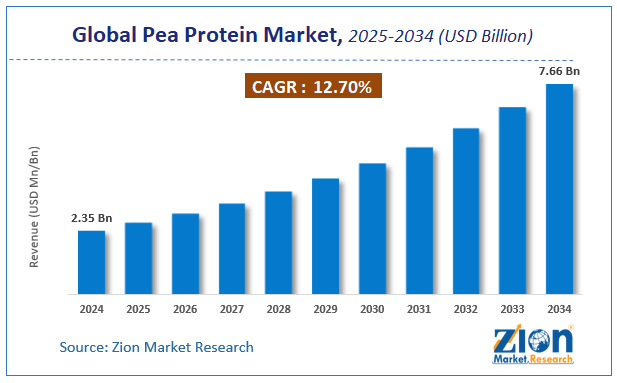

Pea Protein Market Size, Growth Drivers, Opportunities | Forecast Report 2028

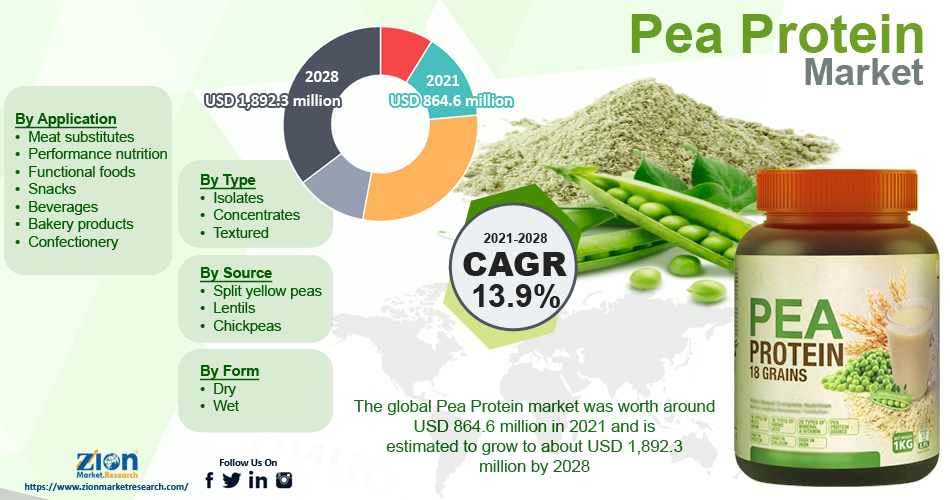

Pea Protein Market - By Type (Isolates, Concentrates, and Textured), By Form (Dry and Wet), By Source (Yellow Split Peas, Lentils, and Chickpeas), By Application (Meat Substitutes, Performance Nutrition, Functional Foods, Snacks, Beverages, Bakery Products, and Confectionery), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 864.6 Million | USD 1,892.3 Million | 13.9% | 2021 |

Pea Protein Market: Industry Perspective

The global pea protein market size was worth around USD 864.6 million in 2021 and is predicted to grow to around USD 1,892.3 million by 2028 with a compound annual growth rate (CAGR) of roughly 13.9% between 2022 and 2028.

The report analyzes the global pea protein market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the pea protein industry.

Pea Protein Market: Overview

Protein powder can be available in different forms such as whey protein, brown rice protein powder, soy protein, pea protein, etc. However, pea protein is increasingly becoming popular due to its large nutrient content and numerous applications in the food & beverage industry. Pea protein products can act as a replacement for a major portion of other proteins in the wide range of food products without having any effect on the taste, color, or texture of the product and in some cases can offer potential cost savings. Pea protein is preferred over other available options because it has no gluten or dairy.

Pea protein is easy to digest and does not cause bloating; a common problem with other protein powders. Pea protein is useful in many medical applications such as maintaining healthy muscle, weight management, boosting metabolism, controlling blood sugar, and improving blood circulation and calcium absorption, among others. As a result, is growingly seen as a major alternative to other available forms of protein.

Pea protein powder is a dietary supplement manufactured from yellow pea protein. It's commonly used to boost the protein level in smoothies and shakes, and because it's naturally vegan and hypoallergenic, it's a good fit for practically any diet. Pea protein is an excellent source of high-quality protein and iron. Pea protein includes all nine necessary amino acids that the human body cannot produce and must obtain from foodstuffs, making it beneficial to muscular building, weight loss, and cardiovascular health.

COVID-19 Impact Analysis:

The COVID-19 pandemic had many impacts on the agriculture industry as a whole. Countries that produce yellow peas and chickpeas, which are the principal suppliers of pea protein, encountered problems such as impediments to export and transportation. The overall output of these pulses was also hampered by manpower shortages during peak harvest seasons.

During the pandemic, however, demand for nutritious and functional meals increased. Pea protein is becoming more popular in affluent nations such as Germany, the United States, the United Kingdom, the Netherlands, and France, where vegan populations are on the rise. As the market gradually reopened, they were able to attain equilibrium in terms of pea demand and supply, and so the global pea protein market could be regarded to have experienced a low impact.

Pea Protein Market: Growth Drivers

The increasing popularity of plant-based products and vegan food consumers fueling the market growth

Consumer eating choices have shifted dramatically around the world. A large portion of the population is increasingly preferring foods that are of non-animal origin and non-meat, which includes milk or milk-based products. This is primarily fueling the demand for pea protein across the world. Further, health issues including lactose intolerance and animal allergies, as well as a growing health consciousness among consumers, are driving the change in food preferences. As a result of these circumstances, customers have begun to favor plant-based proteins that are free of allergens. In addition to this, an increase in disposable income and the availability of products through several online channels are also contributing to the growth of the global pea protein market.

Increasing preference towards a vegetarian diet is expected to be the major driver for the global pea protein market. In addition, increasing concern for health and wellness is expected to trigger the growth of pea protein market in the coming years. Moreover, heavy investment in research in development by pea protein manufacturing companies is expected to play a vital role in the growth of pea protein market. However, lack of awareness among end users is projected to act as a major restraint for pea protein market. Nevertheless, technological advancements in extrusion and processing and emerging markets across the globe are expected to act as an opportunity for pea protein market shortly.

Pea Protein Market: Restraints

The high cost associated with the extraction and processing of pea protein is likely to hamper the market growth

As a fact, soy protein has a higher level of consumer awareness than pea protein. Because of their large production capacity and great demand, soy protein manufacturers have achieved economies of scale. A pea, on the other hand, is a relatively new product. Wet fractionation is a high-cost process that involves four basic phases and needs a lot of heavy equipment, technology, and procedures. As a result, producers are not aggressively pursuing pea protein as a stand-alone product.

Pea Protein Market: Opportunities

The development of pea protein in new applications may offer a great opportunity for market expansion

Pea protein has limited applicability, and it was largely employed as a meat replacement in products that replace plant-based meat and nutraceuticals. Companies operating in the industry, on the other hand, are currently developing new plant-based goods and have effectively incorporated a variety of pea protein uses. Protein powders, nutrition bars, cereals, snacks, ready-to-eat meals, crisps, beverages, bakery, meal-replacement drinks, and confectionery & dairy replacements all include it.

Pea Protein Market: Challenges

Growth prospects are being hampered by supply restrictions

The conversion ratio of pea protein extracted from various varieties of peas varies depending on the procedure and the type of pea employed. Peas should be transformed into proteins at a rate of 15 to 20 percent. If the supply of pea protein does not meet the requirements of food and beverage makers, they may move to pea protein substitutes, which might stifle the global pea protein market's growth.

Pea Protein Market: Segmentation

The global pea protein market is segmented based on type, form, source, application, and region.

Based on the type, the global market is bifurcated into concentrates, isolates, and textured.

By form, the market is divided into wet and dry. In terms of revenue, the dry form accounts for the lion's share.

The source segment of the market is bifurcated into lentils, split yellow peas, and chickpeas. Split yellow peas dominate the market, accounting for more than 40% of the total.

The application segment is split into meat substitutes, performance nutrition, functional foods, snacks, beverages, bakery products, and confectionery. Among these, the meat substitute segment is projected to register rapid growth over the forecast period.

Pea Protein Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pea Protein Market |

| Market Size in 2021 | USD 864.6 Million |

| Market Forecast in 2028 | USD 1,892.3 Million |

| Growth Rate | CAGR of 13.9% |

| Number of Pages | 175 |

| Key Companies Covered | Ingredion, Rouquette Freres, Puris Foods, Emsland Group, The Green Labs LLC, Fenchem Inc., DuPont, A&B Ingredients, The Scoular Company, Glanbia PLC, and Axiom Foods Inc., and others. |

| Segments Covered | By Type, By Form, By Source, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2021 |

| Historical Year | 2018 to 2021 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pea Protein Market: Regional Landscape

Europe controls more than 35% of the global pea protein market. This is largely due to the increasing vegan population in the region. In only four years, the number of vegan food consumers has almost doubled. In the previous four years, the number of vegans in Europe increased from 1.3 million to 2.5 million, accounting for 3.2 percent of the population.

Moreover, the demand for disease nutrition and weight control is fueling the pea protein market's expansion in Europe. To meet consumers' health and wellness needs, major food & beverage businesses in Europe are focusing on creating products made with plant protein sources. The market in the Asia Pacific is still developing and is expected to offer better growth opportunities for the expansion of the pea protein market over the forecast period.

Recent Developments

-

In January 2020, Merit Functional Food Corp, a joint venture firm of Burcon Nutrascience Corp, obtained a co-investment from the Protein Industry (Canada). Merit Functional Food Corp's quick expansion in the protein production business would be aided by this advancement. It would make Burcon's new pea and canola protein constituents easier to make.

- In January 2020, Rouquette Freres signed a multi-year agreement with the US-located Beyond Meat to provide pea protein for the company's plant-based meat products. Roquette Freres' supply of pea proteins to the joint firm, Beyond Meat, is projected to rise as a result of the relationship.

Pea Protein Market: Competitive Landscape

Key players functioning in the global pea protein market include;

- Ingredion

- Rouquette Freres

- Puris Foods

- Emsland Group

- The Green Labs LLC

- Fenchem Inc.

- DuPont

- A&B Ingredients

- The Scoular Company

- Glanbia PLC

- Axiom Foods Inc.

The Global Pea Protein market is segmented as follows:

By Type

- Isolates

- Concentrate

- Textured

By Form

- Dry

- Wet

By Source

- Split Yellow Peas

- Lentils

- Chickpeas

By Application

- Meat Substitutes

- Performance Nutrition

- Functional Foods

- Snacks

- Beverages

- Bakery Products

- Confectionery

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Consumer eating choices have shifted dramatically over the world. Because a large portion of the population increasingly prefers food that is non-animal origin and non-meat that include milk or milk-based products. This is primarily fueling the demand for pea protein across the world.

According to a study, the global pea protein market size was worth around USD 864.6 million in 2021 and is expected to reach USD 1,892.3 million by 2028., with a compound annual growth rate (CAGR) of around 13.9%.

Europe is expected to dominate the pea protein market over the forecast period.

Key players in this market include Rouquette Freres, Ingredion, Puris Foods, Emsland Group, Fenchem Inc., DuPont, The Green Labs LLC, A&B Ingredients, Glanbia PLC, The Scoular Company, and Axiom Foods Inc.

The pea protein market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed