper. The production process uses detailed printing, color controls, embossing or debossing, and strict quality checks to make sure the cards look good and last long. Today’s card makers use digital printing, eco-friendly paper sourcing, and tools that let customers create their personalized designs and messages. The market offers a huge variety in card sizes, styles, art, and themes for all types of cultural events and celebrations. Companies use high-technology cutting machines, folding tools, and packaging systems to maintain product quality and a premium look. Safety rules and industry standards ensure these cards are made responsibly and give people a meaningful way to give gifts.

The increasing adoption of sustainable paper-based alternatives is expected to drive substantial growth in the paper card gift market throughout the forecast period.

Paper Card Gift Market: Growth Drivers

How is the increasing demand for personalized and meaningful gifting experiences propelling the paper card gift market growth?

The paper card gift market is growing rapidly as people seek more personal ways to express their feelings and commemorate special events. Even in the modern digital age, physical cards offer a thoughtful and lasting way to show you care, which is something digital messages often cannot match. Personalization is becoming more popular, and people now want cards they can customize with messages, photos, and original designs.

Younger consumers, such as Millennials and Generation Z, prefer items that feel real and handcrafted, and are willing to spend more on cards that reflect their personality and values. Social media has also made paper cards trendier, as people use them as photo props and keepsakes to enhance gift-giving. As people look to spend less time online and connect more deeply through real-life moments, paper cards continue to be a key part of how we celebrate and build relationships.

Growing awareness of environmental sustainability and eco-friendly products

The global paper card gift industry is also growing because consumers want environmentally friendly options instead of plastic or synthetic gifts. Many card companies now use recycled paper, responsibly managed forest products, and eco-friendly inks to win over consumers. As people are adopting better packaging practices, paper-based gifts are becoming appealing.

Campaigns about recycling and smart consumption help people understand why paper products are better for the planet than digital or plastic alternatives. Government laws supporting green packaging and business sustainability goals also boost this trend. As consumers become more aware of environmental issues, they prefer to buy paper cards that reflect their values but still offer a personal and emotional gift experience.

Paper Card Gift Market: Restraints

How are digital alternatives and changing communication patterns restricting the progress of the paper card gift market?

One of the biggest challenges for the paper card gift market is the rise of digital communication. More people, especially the younger generation, are using social media, e-cards, and messaging applications instead of traditional cards. Digital tools are fast, easy, and often free, making them convenient for people who are always on the go.

Because of this shift, fewer people are buying paper cards, especially among younger generations. The COVID-19 pandemic made this trend stronger by changing how people connect socially. Budget shoppers also avoid paper cards because digital options cost less or are free. These factors limit how often people choose paper cards, affecting overall sales in the market.

Paper Card Gift Market: Opportunities

Expansion into emerging markets and cultural celebrations

The paper card gift market presents significant growth opportunities through expansion into emerging markets, where rising disposable incomes and westernization of celebration practices create new demand. Developing countries experiencing economic growth show increasing adoption of greeting card traditions for holidays, birthdays, and special occasions. The growing middle class in emerging economies values branded products and premium gifting experiences, creating demand for high-quality paper card options.

E-commerce platforms and digital marketing enable manufacturers to reach consumers in remote locations and introduce paper card traditions to new markets. International business expansion and cultural exchange also drive demand for corporate greeting cards and cross-cultural celebration products.

Paper Card Gift Market: Challenges

How are supply chain disruptions and raw material costs limiting the growth of the market?

The paper card gift industry faces ongoing challenges related to supply chain disruptions and fluctuating raw material costs, particularly for specialty papers and printing materials. Global supply chain issues have affected the availability and pricing of quality paper stocks, impacting production schedules and profit margins. Transportation delays and increased shipping costs have made it difficult for manufacturers to maintain consistent delivery schedules and competitive pricing.

The rising costs of printing inks, specialty finishes, and packaging materials have pressured manufacturers to increase prices or reduce product quality. Labor shortages in the manufacturing and logistics sectors have further complicated operations and increased production costs. Small and medium-sized manufacturers face particular challenges in securing reliable supply chains and managing cost fluctuations, limiting their ability to compete with larger companies that have better supply chain resources.

Paper Card Gift Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Paper Card Gift Market |

| Market Size in 2024 | USD 5.79 Billion |

| Market Forecast in 2034 | USD 28.31 Billion |

| Growth Rate | CAGR of 17.20% |

| Number of Pages | 219 |

| Key Companies Covered | Hallmark Cards, American Greetings Corporation, Papyrus-Recycled Greetings, Designer Greetings, Avanti Press, NobleWorks Cards, Recycled Paper Greetings, Carlton Cards, Sunrise Greetings, Freedom Greetings, Paper Magic Group, Leanin' Tree, Blue Mountain Arts, Christian Art Gifts, Marcel Schurman Company, and others. |

| Segments Covered | By Application, By Product Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Paper Card Gift Market: Segmentation

The global paper card gift market is segmented based on application, product type, end user, and region.

Based on application, the global paper card gift industry is segregated into holiday celebrations, birthday occasions, wedding events, corporate gifting, anniversary celebrations, and graduation ceremonies. Holiday celebrations hold the largest market share due to widespread seasonal card-giving traditions, high volume purchases during festive periods, and extensive use across multiple cultural and religious celebrations worldwide.

Based on product type, the global paper card gift market is classified into greeting cards, gift cards with paper backing, handmade paper cards, premium paper cards, folded paper cards, and flat paper cards. Greeting cards are expected to lead the market during the forecast period due to their versatile applications, established consumer acceptance, and wide availability across retail channels and price points.

Based on end-user, the global market is segmented into individual consumers, retail establishments, corporate buyers, event planners, educational institutions, and non-profit organizations. Individual consumers lead the market due to personal gifting needs, emotional purchasing decisions, and widespread use of paper cards for family and social celebrations.

Paper Card Gift Market: Regional Analysis

North America leads the global market

North America leads the global paper card gift market due to established greeting card traditions, retail infrastructure, and consumer spending on celebratory products. The region accounts for approximately 40% of global paper card consumption, with the United States driving demand through its extensive holiday celebration culture and gift-giving traditions. American consumers have deeply ingrained habits of purchasing greeting cards for various occasions, supported by widespread retail availability and marketing campaigns. The region benefits from advanced printing technology, efficient distribution networks, and innovative product development that maintains market leadership.

Established relationships between card manufacturers, retailers, and consumers create stable demand patterns and brand loyalty. The presence of major greeting card companies and retail chains ensures consistent market growth and product innovation. North American consumers demonstrate willingness to pay premium prices for quality cards and personalized options, supporting market value and profitability.

What factors are driving Europe's expected strong growth in the paper card gift market?

Europe's paper card gift industry is experiencing steady expansion driven by diverse cultural celebrations, premium product preferences, and growing environmental consciousness. The region's rich tradition of handwritten communication and formal etiquette supports continued demand for paper-based greeting solutions. European consumers increasingly value artisanal and locally-produced cards that reflect regional artistic traditions and cultural heritage.

Environmental regulations and sustainability initiatives favor paper card manufacturers who can demonstrate responsible sourcing and production practices. The European Union's emphasis on circular economy principles creates opportunities for recycled and biodegradable card products. As disposable incomes rise and gift-giving occasions expand beyond traditional holidays, demand for specialized and premium paper cards continues to grow. The region's strong retail sector and established distribution channels facilitate market access for both domestic and international card manufacturers.

Recent Market Developments:

In January 2025, Green Field Paper Company, a U.S.-based leading greeting card manufacturer, launched a new line of plantable paper cards embedded with flower seeds, combining traditional card-giving with environmental sustainability and garden creation experiences.

Paper Card Gift Market: Competitive Analysis

The leading players in the global paper card gift market are:

- Hallmark Cards

- American Greetings Corporation

- Papyrus-Recycled Greetings

- Designer Greetings

- Avanti Press

- NobleWorks Cards

- Recycled Paper Greetings

- Carlton Cards

- Sunrise Greetings

- Freedom Greetings

- Paper Magic Group

- Leanin' Tree

- Blue Mountain Arts

- Christian Art Gifts

- Marcel Schurman Company

The global paper card gift market is segmented as follows:

By Application

- Holiday Celebrations

- Birthday Occasions

- Wedding Events

- Corporate Gifting

- Anniversary Celebrations

- Graduation Ceremonies

By Product Type

- Greeting Cards

- Gift Cards with Paper Backing

- Handmade Paper Cards

- Premium Paper Cards

- Folded Paper Cards

- Flat Paper Cards

By End User

- Individual Consumers

- Retail Establishments

- Corporate Buyers

- Event Planners

- Educational Institutions

- Non-profit Organizations

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Paper card gifts represent a traditional yet evolving segment of the consumer goods industry, encompassing various greeting cards, gift cards with paper backing, and specialty paper-based gifting solutions.

The global paper card gift market is projected to grow due to increasing demand for personalized gifting experiences, rising adoption of sustainable paper-based alternatives, and growing corporate gifting initiatives across various industries.

According to a study, the global paper card gift market size was worth around USD 5.79 billion in 2024 and is predicted to grow to around USD 28.31 billion by 2034.

The CAGR value of the paper card gift market is expected to be around 17.20% during 2025-2034.

North America is expected to lead the global paper card gift market during the forecast period.

The major players profiled in the global paper card gift market include Hallmark Cards, American Greetings Corporation, Papyrus-Recycled Greetings, Designer Greetings, Avanti Press, NobleWorks Cards, Recycled Paper Greetings, Carlton Cards, Sunrise Greetings, Freedom Greetings, Paper Magic Group, Leanin' Tree, Blue Mountain Arts, Christian Art Gifts, and Marcel Schurman Company.

The report examines key aspects of the paper card gift market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

The growth of the paper card gift market is impacted by environmental and regulatory factors such as sustainable packaging requirements, forest management regulations, recycling policies, and environmental protection standards promoting recyclable and biodegradable paper product alternatives.

Macroeconomic factors, including consumer spending patterns, retail industry trends, disposable income levels, and cultural celebration practices, will significantly influence the growth of the paper card gift market through purchasing behaviors, seasonal demand fluctuations, and market penetration across different demographic segments.

To stay competitive in the paper card gift market, stakeholders should adopt a comprehensive strategy focusing on product innovation, market segmentation, and customer engagement excellence. These comprise investment in sustainable production methods, development of personalized product offerings, and expansion into digital-physical hybrid experiences and emerging celebration occasions, among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed