Personal Finance Apps Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

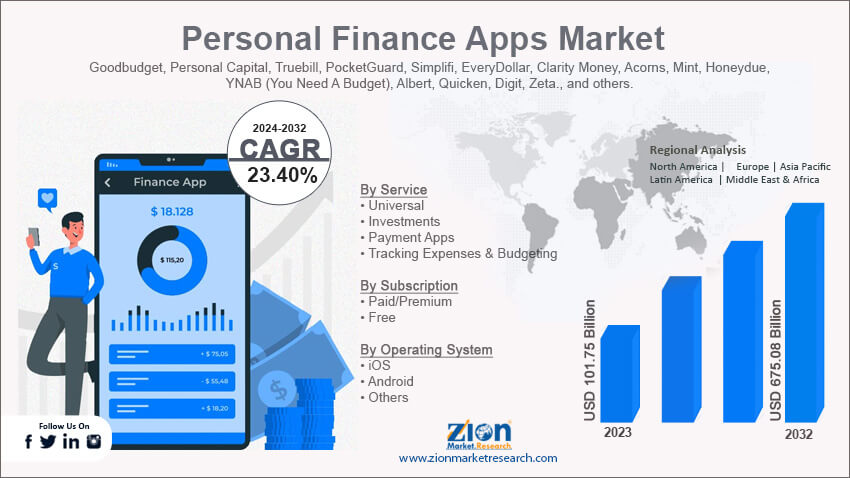

Personal Finance Apps Market By Service (Universal, Investments, Payment Apps, and Tracking Expenses & Budgeting), By Subscription (Paid/Premium and Free), By Operating System (iOS, Android, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

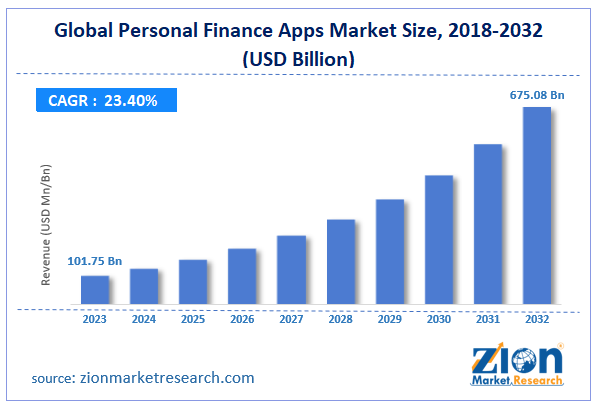

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 101.75 Billion | USD 675.08 Billion | 23.40% | 2023 |

Personal Finance Apps Industry Prospective:

The global personal finance apps market size was worth around USD 101.75 billion in 2023 and is predicted to grow to around USD 675.08 billion by 2032 with a compound annual growth rate (CAGR) of roughly 23.40% between 2024 and 2032.

Personal Finance Apps Market: Overview

Personal finance applications are solutions designed to help people manage their personal expenses. The applications are available on digital devices such as smartphones or laptops and can be accessed from anywhere. The main application of personal finance apps is to provide facilities through which people can track their income, expenses, and investments. This allows consumers to make informed decisions about spending habits.

In addition, advanced finance application tools for personal use provide information on potential investment areas, thus helping create a stable financial portfolio. Currently, several personal finance apps are available in the market, and each product offers specific features and solutions. For instance, the Honeydue application is specially designed for couples to plan their budgets, income, and expenses.

However, personal finance apps must be used carefully since these tools require users to feed confidential information, thus raising concerns over user data privacy. During the projection period, the demand for secure personal finance apps is likely to improve.

Key Insights:

- As per the analysis shared by our research analyst, the global personal finance apps market is estimated to grow annually at a CAGR of around 23.40% over the forecast period (2024-2032)

- In terms of revenue, the global personal finance apps market size was valued at around USD 101.75 billion in 2023 and is projected to reach USD 675.08 billion, by 2032.

- The personal finance apps market is projected to grow at a significant rate due to the growing access to consumer electronics and awareness.

- Based on the service, the tracking expenses & budgeting segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the operating system, the Android segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Personal Finance Apps Market: Growth Drivers

Growing access to consumer electronics and awareness to generate more product demand

The global personal finance apps market is expected to grow due to the growing access to modern consumer electronics. Personal finance apps are generally accessed through digital tools such as smartphones. Certain applications are also available in web-based forms as well; thus, they can be leveraged using laptops and tablets. In addition to this, modern consumers are increasingly becoming aware of solutions available on the Internet for personal use and benefits.

According to market research, an average smartphone user switches between 9 to 10 applications per day. The average number of applications used by a smartphone user is more than 25. Factors such as increased disposable income, availability of financial assistance, the growing launch of affordable smart technology, and access to inexpensive internet will promote demand for smart devices, ultimately leading to higher revenue for personal finance app companies.

Greater need to better manage income and expenses will create a higher demand for personal finance apps

The requirement for personal finance programs is anticipated to be influenced by the growing need for improved management of personal income. The global economic uncertainty and increasing cost of living have encouraged more people to opt for digital solutions that can accurately manage income & expenses and develop budgets. These tools are designed to prevent users from collecting excessive debt or provide cushioning in the event of an unforeseen situation, such as a job layoff or a certain medical emergency.

Apart from tracking income and expenditure, modern personal finance applications are also capable of providing extensive solutions, including long-term and short-term financial planning. For instance, in June 2024, the Securities & Exchange Board of India (SEBI) announced the launching of Saa ? 2.0 app meant for investor’s personal finance. The tool provides information on complex financial concepts in a simple format. Such initiatives will promote demand in the global personal finance apps market.

Personal Finance Apps Market: Restraints

Growing cyber anxiety globally will limit the industry’s expansion rate

The global industry for personal finance apps is expected to be limited by the growing levels of apprehensions against digital tools. This trend is a result of the rise in cybercrime worldwide. Personal finance applications store personal and confidential information about users including bank details and monetary transactions.

In recent times, the number of cyber-attacks has surged leading to increased fear among regular digital solutions users. According to official reports, more than 2300 cyber-attacks were reported in 2023.

Personal Finance Apps Market: Opportunities

Increasing comfort with fintech solutions worldwide to generate expansion possibilities for the market players

The global personal finance apps market is projected to generate more growth opportunities in the coming years due to the growing comfort of the general population with fintech solutions. According to market reports, more than 72% of users globally use online banking at least once a month. This is promoted by increased undertakings by financial institutions to educate consumers about safe practices when using financial technologies.

For instance, in September 2024, the Indian Union Home Ministry announced the launch of the Cyber Fraud Mitigation Centre (CFMC) along with the Samanvay platform. These initiatives focus on developing an infrastructure in the country that promotes cyber security.

Integration of Artificial Intelligence (AI) and Machine Learning (ML) with the applications will aid future expansion

The intensifying investments in AI and ML-powered personal finance apps are expected to shape the personal finance apps industry’s growth rate in the future. In August 2024, SoFi Technologies, a global leader in terms of personal finance and related technology, announced that it had integrated a conversational AI engine by Galileo Financial Technologies in the company’s personal finance apps.

The technology is called Cyberbank Konecta, and it has already improved app response time by 65% along with enhanced member satisfaction. AI and ML can assist market players in delivering exceptional results if leveraged correctly, thus impacting the global market growth rate.

Personal Finance Apps Market: Challenges

Regulatory hurdles will impact the market growth trend over the forecast period

The global industry for personal finance apps is expected to be challenged by the presence of complex regulatory environments worldwide. Fintech is an emerging industry. The regulations governing the market change from one nation to another. These laws are perpetually evolving, and keeping up with the changing framework could be difficult for the market players.

Personal Finance Apps Market: Segmentation

The global personal finance apps market is segmented based on service, operating system, subscription, and region.

Based on the service, the global market divisions are universal, investments, payment apps, and tracking expenses & budgeting. In 2023, the highest growth was witnessed in the tracking expenses & budgeting segment. The rising inflation rate along with changing economic conditions universally has encouraged more people to opt for digital solutions that assist in navigating monthly expenses. The growing use of personal finance apps among the Gen Z generation will fuel the segmental demand. According to market research, over 70% of the Gen Z population spends digital media time on several apps.

Based on subscription, the global personal finance apps industry is divided into paid/premium and free.

Based on the operating system, the global market segments are iOS, Android, and others. In 2023, the highest growth was witnessed in the Android segment led by the greater use of Android-based smartphones globally. During the projection period, the iOS segment is expected to dominate around 35.01% of the total market share. iOS systems are known to deliver exceptional security which could act as a lucrative feature for industry consumers.

Personal Finance Apps Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Personal Finance Apps Market |

| Market Size in 2023 | USD 101.75 Billion |

| Market Forecast in 2032 | USD 675.08 Billion |

| Growth Rate | CAGR of 23.40% |

| Number of Pages | 225 |

| Key Companies Covered | Goodbudget, Personal Capital, Truebill, PocketGuard, Simplifi, EveryDollar, Clarity Money, Acorns, Mint, Honeydue, YNAB (You Need A Budget), Albert, Quicken, Digit, Zeta., and others. |

| Segments Covered | By Service, By Subscription, By Operating System, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Personal Finance Apps Market: Regional Analysis

North America to continue its dominance during the forecast period

The global personal finance apps market is expected to be led by North America during the forecast period. The US will contribute to around 45.7% of the regional market share, as per industry research. The US’s lead is influenced by the presence of a robust infrastructure in terms of developing and marketing personal finance apps. The complex tax structure in the US is made easy using personal finance applications. In addition to this, the surge in mobile banking activities will aid further regional market growth rate.

Asia-Pacific is another prominent region likely to witness growing revenue in the personal finance apps industry. During the forecast period, China will hold control over 48% of the regional market revenue. The developing economy is registering a rise in working groups with increasing disposable income.

In addition to this, the launch of several new solutions across China, India, Japan, and other Asian countries along with improved consumer awareness is critical to the regional market growth rate. Governments in China, India, and other countries are focusing on developing a secure environment for digital transactions which will promote enhanced adoption of personal finance apps.

Personal Finance Apps Market: Competitive Analysis

The global personal finance apps market is led by players like:

- Goodbudget

- Personal Capital

- Truebill

- PocketGuard

- Simplifi

- EveryDollar

- Clarity Money

- Acorns

- Mint

- Honeydue

- YNAB (You Need A Budget)

- Albert

- Quicken

- Digit

- Zeta.

The global personal finance apps market is segmented as follows:

By Service

- Universal

- Investments

- Payment Apps

- Tracking Expenses & Budgeting

By Subscription

- Paid/Premium

- Free

By Operating System

- iOS

- Android

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Personal finance applications are solutions designed to help people manage their personal expenses.

The global personal finance apps market is expected to grow due to the growing access to modern consumer electronics.

According to study, the global personal finance apps market size was worth around USD 101.75 billion in 2023 and is predicted to grow to around USD 675.08 billion by 2032.

The CAGR value of the personal finance apps market is expected to be around 23.40% during 2024-2032.

The global personal finance apps market is expected to be led by North America during the forecast period.

The global personal finance apps market is led by players like Goodbudget, Personal Capital, Truebill, PocketGuard, Simplifi, EveryDollar, Clarity Money, Acorns, Mint, Honeydue, YNAB (You Need A Budget), Albert, Quicken, Digit and Zeta.

The report explores crucial aspects of the personal finance apps market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed