Pharmaceutical CDMO Market Size, Share, Trends, Growth 2032

Pharmaceutical CDMO Market By Application (Infectious Diseases, Oncology, Neurological Disorders, and Others), By Workflow (Commercial and Clinical), By Product (Synthesis, Manufacturing, Drug, and API), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

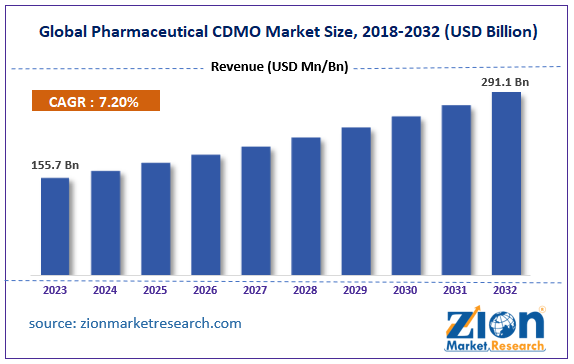

| USD 155.7 Billion | USD 291.1 Billion | 7.20% | 2023 |

Pharmaceutical CDMO Industry Prospective:

The global pharmaceutical CDMO market size was worth around USD 155.7 billion in 2023 and is predicted to grow to around USD 291.1 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.20% between 2024 and 2032.

Pharmaceutical CDMO Market: Overview

Pharmaceutical CDMO is also known as a contract development and manufacturing organization. CDMO service providers help pharmaceutical companies accelerate the production and introduction of medicines in the market. The pharmaceutical industry is challenged by the several complexities that are associated with processes starting from drug discovery to marketing and final sale. The risks associated with these processes can be mitigated with the help of contract development and manufacturing organization (CDMO). Durg developers actively participate with CDMO companies to leverage the drug production intelligence and capacity of contract development and manufacturing organizations.

CDMOs differ from other forms of service providers that are categorized as contract manufacturing organizations (CMOs). The services provided by CDMOs are considered more comprehensive since they offer drug development services along with all other solutions provided by a typical CMO. The pharma sector faces multiple challenges and some of them can be easily managed by partnering with an efficient CDMO. Some of these challenges include risk sharing, achieving economies of scale, compliance management, and regulatory & quality support. During the forecast period, the demand in the pharmaceutical CDMO industry is expected to fuel at a high rate.

Key Insights:

- As per the analysis shared by our research analyst, the global pharmaceutical CDMO market is estimated to grow annually at a CAGR of around 7.20% over the forecast period (2024-2032)

- In terms of revenue, the global pharmaceutical CDMO market size was valued at around USD 155.7 billion in 2023 and is projected to reach USD 291.1 billion by 2032.

- The market is projected to grow at a significant rate due to the rising demand for novel therapies.

- Based on application segmentation, the oncology segment is growing at a high rate and is projected to dominate the global market.

- Based on product segmentation, the API segment is projected to swipe the largest market share.

- On the basis of region, Asia-Pacific is expected to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Pharmaceutical CDMO Market: Growth Drivers

Rising demand for novel therapies will boost the market revenue in the coming years

The global pharmaceutical CDMO market is expected to grow due to the rising demand for novel therapies across the globe. The healthcare sector is currently witnessing increasing pressure to deliver quality medical care. The world population is on the rise. This in turn has led to an increase in the number of medical patients across the globe suffering from milder conditions to more serious medical issues. The COVID-19 pandemic further intensified the need to create more robust healthcare systems capable of managing sudden increases in patient rates and the growing complexities associated with specific medical conditions. The World Health Organization (WHO) published a report in March 2024 citing the findings published by The Lancet Neurology.

As per the review, more than 3 billion people globally were affected by some form of neurological condition in 2021. Certain medical problems are hereditary while a large portion of the currently known diseases are a result of environmental factors. The growing number of people affected by the lack of access to affordable medical care has encouraged more players to enter the market and develop efficient treatments for the general public. The rising focus on research and innovation related to novel medical therapies including orphan drugs, personalized medicine, biologics, and biosimilars will fuel the demand for contract development and manufacturing organization.

In January 2024, India’s Tata Institute announced a groundbreaking discovery for cancer treatment. Years of research have helped the institute formulate a new medicine that could possibly prevent the recurrence of cancer. Additionally, the medicine is also expected to help curb the side effects of the treatments used for cancer by 50%. Such high strides in the field of medical research and drug development are made possible through the extensive knowledge and expertise of CDMOs.

Increasing partnerships between drug developers and CDMOs to lead to higher revenue

The global pharmaceutical CDMO market is expected to be further impacted by the increasing rate of partnerships, acquisitions, and collaborations observed in the industry. For instance, in April 2024, Blue Wolf Capital Partners LLC, a middle market private equity company operating in the industrial and healthcare sectors, announced that it plans to acquire 7 new development and manufacturing units from Recipharm. The latter is a leading contract development and manufacturing organization from Sweden. The facilities are currently used for the development of liquid dosage, semi-solid, and oral solid forms of pharmaceutical drugs.

Pharmaceutical CDMO Market: Restraints

Difficulty in keeping up with the escalating product demand could restrict the market expansion rate

The global industry for pharmaceutical CDMOs is expected to be restricted due to the difficulties and challenges faced by CDMOs in keeping up with the exponentially rising demand for final products. Contract development and manufacturing organizations are required to have extreme agility to survive the complexities of drug manufacturing.

Additionally, the industry faces concerns in terms of the dynamic nature of certain product demand. The supply of raw materials used by CDMOs for drug development and manufacturing faces uncertainties in the current volatile global market. Basic materials such as vials and syringes have a lead time of 6 to 7 months thus causing problems for CDMOs to keep the manufacturing rate aligned with the demand rate.

Pharmaceutical CDMO Market: Opportunities

Expansion of CDMOs in new territories will generate high growth opportunities

The global pharmaceutical CDMO market will generate high growth opportunities due to the growing expansion of existing firms in new regions. Expansion policies allow companies to gain higher access to customers available for partnership in the new regions. For instance, in January 2024, Indian biopharmaceutical CDMO company, Enzene Biosciences announced the launch of its new manufacturing facility in the United States. The parent company of Enzene is Alkem Labs. The new facility located in New Jersey is expected to become operational by June 2024.

Seattle-based CDMO company AGC Biologics announced its plans to expand its footprint in Japan with the launch of the second CDMO facility in Japan. The announcement was made in January 2024. AGC already has a functional manufacturing site in Japan and the new 20,000 square meters will be the second facility to be owned by AGC in Japan. In February 2024, Pharmascience announced the expansion of its business units with its entry into the injectables product segment. In 2023, the company had already invested $120 billion in a manufacturing facility for sterile injectables.

Pharmaceutical CDMO Market: Challenges

Price war between the market players could challenge the growth rate

The global pharmaceutical CDMO industry is expected to be challenged by the extreme competitiveness in the industry. Since multiple players are vying for the same set of potential clients. Additionally, pharma companies are seeking solution providers that offer optimal rates since drug developers also have to be mindful of achieving profits in the long run. This gives rise to price wars between CDMOs leading to several growth limitations in the industry.

Pharmaceutical CDMO Market: Segmentation

The global pharmaceutical CDMO market is segmented based on application, workflow, product, and region.

Based on application, the global market segments are infectious diseases, oncology, neurological disorders, and others. In 2023, the highest growth was witnessed in the oncology segment which dominated more than 22% of the overall market share. During the forecast period, the industry is likely to grow at a CAGR of over 8.02%. The growing demand for cancer care and the rising number of patients suffering from cancer are the leading reasons for the higher demand for CDMOs specializing in cancer drug development and manufacturing.

Based on workflow, the global pharmaceutical CDMO industry is divided into commercial and clinical.

Based on product, the global industry divisions are synthesis, manufacturing, drug, and API. In 2023, the highest revenue-generating segment was the active pharmaceutical ingredient (API) segment. Over 81.05% of the total segmental share was led by API. The reasons for higher segmental demand include higher demand for drug development and surging global acceptance. The increasing investments in API research are expected to help the segment grow at a CAGR of over 5.06% during the projection period. The rising demand and consumption of drug products are expected to drive the drug segment in the coming years.

Pharmaceutical CDMO Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pharmaceutical CDMO Market |

| Market Size in 2023 | USD 155.7 Billion |

| Market Forecast in 2032 | USD 291.1 Billion |

| Growth Rate | CAGR of 7.20% |

| Number of Pages | 209 |

| Key Companies Covered | WuXi AppTec, Catalent Inc., AbbVie Contract Manufacturing, Lonza Group AG, Evonik Industries AG, Patheon, Siegfried Holding AG, Recipharm AB, Aenova Group, CordenPharma, Jubilant Life Sciences Ltd., Almac Group, Piramal Pharma Solutions, Cambrex Corporation, Fareva., and others. |

| Segments Covered | By Application, By Workflow, By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pharmaceutical CDMO Market: Regional Analysis

Asia-Pacific to lead the industry growth rate during the projection period

The global pharmaceutical CDMO market will be led by Asia-Pacific. In 2023, around 38% of the global revenue was registered in Asia-Pacific due to the large-scale presence of key CDMOs in the region. North America is expected to emerge as a prominent figure. The United States region will witness the highest revenue. The growing trend of outsourcing drug development processes to experts such as contract development and manufacturing organizations will benefit the regional market. In addition to this, CDMOs in the US have access to extensive resources for continuous investments in research & development as well as the expansion of product and service portfolios.

In May 2023, CordenPharma, a leading player in the CDMO industry specializing in API manufacturing, entered the synthetic oligonucleotide production sector. Europe is expected to deliver lucrative results. Germany will hold the highest share of the regional revenue. The growing demand for speeding up drug development procedures to meet the medical needs of the general population will fuel higher collaboration with pharma companies and CDMOs. In March 2024, Adare Pharma Solutions announced investments in its existing facility in Italy. The company plans to expand its oral dosage production capabilities with the help of the newly installed high-shear mixer granulator.

Pharmaceutical CDMO Market: Competitive Analysis

The global pharmaceutical CDMO market is led by players like:

- WuXi AppTec

- Catalent Inc.

- AbbVie Contract Manufacturing

- Lonza Group AG

- Evonik Industries AG

- Patheon

- Siegfried Holding AG

- Recipharm AB

- Aenova Group

- CordenPharma

- Jubilant Life Sciences Ltd.

- Almac Group

- Piramal Pharma Solutions

- Cambrex Corporation

- Fareva.

The global pharmaceutical CDMO market is segmented as follows:

By Application

- Infectious Diseases

- Oncology

- Neurological Disorders

By Workflow

- Commercial

- Clinical

By Product

- Synthesis

- Manufacturing

- Drug

- API

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pharmaceutical CDMO is also known as a contract development and manufacturing organization.

The global pharmaceutical CDMO market is expected to grow due to the rising demand for novel therapies across the globe.

According to study, the global pharmaceutical CDMO market size was worth around USD 155.7 billion in 2023 and is predicted to grow to around USD 291.1 billion by 2032.

The CAGR value of pharmaceutical CDMO market is expected to be around 7.20% during 2024-2032.

The global pharmaceutical CDMO market will be led by Asia-Pacific.

The global pharmaceutical CDMO market is led by players like WuXi AppTec, Catalent, Inc., AbbVie Contract Manufacturing, Lonza Group AG, Evonik Industries AG, Patheon, Siegfried Holding AG, Recipharm AB, Aenova Group, CordenPharma, Jubilant Life Sciences Ltd., Almac Group, Piramal Pharma Solutions, Cambrex Corporation, and Fareva.

The report explores crucial aspects of the pharmaceutical CDMO market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed