Pet Boarding Services Market Size, Share, Industry Analysis, Trends, Growth, Forecasts, 2032

Pet Boarding Services Market By Service Type (Short-Term and Long-Term), By Pet Type (Cats, Dogs, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

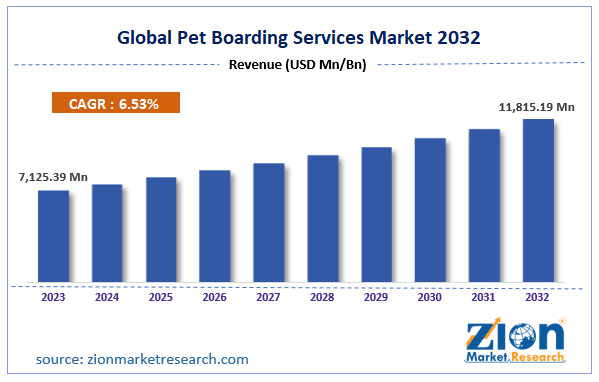

| USD 7,125.39 Million | USD 11,815.19 Million | 6.53% | 2023 |

Pet Boarding Services Industry Prospective:

The global pet boarding services market size was worth around USD 7,125.39 million in 2023 and is predicted to grow to around USD 11,815.19 million by 2032 with a compound annual growth rate (CAGR) of roughly 6.53% between 2024 and 2032.

Pet Boarding Services Market: Overview

Pet boarding services refer to facilities that are available for pet owners to keep their pets in a safe environment while they are away. These facilities are fully equipped to handle all types of pet needs and hence have become a preferred choice for many pet owners who cannot be with their pets throughout the day. Some facilities offer long-term boarding facilities while certain service providers only deliver day-care services. Facilities offering pet boarding are also known as pet hotels, pet daycares, veterinarian boarding kennels, and many more. Pet boarding service providers generally tend to employ certified professionals who can manage pet needs.

Over time, pet hotels or boarding facilities have evolved especially as pet care is not considered as an afterthought but a priority for pet owners. Several new formats of pet boarding services have been introduced in the market including affordable care, luxurious stay, pet sitters, and in-home boarding. Some basic requirements of enrolling pets into boarding services are to ensure they have been previously potty-trained, vetted, neutered, and non-aggressive.

Key Insights:

- As per the analysis shared by our research analyst, the global pet boarding services market is estimated to grow annually at a CAGR of around 6.53% over the forecast period (2024-2032)

- In terms of revenue, the global pet boarding services market size was valued at around USD 7,125.39 million in 2023 and is projected to reach USD 11,815.19 million, by 2032.

- The pet boarding services market is projected to grow at a significant rate due to the growing number of pet owners across the world

- Based on service type segmentation, short-term was predicted to show maximum market share in the year 2023

- Based on pet type segmentation, dogs were the leading segment in 2023

- On the basis of region, North America was the leading revenue generator in 2023

Pet Boarding Services Market: Growth Drivers

Growing number of pet owners across the world to drive market growth

The global pet boarding services market is projected to grow owing to the increasing number of pet owners globally. As per the Health for Animals organization, around 50% of the world's population owns at least one pet in their homes. In 2021, around 70% of the US population owned a pet with dogs being the most preferred pets. As per research, COVID-19 played a crucial role in accelerating pet adoption globally. The lockdown imposed during COVID-19 isolated many people worldwide. Several reports indicate that COVID-19 alone was not the only reason for adopting pets; however, it helped people make a final decision about pet ownership. The rising rate of pet owners can be attributed to several factors.

For instance, certain countries enjoy a well-established cultural and social norm for pet ownership while certain nations are steadily registering a change in pet demographics. Additionally, pet care is of prime importance to many pet owners since pets are no longer considered as animals for protection. They are treated as children by pet owners who want to provide the best care possible to their pets. In such events, the demand for pet boarding services is continuously growing as working pet owners may be unable to take care of their pets while working.

Increased inputs from regulatory bodies to ensure quality services in the market could encourage higher revenue

The pet care industry has become an important part of the national economy in several countries. Large revenue is generated from the regional pet care industry. This is one of the many reasons that has encouraged regulatory bodies to draft regulations and implementation policies that ensure high-quality services are provided by pet boarding brands or institutions.

For instance, pet boarding service providers in Singapore can only operate after passing the mandatory training on pet welfare and animal management courses provided by institutions recognized by the Animal & Veterinary Service Singapore government agency. The pet boarding service providers can operate without receiving the final approval from the state regulatory board thus promoting more consumers in the global pet boarding services market to show confidence in such facilities.

Pet Boarding Services Market: Restraints

Rising incidents of pet attacks in service centers may restrict market demand

The global pet boarding services industry is expected to face growth restrictions due to the rising cases of incidents in which pets have either attached service providers or other pets in the facility. In March 2023, a pet dog was killed at a boarding facility after being attacked by another dog. As per reports, the boarding facility did not comply with standard protocols resulting in the death of the family dog.

In July 2023, in another similar attack, a dog lost one of its ears during an incident that happened at the service center. Such reports are registered even at centers with standard rules since animals can be unpredictable in certain situations resulting in a growing number of pet owners refraining from using the services of pet boarding providers.

Pet Boarding Services Market: Opportunities

Increasing entry of giant pet care companies in the service segment could deliver new opportunities for growth

The global pet boarding services market is expected to benefit from the increasing entry of popular brands into the service segment. Companies that have been widely accepted for pet care products are now making a market in the service end of pet care with the launch of authorized and well-regulated pet boarding services. Since the brands enjoy consumer loyalty, the adoption rate of pet boarding services by already famous brands will be positive. In September 2023, Walmart, the world’s leading multinational retail company, announced its entry into the pet care segment as it opened its first pet service center at a Gergio, USA store. The facility will offer multiple services including vaccination, teeth cleaning, and other services.

In February 2022, a leading pet-focused health and wellness company, Petco Health and Wellness Company, Inc., announced a partnership with Rover.com. The latter is an online company offering pet care products and services. Through the collaboration, Petco aims to connect its large consumer base with access to more information on pet boarding, sitting, and dog walking services.

Increasing investments in the digital transformation of the market will positively impact market demand

The global pet boarding services industry will be highly influenced by the growing adoption of digital technology in the pet care industry. Service providers are increasingly adopting new and improved digital tools such as remote video access to boarding centers, novel methods to communicate with pets, and collaboration with veterinary clinics in case of immediate medical attention. Such positive changes will attract more customers to the market.

Pet Boarding Services Market: Challenges

Lack of standardized regulations for pet boarding services may challenge industry growth trend

The global industry for pet boarding services is projected to be challenged by the lack of standard regulations across the globe. Although specific regulations exist in some parts of the world for pet boarding services, it is relatively a new market, and countries with recent introductions to pet care do not enjoy full-fledged standard regulations leading to differences in the quality of services provided.

Pet Boarding Services Market: Segmentation

The global pet boarding services market is segmented based on service type, pet type, and region.

Based on service type, the global market segments are short-term and long-term. In 2022, the highest growth was observed in the short-term segment. It dominated nearly 55% of the total share driven by the increased demand for day care centers. The increasing number of people going back to offices for work has prompted higher demand for facilities that can provide pet boarding services for a limited duration. Additionally, the growing acceptance of animal-friendly travel has caused more pet owners to travel along with their pets in case of longer visits.

Based on pet type, the global market divisions are cats, dogs, and others. In 2022, around 80.1% of the total revenue was witnessed in the dogs segment. The majority of pets globally are dogs. Since ages, canines have been considered as the ideal animal companion for humans. They offer extreme loyalty and are generally considered ideal for families with children as they offer protection as well. The cats segment is projected to grow at a CAGR of around 9.1% during the projection period.

Pet Boarding Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pet Boarding Services Market |

| Market Size in 2023 | USD 7,125.39 Million |

| Market Forecast in 2032 | USD 11,815.19 Million |

| Growth Rate | CAGR of 6.53% |

| Number of Pages | 208 |

| Key Companies Covered | Camp Bow Wow, Dogtopia Enterprises, A Place for Rover Inc., PetSmart LLC, Holidog.com, PARADISE 4 PAWS, Fetch! Pet Care, PetBacker, Anvis Inc., We Love Pets, Swifto Inc., and others. |

| Segments Covered | By Service Type, By Pet Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pet Boarding Services Market: Regional Analysis

North America will register the highest market growth rate during the projection period

The global pet boarding services market is projected to witness the highest growth rate in North America. In 2022, it held control over 35.1% of the global market share. The US and Canada have a large population of pet owners. As per official data, over 35 million millennials in the US have at least one pet. The country spends nearly USD 99 billion every year on pet care products and services. North American countries have culturally registered a higher rate of pet ownership. Additionally, since the per capita in the US and Canada regions is higher, the demand for pet boarding services is higher in these countries.

The growing number of people returning to offices and an increased urban population with limited time at home are some of the primary reasons for higher regional market demand. The US pet boarding services market is one of the well-regulated industries globally with strict actions for non-compliance. Europe is a leading market with a high share of global customers. As of 2022, around 90 million households in Europe own at least one pet. The region has witnessed an increase in pet ownership rate by 20 million in the last decade.

Pet Boarding Services Market: Competitive Analysis

The global pet boarding services market is led by players like:

- Camp Bow Wow

- Dogtopia Enterprises

- A Place for Rover Inc.

- PetSmart LLC

- Holidog.com

- PARADISE 4 PAWS

- Fetch! Pet Care

- PetBacker

- Anvis Inc.

- We Love Pets

- Swifto Inc.

The global pet boarding services market is segmented as follows:

By Service Type

- Short-Term

- Long-Term

By Pet Type

- Cats

- Dogs

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pet boarding services refer to facilities that are available for pet owners to keep their pets in a safe environment while they are away.

The global pet boarding services market is projected to grow owing to the increasing number of pet owners globally.

According to study, the global pet boarding services market size was worth around USD 7,125.39 million in 2023 and is predicted to grow to around USD 11,815.19 million by 2032.

The CAGR value of pet boarding services market is expected to be around 6.53% during 2024-2032.

The global pet boarding services market is projected to witness the highest growth rate in North America.

The global pet boarding services market is led by players like Camp Bow Wow, Dogtopia Enterprises, A Place for Rover, Inc., PetSmart LLC, Holidog.com, PARADISE 4 PAWS, Fetch! Pet Care, PetBacker, Anvis Inc., We Love Pets, and Swifto Inc. among others.

The report explores crucial aspects of the pet boarding services market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed