Payment Processing Solutions Market Size, Share, Trends, Growth 2032

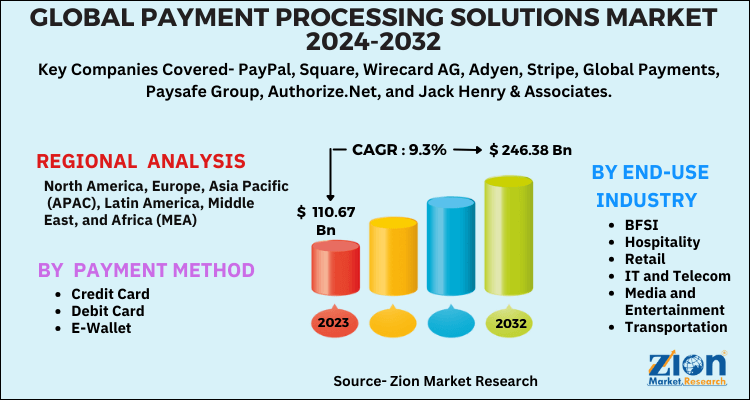

Payment Processing Solutions Market By Payment Method (Credit Card, Debit Card, E-Wallet, and Others) and By End-Use Industry (BFSI, Hospitality, Retail, IT & Telecom, Media & Entertainment, Transportation, and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 110.67 Billion | USD 246.38 Billion | 9.3% | 2023 |

Global Payment Processing Solutions Market Insights

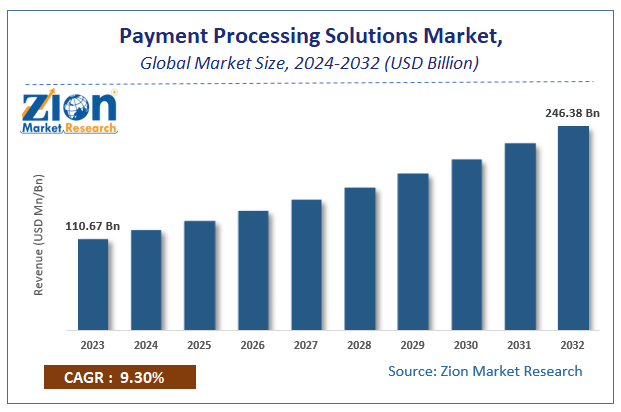

According to Zion Market Research, the global Payment Processing Solutions Market was worth USD 110.67 Billion in 2023. The market is forecast to reach USD 246.38 Billion by 2032, growing at a compound annual growth rate (CAGR) of 9.3% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Payment Processing Solutions Market industry over the next decade.

The report analyzes and forecasts the payment processing solutions market on a global and regional level. The study offers historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion). The assessment of payment processing solutions market dynamics gives a brief thought about the drivers and restraints of the payment processing solutions market along with their impact on the demand over the years to come. Additionally, the report also includes the study of opportunities available in the payment processing solutions market on a global level.

Payment Processing Solutions Market: Growth Factors

Payment processing solutions are widely used for various applications, such as credit card, terminals, recurring billing, and virtual terminals, for transacting on internet-based devices. The adoption of mobile commerce in the transportation sector is increasing. Car rental organizations, such as Uber and Lyft, are the major reason for this growth. Various market players, such as PayPal, are investing in car rental service provider companies. In April 2019, PayPal announced investments worth USD 500 million in Uber’s digital wallet.

Thus, the payment processing solutions market will grow in the future, owing to the technological adoption in the transportation sector. Additionally, the growing adoption of online banking transactions has resulted in the increased use of developed technology in the BFSI sector. Payment processing solutions help banks and other financial institutes to modernize customer ATM experience, leverage open banking platform, etc.

For instance, JP Morgan Chase invests around USD 11 billion on technology annually. These investments are bound to increase considering initiatives for digitalization across various countries. However, the lack of standardization for international transactions may have an adverse effect on market growth. Alternatively, organizations are focusing on developing payment processing solutions by using artificial intelligence to cater to various end-user requirements.

The report gives a transparent view of the payment processing solutions market. We have included a detailed competitive scenario and portfolio of the leading vendors operating in the payment processing solutions market. To understand the competitive landscape in the payment processing solutions market, an analysis of Porter’s Five Forces model for the payment processing solutions market has also been included. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

Key Insights

- As per the analysis shared by our research analyst, the global Payment Processing Solutions Market is estimated to grow annually at a CAGR of around 9.3% over the forecast period (2024-2032).

- In terms of revenue, the global Payment Processing Solutions Market size was valued at around USD 110.67 Billion in 2023 and is projected to reach USD 246.38 Billion by 2032.

- Based on the payment method, the credit cards were the leading payment method, accounting for over 44% of the global revenue in the payment processing solutions market. Their widespread acceptance and integration into various business operations contribute to this dominance.

- Based on the end-use industry, The hospitality sector, encompassing services like lodging, food and beverages, event planning, and transportation, held the largest market share in 2022, representing more than 39% of the global revenue. The industry's diverse payment processing needs, including bookings and on-site services, drive this prominence.

- Based on the region, In 2022, North America dominated the payment processing solutions market, capturing a 34.75% share of the global revenue. This leadership is attributed to the region's high adoption of digital payment solutions and a robust financial infrastructure.

Payment Processing Solutions Market: Dynamics

Key Growth Drivers

The payment processing solutions market is experiencing significant growth due to the rapid adoption of digital payment methods and the increasing preference for contactless transactions. The widespread use of smartphones and the expansion of e-commerce platforms have fueled the demand for secure and efficient payment gateways. Additionally, advancements in financial technology (FinTech), including blockchain and artificial intelligence (AI), are enhancing payment security and enabling faster transaction processing. Government initiatives promoting cashless economies and the growing acceptance of digital wallets and buy-now-pay-later (BNPL) solutions further drive market growth. Businesses across various sectors are also embracing omnichannel payment solutions to offer seamless customer experiences, contributing to market expansion.

Restraints

Despite the favorable growth, the payment processing solutions market faces several restraints. Cybersecurity threats, including fraud and data breaches, remain a significant concern, leading to financial losses and reputational damage for businesses. Additionally, the high cost of implementing and maintaining advanced payment infrastructure can be a barrier for small and medium-sized enterprises (SMEs). Regulatory complexities across different regions, including compliance with data protection laws like GDPR and PCI DSS, pose challenges for payment service providers. Furthermore, technical issues such as transaction failures and downtime can impact customer trust and hinder market growth.

Opportunities

The increasing penetration of mobile and internet services in emerging markets presents lucrative opportunities for payment processing solution providers. As more consumers and businesses in developing regions embrace digital payments, companies can expand their presence and offer localized solutions. The integration of artificial intelligence and machine learning for fraud detection and real-time payment monitoring is another key opportunity. Additionally, the growing adoption of cross-border e-commerce and international remittances has heightened the demand for global payment solutions. Partnerships between payment processors, banks, and FinTech companies also create new revenue streams and enhance service offerings.

Challenges

The payment processing solutions market faces challenges related to market saturation and intense competition among established players and new entrants. Maintaining compliance with evolving regulatory requirements across different regions can be resource-intensive and complex. Moreover, the need to offer seamless integration with various payment methods, currencies, and financial systems adds to the operational complexity. Consumer concerns over data privacy and the potential misuse of personal financial information pose additional challenges. Lastly, the rapid technological advancements in the sector demand continuous innovation and investment, which may strain the resources of smaller players.

Payment Processing Solutions Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Payment Processing Solutions Market |

| Market Size in 2023 | USD 110.67 Billion |

| Market Forecast in 2032 | USD 246.38 Billion |

| Growth Rate | CAGR of 9.3% |

| Number of Pages | 148 |

| Key Companies Covered | PayPal, Square, Wirecard AG, Adyen, Stripe, Global Payments, Paysafe Group, Authorize.Net, and Jack Henry & Associates |

| Segments Covered | By Payment Method, By End-use Industry And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Payment Processing Solutions Market: Segmentation

The study provides a crucial view of the payment processing solutions arket by segmenting the market based on the payment method, end-use industry, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on payment method, the market includes credit card, debit card, e-wallet, and others. The e-wallet segment is estimated to grow significantly in the future, owing to the increasing smartphones adoption.

On the basis of end-use industry, the payment processing solutions market is divided into BFSI, hospitality, retail, IT and telecom, media and entertainment, transportation, and others. The transportation segment is anticipated to witness considerable growth in the payment processing solutions market over the forecast time period, owing to the increasing demand for online car rental services.

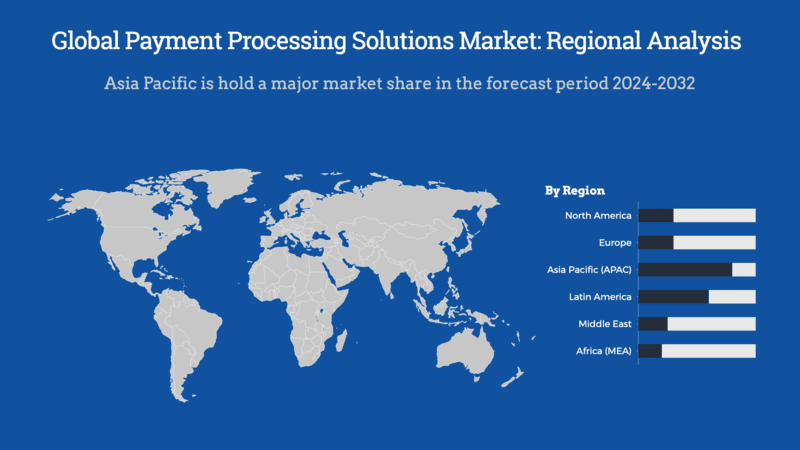

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Payment Processing Solutions Market: Regional Analysis

The regional segmentation comprises the current and forecast demand for the Middle East and Africa, North America, Asia Pacific, Latin America, and Europe.

The Asia Pacific region is estimated to grow substantially in the global payment processing solutions market over the forecast time span. India and China are expected to hold considerable market shares over the coming years in this region. Initiatives taken by the government for promoting the use of technology for making/receiving payments is the major contributor to the Asia Pacific payment processing solutions market. Latin America is anticipated to witness substantial growth in the payment processing solutions market over the forecast timeframe, owing to the growing demand by the Brazilian BFSI sector.

The global payment processing solutions market is experiencing significant growth, driven by technological advancements, increasing adoption of digital payment methods, and evolving consumer preferences. Regional dynamics play a crucial role in shaping the market landscape, with variations in adoption rates, regulatory environments, and technological infrastructure influencing growth patterns.

North America

North America maintains a strong position in the payment processing solutions market, attributed to its advanced digital infrastructure and widespread adoption of electronic payments. In 2023, the region held a 35% share of global revenue, with major players like PayPal, Stripe, and Square leading innovation. The mature financial services industry and early technological adoption have laid a solid foundation for market growth. However, the region's reliance on U.S. payment firms has raised concerns about economic coercion, prompting discussions on enhancing strategic autonomy in payment systems.

Asia-Pacific

The Asia-Pacific region is poised for substantial growth, driven by rapid digitalization and the proliferation of mobile payment platforms. China leads with platforms like Alipay and WeChat Pay, while India's Unified Payments Interface (UPI) has revolutionized digital transactions, contributing to a 46% increase in digital payment traffic in 2023. The region's large population and advanced mobile technologies position it as a key area for digital banking innovation. The APAC region is projected to hold a 45% market share in 2024, advancing at the highest CAGR during 2024–2030.

P&S Intelligence

Europe

Europe's payment processing market is characterized by a diverse landscape, with countries like the UK, Germany, and France spearheading fintech innovation. However, concerns about dependence on U.S. payment systems have emerged, with European Central Bank officials warning of potential economic coercion. Efforts are underway to enhance payment independence, including initiatives like the European Payments Initiative, aiming to establish a more resilient and autonomous payment infrastructure.

Latin America

Latin America is witnessing a rapid transformation in payment processing, driven by government initiatives promoting cashless transactions and financial inclusion. Brazil's instant payment system, Pix, introduced in late 2020, has seen widespread adoption, with projections indicating it will overtake credit cards as the dominant payment method for online purchases by the end of 2025. This shift underscores the region's potential for embracing innovative payment solutions.

Middle East and Africa

The Middle East and Africa present unique challenges and opportunities, with diverse market landscapes and regulatory environments. The increasing shift towards digital payments, driven by rising smartphone adoption and efforts to improve financial inclusion, is creating significant growth potential in these regions.

Payment Processing Solutions Market: Competitive Players

Some of the significant players in the global payment processing solutions market are

- PayPal

- Square

- Wirecard AG

- Adyen

- Stripe

- Global Payments

- Paysafe Group

- Authorize.Net

- Jack Henry & Associates

This report segments the global payment processing solutions market into:

Global Payment Processing Solutions Market: Payment Method Analysis

- Credit Card

- Debit Card

- E-Wallet

- Others

Global Payment Processing Solutions Market: End-Use Industry Analysis

- BFSI

- Hospitality

- Retail

- IT and Telecom

- Media and Entertainment

- Transportation

- Others

Global Payment Processing Solutions Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The systems and technologies that facilitate the transaction of funds between buyers and merchants are referred to as payment processing solutions. These solutions facilitate the authorisation, settlement, and transmission of funds in a variety of payment methods, such as online transactions, mobile payments, debit cards, and credit cards.

The demand for advanced payment processing solutions that support a diverse array of payment methods is driven by the increase in online purchasing, mobile payments, and e-commerce.

According to Zion Market Research, the global Payment Processing Solutions Market was worth USD 110.67 Billion in 2023. The market is forecast to reach USD 246.38 Billion by 2032.

According to Zion Market Research, the global Payment Processing Solutions Market a compound annual growth rate (CAGR) of 9.3% during the forecast period 2024-2032.

The regional segmentation comprises the current and forecast demand for the Middle East and Africa, North America, Asia Pacific, Latin America, and Europe.

Some noticeable players of the global payment processing solutions market are PayPal, Square, Wirecard AG, Adyen, Stripe, Global Payments, Paysafe Group, Authorize.Net, and Jack Henry & Associates.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed