Peer to Peer (P2P) Lending Market Size, Share, Analysis, Trends, Growth, 2034

Peer to Peer (P2P) Lending Market By Type (Consumer Lending and Business Lending), By Loan Type (Secured and Unsecured), By End-user (Non Business Loans and Business Loans), By Purpose Type (Repaying Bank Debt, Credit Card Recycling, Education, Home Renovation, Buying Car, Family Celebration, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

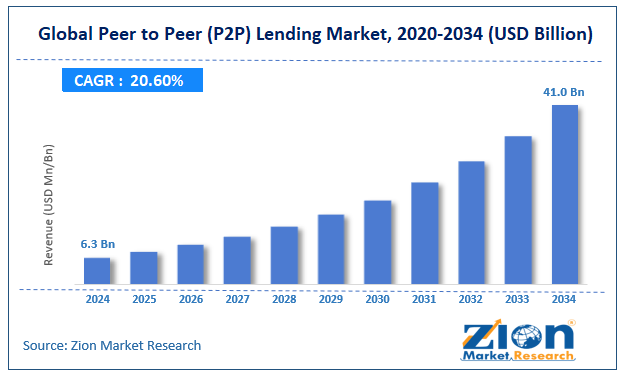

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.3 Billion | USD 41.0 Billion | 20.6% | 2024 |

Peer to Peer (P2P) Lending Industry Prospective:

The global Peer to Peer (P2P) Lending market size was worth around USD 6.3 billion in 2024 and is predicted to grow to around USD 41.0 billion by 2034, with a compound annual growth rate (CAGR) of roughly 20.6% between 2025 and 2034.

Peer to Peer (P2P) Lending Market: Overview

Peer-to-peer, or P2P, lending is the practice of making loans to individuals or companies through internet platforms that link lenders and borrowers. Peer-to-peer lending firms often provide their services online in an attempt to save expenses and provide their services at a lower cost than traditional financial institutions.

As a result, lenders can make higher returns than banks from savings and investment products. At the same time, borrowers can borrow money at lower interest rates, even after the P2P lending company has received a fee for providing the matchmaking platform and credit-checking the borrower. The risk of default exists for borrowers who get loans through peer lending websites.

Key Insights

- As per the analysis shared by our research analyst, the global Peer to Peer (P2P) Lending market is estimated to grow annually at a CAGR of around 20.6% over the forecast period (2025-2034).

- In terms of revenue, the global Peer to Peer (P2P) Lending market size was valued at around USD 6.3 billion in 2024 and is projected to reach USD 41.0 billion by 2034.

- The increasing digital transformation is expected to drive the Peer to Peer (P2P) Lending market over the forecast period.

- Based on the type, the consumer lending segment is expected to hold the largest market share over the forecast period.

- Based on the loan type, the unsecured segment is expected to dominate the market expansion over the projected period.

- Based on the end-user, the non-business loans segment is expected to garner the highest market share over the projected period.

- Based on the purpose type, the repaying bank debt segment is expected to hold a prominent market share during the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Peer to Peer (P2P) Lending Market: Growth Drivers

Technological advancement drives market growth

Due to technology, P2P lending has expanded dramatically. Direct communication between lenders and borrowers made possible by digital infrastructure and online platforms has replaced the necessity of middlemen.

Sophisticated algorithms and data analytics have also made efficient credit risk assessment possible, therefore improving the general speed and efficacy of the lending process. The growth of the peer to peer lending business is driven by the possibility of higher returns for lenders compared to more traditional investment opportunities.

P2P lending lets users invest directly in loans and earn interest income, unlike standard savings accounts or other investment vehicles, so possibly produce superior returns.

Peer to Peer (P2P) Lending Market: Restraints

Cybersecurity & fraud risks hinder market growth

Due to their all-online operations, P2P lending platforms are vulnerable to fraud and other cybersecurity risks that might harm investor confidence and slow industry expansion. Hackers pose as borrowers, apply for loans using stolen personal information, and then take the money and run. Investor accounts may be compromised by scammers to transfer money illegally.

Additionally, scammers use synthetic identities to fabricate profiles to obtain loans that they never plan to pay back. To obtain money intended for small businesses, some people create fictitious company names. Thus, cybersecurity & fraud risks might hinder the growth of the peer to peer lending industry.

Peer to Peer (P2P) Lending Market: Opportunities

Development in the regulatory framework offers a lucrative opportunity for market growth

P2P lending development is significantly influenced by how various geographical locations' regulatory frameworks change. Acknowledged by governments and financial regulatory bodies, peer to peer lending is growingly crucial in the financial ecosystem. They are creating and implementing rules that combine promoting innovation with protecting lender and borrower interests. These rules help to keep the market stable and ethical. They inspire users' trust in these services by providing a controlled environment that lowers risks, including fraud and defaults. Clear legislation allows new companies to enter the market, therefore validating peer-to-peer lending as a good alternative to traditional finance.

Peer to Peer (P2P) Lending Market: Challenges

Competition from traditional financial institutions & fintech firms poses a major challenge to market expansion

The P2P lending market is seeing increased rivalry from both traditional financial institutions (banks, credit unions) and fintech startups, limiting its expansion and adoption. Traditional banks are incorporating AI-powered loan approval systems and automating their lending procedures to make it easier for borrowers to obtain loans.

Some banks now offer unsecured loans at competitive interest rates, lessening the appeal of peer-to-peer lending. Established banks have higher consumer trust, regulatory compliance, and risk management processes than many peer-to-peer platforms.

Peer to Peer (P2P) Lending Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Peer to Peer (P2P) Lending Market |

| Market Size in 2024 | USD 6.3 Billion |

| Market Forecast in 2034 | USD 41.0 Billion |

| Growth Rate | CAGR of 20.6% |

| Number of Pages | 212 |

| Key Companies Covered | Funding Circle Limited, SocietyOne, Prosper Funding LLC, Lending Loop, Harmoney Australia Pty Ltd, Linked Finance, LENDINGCLUB BANK, LendingTree LLC, goPeer, Upstart Network Inc., and others. |

| Segments Covered | By Type, By Type, By End-user, By Purpose Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Peer to Peer (P2P) Lending Market: Segmentation

The global Peer to Peer (P2P) Lending industry is segmented based on type, loan type, end-user, purpose type, and region.

Based on the type, the global Peer to Peer Lending market is bifurcated into consumer lending and business lending. The consumer lending segment is expected to hold the largest market share over the forecast period.

One of the primary advantages of peer-to-peer lending is that borrowers can obtain loans at lower interest rates than traditional banks or credit unions. This advantage arises from P2P lenders' lower overhead expenses, which allow them to offer loans at more competitive rates.

Furthermore, P2P lending platforms often use a more efficient underwriting procedure, which contributes to lower loan costs and makes P2P lending an appealing choice for customers looking for low-cost borrowing opportunities.

Based on the loan type, the global Peer to Peer Lending industry is bifurcated into secured and unsecured. The unsecured segment is expected to dominate the market expansion over the projected period. The lack of collateral requirements for unsecured loans streamlines the application procedure and increases accessibility for a wider range of applicants.

As a result, laborious and time-consuming asset evaluation processes are no longer necessary. Furthermore, unsecured P2P lending appeals to borrowers who might not have substantial assets to pledge as security because it does not require collateral.

Based on the end-user, the global Peer to Peer Lending market is bifurcated into non-business loans and business loans. The non-business loans segment is expected to garner the highest market share over the projected period.

Numerous personal financial demands are met by personal loans, including debt consolidation, home remodeling, medical costs, schooling, and other personal expenses. This wide range of applications draws a sizable borrower base, which helps explain why non-business loans are so popular.

Additionally, people looking for smaller loan amounts with shorter repayment periods find P2P lending services appealing since they provide flexibility in loan amounts and repayment conditions.

Based on the purpose type, the global Peer to Peer Lending industry is bifurcated into repaying bank debt, credit card recycling, education, home renovation, buying cars, family celebrations and others. The repaying bank debt segment is expected to hold a prominent market share during the forecast period. P2P lending is frequently used by borrowers to refinance and consolidate their bank debt.

In contrast to their current bank loans, borrowers may be able to obtain better terms by taking out a peer-to-peer loan, such as longer repayment periods or cheaper interest rates. This reduces their overall financial burden and helps them manage their debt more effectively.

Peer To Peer (P2P) Lending Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global peer to peer lending market during the forecast period. With a strong focus on innovation and technology developments, the North American financial ecosystem is more advanced. Both investors and borrowers drawn to this space have helped P2P lending systems flourish.

Since a good number of people in North America are tech-savvy and at ease with digital platforms and online transactions, peer-to-peer lending is also more accepted there.

Furthermore, P2P lending has been encouraged by North American legislators, therefore fostering an environment fit for platform development.

Peer to Peer (P2P) Lending Market: Competitive Analysis

The global Peer to Peer (P2P) Lending market is dominated by players like:

- Funding Circle Limited

- SocietyOne

- Prosper Funding LLC

- Lending Loop

- Harmoney Australia Pty Ltd

- Linked Finance

- LENDINGCLUB BANK

- LendingTree LLC

- goPeer

- Upstart Network Inc.

The global Peer to Peer (P2P) Lending market is segmented as follows:

By Type

- Consumer Lending

- Business Lending

By Loan Type

- Secured

- Unsecured

By End-user

- Non Business Loans

- Business Loans

By Purpose Type

- Repaying Bank Debt

- Credit Card Recycling

- Education

- Home Renovation

- Buying Car

- Family Celebration

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Peer-to-peer, or P2P, lending is the practice of making loans to individuals or companies through internet platforms that link lenders and borrowers.

The Peer to Peer (P2P) Lending market is driven by several factors such as rising demand for alternative financing, lower interest rates & higher returns, technological advancements in Fintech, regulatory support & evolving policies, and others.

According to the report, the global peer to peer lending market size was worth around USD 6.3 billion in 2024 and is predicted to grow to around USD 41.0 billion by 2034.

The global Peer to Peer (P2P) Lending market is expected to grow at a CAGR of 20.6% during the forecast period.

The global peer to peer lending market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the presence of major players and increasing government initiatives.

The global Peer to Peer (P2P) Lending market is dominated by players like Funding Circle Limited, SocietyOne, Prosper Funding LLC, Lending Loop, Harmoney Australia Pty Ltd, Linked Finance, LENDINGCLUB BANK, LendingTree, LLC, goPeer, and Upstart Network, Inc., among others.

The peer to peer lending market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed