Pharmaceutical Blister Packaging Market Size, Share Report, Analysis, Trends, Growth, 2030

Pharmaceutical Blister Packaging Market By Component (Packaging Accessories, Packaging Films, Secondary Containers, and Lidding Materials), By Product Type (Carded and Clamshell), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

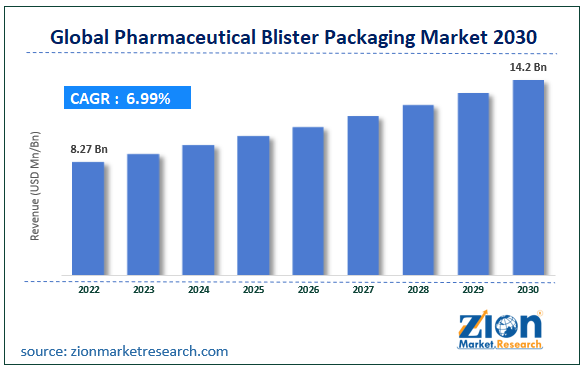

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.27 Billion | USD 14.2 Billion | 6.99% | 2022 |

Pharmaceutical Blister Packaging Industry Prospective:

The global pharmaceutical blister packaging market size was worth around USD 8.27 billion in 2022 and is predicted to grow to around USD 14.2 billion by 2030 with a compound annual growth rate (CAGR) of roughly 6.99% between 2023 and 2030.

Request Free Sample

Request Free Sample

Pharmaceutical Blister Packaging Market: Overview

Blister packaging in the pharmaceutical industry is a form of pre-formed plastic packaging. It is used for packaging tablets, lozenges, and capsules in the form of unit-dose packaging. This form of packaging solution helps improve medicine shelf life by creating barrier protection for the packaged content. In most parts of the world, especially countries in which re-packaging or pharmacy dispensing is uncommon, blister packaging is the primary method of packaging medicines. However, in the United States, this method is mainly used to store physician samples or for over-the-counter (OTC) products.

Blister packaging has proven to be tamper-proof. To seek the tablet, a patient has to push out the individually sealed medicines from the foil. It also offers an excellent way of remembering if the previous medicine dose was consumed which is an aspect that is typically missed when medicines or tablets are filled in a refill bottle. Some of the other benefits apart from the primary advantages of using blister packaging in the pharmaceutical industry include cost-effectiveness, easier production rate even in high volumes and at a greater speed, product visibility, and availability of the packet in different colors that can impact brand value. The global pharmaceutical blister packaging market is expected to generate a steady growth rate during the forecast period while dealing with certain challenges.

Key Insights:

- As per the analysis shared by our research analyst, the global pharmaceutical blister packaging market is estimated to grow annually at a CAGR of around 6.99% over the forecast period (2023-2030)

- In terms of revenue, the global pharmaceutical blister packaging market size was valued at around USD 8.27 billion in 2022 and is predicted to grow to around USD 14.2 billion, by 2030.

- The pharmaceutical blister packaging market is projected to grow at a significant rate due to the growing demand for sustainable packaging

- Based on component segmentation, packaging films were predicted to show maximum market share in the year 2022

- Based on product type segmentation, carded was the leading type in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Pharmaceutical Blister Packaging Market: Growth Drivers

Growing consumption of medicines to drive market growth

The primary growth driver in the global pharmaceutical blister packaging market is the increasing consumption of medicines across the world. This trend is a result of an increased number of patients suffering from various medical conditions including mild medical issues to life threatening diseases and rare diseases. For instance, people living with diabetes, in most cases, are required to take medication regularly to manage or control the condition. A recent study indicates that more than 88% of US citizens diagnosed with diabetes take some form of oral medication. The International Diabetes Federation (IDF) claims that nearly 1 in every 10 people is diagnosed with diabetes. In addition to this, the number of people falling sick due to diminished immunity since COVID-19 in 2020 has risen tremendously. The general population has become more prone to contracting respiratory disorders in recent times. However, more conclusive studies are needed to confirm the relationship between Covid-19 infection and lowered immunity levels.

Other factors such as growing access to medical care as a result of increased investments in the healthcare industry along with rising awareness rates about the availability of generic medicines in developing countries have further fueled the demand for tablets. This has led to more pharmaceutical companies adopting blistering packaging to meet the growing consumer demand. The latest report by the Centers for Disease Control and Prevention (CDC) claimed that approximately 46.7% of adults in the age group of 20 to 59 years are on some form of prescribed medicines. Another crucial factor fueling the demand for medicines is the growing geriatric population which is highly sensitive to multiple forms of age-induced conditions including blood pressure and body pain. The American Heart Association (AHA) estimated that the chances of contracting high blood pressure between age 20 to 85 is around 69% to 86%.

Pharmaceutical Blister Packaging Market: Restraints

Increasing rate of medical waste and growing concerns over it may restrict market expansion

The pharmaceutical blister packaging industry is expected to face growth restrictions owing to the rising rate of medical waste generated globally. The World Health Organization (WHO) defines medical waste as unwanted materials generated from healthcare activities. All forms of pharmaceutical packaging including the blistering method remain a primary concern for regional and international healthcare agencies as it poses a significant threat to the environment. A recent report suggests that hospitals produce more than 4.95 million tons of waste annually. Furthermore, since blister packaging is plastic-oriented, the severity of its environmental impact increases multifold unless effective disposable systems are established to ensure proper waste management.

Pharmaceutical Blister Packaging Market: Opportunities

Rising application of environment-friendly materials for blistering packaging to create higher growth opportunities

The pharmaceutical blister packaging industry can expect greater growth opportunities led by the increasing innovation activities undertaken by market players to develop and promote the use of environment-friendly materials that can be used instead of plastic for blister packaging. For instance, in April 2021, Amcor, a leading industry player, announced that its novel recyclable packaging solution called AmSky would be made available in the commercial market by the second half of 2022. The product is the first-of-its-kind recyclable polyethylene (PE)-made thermoform blister packaging item. In 2022, the same product was awarded with the Recyclable Packaging award at Packaging Europe's 2022 Sustainability Awards. In October 2022, TekniPlex launched the world’s first recyclable and completely transparent mid-barrier blister packaging.

Pharmaceutical Blister Packaging Market: Challenges

Growing cases of medicine counterfeiting are a crucial challenge for industry players

The global pharmaceutical blister packaging market players are susceptible to losses caused by medical counterfeiting. Pharmaceutical items are more prone to tampering and one of the major ways used to achieve this is by copying the outer packaging of the products. Blister packaging can be easily copied which can lead to serious health hazards since the content may be extremely harmful for the consumer. A 2017 report by the WHO suggested that nearly 1 in every 10 medical products in developing or underdeveloped countries was either falsified or substandard. Hence, companies must adopt anti-counterfeit blister packaging solutions for maximum safety.

Pharmaceutical Blister Packaging Market: Segmentation

The global pharmaceutical blister packaging market is segmented based on component, type, and region.

Based on component, the global market segments are packaging accessories, packaging films, secondary containers, and lidding materials. In 2022, the pharmaceutical blister packaging industry was led by the packaging films segment. It is one of the most crucial components of the overall blister packaging. They are typically made of polyvinylidene chloride (PVDC) or polyvinyl chloride (PVC) and are the form of a cavity that holds the medicine. On the other hand, lidding materials form the top layer of each cavity and the most common material used is aluminum foil as it is easy to break with minimum pressure. The global plastic healthcare packaging market is projected to grow at a CAGR of over 5% during the forecast period.

Based on product type, the pharmaceutical blister packaging industry segments are carded and clamshell. In 2022, the most significant growth was observed in the carded segment and is expected to continue the same trend driven by excellent functional attributes such as safety, practicality, and flexibility. The segmental CAGR by 2030 is expected to reach 6.82% as the product does not compromise the structural integrity of the packaged product.

Pharmaceutical Blister Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pharmaceutical Blister Packaging Market |

| Market Size in 2022 | USD 8.27 Billion |

| Market Forecast in 2030 | USD 14.2 Billion |

| Growth Rate | CAGR of 6.99% |

| Number of Pages | 224 |

| Key Companies Covered | Honeywell International Inc., Bemis Company Inc., ACG Pharmapack Pvt. Ltd., The Dow Company, Display Pack, Sonoco Products Company, Bilcare Research Inc., West Rock Company, and Rohrer Corporation. |

| Segments Covered | By Component, Product Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pharmaceutical Blister Packaging Market: Regional Analysis

North America to register the highest growth rate

The global pharmaceutical blister packaging market is anticipated to be led by North America during the forecast period mainly led by the growing sale of OTC drugs in the US and Canada. An average American household spends nearly USD 338 annually on OTC drugs as reported by the Consumer Healthcare Products Association. Additionally, a greater percentage of the general population in these countries have access to basic healthcare which further expands the overall market for medicinal drugs. The US is home to some of the largest pharmaceutical companies including Pfizer and Moderna among others. These companies have patent rights over some of the largest-selling medicines globally.

Europe is an important region of the global market due to the existence of a robust medical infrastructure along with an increasing rate of drug development and growing emphasis on the use of recyclable material for blister packaging in the regional pharma industry which is currently valued at over USD 296 billion. The increasing older population and growing number of patients may further contribute to regional growth.

Pharmaceutical Blister Packaging Market: Competitive Analysis

The global pharmaceutical blister packaging market is led by players like:

- Honeywell International Inc.

- Bemis Company Inc.

- ACG Pharmapack Pvt. Ltd.

- The Dow Company

- Display Pack

- Sonoco Products Company

- Bilcare Research Inc.

- West Rock Company

- Rohrer Corporation

The global pharmaceutical blister packaging market is segmented as follows:

By Component

- Packaging Accessories

- Packaging Films

- Secondary Containers

- Lidding Materials

By Product Type

- Carded

- Clamshell

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Blister packaging in the pharmaceutical industry is a form of pre-formed plastic packaging. It is used for packaging tablets, lozenges, and capsules in the form of unit-dose packaging.

The primary growth driver in the global pharmaceutical blister packaging market is the increasing consumption of medicines across the world.

According to study, the global pharmaceutical blister packaging market size was worth around USD 8.27 billion in 2022 and is predicted to grow to around USD 14.2 billion by 2030.

The CAGR value of the pharmaceutical blister packaging market is expected to be around 6.99% during 2023-2030.

The global pharmaceutical blister packaging market is anticipated to be led by North America during the forecast period mainly led by the growing sale of OTC drugs in the US and Canada.

The global pharmaceutical blister packaging market is led by players like Honeywell International Inc., Bemis Company Inc., ACG Pharmapack Pvt. Ltd., The Dow Company, Display Pack, Sonoco Products Company, Bilcare Research Inc., West Rock Company, and Rohrer Corporation to name a few.

The global pharmaceutical blister packaging market explores crucial aspects of the pharmaceutical blister packaging market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the pharmaceutical blister packaging market.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed