Pharmaceutical CRM Software Market Size, Share, Analysis, Trends, Growth, 2032

Pharmaceutical CRM Software Market By End-User (Contract Research Organization (CRO), Biotechnology Companies, Pharmaceutical Companies, and Others), By Deployment Type (Cloud-Based CRM Software and On-Premises CRM Software), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

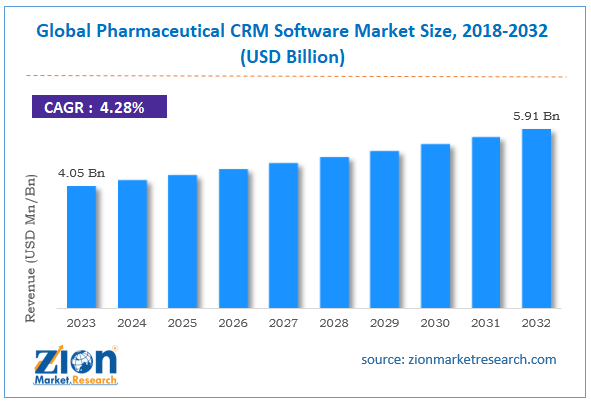

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.05 Billion | USD 5.91 Billion | 4.28% | 2023 |

Pharmaceutical CRM Software Industry Prospective:

The global pharmaceutical CRM software market size was worth around USD 4.05 billion in 2023 and is predicted to grow to around USD 5.91 billion by 2032 with a compound annual growth rate (CAGR) of roughly 4.28% between 2024 and 2032.

Pharmaceutical CRM Software Market: Overview

Pharmaceutical customer relationship management (CRM) software is a specially designed application for drug research and developing companies.

Pharmaceutical CRM software provides customized solutions to pharma companies. These tools are used by a wide range of end-users in the drug manufacturing, distributing, and developing sectors, including healthcare professionals, researchers, pharmacists, and physicians.

Pharmaceutical CRM can track several aspects of medical care, such as compliance with regional regulations, preferences, and interactions with stakeholders.

The growing complexity in the regulatory framework surrounding the pharmaceutical industry is one of the leading market growth drivers. Some of the main features of pharma CRM include sample & inventory management, sales & marketing analytics, health professional relationship management, and compliance & regulatory tracking.

The growing introduction of Artificial Intelligence (AI) powered pharma-based customer relationship management software will help fuel further revenue in the pharmaceutical CRM software industry. However, the high cost of the solutions, along with concerns over cybercrime, may impact product adoption in the long run.

Key Insights:

- As per the analysis shared by our research analyst, the global pharmaceutical CRM software market is estimated to grow annually at a CAGR of around 4.28% over the forecast period (2024-2032)

- In terms of revenue, the global pharmaceutical CRM software market size was valued at around USD 4.05 billion in 2023 and is projected to reach USD 5.91 billion by 2032.

- The pharmaceutical CRM software market is projected to grow at a significant rate due to the growing investments in the pharmaceutical industry.

- Based on end-user, the pharmaceutical companies segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on deployment, the cloud-based CRM software segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Pharmaceutical CRM Software Market: Growth Drivers

Growing investments in the pharmaceutical industry to drive the market growth rate

The global pharmaceutical CRM software market is expected to grow due to the rising investments in the pharmaceutical industry. The increase in world population, along with the growing burden on global healthcare infrastructure, has resulted in greater pressure on pharmaceutical companies to meet the medical needs of patients.

This, in turn, has resulted in greater investments in the global pharmaceutical industry across regions, including emerging economies and developed countries. The investments are directed from government-backed decisions, private companies, and global welfare organizations.

For instance, in September 2024, China announced it would open its healthcare and manufacturing sectors for 100% foreign direct investment (FDI) opportunities. The country is seeking ways to revive its slowing economy.

According to market research, Europe registered more than 14 private equity deals in the second quarter of 2024. The total value of the equity deals is over USD 18 million.

Similarly, other countries are upgrading pharmaceutical infrastructure to meet the demands of the growing patient database suffering from mild to severe or rare conditions.

Stringent regulations in the pharmaceutical industry to encourage higher adoption of CRM solutions

One of the key benefits of pharma-oriented customer relationship management applications is to ensure compliance with regional laws and regulations. Governments across the globe are enlisting stricter policies to ensure the circulation of quality products. In recent times, the number of incidents concerning the sale of substandard medication globally has risen at an unprecedented rate.

For instance, the US region is governed by the Current Good Manufacturing Practice (CGMP) regulations specially designed around human pharmaceuticals. If a drug company fails to comply with CGMP guidelines, the products can be deemed ‘adulterated’ under US law. The regional guidelines are not only strict but also complex.

However, 100% compliance is crucial to ensuring successful business transactions. The solutions available in the global pharmaceutical CRM software market can help drug developers navigate the complex web of pharmaceutical-related regulations and ensure complete compliance.

Pharmaceutical CRM Software Market: Restraints

Higher expenses associated with tool implementation and long-term maintenance will limit the industry’s expansion rate

The global pharmaceutical CRM software industry is projected to be restricted by the high expenses associated with the tool. Implementing pharma-based customer relationship management tools on a large scale is an expensive process.

In addition, the final costs include expenses related to personnel training and the development of supporting infrastructure. Pharmaceutical CRM tools require consistent maintenance, as they must be perpetually upgraded to meet the current regional regulatory mandates, further affecting the final expenses associated with the use of the product.

Pharmaceutical CRM Software Market: Opportunities

Ongoing investments in next-generation software to create higher growth opportunities

The global pharmaceutical CRM software market is projected to generate growth opportunities due to consistent investments in next-generation offerings. Market players are focusing on three main parameters that are connected data, contextual insights, and workflow continuity.

For instance, the first parameter will deal with avoiding one-dimensional recommendations and insisting on deeper context which will leave a greater impact on the consumer experience. The use of generative Artificial Intelligence will be pivotal to shaping the industry for pharmaceutical CRM applications in the long run.

In November 2023, GSK, one of the world’s leading pharmaceutical companies, announced a new strategic partnership with Veeva Systems. According to the contract, the latter will provide GSK access to Veeva Vault CRM to engage with global customers.

In October 2023, Salesforce announced the launch of Life Sciences Cloud. The novel tool is a highly secure platform developed especially for pharma companies and medical technology firms to improve drug and device development procedures.

The tool will also offer solutions related to retaining patients and enlisting new ones. Growing end-user awareness and higher comfort with technology will further promote exceptional revenue in the pharma-based CRM industry.

Pharmaceutical CRM Software Market: Challenges

Concerns over data privacy and cybercrimes will challenge market expansion trend

The advancements in the global pharmaceutical CRM software industry in the form of cloud-based distribution among consumers and integration of AI have made modern CRM tools vulnerable to cyber-attacks.

Additionally, a lack of transparency in terms of patient data privacy of customers can impact brand value and overall returns in the industry.

Pharmaceutical CRM Software Market: Segmentation

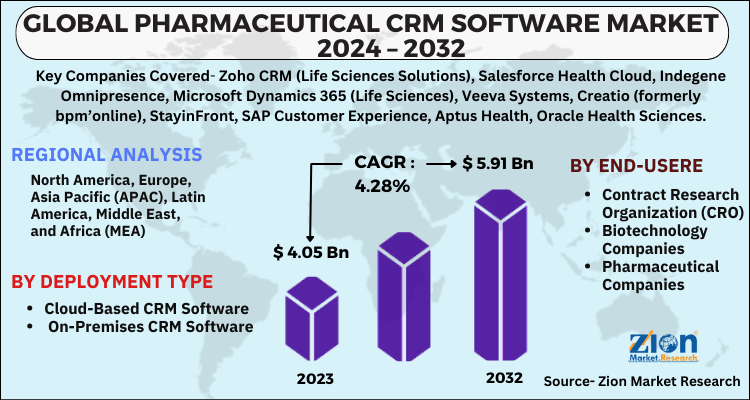

The global pharmaceutical CRM software market is segmented based on end-user, deployment, and region.

Based on the end-user, the global market segments are contract research organizations (CROs), biotechnology companies, pharmaceutical companies, and others.

In 2023, the highest growth was witnessed in the pharmaceutical companies segment. Drug researchers and developers require pharmaceutical CRM to not only meet customer expectations but also generate more consumer base as well as comply with regional regulations.

Some of the latest trends in segmental demand include personalized marketing strategies and the integration of AI for predictive analytics. In 2023, the global generative AI in the medicine industry was valued at more than USD 502 million.

Based on the deployment, the pharmaceutical CRM software industry segments are cloud-based CRM software and on-premises CRM software.

In 2023, the leading segment was cloud-based CRM software. These solutions are offered through remote servers, and users do not need to invest in developing an ancillary infrastructure.

The growing trend of subscription-based pharmaceutical CRM products will help the segment thrive in the long run. According to market research, more than95% of companies globally are deploying cloud-based solutions.

Pharmaceutical CRM Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pharmaceutical CRM Software Market |

| Market Size in 2023 | USD 4.05 Billion |

| Market Forecast in 2032 | USD 5.91 Billion |

| Growth Rate | CAGR of 4.28% |

| Number of Pages | 215 |

| Key Companies Covered | Zoho CRM (Life Sciences Solutions), Salesforce Health Cloud, Indegene Omnipresence, Microsoft Dynamics 365 (Life Sciences), Veeva Systems, Creatio (formerly bpm’online), StayinFront, SAP Customer Experience, Aptus Health, Oracle Health Sciences, Pegasystems, Medisoft, IQVIA, Verix, Synergistix., and others. |

| Segments Covered | By End-User, By Deployment Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pharmaceutical CRM Software Market: Regional Analysis

North America is to be led by the US during the forecast period

The global pharmaceutical CRM software market will be led by North America during the projection period. The US is likely to emerge as the highest revenue generator in the North American market. The presence of a robust and technologically rich pharmaceutical infrastructure in the US helps the region thrive.

In addition, North America is at the forefront of AI-based innovations with applications across major industries, including pharmaceuticals. The growing demand in the region for personalized marketing, as well as increased global expansion, will help North America thrive over the forecast duration.

In December 2022, EVA Pharma and Eli Lilly and Company announced a new partnership aiming to deliver affordable and high-quality analog and human insulin to one million people across low- to middle-income countries (LMICs) for patients with type 1 and type 2 diabetes. Europe is a crucial market for pharmaceutical CRM software providers. The region places heavy emphasis on the regulatory environment.

For instance, in 2020, Europe witnessed the adoption of the Pharmaceutical Strategy for Europe, which focused on drafting guidelines to ensure effective, safe, and affordable medicines for European citizens. The growing number of patient databases, along with rising investments in the regional pharma industry, will help Europe register higher revenue in the coming years.

Pharmaceutical CRM Software Market: Competitive Analysis

The global pharmaceutical CRM software market is led by players like:

- Zoho CRM (Life Sciences Solutions)

- Salesforce Health Cloud

- Indegene Omnipresence

- Microsoft Dynamics 365 (Life Sciences)

- Veeva Systems

- Creatio (formerly bpm’online)

- StayinFront

- SAP Customer Experience

- Aptus Health

- Oracle Health Sciences

- Pegasystems

- Medisoft

- IQVIA

- Verix

- Synergistix.

The global pharmaceutical CRM software market is segmented as follows:

By End-User

- Contract Research Organization (CRO)

- Biotechnology Companies

- Pharmaceutical Companies

- Others

By Deployment Type

- Cloud-Based CRM Software

- On-Premises CRM Software

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pharmaceutical customer relationship management (CRM) software is a specially designed application for drug research and development companies.

The global pharmaceutical CRM software market is expected to grow due to the rising investments in the pharmaceutical industry.

According to study, the global pharmaceutical CRM software market size was worth around USD 4.05 billion in 2023 and is predicted to grow to around USD 5.91 billion by 2032.

The CAGR value of the pharmaceutical CRM software market is expected to be around 4.28% during 2024-2032.

The global pharmaceutical CRM software market will be led by North America during the projection period.

The global pharmaceutical CRM software market is led by players like Zoho CRM (Life Sciences Solutions), Salesforce Health Cloud, Indegene Omnipresence, Microsoft Dynamics 365 (Life Sciences), Veeva Systems, Creatio (formerly bpm’online), StayinFront, SAP Customer Experience, Aptus Health, Oracle Health Sciences, Pegasystems, Medisoft, IQVIA, Verix, and Synergistix.

The report explores crucial aspects of the pharmaceutical CRM software market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed