Payment Orchestration Platform Market Size, Share, Trends, Growth and Forecast 2032

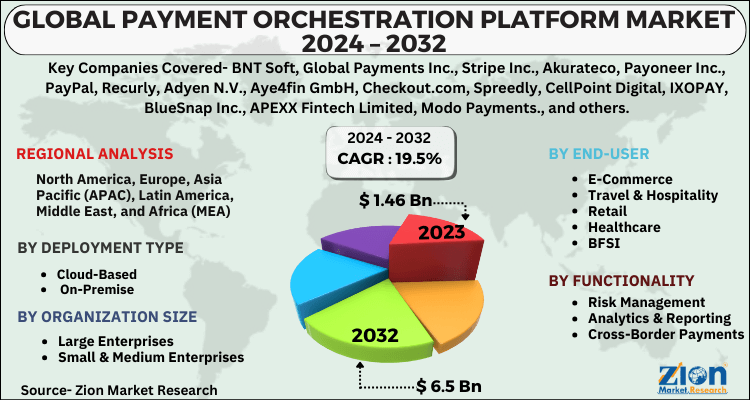

Payment Orchestration Platform Market By Deployment Type (Cloud-Based and On-Premise), By Organization Size (Large Enterprises and Small & Medium Enterprises), By End-User (E-Commerce, Travel & Hospitality, Retail, Healthcare, and BFSI), By Functionality (Risk Management, Analytics & Reporting, and Cross-Border Payments), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

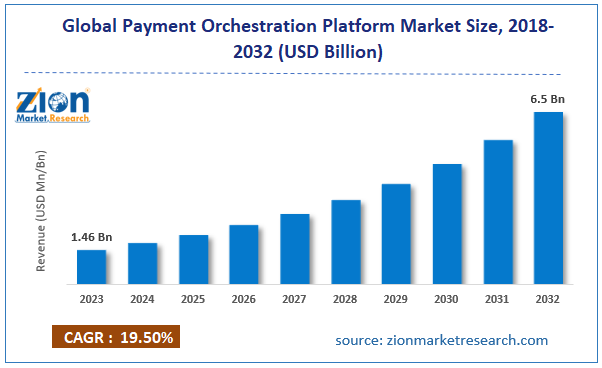

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.46 Billion | USD 6.5 Billion | 19.5% | 2023 |

Payment Orchestration Platform Industry Prospective:

The global payment orchestration platform market size was evaluated at $1.46 billion in 2023 and is slated to hit $6.5 billion by the end of 2032 with a CAGR of nearly 19.5% between 2024 and 2032.

Payment Orchestration Platform Market: Overview

Payment orchestration platform is a key solution streamlining & managing the overall payment process of various businesses. It integrates a slew of payment service providers and gateways.

Moreover, it helps traders and merchants in optimizing payment flows along with improving customer experiences. Key characteristics of payment orchestration include multi-channel support, unified integration, fraud prevention, dynamic routing, and analytics & reporting.

Key Insights

- As per the analysis shared by our research analyst, the global payment orchestration platform market is projected to expand annually at the annual growth rate of around 19.5% over the forecast timespan (2024-2032)

- In terms of revenue, the global payment orchestration platform market size was evaluated at nearly $1.46 billion in 2023 and is expected to reach $6.5 billion by 2032.

- The global payment orchestration platform market is anticipated to grow rapidly over the forecast timeline owing to flourishing e-commerce sector along with an increase in the online payments resulting in need for secured payment services.

- In terms of deployment type, the cloud-based segment is slated to register the highest CAGR over the forecast period.

- Based on organization size, the large enterprises segment is predicted to contribute majorly towards segmental space in the upcoming years.

- On the basis of end-user, the e-commerce segment is expected to dominate the segmental growth in the ensuing years.

- Based on functionality, the cross-border payments segment is predicted to lead the global industry expansion over the assessment period.

- Region-wise, the Asia-Pacific payment orchestration platform industry is projected to register the fastest CAGR during the assessment timespan.

Payment Orchestration Platform Market: Growth Factors

An increase in the digital transactions to prop up the global market expansion over forecast period

Flourishing e-commerce sector along with an increase in the online payments resulting in need for secured payment services has boosted the global payment orchestration platform market expansion.

Additionally, a rise in the cross-border commerce activities along with need for fraud prevention & improved security is likely to augment the global market surge in the upcoming years.

Moreover, need for integrating fraud prevention tools, gateways, and various payment service providers with complex payment ecosystems into a single tool will push the growth of the global market in the upward direction. Demand for improving end-user experience and investment in digital payment systems will multiply the global market size.

Payment Orchestration Platform Market: Restraints

A rise in the cases of data breaches & transactional fees to obstruct the global industry by 2032

Data violations along with huge costs associated with its implementation can hinder the growth of the global payment orchestration platform industry.

An increase in the transactional charges associated with use of payment orchestration platform can retard the global industry.

Payment Orchestration Platform Market: Opportunities

A surge in the investments in fintech segment can generate new dimensions of growth over the forecast period

High focus on Omni channel payment modes and growing promotion of cashless payments across the globe post COVID-19 pandemic has opened new growth avenues for the global payment orchestration platform market.

An increase in the allocation of funds in fintech sector will embellish the scope of the global market in the years ahead.

Payment Orchestration Platform Market: Challenges

Demand for high fund allocation for developing & implanting the tool can challenge the global industry surge by 2032

Growing security & compliance issues and challenging task of integrating multiple payment service providers into a sole orchestration tool can create hurdles in the growth of the global payment orchestration platform industry.

Need for huge initial investments and rising operating costs along with skepticism of consumers towards using new technologies can obstruct the growth of the global industry.

Payment Orchestration Platform Market: Segmentation

The global payment orchestration platform market is divided into deployment type, organization size, end-user, functionality, and region.

In terms of deployment type, the payment orchestration platform market across the globe is segmented into cloud-based and on-premise segments.

Apparently, the cloud-based segment, which garnered nearly 33% of the global market revenue in 2023, is set to record fastest growth rate each year over 2024-2032 subject to benefits of cloud-based deployment mode such as flexibility, scalability, cost-efficiency, and security.

Based on the organization size, the global payment orchestration platform industry is divided into large enterprises and small & medium enterprises segments.

Apparently, the large enterprises segment, which dominated the industry share globally in 2023, is expected to contribute lucratively towards the expansion of the segment in the analysis timespan and this can be as a result of rise in the volume of online transactions along with complex payments experienced in large enterprises. Need for advanced analytics & security will prop up the segmental growth.

On the basis of end-user, the global payment orchestration platform market is sectored into e-commerce, travel & hospitality, retail, healthcare, and BFSI sectors.

Apart from this, e-commerce segment, which dominated the end-user segment in 2023, is likely to retain its domination status in the coming eight years due to demand for payment orchestration tool in e-commerce sector with focus on improving end-user experience and susceptibility of e-commerce transactions to online frauds.

Based on the functionality, the global payment orchestration platform industry is bifurcated into risk management, analytics & reporting, and cross-border payments segments.

Moreover, cross-border payments segment, which lead the global industry size in 2023, will continue to lead the global industry in the foreseeable future. This growth can be attributed to surging cross-border trade globally along with ease of currency exchange transactions.

Payment Orchestration Platform Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Payment Orchestration Platform Market |

| Market Size in 2023 | USD 1.46 Billion |

| Market Forecast in 2032 | USD 6.5 Billion |

| Growth Rate | CAGR of 19.5% |

| Number of Pages | 217 |

| Key Companies Covered | BNT Soft, Global Payments Inc., Stripe Inc., Akurateco, Payoneer Inc., PayPal, Recurly, Adyen N.V., Aye4fin GmbH, Checkout.com, Spreedly, CellPoint Digital, IXOPAY, BlueSnap Inc., APEXX Fintech Limited, Modo Payments., and others. |

| Segments Covered | By Deployment Type, By Organization Size, By End-User, By Functionality, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Payment Orchestration Platform Market: Regional Insights

North America is likely to maintain leading status in the global market over the analysis timespan

North American, which contributed for about half of the global payment orchestration platform market size in 2023, is anticipated to establish a leading position in the global market in the analysis timeline.

Furthermore, the regional market expansion in the upcoming years can be owing to availability of strong technological infrastructure and acceptance of new payment systems in the countries such as the U.S.

Asia-Pacific payment orchestration platform industry is set to record the highest growth rate in the projected timeline. The progress of the industry in the continent can be subject to flourishing e-commerce sector and technological breakthroughs, swift digital transformation, varied payment processes, and supportive government schemes.

Key Developments

- In December 2023, Cashfree Payments introduced self-hosted payment orchestration tool referred to as FlowWise in India.

- In July 2024, BR-DGE introduced a white label payment orchestration service to improve the abilities of tools, payment acquirers, and gateways.

Payment Orchestration Platform Market: Competitive Space

The global payment orchestration platform market profiles key players such as:

- BNT Soft

- Global Payments Inc.

- Stripe Inc.

- Akurateco

- Payoneer Inc.

- PayPal

- Recurly

- Adyen N.V.

- Aye4fin GmbH

- Checkout.com

- Spreedly

- CellPoint Digital

- IXOPAY

- BlueSnap Inc.

- APEXX Fintech Limited

- Modo Payments.

The global payment orchestration platform market is segmented as follows:

By Deployment Type

- Cloud-Based

- On-Premise

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By End-User

- E-Commerce

- Travel & Hospitality

- Retail

- Healthcare

- BFSI

By Functionality

- Risk Management

- Analytics & Reporting

- Cross-Border Payments

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Payment orchestration platform is a key solution streamlining & managing the overall payment process of various businesses. It integrates a slew of payment service providers and gateways.

Which key factors will influence global payment orchestration platform market growth over 2024-2032?

The global payment orchestration platform market growth over the forecast period can be owing to a rise in the cross-border commerce activities along with need for fraud prevention & improved security.

According to a study, the global payment orchestration platform industry size was $1.46 billion in 2023 and is projected to reach $6.5 billion by the end of 2032.

The global payment orchestration platform market is anticipated to record a CAGR of nearly 19.5% from 2024 to 2032.

Asia-Pacific payment orchestration platform industry is set to register the fastest CAGR over the forecasting timeframe owing to flourishing e-commerce sector and technological breakthroughs, swift digital transformation, varied payment processes, and supportive government schemes.

The global payment orchestration platform market is led by players such as BNT Soft, Global Payments Inc., Stripe Inc., Akurateco, Payoneer Inc., PayPal, Recurly, Adyen N.V., Aye4fin GmbH, Checkout.com, Spreedly, CellPoint Digital, IXOPAY, BlueSnap Inc., APEXX Fintech Limited, and Modo Payments.

The global payment orchestration platform market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, cash-benefit analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, factor analysis, and value chain analysis. It provides an apt scenario about demand and factor conditions in the country impacting the profitability of the firms in the domestic and international markets.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed