Pawn Shop Market Size, Share, Trends, Growth 2032

Pawn Shop Market By Type (Jewelry & Accessories, Musical Devices, Precious Metals & Stones, Electronics & Tools, and Guns), By Service (Buying, Loan, and Selling), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

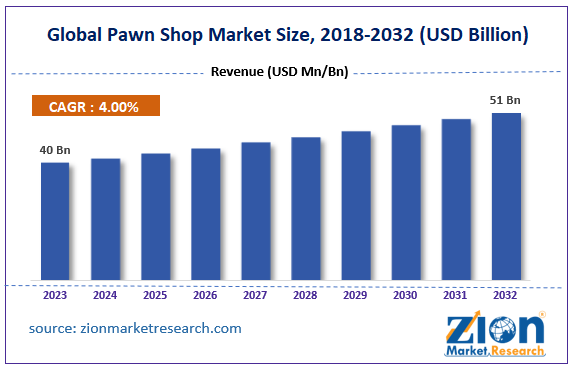

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 40 Billion | USD 51 Billion | 4% | 2023 |

Pawn Shop Industry Prospective:

The global pawn shop market size was evaluated at $40 billion in 2023 and is slated to hit $51 billion by the end of 2032 with a CAGR of nearly 4% between 2024 and 2032.

Pawn Shop Market: Overview

A pawn shop provides money as a loan to individuals when they give valuable items such as gold, musical instruments, jewelry, televisions, tablets, and smartphones to pawnbrokers. Reportedly, the valuables that individuals leave with pawnbrokers are referred to as collateral. Moreover, an individual can get the valuable item back from a pawnbroker after that individual pays back the money loaned to him/her. Furthermore, a pawnbroker can sell the valuable item of the individual and recover the money if the loan amount is not paid by him/her as per the decided time limit.

Key Insights

- As per the analysis shared by our research analyst, the global pawn shop market is projected to expand annually at the annual growth rate of around 4% over the forecast timespan (2024-2032)

- In terms of revenue, the global pawn shop market size was evaluated at nearly $40 billion in 2023 and is expected to reach $51 billion by 2032.

- The global pawn shop market is anticipated to grow rapidly over the forecast timeline owing to a surge in the rate of inflation along with the need for quick loan methods.

- In terms of type, the jewelry & accessories segment is slated to register the highest CAGR over the forecast period.

- Based on service, the loan segment is predicted to contribute majorly towards the global industry earnings in the upcoming years.

- Region-wise, the Asia-Pacific pawn shop industry is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

Pawn Shop Market: Growth Factors

Growing rates of inflation can prop up the expansion of the market globally over 2024-2032

A surge in the rate of inflation along with the need for quick loan methods is set to expedite the growth of the global pawn shop market. Moreover, the growing need for fulfilling basic requirements including paying rent, payment of power bills, and filling fuel in cars is likely to prop up the expansion of the global market. Escalating demand for quick money access is likely to boost the global market trends. Firms operating in the business are focusing on implementing new business growth strategies along with introducing new online tools for pawn broking activities, thereby embellishing the growth of the market across the globe. The flourishing e-commerce sector is likely to spike the elevation of the market across the globe in the coming years.

Pawn Shop Market: Restraints

Enacting strict laws for regulating pawn shop establishments can hinder the global industry expansion by 2032

Strict laws such as The Truth in Lending Act also referred to as TILA (in the U.S.) which protects an individual against unfair credit billing as well as unfair credit card practices can obstruct the growth of the global pawn shop industry. Apart from this, the lesser time limit set by pawnbrokers for loan repayment can further decimate the expansion of the global industry.

Pawn Shop Market: Opportunities

A rise in the costs of precious metals can open a spectrum of growth opportunities for the global market

A surge in product offerings and an increment in the costs of gold & precious metals can open a slew of growth avenues for the global pawn shop market in the years ahead. An increment in the customer demand for finances is likely to prop up the growth of the market globally.

Pawn Shop Market: Challenges

Stringent laws enforced by the government over pawn shop operations can halt the growth of the global industry

Strict regulations governing the functioning of pawn shops along with the launching of duplicate products are likely to challenge the expansion of the global pawn shop industry. In addition to this, high competition from buyback programs is anticipated to stagger the growth of the industry globally.

Pawn Shop Market: Segmentation

The global pawn shop market is divided into type, service, and region.

In terms of type, the pawn shop market across the globe is bifurcated into jewelry & accessories, musical devices, precious metals & stones, electronics & tools, and guns segments. Additionally, the jewelry & accessories segment, which gathered about 75% of the global market revenue in 2023, is predicted to register the highest rate of annual growth in the forecast timespan. The growth of the segment in the next eight years can be subject to a rise in the offering of loans to individuals after they leave jewelry & accessories as collateral with pawnbrokers.

Based on the service, the global pawn shop industry is divided into buying, loan, and selling segments. Moreover, the loan segment, which garnered approximately 70% of the global industry share in 2023, is projected to make immense contributions towards the global industry size over the period from 2024 to 2032. The segmental surge in the upcoming years can be credited to easy access to loans for customers through leveraging personal property as collateral. In addition to this, the loan service also fulfills the needs of people seeking financial aid through the use of valuables as a guarantee to the pawn shops. In addition to this, the loan service offers a slew of avenues to individuals for acquiring second-hand products.

Pawn Shop Market Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pawn Shop Market |

| Market Size in 2023 | USD 40 Billion |

| Market Forecast in 2032 | USD 51 Billion |

| Growth Rate | CAGR of 4% |

| Number of Pages | 206 |

| Key Companies Covered | New Bond Street Pawnbrokers, American Jewelry and Loan, Central Mega Pawn, Borro, Cash Canada, Browns Pawnbrokers, EZCORP Inc., First Cash Financial Services Inc., Cash America International Inc., Empire Pawn of Nassau Inc., National Pawnbrokers Association (NPA), Gold & Silver Pawn Shop, Prestige Pawnbrokers, Value Pawn & Jewelry, Maxferd Jewelry & Loan, USA Pawn & Jewelry, LoanMart, Pawn America, SuperPawn, Quik Pawn Shop., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pawn Shop Market: Regional Insights

North America is expected to maintain the leading status in the global market in the next few years

North America, which contributed about 54.5% of the global pawn shop market earnings in 2023, is predicted to retain global market domination in the ensuing years. Furthermore, the regional market surge in the next couple of years can be a result of thriving resale culture in countries such as the U.S. Additionally, economic uncertainties and changing customer trends will embellish the growth of the market in the region. Apart from this, the presence of pawn shops in the countries of North America will further spur regional market trends.

Asia-Pacific pawn shop industry is predicted to record the fastest annual rate of growth in the forecast timeline. The swift expansion of the industry in the sub-continent during the analysis timeline can be credited to rising urbanization and an increase in the need for luxury items by middle-income groups in countries such as China, Indonesia, Thailand, and India.

Pawn Shop Market: Competitive Space

The global pawn shop market profiles key players such as:

- New Bond Street Pawnbrokers

- American Jewelry and Loan

- Central Mega Pawn

- Borro

- Cash Canada

- Browns Pawnbrokers

- EZCORP Inc.

- First Cash Financial Services Inc.

- Cash America International Inc.

- Empire Pawn of Nassau Inc.

- National Pawnbrokers Association (NPA)

- Gold & Silver Pawn Shop

- Prestige Pawnbrokers

- Value Pawn & Jewelry

- Maxferd Jewelry & Loan

- USA Pawn & Jewelry

- LoanMart

- Pawn America

- SuperPawn

- Quik Pawn Shop.

The global pawn shop market is segmented as follows:

By Type

- Jewelry & Accessories

- Musical Devices

- Precious Metals & Stones

- Electronics & Tools

- Guns

By Application

- Buying

- Loan

- Selling

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A pawn shop provides money as a loan to individuals when they give valuable items such as gold, musical instruments, jewelry, televisions, tablets, and smartphones to pawnbrokers. Reportedly, the valuables that individuals leave with pawnbrokers are referred to as collateral.

The global pawn shop market growth over the forecast period can be owing to the growing need for fulfilling basic requirements including paying rent, payment of power bills, and filling fuel in cars.

According to a study, the global pawn shop industry size was $40 billion in 2023 and is projected to reach $51 billion by the end of 2032.

The global pawn shop market is anticipated to record a CAGR of nearly 4% from 2024 to 2032.

Asia-Pacific pawn shop industry is set to register the fastest CAGR over the forecasting timeline owing to rising urbanization and an increase in the need for luxury items by middle-income groups in countries such as China, Indonesia, Thailand, and India.

The global pawn shop market is led by players such as New Bond Street Pawnbrokers, American Jewelry and Loan, Central Mega Pawn, Borro, Cash Canada, Browns Pawnbrokers, EZCORP, Inc., First Cash Financial Services, Inc., Cash America International, Inc., Empire Pawn of Nassau Inc., National Pawnbrokers Association (NPA), Gold & Silver Pawn Shop, Prestige Pawnbrokers, Value Pawn & Jewelry, Maxferd Jewelry & Loan, USA Pawn & Jewelry, LoanMart, Pawn America, SuperPawn, and Quik Pawn Shop.

The global pawn shop market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed